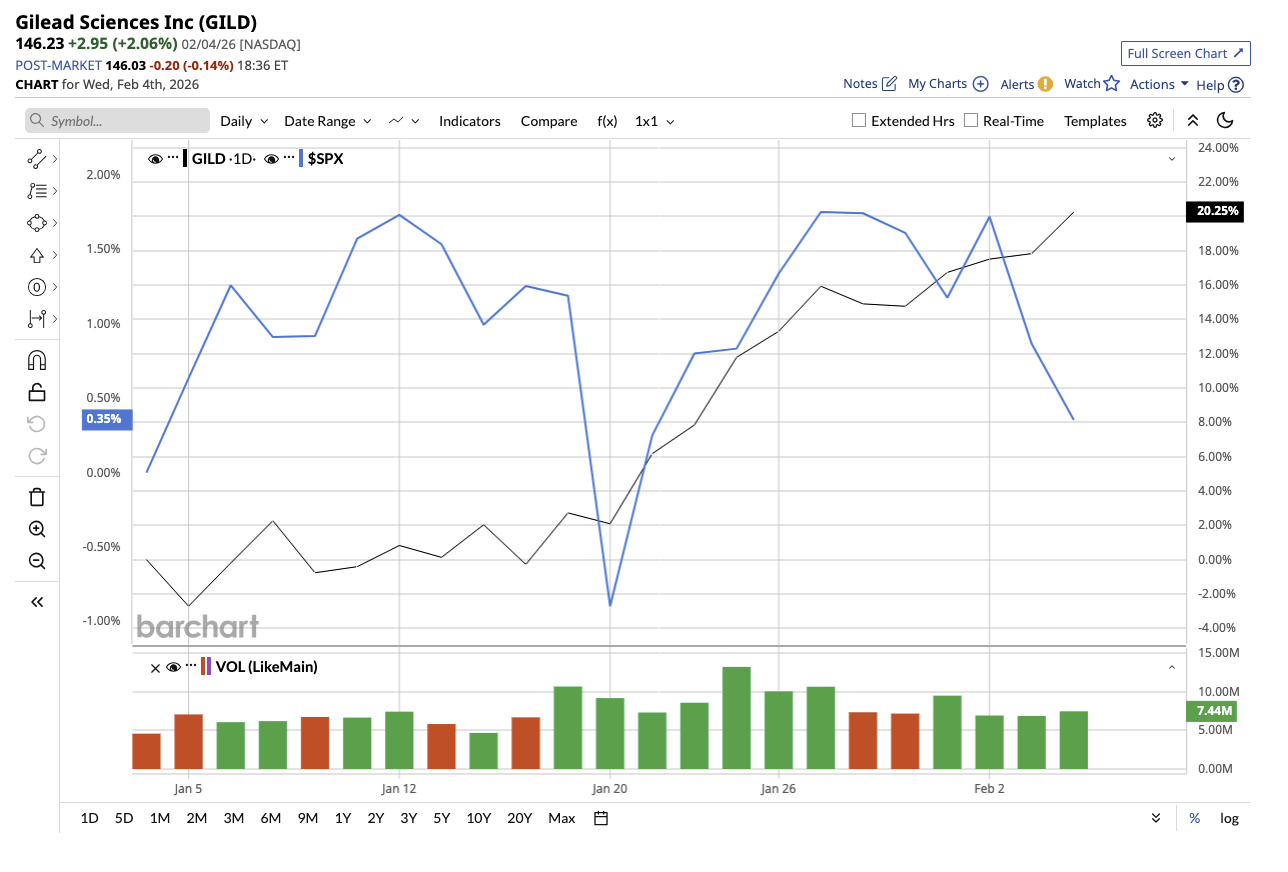

Biotech investors often chase early-stage companies in the hope that a single breakthrough trial will deliver massive returns. While those clinical-stage biotech stocks can offer enormous upside, they also come with outsized risk. However, sometimes established biotech companies like Gilead Sciences (GILD), which can deliver steadier and sometimes surprising growth, are overlooked. GILD stock has surged 22% so far this year, outperforming the broader market gain.

As Gilead prepares to report its fourth-quarter earnings on Feb 10, investors may be underestimating just how much momentum is building beneath the surface.

HIV Franchise Continues to Power Growth

Valued at $181.4 billion by market capitalization, Gilead Sciences is a biotech company that develops and sells medicines primarily for serious diseases. It is best known for its leadership in HIV treatment and prevention. However, its therapies in oncology, antiviral medicines, and next-generation cell therapy, all of which have long-term growth potential, make it an established biotech stock still worth considering.

In the third quarter, total revenue rose 3% year-over-year (YOY) to $7.8 billion, even as product sales dipped 2% to $7.3 billion, owing mostly to decreased Covid-19-related demand for Veklury and persistent competitive pressure in cell therapy. Importantly, product sales excluding Veklury climbed 4% to $7.1 billion, highlighting the resilience of the core business. HIV remains the backbone of Gilead’s business, with product sales up 4% YOY to $5.3 billion, driven by strong demand. Notably, Biktarvy sales climbed 6% to $3.7 billion, reflecting continued share gains and sustained demand, while Descovy sales surged 20% to $701 million, benefiting from strong adoption in both treatment and prevention.

Management now expects the HIV franchise to grow approximately 5% YOY, up from prior guidance of 3%, despite the impact of U.S. Part D redesign changes. The PrEP market expanded at a rate of about 14% to 15% per year, which management expects to be sustainable through 2026. Gilead's liver disease portfolio also had another outstanding quarter, with sales up 12% YOY to $819 million, principally due to increased demand for Livdelzi.

In oncology, Trodelvy sales rose 7% YOY to $357 million, supported by higher demand and encouraging clinical data. However, cell therapy continued to be a drag in the quarter, with revenues falling 11% to $432 million due to a drop in Yescarta and Tecartus sales. Despite these obstacles, Gilead continues to invest in the field, as evidenced by its acquisition of Interius BioTherapeutics, which broadens its in vivo cell therapy goals.

Profitability and Capital Returns Remain Solid

Profitability remained resilient in Q3 with adjusted earnings up 22% to $2.47 per share and adjusted gross margin at 86.5%. Gilead paid out $1.4 billion to shareholders, including $1 billion in dividends and $435 million in share repurchases, and ended the quarter with $9.4 billion in cash and marketable securities. One of the most closely watched drivers heading into Q4 is Yeztugo for HIV PrEP. Management noted that the launch has been met with strong early reception from clinicians, payers, and patients. In fact, Yeztugo's sales have reached $54 million year-to-date (YTD), with full-year 2025 revenues estimated to be around $150 million.

Another positive move in the quarter was the recent patent settlement agreements, which pushed Biktarvy's earliest U.S. generic entry date to April 2036, extending exclusivity by more than two years.

While Gilead didn’t provide any guidance for Q4, analysts predict revenue of $7.68 billion with earnings of $1.83 per share. In the Q4 announcement, investors should watch out for continued acceleration in Yeztugo uptake, sustained HIV growth above market rates, and further clarity on pipeline milestones expected in oncology and HIV over the coming quarters. However, for the full year, management expects product sales of $28.4 million to $28.7 billion and adjusted EPS in the range of $8.05 and $8.25 per share, in line with consensus estimates. For 2026, analysts expect revenue growth of 3.3% with earnings increasing by 7.6%.

Trading at 16.6 times forward earnings, Gilead is a reasonable buy now. With multiple potential launches slated for 2026, a strengthened balance sheet, and no major patent expirations expected until 2036, Gilead is entering Q4 from a position of unusual stability for a large-cap biotech.

What Does Wall Street Say About Gilead Stock?

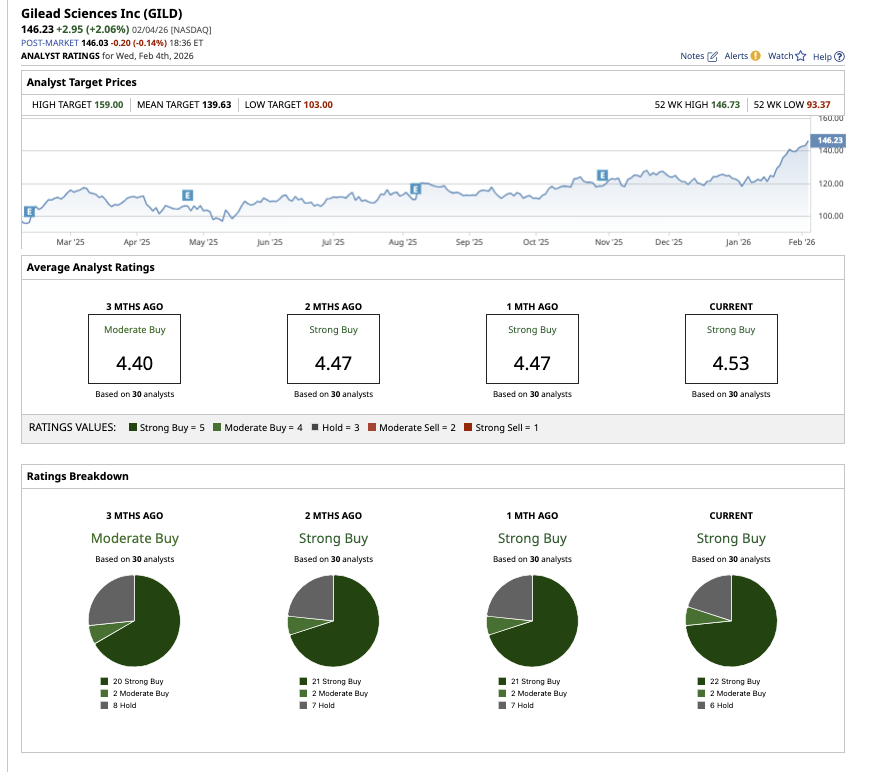

Overall, Wall Street rates GILD stock as a consensus “Strong Buy.” Of the 30 analysts covering the stock, 22 rate it as a “Strong Buy,” two say it is a “Moderate Buy,” and six analysts rate shares as a “Hold.” GILD stock has surpassed its average target price of $139.63. However, the high target price of $159 implies a 6% potential increase over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nio Says Profitability Is Just Around the Corner. Should You Buy NIO Stock Here?

- As Analysts Forecast 50% Upside, Is Now the Time to Buy the Dip in AMD?

- Is There a Light at the End of the Tunnel for Qualcomm Stock? What Options Data, Technicals Tell Us.

- This Overlooked Biotech Giant Could Surprise Investors This Quarter