Files Definitive Proxy

Urges Shareholders to Protect Their Investments by Voting FOR the Proposed Transaction

Consolidated Communications Holdings, Inc. (Nasdaq: CNSL) (the “Company” or “Consolidated”), a top 10 fiber provider in the U.S., today announced that it has filed its definitive proxy statement. The Company has also filed a letter to shareholders in connection with its upcoming special meeting of shareholders (the “Special Meeting”) urging shareholders to vote “FOR” the proposed acquisition of the Company by affiliates of Searchlight Capital Partners, L.P. (“Searchlight”) and British Columbia Investment Management Corporation (“BCI”) (the “Proposed Transaction”). The Special Meeting is scheduled to be held on January 31, 2024, and shareholders of record as of December 13, 2023 will be entitled to vote at the meeting.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231217888743/en/

1. Unaffected stock price as of April 12, 2023, the last trading day prior to public announcement of the non-binding proposal. 2. Peers include Frontier Communications, Lumen, Cable One, Shentel, ATN International, WideOpenWest, Altice USA and Charter Communications. 3. Calendar day volume-weighted average prices as of April 12, 2023.

The Consolidated board of directors (the “Board”) believes the offer of $4.70 per share represents the best risk-adjusted outcome for shareholders, particularly in light of the significant risks associated with Consolidated’s prospects as a public company with limited access to capital. The Board urges shareholders to vote “FOR” the Proposed Transaction. Highlights from the letter include:

-

The Proposed Transaction delivers a significant cash premium, representing a compelling opportunity for shareholders to receive an attractive and certain value for their investment.

- Even as peer stock prices have fallen, the purchase price exceeds Consolidated’s stock price at every point over the last year, even after the initial bid was made public, underscoring the value-maximizing nature of the Proposed Transaction.

-

The Proposed Transaction eliminates the ongoing uncertainty from liquidity, funding and execution risks and transfers those risks to Searchlight and BCI.

- The operating environment makes it difficult and costly for Consolidated to execute its strategy, and Consolidated does not have the liquidity to fund its future fiber builds at the pace necessary to remain competitive.

- By slowing the Company’s fiber build pace, which it needs to do in 2024 to preserve liquidity, competitors will have additional time to build fiber in certain of Consolidated’s markets ahead of the Company, creating a clear competitive disadvantage and an impediment to future growth.

- The special committee established by the Board, composed of independent and disinterested directors, undertook a robust and thorough evaluation of all opportunities, including continuing as a standalone company, and determined that the Proposed Transaction is the most compelling – and only viable – path forward.

- Wildcat’s perspective is based on incomplete information, and a misunderstanding of the risks and opportunities facing the Company. Wildcat has based its views on hypothetical and highly uncertain long-term scenarios for Consolidated that ignore the near-term realities of operational risk, competitive intensity and financing uncertainty that the Company faces today. Following Wildcat’s misguided perspective would only endanger the value and certainty that shareholders will receive if they support the Proposed Transaction.

The full text of the letter mailed to shareholders follows:

YOUR VOTE IS IMPORTANT

PROTECT THE VALUE OF YOUR INVESTMENT BY VOTING FOR THE TRANSACTION TODAY

December 18, 2023

Dear Fellow Shareholders,

On January 31, 2024, Consolidated Communications Holdings, Inc. (“Consolidated” or the “Company”) will hold a special meeting of shareholders (the “Special Meeting”) to consider the proposed acquisition of the Company by affiliates of Searchlight Capital Partners, L.P. (“Searchlight”) and British Columbia Investment Management Corporation (“BCI”).

The Consolidated board of directors (the “Board”) believes this transaction, which will deliver $4.70 in cash for each share you own, is fair and in the best interests of the Company and its shareholders. The transaction represents a compelling opportunity to receive an attractive and certain value for your investment. The Board recommends that you vote "FOR" the proposal to approve the Searchlight and BCI transaction (the “Proposed Transaction”) on the enclosed proxy card today. Your vote is important, regardless of the number of shares you own. Not voting will have the same effect as voting against the transaction.

In short, the Board believes this offer of $4.70 per share represents the best risk-adjusted outcome for shareholders, particularly in light of the significant risk associated with Consolidated’s prospects as a standalone business.

The Proposed Transaction Delivers Financially Compelling and Certain Value to Consolidated Shareholders

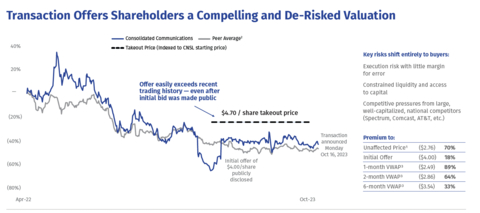

The $4.70 per share to be paid in cash is a 70% premium to the Company’s share price on the last full trading day prior to the submission of Searchlight’s and BCI’s initial non-binding proposal.1 This premium is being offered even as our peers’ stock prices have fallen. Moreover, the purchase price exceeds Consolidated’s stock price at every point over the last year, even after the initial bid was made public, underscoring the value-maximizing nature of the Proposed Transaction.

| _______________________________ |

1 Unaffected stock price as of April 12, 2023, the last trading day prior to public announcement of the non-binding proposal. |

See Image 1.

The value of the Proposed Transaction is also highly compelling when compared to the multiples secured in other relevant transactions, as detailed below, and as compared to similar precedent all cash transactions.

See Image 2.

Casting your vote is the best way for you to secure this cash premium. Without sufficient shareholder support, the Proposed Transaction will not be completed, risking a steep drop in Consolidated’s share price potentially to well below the pre-announcement price. Maximize the value of your investment and vote FOR the Proposed Transaction today.

The Current Operating Environment Makes it Difficult and Costly to Execute our Strategy to Effectively Compete and Grow

To remain competitive, telecommunications companies like Consolidated must upgrade their networks from copper-based DSL to fiber. Consolidated’s copper-based DSL network is costly to maintain and is generally incapable of delivering a competitive residential or commercial broadband service. In fact, on average, Consolidated only provides its subscribers with 25 Mbps over its legacy copper DSL network. By comparison, the Company can offer 1 Gbps and above (i.e., at least 40 times faster than the 25 Mbps currently being delivered to customers over its legacy copper DSL network) over its fiber network. We believe this upgrade is necessary to ensure the long-term sustainability of the Company. Failure to execute, or even significantly slowing this upgrade, jeopardizes the Company’s already precarious competitive position. Consolidated is not alone in pursuing this fiber upgrade, as many of its competitors are also making this transition.

The conversion we have undertaken is very capital-intensive. Since 2021, when Consolidated first began converting its network to fiber, cumulative capital expenditures have totaled approximately $1.5 billion, and fiber now reaches approximately 45% of our base. While we have accomplished much, we are now attempting to complete our goal of bringing fiber to approximately 70% of our network while combatting a deteriorating financing and operating environment that is substantially different from when our plan was originally developed. The challenges we face in today’s uncertain market include:

- Accelerating industry-wide declines in voice and access revenue, as consumers increasingly rely on their mobile phones instead of their traditional landline ‘home phones’;

- Increased inflationary pressures that directly impact our costs, resulting in higher than expected fiber construction and installation costs and a lower return on our network investment;

- Strong competition for broadband subscribers, in particular from scaled nationwide providers, resulting in penetration levels behind initial plans;

- A competitive and deflationary commercial and carrier market, resulting in slower than anticipated growth and comparatively unfavorable pricing; and

- Increased interest expense in light of higher interest rates.

Owing to the challenges outlined above – among others – our prior investments have not yielded the desired results. The Company has responded to this new reality by trying to generate additional liquidity, including through asset sales and cost cutting, but these efforts have been insufficient to alleviate the impact of market challenges on our business performance and liquidity position. In short, Consolidated is unable to fund its future fiber builds at the pace necessary to remain competitive and continue to grow.

The Proposed Transaction eliminates the ongoing uncertainty from liquidity, funding and execution risks and transfers those risks to Searchlight and BCI.

Standalone Consolidated Does Not Have the Liquidity to Fund its Growth Plan – the Proposed Transaction is Critical to Realizing the Value of Your Investment

Because of Consolidated’s limited access to capital and constrained liquidity position, we can no longer execute on our original fiber upgrade plan. As a standalone Company, we will be forced to significantly slow the pace of our upgrade to roughly 45,000 – 75,000 passings per year, well below our 2021 – 2023 average of more than 300,000 passings per year. As a result, our build plan now has a completion date of 2029 – three years after our original target. Given this delay in our plan, competitors will have additional time to build fiber in certain of our markets ahead of the Company, creating a clear competitive disadvantage for us and an impediment to future growth.

See Image 3.

Management’s updated standalone plan, established in August 2023, anticipated that even with only 75,000 locations passed in 2024, the Company’s liquidity would shrink from $231 million at the end of 2023, to $89 million at the end of 2024 and to a low point of only $11 million at the end of 2025.

Even with our significantly reduced build plan in 2024 and 2025, the Company will have an extremely limited liquidity cushion. A relatively modest miss on revenue or EBITDA, an overspend on capex or unexpected movements in interest rates could put the Company in a dire financial position.

Many of our competitors will also be capitalizing on the upcoming Broadband Equity, Access, and Deployment (BEAD) program, a government program that provides funds to expand high-speed internet access. Utilizing these government funds will require an upfront capital outlay from the Company. As a standalone company, Consolidated may not have the liquidity to meaningfully participate in the BEAD program, putting the Company at a severe competitive disadvantage. Without capital, there is a risk of our competitors winning subsidies and over-building our network, thereby jeopardizing our competitive position.

Given the above, the Company will be in the midst of a significant transformation for the next several years. Again, transformation into a predominantly fiber business is competitively critical, and many risks exist to get there successfully, as the recent challenging operating environment has underscored. Taking into account these risks, as well as the protracted timeline of Consolidated’s FTTH transition, the Board believes this offer of $4.70 per share represents the best risk-adjusted outcome for shareholders.

Special Committee of Independent and Disinterested Directors Undertook a Robust Evaluation of All Opportunities to Maximize Value for All Shareholders

After receiving the initial proposal for the Proposed Transaction from Searchlight and BCI on April 12, 2023, the Board established a special committee composed of independent and disinterested directors, advised by independent legal and financial advisors (the “Special Committee”). The purpose of the Special Committee was to evaluate the proposal as well as all potential alternatives to maximize shareholder value.

It was well known to the market that the Board was undertaking this evaluation. The Company issued a press release acknowledging the proposal and noting that the Special Committee would review the proposal along with any alternative proposals or other strategic alternatives that may be available.

Despite the publicity of the initial proposal and the Company’s disclosure of its evaluation process and the formation of the Special Committee, no inbound inquiries were received expressing interest in an acquisition proposal.

Indeed, the Special Committee considered the Searchlight and BCI proposal very seriously and conducted an extremely thorough process, holding more than 35 formal meetings over six months to discuss and evaluate the Proposed Transaction and potential alternatives in order to ensure the Proposed Transaction delivered the highest possible value. The alternatives considered included additional asset divestitures and various financing transactions to inject additional capital into the Company. These were deemed not viable for a variety of reasons, as outlined below:

- The difficulty of obtaining financing on acceptable terms in today’s environment;

- Limited interest from buyers for other of our non-core assets at attractive valuations and the likely timeframe to realize any potential sale proceeds relative to the timing of our capital needs;

- The likely significant dilution to shareholders; and

- Limitations imposed by Searchlight’s consent rights with respect to debt incurrence and equity issuances.

The Special Committee determined that if Consolidated were to remain a standalone company, it would yield more downside risk than upside potential. The Board’s robust evaluation underscores that the Proposed Transaction is the most compelling path forward for Consolidated and its shareholders.

The Special Committee negotiated an 18% increase of the initial offer price, a significant benefit for shareholders when considering the standalone option.

Wildcat is Attempting to Create a False Narrative for Shareholders

We believe that Wildcat Capital Management, LLC’s perspective is based on incomplete information, and a misunderstanding of the risks and opportunities facing the Company. Wildcat has based its views on hypothetical and highly uncertain long-term scenarios for Consolidated that ignore the near-term realities of operational risk, competitive intensity and financing uncertainty that the Company faces today. The resulting perspective is misguided and endangers the value and certainty that shareholders will receive if they support the Proposed Transaction. While Wildcat may dismiss the urgency of our liquidity constraints and the negative impact on the Company’s value from slowing our fiber build plan, the market certainly will not if this deal is voted down.

Note that Wildcat has an unrealistic demand for $14.00 per share, a 407% premium over the unaffected stock price, based on their incorrect analysis. Consolidated’s share price was only $2.76 on April 12, 2023, the day before the non-binding offer was made public. Without the certainty of the $4.70 per share offer, the Company’s share price will certainly fall, most likely to levels below the $2.76 unaffected stock price, given the well-known risks to the business. As a result, significant and certain value for all shareholders will have been destroyed.

Your Vote is Important – Not Voting is the Same as Voting Against the Transaction

VOTE “FOR” THE PROPOSED TRANSACTION TODAY

As a Consolidated shareholder, your choice is clear: vote for significant, compelling and immediate value.

Your Board recommends that you vote “FOR” the Merger Agreement Proposal. Your vote is important, no matter how many shares you own. Please vote today.

We thank you for your continued support.

Sincerely,

The Consolidated Communications Board of Directors

The Board believes the offer of $4.70 per share represents the best risk-adjusted outcome for shareholders, particularly in light of the significant risks associated with Consolidated’s prospects as a public company with limited access to capital. The Board urges shareholders to vote “FOR” the Proposed Transaction.

Shareholders with questions or who require assistance voting their shares should contact Consolidated’s proxy solicitor, Morrow Sodali. Shareholders may call toll-free: (800) 662-5200 or +1 (203) 658-9400 (international) or email CNSL@info.morrowsodali.com.

Advisors

Rothschild & Co is acting as financial advisor to the Special Committee and Cravath, Swaine & Moore LLP is acting as its legal counsel. Latham & Watkins LLP is providing legal counsel to Consolidated Communications.

About Consolidated Communications

Consolidated Communications Holdings, Inc. (Nasdaq: CNSL) is dedicated to moving people, businesses and communities forward by delivering the most reliable fiber communications solutions. Consumers, businesses and wireless and wireline carriers depend on Consolidated for a wide range of high-speed internet, data, phone, security, cloud and wholesale carrier solutions. With a network spanning nearly 60,000 fiber route miles, Consolidated is a top 10 U.S. fiber provider, turning technology into solutions that are backed by exceptional customer support.

Forward-Looking Statements

Certain statements in this communication are forward-looking statements and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect, among other things, the Company’s current expectations, plans, strategies and anticipated financial results.

There are a number of risks, uncertainties and conditions that may cause the Company’s actual results to differ materially from those expressed or implied by these forward-looking statements, including: (i) the risk that the Proposed Transaction may not be completed in a timely manner or at all; (ii) the failure to receive, on a timely basis or otherwise, the required approvals of the Proposed Transaction by the Company’s stockholders; (iii) the possibility that any or all of the various conditions to the consummation of the Proposed Transaction may not be satisfied or waived, including the failure to receive any required regulatory approvals from any applicable governmental entities (or any conditions, limitations or restrictions placed on such approvals); (iv) the possibility that competing offers or acquisition proposals for the Company will be made; (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the definitive transaction agreement relating to the Proposed Transaction, including in circumstances which would require the Company to pay a termination fee; (vi) the effect of the announcement or pendency of the Proposed Transaction on the Company’s ability to attract, motivate or retain key executives and employees, its ability to maintain relationships with its customers, suppliers and other business counterparties, or its operating results and business generally; (vii) risks related to the Proposed Transaction diverting management’s attention from the Company’s ongoing business operations; (viii) the amount of costs, fees and expenses related to the Proposed Transaction; (ix) the risk that the Company’s stock price may decline significantly if the Proposed Transaction is not consummated; (x) the risk of shareholder litigation in connection with the Proposed Transaction, including resulting expense or delay; and (xi) (A) the risk factors described in Part I, Item 1A of Risk Factors in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and (B) the other risk factors identified from time to time in the Company’s other filings with the SEC. Filings with the SEC are available on the SEC’s website at http://www.sec.gov.

Many of these circumstances are beyond the Company’s ability to control or predict. These forward-looking statements necessarily involve assumptions on the Company's part. These forward-looking statements generally are identified by the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “should,” “may,” “will,” “would” or similar expressions. All forward-looking statements attributable to the Company or persons acting on the Company’s behalf are expressly qualified in their entirety by the cautionary statements that appear throughout this communication. Furthermore, undue reliance should not be placed on forward-looking statements, which are based on the information currently available to the Company and speak only as of the date they are made. The Company disclaims any intention or obligation to update or revise publicly any forward-looking statements.

Participants in the Solicitation

The Company and its directors, executive officers and certain other members of management and employees, under SEC rules, may be deemed to be “participants” in the solicitation of proxies from stockholders of the Company in connection with the Proposed Transaction. Information about who may, under SEC rules, be considered to be participants in the solicitation of the Company’s stockholders in connection with the Proposed Transaction is set forth in the definitive proxy statement filed with the SEC on December 15, 2023 (the “Proxy Statement”) in connection with the Proposed Transaction. To the extent holdings of the Company’s securities have changed since the amounts set forth in such Proxy Statement, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC. Additional information concerning the interests of the Company’s participants in the solicitation, which may, in some cases, be different than those of the Company’s stockholders generally, are set forth in the Proxy Statement.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the Proposed Transaction. The Special Meeting will be held on January 31, 2024 at 9:00 A.M. Central Time, at which meeting the stockholders of the Company will be asked to consider and vote on a proposal to adopt the merger agreement and approve the Proposed Transaction. In connection with the Proposed Transaction, the Company filed relevant materials with the SEC, including the Proxy Statement. The Company intends to mail the Proxy Statement and a proxy card on December 18, 2023 to each stockholder of the Company entitled to vote at the Special Meeting. In addition, the Company and certain affiliates of the Company jointly filed an amended transaction statement on Schedule 13e-3 (the “Schedule 13e-3”). INVESTORS AND STOCKHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT AND THE SCHEDULE 13E-3, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, SEARCHLIGHT AND BCI AND THE PROPOSED TRANSACTION. Investors and stockholders of the Company are able to obtain these documents free of charge from the SEC’s website at www.sec.gov, or free of charge from the Company by directing a request to the Company at 2116 South 17th Street, Mattoon, IL 61938, Attention: Investor Relations or at tel: +1 (844) 909-2675.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231217888743/en/

Contacts

Consolidated Communications

Philip Kranz, Investor Relations

+1 217-238-8480

Philip.kranz@consolidated.com

Jennifer Spaude, Media Relations

+1 507-386-3765

Jennifer.spaude@consolidated.com