Non-Bank Lenders Began to Close Customer Satisfaction Gap with Nimble Digital Solutions

Industry-wide, mortgage servicers earned high levels of customer satisfaction during the pandemic, increasing overall satisfaction by a significant six points this year (on a 1,000-point scale) through a combination of relief efforts and quick pivots to digital solutions. However, according to the J.D. Power 2021 U.S. Primary Mortgage Servicer Satisfaction Study,℠ released today, all that pandemic-driven goodwill belies a bigger set of customer experience challenges—particularly for bank-affiliated lenders. As loan forbearance programs come to an end and more normalized customer interactions resume, traditional banks are starting to lose their edge over non-bank lenders.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210729005219/en/

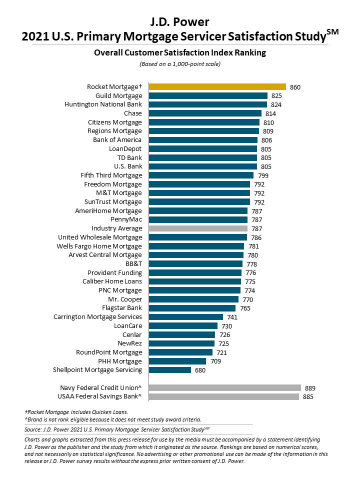

J.D. Power 2021 U.S. Primary Mortgage Servicer Satisfaction Study (Graphic: Business Wire)

"Mortgage servicer satisfaction was buoyed by the industry’s response to the pandemic, with some of the biggest gains in customer satisfaction being driven by at-risk and moderate-risk customers who participated in forbearance programs,” said Jim Houston, director of consumer lending intelligence at J.D. Power. “However, as we look at post-pandemic customer behaviors and responses of low-risk customers, we see that lift in satisfaction may be short-lived. In fact, despite the attention on relief programs, nearly one-fifth of current mortgage customers have had no interaction with their servicer during the past year. Mortgage servicers will really need to up their customer engagement games as the marketplace stabilizes.”

Following are some key findings of the 2021 study:

- Bank-affiliated servicers start to lose their edge to non-banks: While overall satisfaction increases six points this year, the bulk of that increase is driven by non-bank servicers, which see a significant 17-point increase in satisfaction. Bank-affiliated servicers, which have historically outperformed non-banks by a large margin, gain just four points in satisfaction this year.

- Forbearance lift will not last long: Another key driver of increased customer satisfaction this year is the at-risk customer category. Overall satisfaction among at-risk customers increases 15 points year over year, while satisfaction scores among low-risk customers declines one point. Likewise, satisfaction is highest in the study among those customers who participated in forbearance programs (846). This compares with a score of 783 among those who never enrolled in one and 776 among customers who were previously enrolled in a program but are no longer enrolled.

- Banks get satisfaction lift from non-mortgage services: Higher overall satisfaction scores for bank-affiliated servicers are inflated by non-mortgage services. Satisfaction scores among customers who also use their servicer’s bank products are 55 points higher than among those who have mortgage-only relationships.

- Need evident to expand engagement on digital, self-service channels: While website usage increases five percentage points this year, there is still room for improvement with the online channel. Only 38% of customers say they found the desired information on their servicer’s website within the first two pages. When customers had to visit more than two pages, overall satisfaction declined 55 points. Among customers who indicated they would switch lenders if given the opportunity their top reasons, in addition to better rates, were “better/improved customer service” and “easy access to help myself to information about my loan.”

Study Ranking

Rocket Mortgage (which includes Quicken Loans) is the highest-ranked mortgage servicer for an eighth consecutive year, with a score of 860. Guild Mortgage (825) ranks second and Huntington National Bank (824) ranks third.

The 2021 U.S. Primary Mortgage Servicer Satisfaction Study measures customer satisfaction with the mortgage servicing experience in five factors: customer interaction; communications; billing and payment process; escrow account administration; and new customer orientation. The study is based on responses from 8,507 customers who originated or refinanced more than 12 months ago. It was fielded from March through May 2021.

For more information about the U.S. Primary Mortgage Servicer Satisfaction Study, visit https://www.jdpower.com/business/resource/us-primary-mortgage-servicer-satisfaction-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2021086.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20210729005219/en/

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com