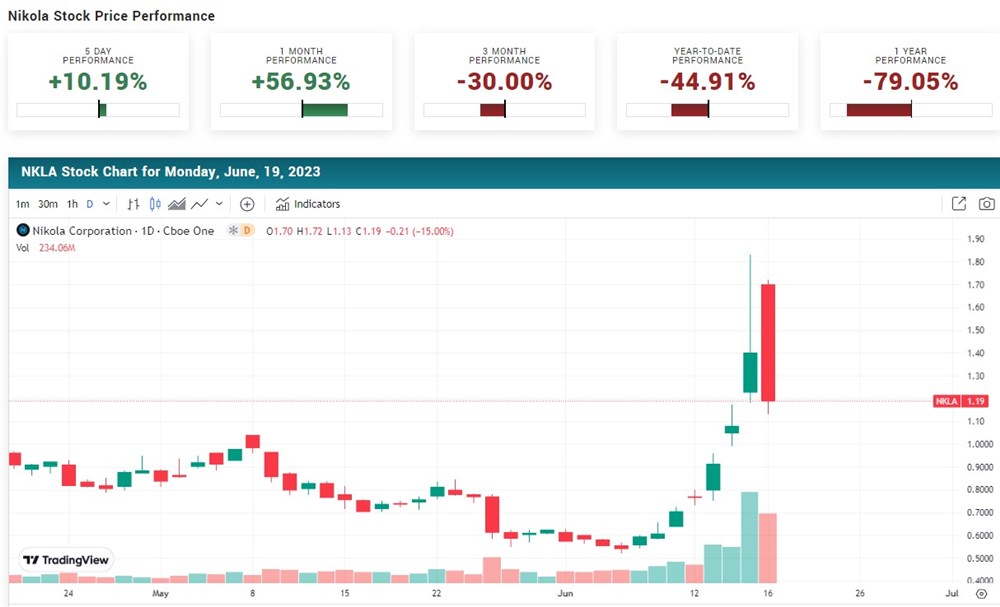

Shares of Nikola (NASDAQ: NKLA) soared over 150% last week, reaching a high of $1.83 per share, before pulling back and ending the week at $1.19, up 68%. After topping out at $93.99 in spectacular fashion in June 2020, the stock has been in a steady downtrend coming off 98%.

The stock traded close to 850 million shares last week, averaging almost 170 million per day, compared with its average volume of 38 million. Is there a specific catalyst or changing fundamentals behind the unusual volume and surge higher, or is it simply a short squeeze and lower high in a higher time frame downtrend?

Brief Overview of NKLA

Nikola is a U.S.-based EV manufacturer and alternative energy company. In 2014 it was founded by Trevor Milton, who has since been found guilty of making false statements while in position at the company. Since Trevor Milton departed from the company, it has become more focused and organized itself into two segments, Truck and Energy.

The Truck segment manufactures the Tre and is developing additional vehicles to round out the commercial lineup. The Energy segment is building a network of hydrogen and BEV fueling stations.

Recent Announcements and Catalyst

The surge in price and volume began in the run-up to the company’s annual shareholder meeting. The company put to vote on a proposal to allow it to increase its total number of authorized shares to raise capital in the future. After failing to secure enough support on the vote, the meeting was adjourned, with plans to reconvene it on July 6. On Friday, the company laid off 270 workers as its cash dwindles.

Nikola Needs Cash…Fast

Nikola is desperate for the vote to pass so that they can raise further capital in the future, to continue business operations. The layoff announcement on Friday comes at a time when the company desperately needs capital to continue to grow and progress.

The company expects its annual cash burn to fall below $400 million by 2024. As of March 31, Nikola had $208 million in cash, of which $85 million was restricted.

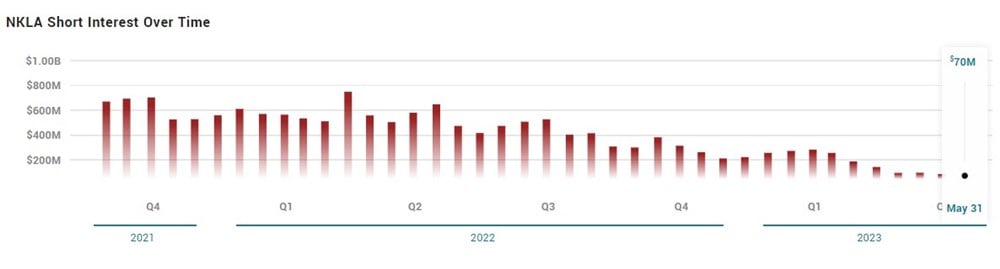

The Short Interest

While the short interest is elevated at 16.26% of the float sold short, it has steadily declined over previous quarters as the stock has fallen. The dollar volume sold short is $70.44 million, the lowest in years.

So while the above figures are not staggering in terms of short interest, the percentage of the float sold short equates to 103.67 million shares sold short. That figure is significant compared to the average daily volume before the run-up. Almost three times the average volume is sold short. Undoubtedly, the short volume in the stock exacerbated the move this week.

Insider Transactions

So far, in 2023, insiders have not purchased any company shares. The last time an insider purchased stock in NKLA was in Q3 2022. Since then, insiders have sold almost $8.7 million in stock. The most recent transaction was done by a company director, selling 75,000 shares in May for an average price of $0.79.

Should You Invest In NKLA?

The recent surge in price and volume raises questions about the underlying catalysts. While the company certainly needs to raise additional capital, the rally could be mainly attributed to increased attention by retail investors and traders looking for a short squeeze.

The outcome of the shareholder meeting and the company’s ability to increase its authorized share count will be crucial factors in determining NKLA’s prospects and investment ability. For now, Nikola appears to be a trading vehicle, not an investment one.