NYSE: JT) Big Data Institute across the 41 cities for March 2021 (with data in statistics collected from February 20, 2021, to March 18, 2021), 20 cities recorded a MoM increase in mortgage rates, four of which experienced a rise of over 10BPs" />

NYSE: JT) Big Data Institute across the 41 cities for March 2021 (with data in statistics collected from February 20, 2021, to March 18, 2021), 20 cities recorded a MoM increase in mortgage rates, four of which experienced a rise of over 10BPs" />Tier-1 Cities’ Average First-home Mortgage Rates on a MoM basis

Jianpu Technology (NYSE: JT)

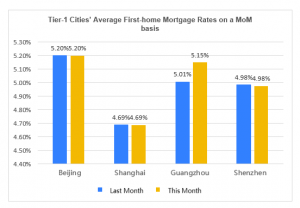

BEIJING, BEIJING, 中国, May 15, 2021 /EINPresswire.com/ -- According to surveillance data from Rong360 Jianpu Technology (NYSE: JT) Big Data Institute across the 41 cities for March 2021 (with data in statistics collected from February 20, 2021, to March 18, 2021), 20 cities recorded a MoM increase in mortgage rates, four of which experienced a rise of over 10BPs. Huizhou saw the most significant growth, with first- and second-home mortgage rates rising by 26BPs on a MoM basis. Among the cities that witnessed MoM declines, Suzhou saw the highest drops of 6BPs and 3BPs for first- and second-time home buyers, respectively.Among tier-1 cities in March 2021, Guangzhou continued to record an increase in the mortgage rate, with average first- and second-home mortgage rates increasing by 14BPs and 6BPs, respectively, on a MoM basis. Banks that have not raised mortgage rates or saw a modest rise in February also recorded an increase, with 5.2% and 5.4% becoming the mainstream first-home mortgage rate and second-home mortgage rates in Guangzhou. Meanwhile, mortgage rates for some joint-stock banks even climbed to 5.3% or 5.25% for first-home and 5.45% for second-home.

The mortgage rates in Beijing, Shanghai, and Shenzhen remained unchanged, but housing-related loans were tightened in these cities.

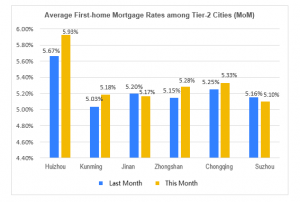

According to surveillance data from Rong360 Jianpu Technology Big Data Institute, 19 tier-2 cities recorded a MoM increase in mortgage rates in March 2021, three of which experienced an increase of over 10BPs. In addition to Huizhou, which saw the highest growth by 26BPs, the overall mortgage rate in Zhongshan, another city in Guangdong, posted a MoM increase of 13BPs. Kunming and Chongqing also recorded MoM increases of over 5BPs in mortgage rates. However, mortgage rates in Suzhou and Jinan dropped a bit.

Media Contact

Jianpu Technology

+86 10 8262 5755

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn