New Global Renewable Markets Attractiveness Rankings for period ending December 2020 place United States in the top spot among markets

As the Biden Administration aims to significantly increase federal investment in renewable energy under the American Jobs Plan, the United States already ranks as the most attractive market for renewables investment, according to results from a new ranking by IHS Markit (NYSE: INFO), a world leader in critical information, analytics and solutions.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210505005078/en/

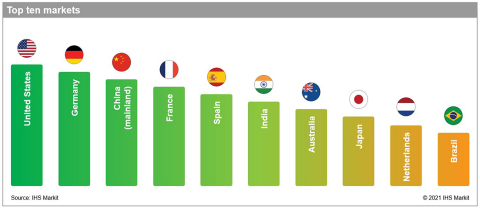

Top 10 markets. IHS Markit Global Renewable Markets Attractiveness Rankings. (Source: IHS Markit)

The IHS Markit Global Renewables Markets Attractiveness Rankings, which tracks attractiveness for investment for non-hydro renewables (offshore wind, onshore wind and solar PV), placed the United States in the number one spot for the period ending December 2020. The United States claimed the top spot on account of sound market fundamentals and the availability of an attractive—though phasing down—support scheme.

Mainland China, which accounted for over half of the world’s total non-hydro renewables additions last year, ranked third on the attractiveness ranking—just behind number two Germany—as difficulties in accessing the market weighed down its overall score.

The IHS Markit Global Renewable Markets Attractiveness Rankings utilize an integrated proprietary methodology to provide comparable views of 35 markets that are expected to account for 90% of non-hydro renewables capacity additions to 2030.

The ranking evaluates each country on the basis of seven subcategories that include the current policy framework, market fundamentals, investor friendliness, infrastructure readiness, revenue risks and return expectations, easiness to compete and the overall opportunity size for each market. Each market is scored in individual categories for solar PV, onshore wind, offshore wind and an overall renewables score is calculated.

The overall country rankings are based on a combined score for offshore wind, onshore wind and solar PV that weights the different technologies based on their expected levels of installations over the next decade.

“Onshore wind, offshore wind and solar PV are set to account for over 80% of all new power generation capacity additions globally to 2030,” said Eduard Sala de Vedruna, executive director, global clean energy technology and renewables, IHS Markit. “While the lion’s share of 2020 capacity additions came from just two markets—China and the United States—close to 50 markets recorded double digit growth in the past year. The investment opportunity in renewables is significant and the new Global Renewable Markets Attractiveness Rankings is an important tool for investors to better understand the relative attributes of a given market.”

France and Spain secured the fourth and fifth spot, respectively, based on strong market fundamentals backed by stable procurement mechanisms and long-term clean energy targets. Similar factors also boosted the ranks of Japan (Rank 8) and the Netherlands (Rank 9), further supported by their strong impetus towards offshore wind—expected to be the fastest growing renewable energy technology in the next decade.

“The ongoing transition to competitive procurement and a growing need for grid-parity renewable power has forced investors to look beyond just financial incentives and focus on factors including economic stability, market liberalization and investor friendliness,” said Indra Mukherjee, senior analyst, global clean energy technology and renewables, IHS Markit.

Strong ambitions and stable procurement initiatives in India (rank 6), and availability of attractive subsidies and a high degree of investor friendliness in Australia (rank 7) propelled these markets to top spots on the list. However, these markets are beginning to encounter infrastructure constraints on their continued path towards decarbonization. In the case of India, onshore wind build has suffered from lack of grid and land access, while in Australia the disconnection between federal and state ambitions have increased investor uncertainty.

“While strong ambitions are perceived positively by investors and testify to a market’s commitment towards renewables, this needs to be backed by a well-conceived implementation framework, adequate infrastructure and durable policies,” said Mukherjee.

The Global Renewable Market Attractiveness Rankings is produced by the IHS Markit Global Power and Renewables service and will be updated biannually. The tool facilitates various levels of market comparison by providing flexibility to break down the final scores into their constituent subcategories and parameters. The scores are enriched by analyst rationale and justifications, which when viewed together provide a comprehensive high-level overview of each market.

In individual technology rankings, the United States also retained the top ranking in investment attractiveness for onshore wind and solar PV. The United Kingdom—which failed to crack the top ten in the combined rankings due to its relative lack of support for developing onshore wind and solar PV—ranked as the most attractive market for offshore wind investment.

For more product information about the Global Renewable Market Attractiveness Rankings contact Craig Urch at craig.urch@ihsmarkit.com.

For media inquiries or interview requests contact Jeff Marn at jeff.marn@ihsmarkit.com or press@ihsmarkit.com

About IHS Markit (www.ihsmarkit.com)

IHS Markit (NYSE: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions. Headquartered in London, IHS Markit is committed to sustainable, profitable growth.

IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates. All other company and product names may be trademarks of their respective owners © 2021 IHS Markit Ltd. All rights reserved.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210505005078/en/

Contacts

Jeff Marn

IHS Markit

+1 202 463 8213

Jeff.marn@ihsmarkit.com

Press Team

+1 303 858 6417

press@ihsmarkit.com