Total passenger traffic up 14.0% YoY, up 16.4% YoY in Argentina

International passenger traffic up 14.1% YoY; up 21.1% YoY in Argentina

Corporación América Airports S.A. (NYSE: CAAP), (“CAAP” or the “Company”), one of the leading private airport operators in the world, reported today a 14.0% year-on-year (YoY) increase in passenger traffic in April 2025.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250516780357/en/

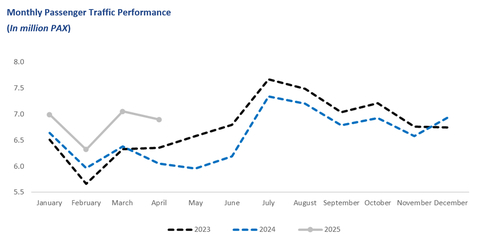

Monthly Passenger Traffic Performance (In million PAX)

Passenger Traffic, Cargo Volume and Aircraft Movements Highlights (2025 vs. 2024) |

|

|

|

|

|||

Statistics |

Apr'25 |

Apr'24 |

% Var. |

|

YTD’25 |

YTD'24 |

% Var. |

Domestic Passengers (thousands) |

3,529 |

3,110 |

13.5% |

|

14,169 |

13,340 |

6.2% |

International Passengers (thousands) |

2,745 |

2,404 |

14.1% |

|

10,579 |

9,360 |

13.0% |

Transit Passengers (thousands) |

624 |

536 |

16.5% |

|

2,518 |

2,334 |

7.9% |

Total Passengers (thousands)1 |

6,898 |

6,050 |

14.0% |

|

27,266 |

25,034 |

8.9% |

Cargo Volume (thousand tons) |

32.2 |

33.0 |

-2.3% |

|

128.2 |

121.0 |

6.0% |

Total Aircraft Movements (thousands) |

71.7 |

64.4 |

11.3% |

|

278.0 |

264.5 |

5.1% |

1 Following the friendly termination process concluded in February 2024, CAAP no longer operates Natal airport. Statistics for Natal are available up to February 18, 2024. Excluding Natal for comparison purposes, total passenger traffic YTD was up 10.5%. |

|||||||

Passenger Traffic Overview

Total passenger traffic increased by 14.0% in April compared to the same month in 2024. Domestic passenger traffic rose by 13.5% year-over-year (YoY), largely driven by a recovery in Argentina, as well as strong performances in Brazil and Italy. Meanwhile, international traffic grew by 14.1%, with all operating countries contributing positively YoY — except Ecuador — and with particularly strong performances in Brazil, Uruguay, and Italy. Notably, Argentina accounted for over 60% of the total traffic growth in April.

In Argentina, total passenger traffic increased by 16.4% YoY, primarily driven by the ongoing recovery in domestic traffic, which rose by 13.9% YoY — marking two consecutive months of double-digit growth. JetSMART, which recently introduced the Aeroparque-Resistencia and Aeroparque-Trelew routes, continued to gain market share and is currently the second-largest domestic operator. During April, Aerolíneas Argentinas resumed its Salta-Rosario and Neuquén-Rosario routes, while Andes Líneas Aéreas incorporated two Boeing 737-700 aircraft into its fleet. International passenger traffic also remained strong, increasing by a solid 21.1% YoY. JetSMART increased the frequency of its Buenos Aires–Asunción route, while GOL resumed operations between Córdoba and São Paulo and announced it will offer daily flights between Buenos Aires and Brasília. Also in April, SKY inaugurated its Buenos Aires–Salvador de Bahía route, and Arajet increased frequencies on its Buenos Aires–Punta Cana route.

In Italy, passenger traffic grew by 11.2% compared to the same month in 2024, mainly supported by an increase in flight frequencies by Ryanair. International passenger traffic — which accounted for over 80% of total traffic — rose by 10.3% YoY, driven by a 13.2% increase at Florence Airport and an 8.3% increase at Pisa Airport. Domestic passenger traffic grew by 15.0% YoY, driven by a robust performance at Pisa Airport.

In Brazil, total passenger traffic increased by a solid 16.8% YoY, reflecting an improvement in traffic trends despite the still challenging aviation environment and aircraft constraints in the country. Domestic traffic, which accounted for nearly 60% of total traffic, rose by 16.2% YoY, while transit passengers increased by 12.8% YoY.

In Uruguay, total passenger traffic — predominantly international — rose by 17.1% YoY, benefiting from additional demand generated by the Easter holiday. In March, Azul Linhas Aéreas announced a new direct route between Montevideo and Campinas, with five weekly flights. This new connection will help strengthen ties between Uruguay and Brazil, facilitating passenger flow and promoting the development of new commercial and tourism opportunities.

In Ecuador, where security concerns persist, passenger traffic decreased by 1.8% YoY. International traffic declined by 3.3% YoY, mainly due to reduced operations to the U.S., while domestic traffic decreased slightly by 0.6% YoY, impacted by high airfares that have dampened travel demand.

In Armenia, passenger traffic increased by 7.8% YoY. Travel demand has benefited from the introduction of new airlines and routes, as well as increased flight frequencies. Wizz Air recently announced the opening of a new base at Yerevan’s Zvartnots Airport, with two aircraft and eight new direct routes to Europe.

Cargo Volume and Aircraft Movements

Cargo volume decreased by 2.3% compared to the same month in 2024, mainly due to volume reductions in Uruguay and Ecuador. Performance by country was as follows: Argentina (-0.5%), Uruguay (-14.2%), Italy (-1.0%), Armenia (+7.8%), Brazil (+2.4%), and Ecuador (-17.6%). Argentina, Brazil, and Armenia accounted for 80% of the total cargo volume in April.

Aircraft movements increased by 11.3% YoY, with positive contributions from all countries of operation: Argentina (+13.4%), Uruguay (+23.1%), Italy (+7.0%), Armenia (+10.8%), Brazil (+7.9%), and Ecuador (+6.5%). Argentina, Brazil, and Italy accounted for more than 80% of total aircraft movements in April.

Summary Passenger Traffic, Cargo Volume and Aircraft Movements (2025 vs. 2024)

|

Apr'25 |

Apr'24 |

% Var. |

|

YTD'25 |

YTD'24 |

% Var. |

Passenger Traffic (thousands) |

|

|

|

|

|

|

|

Argentina |

3,658 |

3,142 |

16.4% |

|

15,826 |

13,954 |

13.4% |

Italy |

899 |

809 |

11.2% |

|

2,528 |

2,285 |

10.6% |

Brazil (1) |

1,331 |

1,139 |

16.8% |

|

5,057 |

5,044 |

0.3% |

Uruguay |

190 |

162 |

17.1% |

|

844 |

801 |

5.4% |

Ecuador |

402 |

409 |

-1.8% |

|

1,536 |

1,519 |

1.1% |

Armenia |

418 |

388 |

7.8% |

|

1,474 |

1,431 |

3.0% |

TOTAL |

6,898 |

6,050 |

14.0% |

|

27,266 |

25,034 |

8.9% |

(1) Following the friendly termination process concluded in February 2024, CAAP no longer operates Natal airport. Statistics for Natal are available up to February 18, 2024. |

|||||||

| Cargo Volume (tons) | |||||||

Argentina |

17,147 |

17,229 |

-0.5% |

|

67,194 |

61,463 |

9.3% |

Italy |

1,050 |

1,060 |

-1.0% |

|

4,274 |

4,175 |

2.4% |

Brazil |

5,328 |

5,205 |

2.4% |

|

20,605 |

20,612 |

0.0% |

Uruguay |

2,335 |

2,720 |

-14.2% |

|

11,224 |

9,613 |

16.8% |

Ecuador |

3,061 |

3,717 |

-17.6% |

|

12,018 |

13,012 |

-7.6% |

Armenia |

3,324 |

3,083 |

7.8% |

|

12,878 |

12,082 |

6.6% |

TOTAL |

32,245 |

33,014 |

-2.3% |

|

128,192 |

120,957 |

6.0% |

Aircraft Movements |

|

|

|

|

|

|

|

Argentina |

38,891 |

34,293 |

13.4% |

|

158,318 |

148,308 |

6.7% |

Italy |

7,955 |

7,432 |

7.0% |

|

22,722 |

21,127 |

7.5% |

Brazil |

12,240 |

11,349 |

7.9% |

|

46,823 |

46,956 |

-0.3% |

Uruguay |

2,996 |

2,434 |

23.1% |

|

12,907 |

12,154 |

6.2% |

Ecuador |

6,387 |

5,995 |

6.5% |

|

25,630 |

24,982 |

2.6% |

Armenia |

3,233 |

2,919 |

10.8% |

|

11,568 |

11,008 |

5.1% |

TOTAL |

71,702 |

64,422 |

11.3% |

|

277,968 |

264,535 |

5.1% |

About Corporación América Airports

Corporación América Airports acquires, develops and operates airport concessions. Currently, the Company operates 52 airports in 6 countries across Latin America and Europe (Argentina, Brazil, Uruguay, Ecuador, Armenia and Italy). In 2024, Corporación América Airports served 79.0 million passengers, 2.7% (or 0.4% excluding Natal) below the 81.1 million passengers served in 2023, and 6.2% below the 84.2 million served in 2019. The Company is listed on the New York Stock Exchange where it trades under the ticker “CAAP”. For more information, visit http://investors.corporacionamericaairports.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250516780357/en/

Contacts

Investor Relations Contact

Patricio Iñaki Esnaola

Email: patricio.esnaola@caairports.com

Phone: +5411 4899-6716