Greater flexibility and leading-edge dividend forecasts in new US options datasets give quantitative analysts richer data to backtest technical strategies, evaluate risk, conduct research on derivatives trading

OptionMetrics, the leading historical options data and analytics provider for institutional investors and academic researchers worldwide, is today announcing IvyDB US 7.0 and IvyDB ETF 5.0, giving investors, hedge funds, and quantitative researchers expanded high-quality options data and more ways in which to leverage it.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260219021665/en/

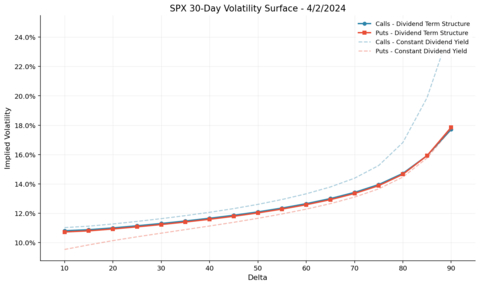

IvyDB US 7.0 provides both calculation methodologies: the implied index yield term structure produces near-identical call and put volatilities across all deltas, while the constant dividend yield surface is included for backward compatibility. The graph displays SPX volatility surface by delta for both calls (blue) and puts (red). Solid lines represent the dividend term structure methodology, where call and put converge tightly across all strikes. Dashed lines show constant dividend yield volatilities. Data source: OptionMetrics.

One of the biggest added benefits of OptionMetrics IvyDB US 7.0 and IvyDB ETF 5.0 is greater flexibility in the methodologies employed in options data calculations. Users can opt for borrow rates—the interest cost associated with holding a stock intended for short sale—or continue to use legacy calculations that do not embed an implied borrow rate. Implied index yields are also now provided in a term structure format for improved calculations.

Additionally, dividend forecasts from leading-edge Woodseer Dividend Forecast data are automatically included alongside respective securities in the upgraded datasets, for quantitative finance professionals and others to assess dividend strategies. IvyDB US 7.0 and IvyDB ETF 5.0 also offer even more accurate securities and implied volatility (IV) price metrics with this leading-edge dividend forecast data now also being used in their calculations.

“OptionMetrics' IvyDB US 7.0 is our most comprehensive and flexible dataset yet. By leveraging borrow rates and including Woodseer Dividend Forecast data alongside the longstanding gold standard in options data, this update provides more precise valuations and richer data for use in options and equities strategies,” said Eran Steinberg, COO at OptionMetrics.

OptionMetrics IvyDB US is known as the gold standard in historical options data. It contains a complete historical record of end-of-day data on all US exchange-traded equity and index options (including options on crypto and other ETFs and ADRs) on over 10,000 underlying stocks and indices from January 1996 onward. Users can seamlessly load data from IvyDB US or IvyDB ETF via FTP, Snowflake, and/or OptionMetrics’ Genie loader, now also enhanced for easier loading.

Contact OptionMetrics to learn more.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260219021665/en/

“OptionMetrics' IvyDB US 7.0 is our most comprehensive and flexible dataset yet,” said Eran Steinberg, COO at OptionMetrics.

Contacts

Media Contact:

Hilary McCarthy

774.364.1440

Hilary@clearpointagency.com