42% of Customers Recall Financial Advice and Guidance and 76% of Those Take Action

With inflation still a day-to-day challenge for most consumers, and less than half of retail bank customers in the United States currently categorized as financially healthy,1 personalized financial advice has emerged as the key to a meaningful bank customer experience. In fact, according to the J.D. Power 2024 U.S. Retail Banking Advice Satisfaction Study,SM released today, financial advice is resonating more than ever with retail bank customers, but only 42% of them indicate recalling that their bank provides guidance and, of those who do receive guidance, more than three-fourths (76%) act on it.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240620545851/en/

J.D. Power 2024 U.S. Retail Banking Advice Satisfaction Study (Graphic: Business Wire)

“Customers who act on the financial advice and guidance provided by their bank are getting not only help on how to save time or money, but also these services result in increased satisfaction and strong engagement and brand advocacy,” said Jennifer White, senior director for banking and payments intelligence at J.D. Power. “As banks get increasingly savvy about how to personalize content by leveraging AI and training their staffs on how best to connect with customers, both recall and usage of financial advice is increasing, which is a very positive step forward for the industry.”

Following are some key findings of the 2024 study:

- Recall of financial advice among younger customers far exceeds the industry average: Overall, 42% of retail bank customers recall receiving financial advice from their bank. Among customers under the age of 40, the average recall rate for financial advice jumps to 60%.

- Majority of bank customers act on advice: A vast majority (76%) of customers who receive financial advice take action. Most frequent actions taken in response to advice include updating account settings (25%), shifting money between accounts (22%) and downloading the bank’s mobile app (22%).

- Big bump in satisfaction when customers take action: Overall satisfaction with retail banking advice increases 163 points (on a 1,000-point scale) when customers act based on specific advice provided by their bank.

- Many banks still miss the mark on consistent personalization: One key variable with a significant effect on satisfaction is “received personalized banking advice/guidance.” When this criterion is met, overall satisfaction increases 195 points and banks are moderately successful at achieving this goal with 63% receiving personalized content.

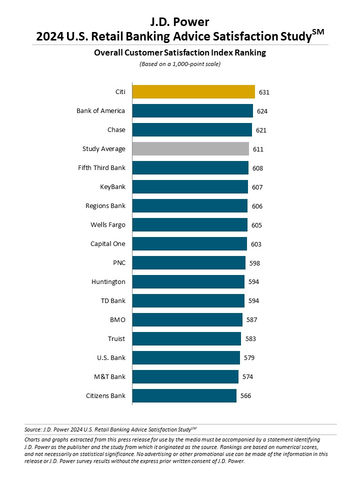

Study Ranking

Citi ranks highest in customer satisfaction with retail banking advice with a score of 631. Bank of America (624) ranks second and Chase (621) ranks third.

The U.S. Retail Banking Advice Satisfaction Study was redesigned for 2024. It includes responses of 7,984 retail bank customers in the United States who received any advice/guidance from their primary bank regarding relevant products and services or other financial needs in the past 12 months. It measures customer satisfaction with retail bank advice/guidance based on performance in five core dimensions on a poor-to-perfect rating scale. Individual dimensions measured are (in order of importance): quality, concern for needs, relevancy, clarity and frequency. The study was fielded from January to March 2024.

In addition to bank financial advice ratings, the study also provides financial health support index benchmarking data that evaluates proficiency of banks and credit card issuers in delivering financial support to customers including such services as helping customers make better financial decisions or helping them meet savings, creditworthiness or budgeting goals. The study also captures responses from customers about their satisfaction with the financial health support provided by their financial partners. Top-performing banks in the banking financial health support index are (in alphabetical order): Bank of America, Chase, Capital One, Fifth Third Bank, First Citizens Bank, Huntington, KeyBank and Regions Bank. Top-performing credit card providers in the credit card financial support index are (in alphabetical order): American Express, Bank of America, Chase and Discover.

For more information about the U.S. Retail Banking Advice Satisfaction Study, visit

https://www.jdpower.com/business/financial-health-and-advice-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2024057.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 J.D. Power measures the financial health of any consumer as a metric combining their spending/savings ratio, creditworthiness, and safety net items like insurance coverage. Consumers are placed on a continuum from healthy to vulnerable.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240620545851/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com