Only 7% of Investors Receive Comprehensive Advice as Defined by J.D. Power Criteria

Although satisfaction among investors with full-service wealth management firms in Canada has increased slightly to 669 (on a 1,000-point scale) from 666 a year ago, only a fraction of those investors are getting the holistic and comprehensive financial advice that is the core value proposition of the industry. According to the J.D. Power Canada 2022 Full-Service Investor Satisfaction StudySM, released today, while 40% of investors say their financial advisor provides them with comprehensive advice, a deeper analysis reveals that only 7% of investors receive all the elements of comprehensive advice as defined by J.D. Power criteria. The criteria include making recommendations in an investor’s best interests; understanding an investor’s goals and needs; and having a documented financial plan. This year’s study results also put Canada’s wealth management industry behind that of the United States, where 14% of full-service investors in 2022 receive comprehensive advice.1

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220505005102/en/

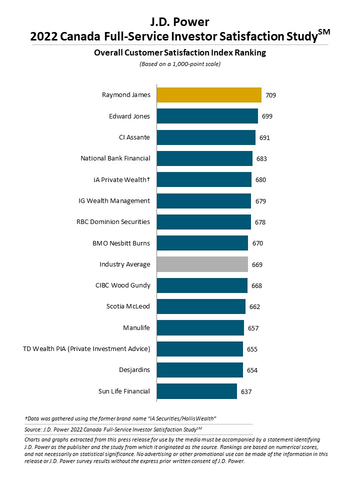

2022 Canada Full-Service Investor Satisfaction Study (Graphic: Business Wire)

“As the traditional advice model faces more challenges from lower cost and technology-driven alternatives such as digital or robo-advice, it’s more critical than ever that advisors provide something truly differentiating to their clients,” said Mike Foy, senior director of wealth intelligence at J.D. Power. “While the industry has long touted comprehensive advice, the study shows that very few full-service investors in Canada—even those with high net worth—are truly receiving such advice from their advisors. And, while many investors may be willing to settle for something less, it’s the investors who do receive comprehensive advice that consistently provide the referrals that drive growth.”

Following are some key findings of the 2022 study:

- Brand trust and client retention: When problems occur with their investment firm or investment performance lags expectations, higher brand trust by clients reduces the risk of attrition. When clients are disappointed in their portfolio performance, 15% of those with low brand trust say they’re considering switching firms vs. just 5% of those with high brand trust. Brand trust is influenced by considerations such as transparency, reliability and the ability to meet client service expectations.

- The honeymoon years: According to the study, trust between clients and their wealth management firms develops most quickly within the first three years of the advisor-client relationship. After that, the risk of attrition declines. Switching consideration drops from 10% among clients with one year of tenure to 5% among those with four years.

- Blending digital and human interactions: Among all age groups, satisfaction is highest when investors experience a mix of human and digital interaction, but there are significant differences in terms of the right blend. Boomers2 show a clear preference for human interaction when it comes to advice and planning but are more comfortable with using digital channels for service and administration. Conversely, Millennials are more comfortable with a mix that includes digital across all types of interactions.

Study Ranking

Raymond James ranks highest in overall investor satisfaction with a score of 709. Edward Jones (699) ranks second and CI Assante (691) ranks third.

The Canada Full-Service Investor Satisfaction Study, now in its 17th year, measures overall investor satisfaction with full-service investment firms in seven factors (in order of importance): trust; people; products and services; value for fees; ability to manage wealth how and when I want; problem resolution; and digital channels.

The study is based on responses from 4,534 investors who make some or all of their investment decisions with a financial advisor or a team of financial advisors. The study was fielded from November 2021 through January 2022.

For more information about the Canada Full-Service Investor Satisfaction Study, visit https://canada.jdpower.com/financial-services/canada-full-service-investor-satisfaction-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2022051.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modelling capabilities to understand consumer behaviour, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business.

About J.D. Power and Advertising/Promotional Rules: http://www.jdpower.com/business/about-us/press-release-info

_________________________

1 J.D. Power 2022 U.S. Full-Service Investor Satisfaction Study

2 J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2004). Millennials (1982-1994) are a subset of Gen Y.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220505005102/en/

Contacts

Gal Wilder, NATIONAL; 416-602-4092; gwilder@national.ca

Nicole Herback, NATIONAL; 403-200-1187; nherback@national.ca

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com