There are many ways to collect income from the stocks. Dividends first come to mind as they pay out a small percentage of the stock price and the number of shares you own in cash, usually on a quarterly basis. However, it takes capital to buy and hold the underlying shares. If you already own stocks in any stock sector, you can write covered calls to collect monthly or weekly income from the options premiums depending on the expiration dates.

Long call diagonal debit spreads (LCDDS)

If you don’t own the stock, you can consider trading long call diagonal debit spreads (LCDDS) for a third of the capital needed to own the stock. This involves buying an in-the-money (ITM) back-month long-term equity appreciation securities (LEAPS) call option and selling an out-of-the-money (OTM) front-month call. Since we're using different strike prices, these are diagonal options. When we use the same strike price with different front and back month expiration dates, that’s called a calendar spread or a horizontal spread.

Calendar spreads

In this article, we’ll review how to collect weekly or monthly income using long call option calendar spreads. They are also called time spreads, horizontal spreads, and vertical spreads with different expirations. If you understand the LCDDS strategy, then calendar spreads should be easier to understand.

Near-term neutral and long-term bullish

Call option calendar spreads are generally market neutral or flat to bearish near-term and bullish longer-term. This is because it’s a two-legged strategy that involves selling a near-dated or front-month OTM call option to collect a premium and buying a long-dated or back-month call option at the same strike.

The short call option experiences greater time decay (theta) as it gets closer to expiration. It eventually becomes worthless if the underlying stock remains at or under the strike price on expiration, and you get to keep the premium. Your long call option can either be closed out simultaneously with the short call option or rolled over. You can put on another OTM short call to collect another premium. Ideally, if the long call option rises sharply after the short call expiration, then you may also profit from it. The long call option rises in value if the underlying stock rises above the strike price ahead of its expiration.

The mechanics of the call option calendar spread

This strategy attempts to collect the premiums as income on the short call option, while the long call option has the potential to move higher for net gains. Like the LCDDS, you are shorting the OTM front month call to collect the income from the premium. Rather than go long an ITM LEAP call, you would go long the same strike price but further out from a week to a month.

Putting on the trade

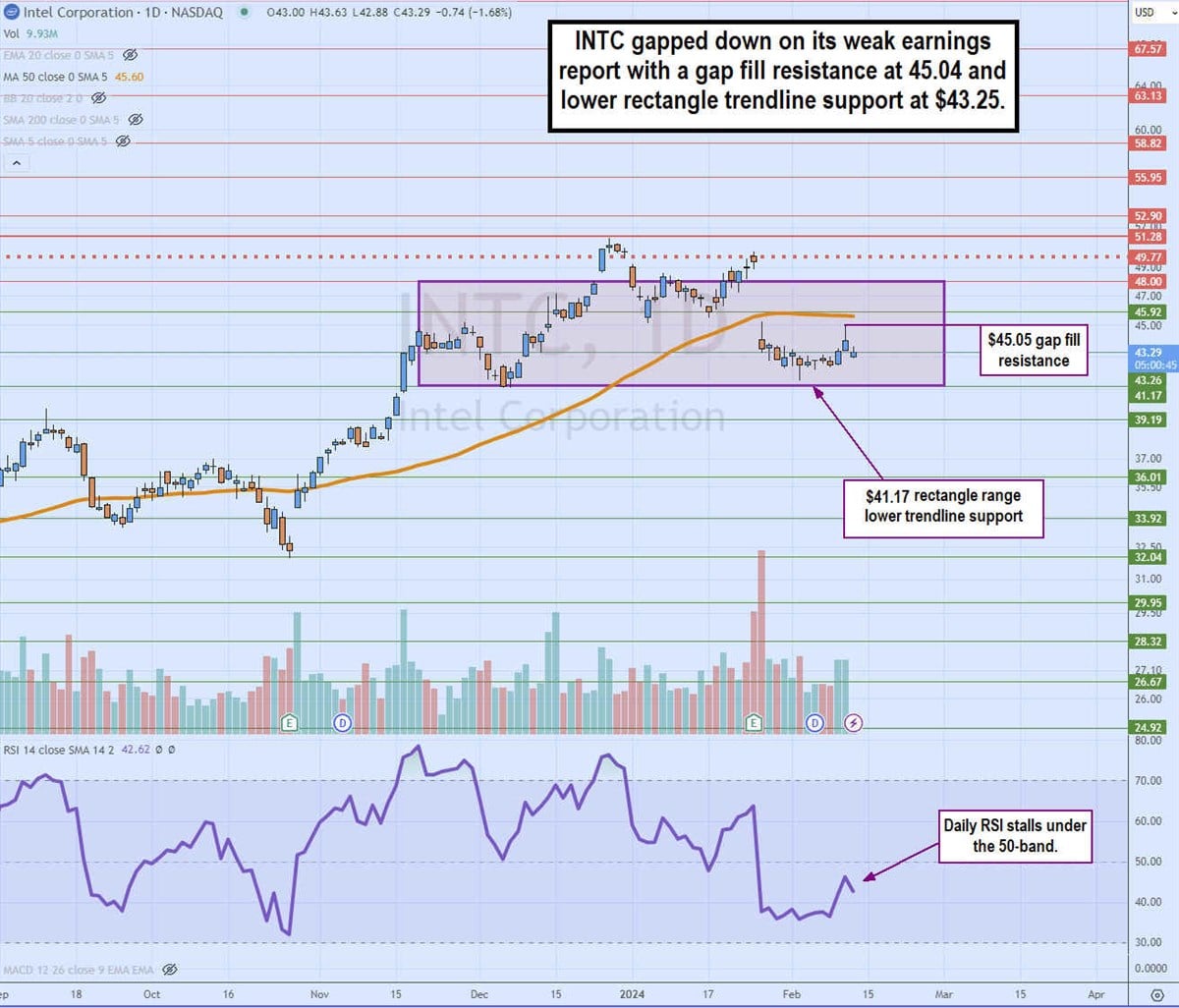

Let’s take an example with semiconductor leader Intel Inc. (NASDAQ: INTC). In this example, INTC is trading at $43.31 on Feb. 13, 2024.

The daily candlestick chart on INTC illustrates a rectangle pattern with a gap fill resistance around the daily 50-period moving average (MA) resistance at $45.60 and a gap fill resistance at $45.05. The rectangle's lower trendline support is at $43.26. The daily relative strength index (RSI) is stalled under the 50-band and flat. INTC has been in a chopping range between $44.03 and $42.14.

Based on the resistance levels at $45.05 and the upper part of the recent trading range around $44.03, we can opt for a $44.50 strike price. This gives us enough of a resistance, especially with the RSI momentum stalling at the 50-band as the bounce fizzles a bit. The trade will be:

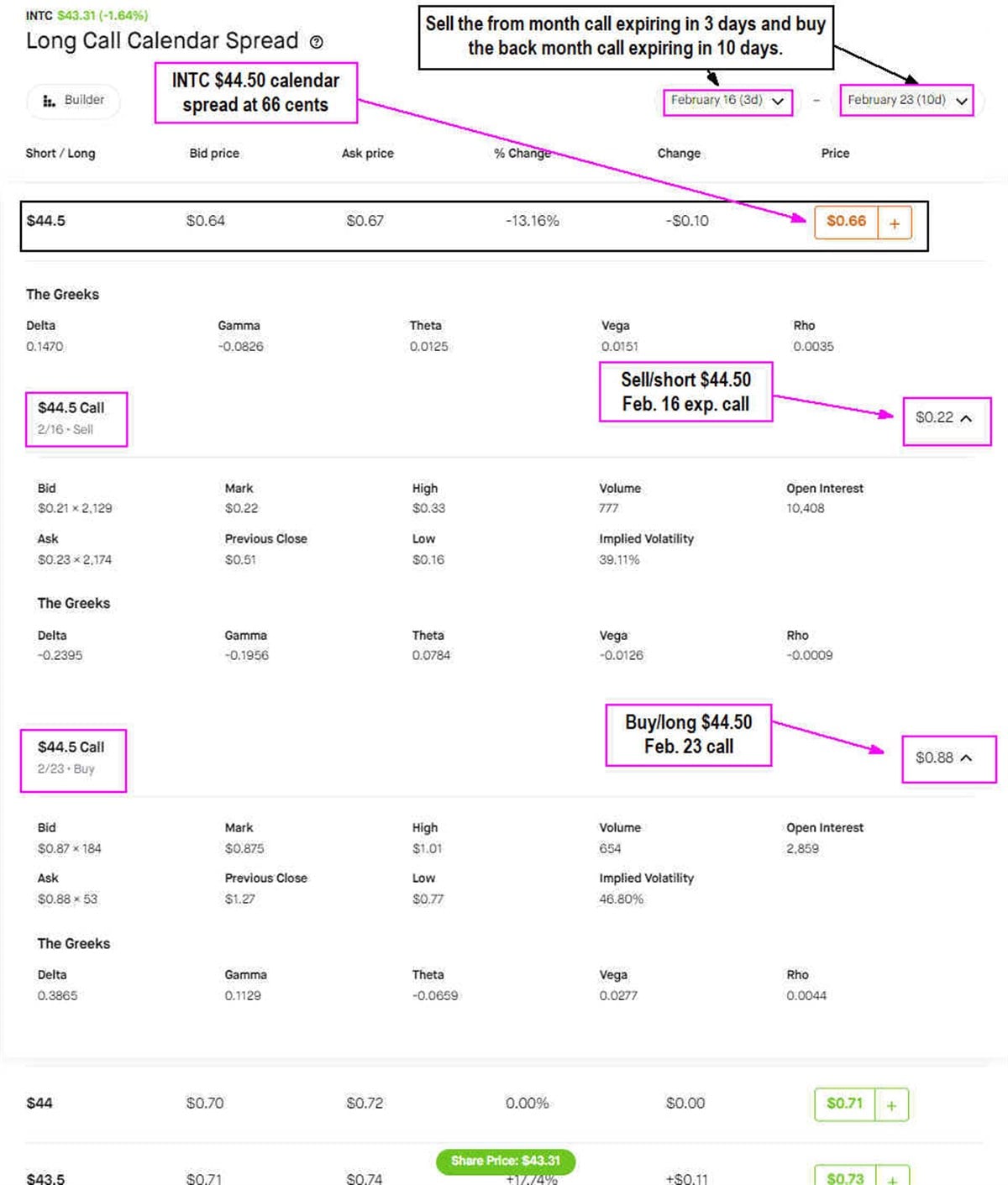

Buy INTC $44.50 long call calendar spread expiring February 16/February 24 at 66 cents.

If we look at the Feb. 16, 2024, expiration call expiring in 3 days for the front month and the Feb. 23, 2024, expiration call expiring in 10 days for the back month, it will cost us 66 cents. This is the spread between the 22-cent short $44.50 call and the 88-cent long $44 call.

Potential outcomes

This is a tight calendar spread in terms of expiration being just 3 days and 10 days out. It's wise to use wider times between the front and back months in the beginning to get comfortable with this strategy. Tighter expirations leave little room for error. The easy part is having the front month expire worthless. The harder part is managing the back month call if not closing out both positions on or before the front month expiration.

The best situation would be for INTC to rise and stay slightly under $44.50 in 3 days to keep the 22-cent short call premium and then spike up to the gap fill area at $45.03 or the daily 50-period MA $45.60 in 10 days to close out the long call with a profit. If the volatility spikes, then it provides even more premium to cash out ahead of the long call expiration.

The key is pulling the trigger to either close out one leg or both legs on the first expiration, or close out the short leg and roll over the long leg if INTC spikes hard to capture more profits on the long call, or roll over the long call and sell another short call again.

Outcome on expiration(s)

Since there are two legs and two expirations, let's review the potential outcomes if the underlying price of INTC rises or falls.

If INTC rises to $44.31 on the Feb. 16 expiration in 3 days, we will keep the 22-cent premium on the short call. We can close out the long call option on the same day for an additional 25-cent premium for a total of 47 cents in profits on a 66-cent investment or a 71% gain.

Here's the calculation: Since INTC rose $1 from when we entered the calendar spread at $43.31, the long call option would be worth $1.13 after factoring in the options Greeks. A rough estimate with a $1 move on INTC with a 0.3865 Delta minus the -0.659 Theta x 3 days would imply an additional net 25-cent premium to the 88-cent cost.

If INTC rises to $45.31 on the Feb. 16 expiration day in 3 days, we would lose 59 cents on the short 44.50 call (81 cents – 22 cents premium) but gain 80 cents premium on the long 44.50 call for a net 21 cents gain on 66 cent investment or 32% gain.

More stock price gains could equal less profits, but losses are capped.

This is an example of how a calendar spread makes the most money on a moderate bounce but makes less money on a giant bounce before the first expiration. However, your loss is also limited to the spread price you paid for the calendar spread should a disaster happen and INTC collapse to the lower rectangle support at $41.17.

There are many ways to play these scenarios, like riding out the long call into expiration, rolling the long call, or both calls. It all lies in the execution as you get more experienced and seasoned with calendar spreads.