Declines across major sectors pull starts to five-month low

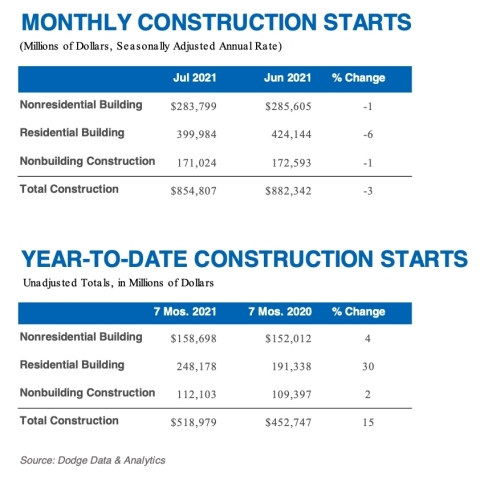

Total construction starts fell 3% in July to a seasonally adjusted annual rate of $854.8 billion, according to Dodge Data & Analytics. There were few bright spots during the month, with all three sectors (residential, nonresidential building and nonbuildings) moving lower in July.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210818005054/en/

JULY 2021 CONSTRUCTION STARTS (Graphic: Business Wire)

“Construction material prices continue their march higher and are weighing heavily on construction starts,” stated Richard Branch, Chief Economist for Dodge Data & Analytics. “Lumber and copper prices have fallen in recent weeks; however, steel, plastic and other construction-related products are continuing their ascent. These increases will continue to impact construction starts over the coming months, somewhat muting the impact of stronger economic activity. A further risk to the sector is the rising number of COVID-19 cases due to the Delta variant. While we don’t expect significant business restrictions in response, it is a risk that can not be fully discounted. On the upside, projects entering the planning stage remain at levels not seen in several years and forward progress on an infrastructure program and the federal budget provides hope that brighter days are ahead.”

Below is the full breakdown:

- Nonbuilding construction starts fell 1% in July to a seasonally adjusted annual rate of $171.0 billion. Starts in the environmental public works category dropped 25% following a large gain in June. Meanwhile, highway and bridge starts advanced in July, increasing 11% and utility/gas plant starts rose 25%. Miscellaneous nonbuilding starts were flat. On a year-to-date basis, total nonbuilding starts were 2% higher through July. Environmental public works starts were up 35% and utility/gas plant starts rose 5%. Highway and bridge starts and miscellaneous nonbuilding starts were both lower on a year-to-date basis, losing 4% and 19% respectively.

For the 12 months ending July 2021, total nonbuilding starts were 2% lower than the 12 months ending July 2020. Environmental public works starts were 32% higher, while utility and gas plant starts were down 18%. Highway and bridge starts were up 1% and miscellaneous nonbuilding starts were 25% lower through the first seven months.

The largest nonbuilding projects to break ground in July were the $728 million I-6 project in Indianapolis, IN, the $315 million Kew Lake Water Supply project in Enid, OK, and the $300 million Cavalier Solar Farm in Surry County, VA.

- Nonresidential building starts fell 1% in July to a seasonally adjusted annual rate of $283.8 billion. Commercial starts lost 19% during the month as starts pulled back in the warehouse, office and retail sectors, while hotel starts rose. Institutional starts rose 11% during the month due to gains in healthcare, recreation and transportation, while education starts fell. Manufacturing starts posted a solid gain in the month, nearly doubling from June’s level. Through the first seven months of 2021 nonresidential building starts were 4% higher when compared to the first seven months of 2020. Commercial starts were up 5% and manufacturing starts rose 45%, while institutional starts were 1% lower.

For the 12 months ending July 2021, nonresidential building starts were 8% lower than the 12 months ending July 2020. Commercial starts were down 8%, while institutional starts fell 5%. Manufacturing starts dropped 26% in the 12 months ending July 2021.

The largest nonresidential building projects to break ground in July were the $1.5 billion JP Morgan Office Tower in New York, NY, the $1 billion Inglewood basketball arena in Los Angeles, CA, and the $825 million REG Geismar Biofuels Plant in Geismar, LA.

- Residential building starts fell 6% in July to a seasonally adjusted rate of $400.0 billion. Single family starts lost 6% in July, while multifamily starts dipped 4%. Through seven months, residential starts were 30% higher than the same period one year ago. Single family starts were up 34%, while multifamily was 19% higher.

For the 12 months ending July 2021, total residential starts were 23% higher than the 12 months ending July 2020. Single family starts gained 29%, while multifamily starts were up 8% on a 12-month sum basis.

The largest multifamily structures to break ground in July were the $223 million second phase of the Sendero Verde project in New York, NY, the $203 million Chestnut Commons in Brooklyn, NY, and the $194 million 100 Flatbush mixed-use project in Brooklyn, NY.

- Regionally, July’s starts rose in the Northeast, Southeast and Midwest regions, but fell in the South Atlantic and West regions.

About Dodge Data & Analytics

Dodge Data & Analytics is North America's leading provider of commercial construction project data, market forecasting & analytics services, and workflow integration solutions for the construction industry. Building product manufacturers, architects, engineers, contractors, and service providers leverage Dodge to identify and pursue unseen growth opportunities that help them grow their business. On a local, regional or national level, Dodge empowers its customers to better understand their markets, uncover key relationships, seize growth opportunities, and pursue specific sales opportunities with success. The company's construction project information is the most comprehensive and verified in the industry.

As of April 15th, Dodge Data & Analytics and The Blue Book -- the largest, most active network in the U.S. commercial construction industry -- combined their businesses in a merger. The Blue Book Network delivers three unparalleled databases of companies, projects, and people.

Dodge and The Blue Book offer 10+ billion data elements and 14+ million project and document searches. Together, they provide a unified approach for new business generation, business planning, research, and marketing services users can leverage to find the best partners to complete projects and to engage with customers and prospects to promote projects, products, and services. To learn more, visit construction.com and thebluebook.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210818005054/en/

Contacts

Eric Becker | 104 West Partners | eric.becker@104west.com