- Gen Z Women Define Financial Confidence on Their Own Terms, With 44% Actively “Unlearning” Gender Stereotypes about Money

- Analysis of Fidelity Customers Reveals Three Key Steps to Minimize Financial Stress

- Viola Davis and Padma Lakshmi Headline Fidelity’s Women’s History Month Special Series Designed to Help Women Increase their Financial Know-How

With financial stress a reality for more than 9-in-10 women, new research from Fidelity Investments® reveals the financial steps women can take to de-stress and increase their financial confidence. Fidelity’s 2024 Women’s History Month Study, released annually at the start of Women’s History Month, finds stress levels remain consistently high among women no matter their total household income. Taking financial action, however, makes the biggest difference in decreasing stress, with women who made financial moves in the past 6 months indicating less stress than women who haven’t. Fidelity’s research also identifies three financial behaviors to help women of all ages and income levels reduce financial stress: saving for emergencies, saving for retirement and thinking ahead.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240301011093/en/

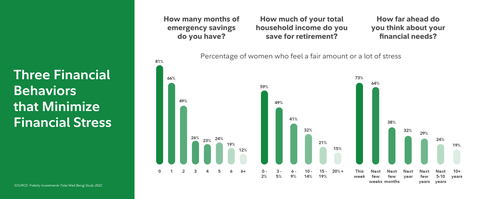

Three Financial Behaviors that Minimize Financial Stress (Graphic: Fidelity Investments)

“It’s not uncommon to feel stress when it comes to finances, so it's critical we support women by providing proven ways to help them combat this feeling and build financial confidence,” said Sangeeta Moorjani, head of Tax Exempt Markets for Fidelity Investments. “We believe knowledge truly is power and are committed to supporting women no matter where they are on their financial journey, by providing access to financial education, planning and tools, so that everyone can feel confident in their ability to build a strong financial future.”

Tackling Stressors Head On: Three Achievable Steps that Can Yield Big Results

With most women indicating financial stress, Fidelity identified three key money moves that can help women reduce financial stress, based on Fidelity research on customers who participate in a workplace retirement plan1:

- Saving for Emergencies: Financial stress levels drastically decrease with each additional month of emergency savings set aside. More than 4-in-5 women (81%) with no emergency savings feel a fair amount or a lot of stress. Once women save three months’ worth of emergency savings, only 1-in-4 women (26%) report high stress levels.

- Saving for Retirement: Small increases in retirement savings can lead to big results when it comes to financial stress. Nearly 3-in-5 women (59%) who save up to 2% of their household income for retirement feel a fair amount or a lot of stress. Once women save between 10 and 14%, only about 3-in-10 women (32%) indicate similar stress levels. This number continues to decrease as women increase their retirement savings contributions, indicating financial stress lessens with every incremental increase in contribution.

- Thinking Ahead: Taking the time to outline financial goals and needs for the next few months can lead to less financial stress. More than 7-in-10 (73%) women who only think ahead a few days feel a fair amount or a lot of stress. Once women plan for a few months ahead, that number drops down to less than 4-in-10 (38%).

While 78% of women took money actions in the past 6 months, only 19% feel confident with their money, indicating women continue to underestimate themselves. To help better understand which actions can make the biggest difference in financial confidence, Fidelity’s research identified the actions women who feel confident with their money are more likely to take. Interestingly, the same actions that reduce financial stress can also improve confidence, including contributing to an emergency fund, saving more for retirement, beginning to invest and working with a financial professional. Fortunately, these are the areas women plan to focus on in the months ahead.

Women Are Breaking Down the Stereotypes that Hold Them Back from Feeling Financially Confident

Women are actively breaking down old stereotypes and misconceptions that have held them back from feeling financially confident, including the idea that men are better at managing finances. More than 1-in-3 women have unlearned the stereotype that men are better at managing finances. Younger generations are leading the way, with 44% of Gen Z women saying they have “unlearned” this stereotype, compared to 32% of Millennial women and 29% of Gen X women. What’s more, women are no longer treating money as a taboo subject and are more open to talking about money with their peers. Fidelity’s latest study found nearly half of women indicated they were more open about their money with their family and friends in the past six months or plan to be in the next six months.

While women have made valuable progress in building confidence, more work still needs to help women address the persistent confidence gap. More than half of women (52%) believe women are better at managing finances and yet 65% of women believe men have had a better return on their investment in the past 10 years, indicating a confidence gap among women.

“Encouragingly, women today are debunking the financial stereotypes that have historically held us back,” said Lorna Kapusta, head of Women and Engagement at Fidelity Investments. “Over the past few years, we’ve seen women make incredible progress with their money. Even though women are making smart money choices, we’re also seeing them continue to doubt themselves. We are committed to not only helping women take the next step on their financial journeys, but also feel confident in their financial choices and their financial futures.”

Bridging the Gender Gap and Instilling Financial Confidence at a Young Age

In another positive shift, Fidelity’s data finds parents are speaking with their children about money and finances with greater frequency than their own parents did. While 72% of respondents claim their parents discussed financial topics, 84% of today’s parents speak to their kids about these topics—and what’s more, parents are talking to sons and daughters at the same rate about financial topics, an encouraging change from previous generations. Prior Fidelity data found teen boys were 5 percentage points more likely to claim their parents spoke to them about investing than teen girls.

This shift is encouraging, as financial education at a young age is essential in helping the next generation achieve financial confidence and financial mobility. To help build a future generation of financially savvy women, Fidelity is launching a new learning series for parents and teen girls. The first-of-its-kind program, Women Talk Money: Teen Girl Learning Series, will help teen girls build positive money habits for future financial success.

Fidelity Resources to Help Women Take Charge of Their Financial Futures

Fidelity is committed to creating free and accessible resources and education to help women make the most of their money, no matter where they are on their financial journeys.

- Women’s History Month Event Series: Fidelity is bringing together celebrity guests and Fidelity leaders for a free, month-long event series to help inspire women to take the next step with their money and achieve their financial goals for the future. The series will feature special guests Viola Davis, award-winning actress, producer, and author, Padma Lakshmi, an Emmy-nominated producer, television host, food expert, and author, and women across Fidelity. Conversations will focus on unlocking your money’s full potential, building career success, creating a financial playbook, building healthy money habits, balancing sandwich generation responsibilities, and teaching kids about money.

- New Learning Series for Teen Girls and their Parents: Launching in April, Women Talk Money: Teen Girl Learning Series is a free digital, self-paced learning series designed to help parents and teen girls build positive money habits. Registration and more information can be found here.

- Women Talk Money: Fidelity’s Women Talk Money community offers a forum for real talk about money, investing, careers, and other topics top of mind for women, through live events, on demand content and other actionable resources to help members take their next best steps with their finances. It’s free to join for everyone.

- Year-Round Support Built for Women: Fidelity launched a new website experience last year built for women, that provides insights on the unique factors that women often need to plan for, when to save and invest based on your individual situation, which accounts make the most sense for your goals, and clear next steps to move forward.

- 24/7 Access to Live Help: Need more help? Fidelity offers free 1:1 consultations with financial professionals who are specifically trained to discuss and help plan for the unique money factors that women often face. This guidance is available 24/7 at 1-800-FIDELITY, or online at Fidelity.com.

About Fidelity’s Women’s History Month Study

This study presents the findings of a national online survey, among 3,008 adults, 18 years of age and older. Interviewing was conducted January 3-12, 2024, by Big Village, which is not affiliated with Fidelity Investments. The results of this survey may not be representative of all adults meeting the same criteria as those surveyed for this study. The theoretical sampling error for all respondents is +/- 1.8 percentage points at the 95% confidence level. Smaller subgroups will have larger error margins. Fidelity was not identified as the sponsor of this study.

The generations are defined as: Boomers (born 1946 - 1964), Gen X (born 1965 - 1980), Millennials (born 1981 - 1996), and Gen Z (born 1997-2012; only those ages 18+ were considered for this study).

About Fidelity Investments

Fidelity’s mission is to strengthen the financial well-being of our customers and deliver better outcomes for the clients and businesses we serve. Fidelity’s strength comes from the scale of our diversified, market-leading financial services businesses that serve individuals, families, employers, wealth management firms, and institutions. With assets under administration of $12.6 trillion, including discretionary assets of $4.9 trillion as of December 31, 2023, we focus on meeting the unique needs of a broad and growing customer base. Privately held for 77 years, Fidelity employs more than 74,000 associates across the United States, Ireland, and India. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

Fidelity Investments and Fidelity are registered service marks of FMR LLC.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

# # #

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC

900 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

245 Summer Street, Boston, MA 0211

1131853.1.0

© 2024 FMR LLC. All rights reserved.

1 Fidelity Total Wellbeing Study 2022. Online survey of 5,366 active Fidelity 401(k) and 403(b) participants in the US, September 2017-October 2022.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240301011093/en/

Contacts

Fidelity Media Relations

FidelityMediaRelations@fmr.com

Jasmine Khayami

Jasmine.Khayami@fmr.com

(617) 563-4169

Follow us on Twitter @FidelityNews

Visit About Fidelity and our online newsroom

Subscribe to emailed news from Fidelity