Toronto, Ontario--(Newsfile Corp. - December 8, 2025) - Omai Gold Mines Corp. (TSXV: OMG) (OTCQB: OMGGF) ("Omai Gold" or the "Company") is pleased to announce assay results from the current drilling program at its 100% owned Omai Gold Project in Guyana, South America. Significant mineralization was intersected in central Wenot (13.54 g/t Au over 13.3m in Hole 145W) and in a new wide high-grade zone at East Wenot (11.07 g/t Au over 14.7m in Hole 142)). The remaining results from the satellite targets are also reported (Table 1).

A total of 79 holes (35,300m) have been completed on the Omai project in 2025. Of these, 30 holes (13,250m) completed or underway on Wenot, are not included in the recent August 2025 updated Mineral Resource Estimate ("MRE"). These will contribute to an updated MRE planned for early 2026, in advance of the updated Preliminary Economic Assessment ("PEA") expected in H1 2026. Five rigs are currently drilling on the Wenot deposit, continuing to focus on areas that have the potential to further expand the resource and optimize the upcoming PEA. The Company is pleased to report that it has exceeded its target of completing an additional 10,000m of drilling, post the August MRE, by year end.

Highlights* from the recent drilling include:

- Hole 25ODD-142 (East Wenot)

- 11.07 g/t Au over 14.7m

- Including 34.31 g/t Au over 4.3m

- 11.07 g/t Au over 14.7m

- Hole 25ODD-145W (Central Wenot)

- 13.54 g/t Au over 13.3m

- Including 27.82 g/t Au over 6.2m

- Including 63.17 g/t Au over 2.2m

- 2.01 g/t Au over 15.0m

- 13.54 g/t Au over 13.3m

- Hole 25ODD-144 (East Wenot)

- 1.11 g/t Au over 31.6m

- 0.98 g/t Au over 12.0m

- 0.99 g/t Au over 13.0m

- Hole 25ODD-146 (East Wenot)

- 6.62 g/t Au over 2.4m

- 1.02 g/t Au over 16.1m

- Hole 25ODD-140 (Camp Zone)

- 2.63 g/t Au over 5.5m

- Including 6.06 g/t Au over 2.3m

- 2.63 g/t Au over 5.5m

Elaine Ellingham, President & CEO commented, "We are excited to see a very significant new zone at the east end of Wenot, where there has been limited drilling in the past. The intersection of 11.07 g/t Au over 14.7m in Hole 142 represents a spectacular new zone and follow-up drilling is underway. We greatly accelerated drilling this year at Omai and set a goal of completing an additional 10,000m of drilling on Wenot prior to year end and are pleased to announce that we have already exceeded this goal. An additional 30 holes have been completed or are currently underway on Wenot and these additional Wenot holes will contribute to a planned updated Mineral Resource Estimate, which will be integrated into the updated PEA planned for H1 2026. Results are pending for the majority of these new holes but are expected shortly.

The additional Central Wenot drilling continues to intersect impressive gold zones, as exemplified in holes 145w and 144 reported today. In particular, the intersection of 13.54 g/t Au over 13.3m in hole 145w illustrates Wenot's potential for a very robust open pit mine plan. The focus of the post-August drill program has been to explore and delineate gold zones within the southern sedimentary sequence that have seen less drilling. However, we continue these holes to the north in order to also drill the CQFP and "Dike Corridor" zones that constitute the major gold zones at Wenot. As a result, this drilling has multiple purpose:it is expected to further increase the Wenot resource, to contribute to reducing the strip ratio in the upcoming PEA, and to upgrade some of the Inferred MRE to Indicated MRE in the major gold zones."

Wenot Drill Results

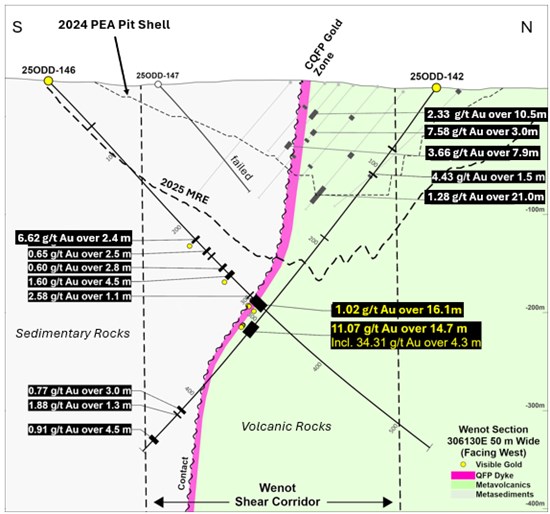

Two significant new gold intersections at East Wenot, beyond the area of the historical pit, indicate high potential for further expansion of the Wenot deposit at the eastern end. Of note, hole 25ODD-142 intersected 11.07 g/t Au over 14.7m at a vertical depth of approximately -240m. A second hole 25ODD-146 above intersected 1.02 g/t Au over 16.1m at a vertical depth of - 210m. Shallow historical drilling by Placer Dome in the early 1990s intersected the interpreted up dip equivalent of this zone, including 1.28 g/t Au over 21.0m, 3.66 g/t Au over 7.9 m, 7.58 g/t Au over 3.0 m and 2.33 g/t Au over 10.5m, all at less than -130m depths. The location of this new zone suggests that the central contact and central quartz feldspar porphyry unit (CQFP) may dip to the south in this eastern area. These holes tested this concept and appear to have successfully proven this. The Wenot gold zones, the contact, CQFP and other main zones are generally near vertical, to slightly north dipping. An additional drill hole is underway to further explore this new high-grade zone at the eastern end of the deposit.

Holes 25ODD-142 and 25ODD-146 were drilled on East Wenot in an area more sparsely explored. The primary objective was to test continuity of the mineralized zones previously intersected in 22ODD-046 (50m to the west), in order to extend mineralization in this area. Hole 142 was drilled from the north and intersected a couple of minor gold zones within the volcanics, including 1.01 g/t Au over 1.5m and 4.43 g/t Au over 1.5m. However, within the Dike Corridor, a very significant high-grade gold zone grading 11.07 g/t Au over 14.7m was intersected mostly within a hematitized "red" felsic dike, at an approximate vertical depth of -210m. This red felsic dike is almost merged with the CQFP in this area. Further downhole, a series of narrow mineralized intercepts within the sediments, included 0.77 g/t Au over 3.0m, 1.88 g/t Au over 1.3m and 0.91 g/t Au over 4.5m.

25ODD-146 is located on the same section line of 25ODD-142 but was drilled from the south. Most significantly, a wide mineralized interval of 1.02 g/t Au over 16.1m was intersected within the Central CQFP with mineralization extending into adjacent diorite and felsic dikes. This zone correlates to the high-grade zone in hole 142 and is only 30m above. Further uphole a couple of mineralized intercepts occur within the sediments, that include 6.62 g/t Au over 2.4m, 0.65 g/t Au over 2.5m, 0.60 g/t Au over 2.8m, and 1.60 g/t Au over 4.5m and 2.58 g/t Au over 1.1m, mostly within a series of minor diorite dikes within the sediments.

25ODD-147 and 147B attempted to drill the up-dip extension of the mineralized zones from the south but failed to go to completion and did not test the target. As typical, minor narrow gold mineralization was still intersected but not within the target area.

Further west, approximately 250m west of Hole 142, hole 25ODD-144 was drilled from the south. Hole 144 first intersected the narrow southern QFP (SPOR), which assayed 0.60 g/t Au over 1.0m, followed by multiple zones of mineralization within the sediments, including 0.98 g/t Au over 12.0m, 4.10 g/t Au over 1.5m, and 1.19 g/t Au over 5.7m. Two gold zones, 2.94 g/t Au over 2.2m and 0.81 g/t Au over 4.1m, were intersected within the Central QFP. Several intercepts were then intersected within the Main Dike Corridor, most notably 1.11 g/t Au over 31.6m but also 0.36 g/t Au over 3.6m, 0.95 g/t Au over 3.0m, and 0.99 g/t Au over 13.0m.

25ODD-144A was the first attempt at Hole 144, but was abandoned due to drilling issues. It was drilled only to 347m but still intersected a series of narrow mineralized intervals within the sediments including 2.96 g/t Au over 1.5m, 2.76 g/t Au over 1.5m, 0.59 g/t Au over 1.1m and 0.58 g/t Au over 1.5m.

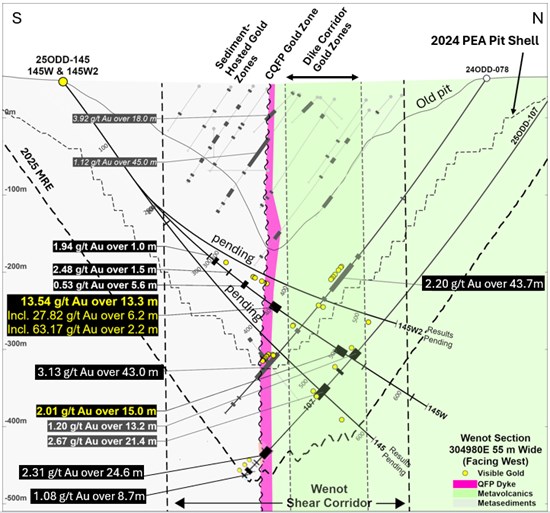

25ODD-145w is one of three holes drilled from the south on a single section line (304980E) in the central Wenot area. A first Hole 145 was followed with a wedged hole (145w) and a second wedged hole (145w2). Results have only been received for Hole 145w with results pending for adjacent holes 145 and 145w2. As usual, multiple gold zones were intersected. The CQFP and adjacent altered diorite dikes returned an impressive 13.54 g/t Au over 13.3m, which included 27.82 g/t Au over 6.2m.

Further downhole within the "Dike Corridor", a wide interval that included two felsic dikes ran 2.0 g/t Au over 15.0m. In the upper part of the hole, within the southern sedimentary sequence of rocks, a number of minor gold zones were encountered including 2.48 g/t Au over 1.5m, 0.53 g/t Au over 5.6m, and 1.94 g/t over 1.0m.

Wedging some of the Wenot holes has multiple purposes and it allows faster and more cost-effective drilling of the multiple Wenot gold zones. It is a current priority to drill additional holes testing the southern sedimentary gold zones. Expansion of the southern gold zones would contribute to a reduced strip ratio in the upcoming PEA. Also, by extending these wedged holes through the CQFP and to the north, we are able to have multiple cuts through the major CQFP and Dike Corridor gold zones, which has the added benefit of potentially upgrading Inferred resources to Indicated.

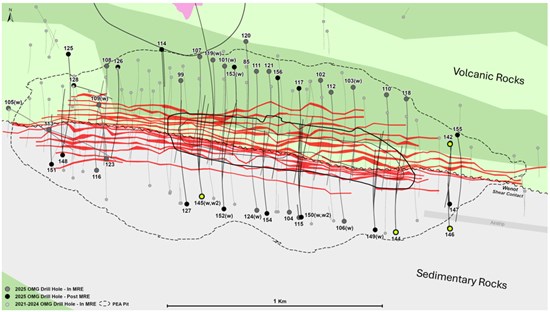

Figure 1. Plan Map of Wenot Showing Drill Hole Locations

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8712/277237_975b573c34c80912_001full.jpg

Figure 2. Cross-Section Showing Holes 25ODD-142, 146 and 147

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8712/277237_975b573c34c80912_002full.jpg

Figure 3. Cross-Section Showing Results of Hole 25ODD-145W

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8712/277237_975b573c34c80912_003full.jpg

BBH Target

Seven drill holes (1,240m) were recently completed on the BBH target, following up on the Company's previous favourable results from trenching and drilling as well as from compilations of historical results. Results from five drill holes were reported recently (news release dated November 3, 2025) and results have been received for the remaining two holes, 25ODD-139 and 25ODD-141. BBH is a broad target area defined by a series of trenches, shallow drill holes and sampling, all of which have identified numerous instances of gold mineralization, often with high grades near surface. In a few areas along the trend, a series of flat-lying, saprolite-hosted ladder veins have been trenched with high gold values. These ladder veins appear to occur between two northeast-trending structures. Drilling in 2021 intersected 1.7 g/t Au over 7.5m, and 3.15 g/t Au over 3.0m and six of eleven 2022 trench samples assayed over 6 g/t Au, including three that assayed over 10 g/t Au (news release dated February 24, 2022). The seven drill holes recently completed were broadly spaced along the interpreted 600-m trend of this target area.

Results are provided for the two remaining holes. Hole 25ODD-141 was drilled 40m northeast of Hole 25ODD-131 which intersected 20.33 g/t Au over 5.3m at a depth of -50m (previously reported). Hole 25ODD-141 was also drilled vertically and intersected only a couple of narrow intercepts of anomalous gold, with best results of up to 1.62 g/t Au over 1.3m (-100m depth), and 0.81 g/t Au over 1.25m (-144m depth). Hole 25ODD-139 was drilled to test across one of the two interpreted northeast trending control structures. A sequence of chlorite-altered volcanics cut by a couple of diorite dikes was intersected but no significant gold mineralization.

All but one hole of this seven-hole program intersected gold mineralization; although recent results show narrow and lower grade mineralization, this near surface widespread mineralization together with the known high-grade areas warrant further exploration. These seven holes proved useful for better understanding the orientation and distribution of gold mineralization in this area. Once the new drill data is incorporated, additional drilling will be planned.

Camp Zone Target

The Camp Zone Target lies approximately 300-500m west of the Wenot deposit. The Wenot Shear Corridor extends through this area, with the expected Central Quartz Feldspar Porphyry ('CQFP') occurring typically at the contact. In this area, however, the shear corridor and CQFP appear slightly offset or splayed slightly north off of the otherwise straight-line projection of the main Wenot shear.

A total of seven diamond drill holes (2,931m) were completed recently at Camp Zone. Gold mineralization has now been identified along a 450m strike in this area. Results from five of these holes were reported recently, with significant results including 2.72 g/t Au over 16.3m in hole 25ODD-135, and 6.81 g/t Au over 1.0m and 2.05 g/t Au over 7.5m in hole 25ODD-136,, and 0.85 g/t Au over 12.7m in hole 25ODD-138 (news release dated November 3, 2025). These intersections are at a vertical depth of less than -200m, making this Camp Zone an attractive potential satellite pit.

Results for the two remaining holes from Camp Zone include: Hole 25ODD-140, located on the eastern side of Camp Zone, which returned 2.63 g/t Au over 5.5m (including 6.06 g/t over 2.3m), 5.01 g/t Au over 1.5m, and 1.44 g/t Au over 0.8m, all at vertical depths of less than 70m. Although these are interesting zones, they are likely a separate zone north of the major zone drilled in Hole 135. Hole 25ODD-143 is collared 70m south of Hole 25ODD-135, designed to test the same zone at very shallow depths. It intersected only narrow intercepts of anomalous gold, including 0.40 g/t Au over 3.8m and 0.49 g/t Au over 1.5m. These intersections are at vertical depths of less than -85m. Depending on the dip of the major zone in hole 135, hole 143 may have been collared too far forward.

Results from this seven-hole drill campaign at Camp Zone were very positive and there are indications of at least one or two significant gold zones that will be pursued early in the new year.

A total of 79 diamond drill holes have been completed to date this year on the Omai property, totalling 35,300m. Importantly, this includes 30 drill holes totalling 13,250m on the Wenot deposit that were not included in the most recent (August 2025) Mineral Resource Estimate, and will be incorporated into the upcoming MRE in early 2026, in advance of the updated PEA.

Table 1. Recent Wenot Drill Results*

| DDH | From | To | Interval | Grade g/t Au) |

| Wenot | ||||

| 25ODD-142 (EWen) | 76.5 | 78.0 | 1.5 | 1.01 |

| 109.0 | 110.5 | 1.5 | 4.43 | |

| 190.7 | 191.5 | 0.8 | 0.95 | |

| 304.0 | 318.7 | 14.7 | 11.07 | |

| Including | 312.6 | 316.9 | 4.3 | 34.31 |

| 419.0 | 422.0 | 3.0 | 0.77 | |

| 426.3 | 427.6 | 1.3 | 1.88 | |

| 460.0 | 464.5 | 4.5 | 0.91 | |

| 25ODD-144 (Wen) | 284.4 | 285.4 | 1.0 | 0.60 |

| 296.0 | 297.5 | 1.5 | 0.62 | |

| 350.0 | 351.5 | 1.5 | 4.10 | |

| 371.3 | 377.0 | 5.7 | 1.19 | |

| 383.0 | 395.0 | 12.0 | 0.98 | |

| 412.5 | 414.7 | 2.2 | 2.94 | |

| 418.0 | 422.1 | 4.1 | 0.81 | |

| 474.5 | 478.1 | 3.6 | 0.36 | |

| 483.5 | 486.5 | 3.0 | 0.95 | |

| 503.0 | 516.0 | 13.0 | 0.99 | |

| 526.5 | 558.1 | 31.6 | 1.11 | |

| 25ODD-144A (Wen) | 224.0 | 225.5 | 1.5 | 0.58 |

| 297.0 | 298.5 | 1.5 | 2.96 | |

| 328.5 | 330.0 | 1.5 | 2.76 | |

| 345.6 | 346.7 | 1.1 | 0.59 | |

| 25ODD-145W (Wen) | 296.0 | 297.0 | 1.0 | 1.94 |

| 304.0 | 309.0 | 5.0 | 0.39 | |

| 328.5 | 330.0 | 1.5 | 2.48 | |

| 352.4 | 358.0 | 5.6 | 0.53 | |

| 397.7 | 411.0 | 13.3 | 13.54 | |

| Including | 398.8 | 405.0 | 6.2 | 27.82 |

| and including | 398.8 | 401.0 | 2.2 | 63.17 |

| 499.5 | 514.5 | 15.0 | 2.01 | |

| 542.5 | 543.6 | 1.1 | 1.13 | |

| 617.2 | 618.2 | 1.0 | 5.28 | |

| 25ODD-146 (EWen) | 219.9 | 222.3 | 2.4 | 6.62 |

| 236.0 | 238.5 | 2.5 | 0.65 | |

| 259.4 | 262.2 | 2.8 | 0.60 | |

| 269.0 | 273.5 | 4.5 | 1.60 | |

| 300.0 | 301.1 | 1.1 | 2.58 | |

| 304.4 | 320.5 | 16.1 | 1.02 | |

| 25ODD-147B (EWen) | 58.0 | 58.5 | 0.5 | 0.52 |

| 160.5 | 162.0 | 1.5 | 0.57 | |

| Camp Zone Target | ||||

| 25ODD-140 (CZ) | 52.5 | 54.0 | 1.5 | 5.01 |

| 66.7 | 67.5 | 0.8 | 1.44 | |

| 86.5 | 92.0 | 5.5 | 2.63 | |

| Including | 89.7 | 92.0 | 2.3 | 6.06 |

| 25ODD-143 (CZ) | 90.3 | 94.1 | 3.8 | 0.40 |

| 107.0 | 108.5 | 1.5 | 0.49 | |

| BBH Target | ||||

| 25ODD-139 (BBH) | no significant intercepts | |||

| 25ODD-141 (BBH) | 96.5 | 97.8 | 1.3 | 1.62 |

| 142.8 | 144.0 | 1.2 | 0.81 | |

*True widths vary as mineralization at Wenot is generally hosted within stockwork vein systems with alteration halos, with an estimated true width range of 70-90%. Cut-off grade 0.30 g/t Au with maximum 3.0m internal dilution is applied. **If indicated, a maximum 5.0m internal dilution was applied. All grades are uncapped unless otherwise noted.

Corporate Update

Omai Gold has entered into an investor relations agreement (the "TBIR Agreement") with TB Investor Relations ("TBIR") to assist the Company in enhancing its communication strategy. The TBIR Agreement is effective as of December 1, 2025 and will continue on a month-to-month basis unless terminated by either party with one month's notice. In consideration for TBIR's services, the Company will pay TBIR a monthly fee of $5,000 plus HST.

Quality Control

Omai maintains an internal QA/QC program to ensure sampling and analysis of all exploration work is conducted in accordance with best practices. Certified reference materials, blanks and duplicates are entered at regular intervals. Samples are sealed in plastic bags.

Drill core samples (halved-core) were shipped to Act Labs and some batches to MSALABS, both certified laboratories in Georgetown Guyana, respecting the best chain of custody practices. At the laboratory, samples are dried, crushed up to 80% passing 2 mm, riffle split (250 g), and pulverized to 95% passing 105 μm, including cleaner sand. Fifty grams of pulverized material is then fire assayed by atomic absorption spectrophotometry (AA). Initial assays with results above 3.0 ppm gold are re-assayed using a gravimetric finish. For samples with visible gold and surrounding samples within deemed gold zones, two separate 250g or 500g pulverized samples are prepared, with 50 grams of each fire assayed by atomic absorption spectrophotometry, with assays above 3.0 ppm gold being re-assayed using a gravimetric finish. Certified reference materials and blanks meet with QA/QC specifications.

Qualified Person

Elaine Ellingham, P.Geo., is a Qualified Person (QP) under National Instrument 43-101 "Standards of Disclosure for Mineral Projects" and has reviewed and approved the technical information contained in this news release. Ms. Ellingham is a director and officer of the Company and is not considered to be independent for the purposes of National Instrument 43-101.

ABOUT OMAI GOLD

Omai Gold Mines Corp. is a Canadian gold exploration and development company focused on rapidly expanding the two orogenic gold deposits at its 100%-owned Omai Gold Project in mining-friendly Guyana, South America. The Company has established the Omai Gold Project as one of the fastest growing and well-endowed gold camps in the prolific Guiana Shield. In August 2025, the Company announced a 96% increase to the Wenot Gold Deposit NI 43-101 Mineral Resource Estimate1 (MRE) to 970,000 ounces of gold (Indicated) averaging 1.46 g/t Au, contained in 20.7 Mt and 3,717,000 ounces of gold (Inferred MRE) averaging 1.82 g/t Au, contained in 63.4 Mt. This brings the global MRE at Omai, including the Wenot and adjacent Gilt Creek deposits, to 2,121,000 ounces of gold (Indicated MRE) averaging 2.07 g/t Au in 31.9 Mt and 4,382,000 ounces of gold (Inferred MRE) averaging 1.95 g/t Au in 69.9 Mt. A baseline PEA announced in April 2024, contemplated an open pit-only development scenario and included less than 30% of the new Mineral Resource Estimate for Omai. Five drills are currently active on the property: at Wenot the focus is to optimize the upcoming PEA, to further test the limits of the deposit, including both east and west, and to commence upgrading the large Inferred MRE to Indicated. Additional drilling will continue to explore certain known gold occurrences for possible near-surface higher-grade satellite deposits. An updated PEA is planned for H1 2026 to include the expanded Wenot open pit deposit and the adjacent Gilt Creek underground deposit. The Omai Gold Mine produced over 3.7 million ounces of gold from 1993 to 20052, ceasing operations when gold was below US$400 per ounce. The Omai site significantly benefits from existing infrastructure and is connected to the two largest cities in Guyana, Georgetown and Linden.

1 NI 43-101 Technical Report dated October 9, 2025 titled "UPDATED MINERAL RESOURCE ESTIMATE AND TECHNICAL REPORT ON THE OMAI GOLD PROPERTY, POTARO MINING DISTRICT NO.2, GUYANA" was prepared by P&E Mining Consultants Inc. and is available on www.sedarplus.ca and on the Company's website.

2 Past production at the Omai Mine (1993-2005) is summarized in several Cambior Inc. documents available on www.sedarplus.ca, including March 31, 2006 AIF and news release August 3, 2006.

For further information, please see our website www.omaigoldmines.com or contact:

Elaine Ellingham, P.Geo.

President & CEO

elaine@omaigoldmines.com

+1.416.473.5351

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Table 2. Drill Hole Coordinates

| Hole ID | Azimuth | Inclination | Easting | Northing | Length | Status |

| (degrees) | (degrees) | (m) | ||||

| 25ODD-139 | 180 | -60 | 303900 | 602645 | 160.7 | Reporting |

| 25ODD-140 | 178 | -48 | 303825 | 602044 | 352.6 | Reporting |

| 25ODD-141 | 70 | -88 | 303954 | 602508 | 229.6 | Reporting |

| 25ODD-142 | 177 | -54 | 306133 | 601595 | 478.7 | Reporting |

| 25ODD-143 | 179 | -48 | 303731 | 601964 | 157.5 | Reporting |

| 25ODD-144 | 356 | -53 | 305882 | 601178 | 564.8 | Reporting |

| 25ODD-144A | 357 | -52 | 305880 | 601181 | 346.7 | Reporting |

| 25ODD-145 | 354 | -52 | 304979 | 601346 | 616.4 | Pending |

| 25ODD-145W | 354 | -52 | 304979 | 601346 | 640.4 | Reporting |

| 25ODD-145W2 | 354 | -52 | 304979 | 601346 | 553.4 | Pending |

| 25ODD-146 | 356 | -46 | 306129 | 601199 | 541.7 | Reporting |

| 25ODD-147 | 356 | -47 | 306130 | 601311 | 144.0 | Reporting |

| 25ODD-147B | 356 | -46 | 306129 | 601288 | 185.0 | Reporting |

| 25ODD-148 | 358 | -45 | 304329 | 601539 | 424.4 | Pending |

| 25ODD-149 | 356 | -50 | 305783 | 601191 | 575.6 | Pending |

| 25ODD-149W2 | 356 | -50 | 305783 | 601191 | 570.4 | Pending |

| 25ODD-150 | 355 | -48 | 305440 | 601250 | 626.0 | Pending |

| 25ODD-150W | 355 | -48 | 305440 | 601250 | 531.7 | Pending |

| 25ODD-150W3 | 355 | -48 | 305440 | 601250 | 604.1 | Pending |

| 25ODD-151 | 358 | -47 | 304278 | 601496 | 361.4 | Pending |

| 25ODD-152 | 356 | -49 | 305080 | 601288 | 511.7 | Pending |

| 25ODD-152W | 356 | -49 | 305080 | 601288 | 618.8 | Pending |

| 25ODD-153 | 173 | -53 | 305128 | 601948 | 689.6 | Pending |

| 25ODD-153W | 173 | -53 | 305128 | 601948 | Ongoing | |

| 25ODD-154 | 354 | -56 | 305280 | 601267 | 631.6 | Pending |

| 25ODD-155 | 172 | -50 | 306166 | 601632 | 481.7 | Pending |

| 25ODD-156 | 175 | -52 | 305330 | 601898 | Ongoing | |

| 25ODD-119W | 175 | -54 | 305028 | 601981 | Ongoing |

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements with respect to the timing of completion of the drill program, and the potential for the Omai Gold Project to allow Omai to build significant gold Mineral Resources at attractive grades, and forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties; delay or failure to receive regulatory approvals; the price of gold and copper; and the results of current exploration. Further, the Mineral Resource data set out in this news release are estimates, and no assurance can be given that the anticipated tonnages and grades will be achieved or that the indicated level of process recovery will be realized. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Cautionary Note Regarding Mineral Resource Estimates

Until mineral deposits are actually mined and processed, Mineral Resources must be considered as estimates only. Mineral Resource Estimates that are not Mineral Reserves have not demonstrated economic viability. The estimation of Mineral Resources is inherently uncertain, involves subjective judgement about many relevant factors and may be materially affected by, among other things, environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant risks, uncertainties, contingencies and other factors described in the Company's public disclosure available on SEDAR+ at www.sedarplus.ca. The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration. The accuracy of any Mineral Resource Estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. Mineral Resource Estimates may have to be re-estimated based on, among other things: (i) fluctuations in mineral prices; (ii) results of drilling, and development; (iii) results of future test mining and other testing; (iv) metallurgical testing and other studies; (v) results of geological and structural modeling including block model design; (vi) proposed mining operations, including dilution; (vii) the evaluation of future mine plans subsequent to the date of any estimates; and (viii) the possible failure to receive required permits, licenses and other approvals. It cannot be assumed that all or any part of a "Inferred" or "Indicated" Mineral Resource Estimate will ever be upgraded to a higher category. The Mineral Resource Estimates disclosed in this news release were reported using Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral Reserves (the "CIM Standards") in accordance with National Instrument 43-101- Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators ("NI 43-101").

Cautionary Statements to U.S. Readers

This news release uses the terms "Mineral Resource", "Indicated Mineral Resource" and "Inferred Mineral Resource" as defined in the CIM Standards in accordance with NI 43-101. While these terms are recognized and required by the Canadian Securities Administrators in accordance with Canadian securities laws, they may not be recognized by the United States Securities and Exchange Commission. The "Mineral Resource" Estimates and related information in this news release may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/277237