Nearly Two-Thirds of Retail Bank Customers Are Struggling Financially

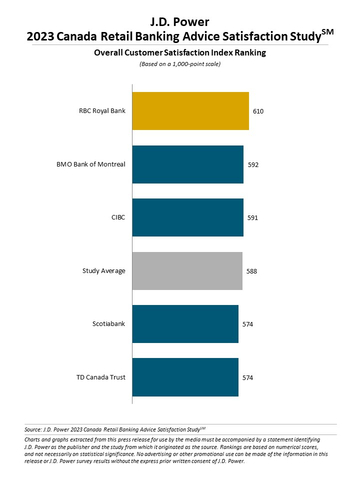

The economic pressure caused by inflation, capital markets volatility and rising interest rates has put its mark on bank customers in Canada, with nearly two-thirds (66%) being classified as financially unhealthy,1 according to the J.D. Power 2023 Canada Retail Banking Advice Satisfaction Study,SM released today. The study also finds that, while personalized financial advice can elevate customer satisfaction and engagement with retail banks, only 42% of customers recall receiving advice from their financial institution and only 50% of those customers found the advice to be effective. Furthermore, overall satisfaction with banking advice declines 4 points year over year to 588 (on a 1,000-point scale).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230629102113/en/

J.D. Power 2023 Canada Retail Banking Advice Satisfaction Study (Graphic: Business Wire)

“Canada’s large banks should be more attuned to their customers’ financial state and needs, offering and tailoring advice that is aligned with their financial challenges and tied to their future financial goals,” said Jennifer White, senior director for banking and payments intelligence at J.D. Power. “During times of financial hardship, customers are looking for guidance. Delivering advice can increase customer trust by 9 percentage points, and when the advice is completely personalized, trust rises 15 percentage points. Unlike their U.S. counterparts that demonstrated an improvement on that front,2 Canadian banks have yet to rise to the occasion and are still lagging in delivering the right advice at the right time to make a positive impact on their customers’ satisfaction.”

Following are some key findings of the 2023 study:

- Financial state tied to satisfaction: The study finds a correlation between customers’ financial state and satisfaction with their bank’s advice. Satisfaction among those who are considered financially healthy is significantly higher (657) than among those who are considered financially stressed (562) or vulnerable (500).

- Advice personalization: The top three key performance indicators (KPIs) for retail banking customer satisfaction are focused on advice personalization: the advice completely meets the customer’s needs; the bank representative shows genuine care for the customer’s concerns; and the advice is highly tailored to the individual. When any of these three KPIs are met, satisfaction increases more than 200 points.

- Most common advice topics: Investment and retirement advice is the most frequent type of advice both desired and received by bank customers and interest for this topic is on the rise.

Study Ranking

RBC Royal Bank ranks highest in customer satisfaction with retail banking advice for a third consecutive year, with a score of 610. BMO Bank of Montreal (592) ranks second and CIBC (591) ranks third.

The 2023 Canada Retail Banking Advice Satisfaction Study includes responses of 2,911 retail bank customers in Canada who received any advice/guidance from their primary bank regarding relevant products and services or other financial needs in the past 12 months. The study was fielded in February-March 2023. In addition to bank financial advice ratings, the study also provides financial health support index benchmarking data that evaluates proficiency of banks and credit card issuers in delivering financial support to customers.

The study also captures responses from customers about their satisfaction with the financial health support provided by their financial partners. Top-performing banks in the banking financial health support index are (in alphabetical order): BMO Bank of Montreal, CIBC, and RBC Royal Bank. Top-performing credit card providers in the credit card financial support index are (in alphabetical order): RBC Royal Bank and TD Canada Trust.

For more information about the Canada Retail Banking Advice Satisfaction Study, visit https://www.jdpower.com/business/financial-health-and-advice-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2023065.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behaviour, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

__________

1 J.D. Power measures the financial health of any consumer as a metric combining their spending/savings ratio, creditworthiness, and safety net items like insurance coverage. Consumers are placed on a continuum from healthy to vulnerable.

2 J.D. Power 2023 U.S. Retail Banking Advice Satisfaction Study

View source version on businesswire.com: https://www.businesswire.com/news/home/20230629102113/en/

Contacts

Gal Wilder, NATIONAL PR; 416-602-4092; gwilder@national.ca

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com