Vancouver, British Columbia--(Newsfile Corp. - January 28, 2026) - Auranova Resources Inc. ("Auranova" or the "Company") and Kenorland Minerals Ltd. ("Kenorland") are pleased to announce complete assay results from the 2025 winter diamond drill program at the South Uchi Project (the "Project"), located in the Red Lake District of Ontario. The program comprised 13 drill holes totalling 7,075 metres and successfully expanded the Papaonga gold target while identifying a new, previously untested mineralised structural corridor concealed beneath glacial cover.

Drill Highlights:

- New gold-bearing structural corridor identified north of the Papaonga target

- Papaonga mineralised footprint expanded to the north and east

- Broad zones of gold anomalism confirm district-scale potential

- Highest grade intercept of 5.42 g/t over 1.80 m including 12.70 g/t Au over 0.40 m

- Follow-up drill program planned for Q1-2026

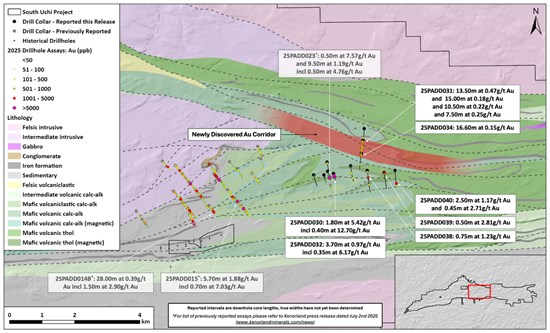

Figure 1. Plan map of Papaonga with drill hole locations including highlights from this press release

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9342/281901_851ccdc6e4d2ba39_001full.jpg

Tom Obradovich, CEO of Auranova commented, "Our last two drill programs have resulted in placing pieces of the puzzle together in an effort to locate the source of the large geochemical anomaly at the South Uchi Project. Our technical team at Kenorland, along with Chris Taylor, have done a superb job identifying new gold bearing structures for the March drill campaign."

Discussion of Results

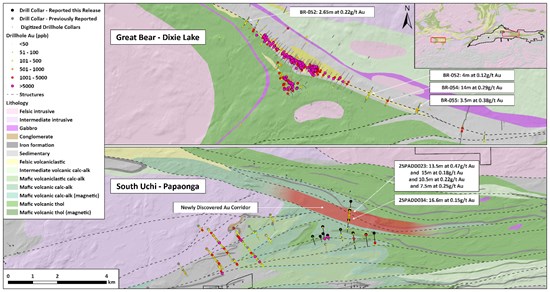

Comparing the South Uchi results to the Great Bear project (owned by Kinross Gold Corporation), Chris Taylor, Director of Auranova and former CEO and President of Great Bear Resources said, "In 2018 at Great Bear, we had already drilled the LP Fault zone a year before its definitive discovery. In August of that year we released: Great Bear's drill hole DNE-001 intersected a very broad, 176-metre-wide hydrothermal alteration zone containing disseminated sulphide mineralisation and quartz-sericite alteration with anomalous gold. The best sub-interval was 3.90 metres of 1.01 g/t gold. The interval that really stuck in our minds, reported in a summary table, was 10.50 metres of 0.31 g/t gold. 1 This together with the full width of the hydrothermally altered zone of almost 200 metres, told us a major mineralising fluid system had affected the rocks. A year later, the implication became obvious."

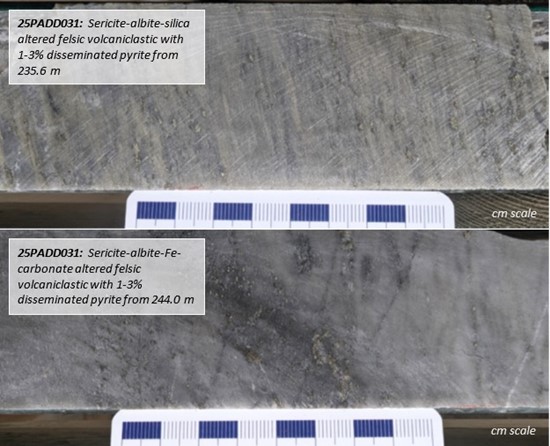

"We have now drilled similar alteration at the Uchi property with Auranova (see figure 3), within a similar magnetic low, and similar felsic rocks. Disseminated sulphide mineralisation and quartz-sericite alteration have been drilled over a similar, approximately 200-metre-wide structural corridor. In aggregate, drill holes 25PADD031 and 032 intersected over 63 metres of anomalous gold bearing mineralisation. We haven't yet tested along this corridor, but it does appear to be a large-scale gold-bearing structure, and we are very excited to see if higher grades are also hosted here."

Notes: (1) Great Bear Resources Ltd. press release (2018, August 22).

Figure 2. South Uchi Papaonga target comparison to the Great Bear project (Kinross Gold Corp.)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9342/281901_851ccdc6e4d2ba39_002full.jpg

Notes: The top image displays the Great Bear project (owned by Kinross Gold Corporation). The inset map in the top right shows the location and distance of the project in relation to the South Uchi Project, indicated by the red rectangles. The Great Bear project data is sourced from public records. Mineralisation on adjacent or nearby properties is not necessarily indicative of mineralisation on the Company's property.

Figure 3. Drill hole 25PADD031 alteration zone from split drill core interval (winter 2025 drill results)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9342/281901_auronova1.jpg

Notes: The two images above use a cm scale bar. These photographs have been selected to show the alteration style from a singular drill hole (25PADD031) and may not be representative of the full drill program results. No assay results are implied.

The 2025 winter drill program represents the second phase of drilling at Papaonga and builds on four years of systematic exploration, including the maiden drill program reported in July 2025. Drilling was designed to (i) follow up high-grade mineralisation intersected in hole 25PADD023 and (ii) test a newly interpreted structural corridor identified from geophysics outside the previously drilled area.

Step-out drilling along the southern structural trend targeted extensions east, west, and down-dip from 25PADD023. Multiple holes intersected quartz-sulphide veining with carbonate-chlorite-silica alteration hosted within mafic volcanic rocks, locally containing visible gold. Notably, hole 25PADD030 returned 1.80 m at 5.42 g/t Au, including 0.40 m at 12.70 g/t Au, confirming continuity of high-grade mineralisation along the structure.

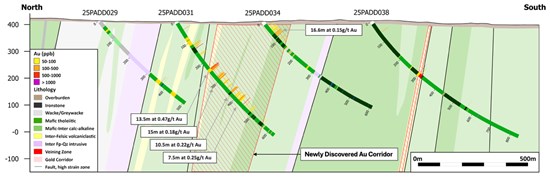

A three-hole fence targeted a previously untested structural corridor north of Papaonga, concealed beneath glacial till and glaciolacustrine cover. Holes 25PADD031 and 25PADD034 intersected a ~200 m-wide mineralised corridor characterised by sericite-albite-silica alteration, 1-5% disseminated sulphides, and multiple ~10 m-scale intervals of anomalous gold values. These results confirm the presence of a broad, belt-parallel gold-bearing structure that remains open along strike.

Drilling also demonstrates that gold anomalism persists east of the current Papaonga footprint, reinforcing the interpretation that mineralisation is distributed across a much broader structural system than previously tested.

Figure 4. Cross section through newly identified northern mineralised corridor and southern trend

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9342/281901_851ccdc6e4d2ba39_009full.jpg

Q1-2026 Drill Program

A proposed drill program of up to 3,000 metres is currently being designed and is scheduled to commence in Q1-2026, subject to permitting. Drilling will focus on step-out fences along the newly identified northern structural corridor, targeting up to 8 km of prospective strike length, with the objective of delineating higher-grade shoots within the broader mineralised system.

Table 1: Table of assay results from the 2025 winter drill program

| HOLE ID | From (m) | To (m) | Interval (m) | Au (g/t) | |

| 25PADD030 | 155.15 | 156.95 | 1.80 | 5.42 | |

| Incl. | 155.55 | 155.95 | 0.40 | 12.70 | |

| 25PADD031 | 234.00 | 247.50 | 13.50 | 0.47 | |

| And | 282.00 | 297.00 | 15.00 | 0.18 | |

| And | 363.00 | 373.50 | 10.50 | 0.22 | |

| And | 412.50 | 420.00 | 7.50 | 0.25 | |

| 25PADD032 | 229.50 | 233.20 | 3.70 | 0.97 | |

| Incl. | 230.50 | 230.85 | 0.35 | 6.17 | |

| 25PADD034 | 67.80 | 84.40 | 16.60 | 0.15 | |

| 25PADD038 | 298.55 | 299.30 | 0.75 | 1.23 | |

| 25PADD039 | 19.50 | 20.00 | 0.50 | 2.81 | |

| 25PADD040 | 507.00 | 509.50 | 2.50 | 0.20 | |

| And | 528.75 | 529.20 | 0.45 | 2.71 | |

Notes: Assay intervals reported are core lengths, true widths have not been determined.

Table 2. Drill hole location and collar table of reported drill holes from the 2025 winter drill program

| HOLE ID | Easting (NAD83) | Northing (NAD83) | Elevation (m) | Depth (m) | Dip | Azimuth |

| 25PADD028 | 554979 | 5640791 | 401 | 309 | -45 | 165 |

| 25PADD029 | 556222 | 5642216 | 414 | 507 | -45 | 185 |

| 25PADD030 | 555275 | 5640836 | 402 | 309 | -45 | 165 |

| 25PADD031 | 556180 | 5641858 | 412 | 627 | -50 | 185 |

| 25PADD032 | 555275 | 5640837 | 402 | 441 | -73 | 165 |

| 25PADD033 | 555095 | 5640903 | 405 | 486 | -59 | 165 |

| 25PADD034 | 556131 | 5641456 | 410 | 606 | -45 | 188 |

| 25PADD035 | 555078 | 5641184 | 410 | 567 | -50 | 170 |

| 25PADD036 | 555802 | 5641071 | 410 | 600 | -48 | 175 |

| 25PADD037 | 554668 | 5640790 | 408 | 507 | -50 | 165 |

| 25PADD038 | 556314 | 5640930 | 411 | 834 | -48 | 172 |

| 25PADD039 | 556836 | 5640868 | 425 | 640 | -48 | 175 |

| 25PADD040 | 557168 | 5640927 | 410 | 642 | -50 | 175 |

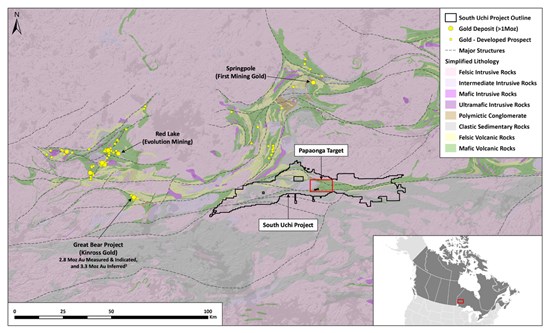

About South Uchi Project

The South Uchi Project was first identified and staked by Kenorland based on the under-explored region's prospectivity to host significant gold mineralised systems. The Project covers a portion of Confederation Assemblage volcanic rocks, as well as the boundary between the Uchi geological subprovince to the north and the English River geological subprovince to the south. Multiple major east-west striking deformation zones associated with the subprovince boundary transect the Project, resulting in zones of strong shearing and folding of the supracrustal stratigraphy, which are favourable settings for orogenic gold mineralisation. Prior to Kenorland staking the Project, records indicated little to no systematic exploration had been completed, and the land package remained under-explored. The majority of gold deposits in the Red Lake District (Red Lake, Madsen, Hasaga, and others) are located on the northern margin of the Confederation Assemblage. However, recent discoveries such as the LP Fault Zone on the Dixie Project by Great Bear Resources Ltd. (acquired by Kinross Gold and renamed Great Bear Project) highlight the prospectivity of the entire Confederation Assemblage along the southern margin of the Uchi subprovince.

Kenorland announced on December 2, 2024, that it had entered into a definitive agreement with Auranova, granting Auranova the right to earn up to a 70% interest in the Project. Pursuant to the agreement, Auranova may earn an initial 51% interest in the Project by making cash payments totalling $500,000 to Kenorland, completing a diamond drilling program with at least $8,000,000 in qualifying expenditures or completing 15,000 metres of drilling within two years of receiving a drill permit, issuing Kenorland 19.9% of Auranova's common shares, and maintaining Kenorland's 19.9% share position until Auranova raises a minimum of $10,000,000 through share issuances, after which Kenorland's stake will remain at 10% on a pro-rata basis through to the completion of a Preliminary Economic Assessment (the "PEA").

Kenorland has received the $500,000 in cash payments and currently holds 9,242,267 common shares of Auranova and confirms that Auranova has now earned a 51% ownership interest in the Project (see press release dated July 2, 2025). Further, Auranova may earn an additional 19% interest, for a total of 70%, by incurring an additional $10,000,000 in qualifying expenditures on or before the third anniversary of Auranova's election to proceed with the second option. Kenorland will also retain a 30% carried interest in the Project through to the completion of the PEA, at which point a joint venture will be formed.

Kenorland also holds a 2% net smelter return royalty on the Project (see press release dated September 16, 2024).

Figure 5. Regional volcanic assemblages with significant gold deposits and South Uchi Project location

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9342/281901_851ccdc6e4d2ba39_010full.jpg

1 Kinross reports 2023 fourth-quarter and full-year results: (Date February 14, 2024) - Updated resource to the technical report titled Great Bear Project Ontario, Canada prepared by Nicos Pfeiffer, P.Geo., John Sims, CPG, Yves Breau, P.Eng., Rick Greenwood, P.Geo., Agung Prawasono, P.Eng., issued February 13, 2023

Qualified Persons

William Yeomans, P.Geo., a "Qualified Person" under National Instrument 43-101, has also reviewed and approved the scientific and technical information in this press release. Mr. Yeomans is a gold exploration professional with over 40 years of experience in all stages of gold exploration throughout the Americas, including the Superior Province throughout Quebec and Ontario. He gained extensive exploration management experience across the entire Guiana Shield with BHP and has generated projects which resulted with significant NI 43-101 gold resources. He has worked as a consultant to IAMGOLD and Dundee Precious Metals Inc., identifying acquisition opportunities across Canada, the USA and South America. He is currently the President of Yeomans Geological Inc. as well as 1127637 B.C. Ltd. and has many years of experience as a board member for several junior mining companies.

QA/QC and Core Sampling Protocols

All drill core samples were collected under the supervision of Kenorland employees. Drill core was transported from the drill platform to the logging facility where it was logged, photographed, and split by diamond saw prior to being sampled. Samples were then bagged, and blanks and certified reference materials were inserted at regular intervals. Groups of samples were placed in large bags, sealed with numbered tags in order to maintain a chain-of-custody, and transported from Red Lake to Bureau Veritas Commodities ("BV") laboratory in Timmins, Ontario.

Sample preparation and analytical work for this drill program were carried out by BV. Samples were prepared for analysis according to BV method PRP70-250: individual samples were crushed to 2mm (10 mesh) and a 250g split was pulverized to 75μm (200 mesh) for analysis and then assayed for gold. Gold in samples were analyzed using BV method FA430 where a 30g split is analyzed with fire assay by Pb collection and AAS finish. Over-limits gold samples were re-analyzed using BV method FA530 where a 30g split is analyzed with fire assay by Pb collection and gravimetric finish. Multi-element geochemical analysis (45 elements) was performed on all samples using BV method MA200 where a 0.25g split is by multi-acid digest with ICP-MS/ES finish. All results passed the QA/QC screening at the lab, all company inserted standards and blanks returned results that were within acceptable limits.

About Auranova Resources

The Company is an unlisted reporting issuer in the Provinces of British Columbia, Alberta, Saskatchewan and Manitoba. Its directors and major shareholders are Thomas Obradovich, Chris Taylor, Timothy Young, William Rand and Blair Zaritsky. The Company is focused on the discovery of new gold systems in the Birch Uchi Belt in partnership with Kenorland Minerals Ltd. as well as expanding its presence in the greenstone belts of Ontario.

Further information can be found on the Company's website www.auranovaresources.com.

On behalf of the Board of Directors of Auranova Resources,

Thomas Obradovich

Chief Executive Officer

Tel: +1 416 985 7140

Email: info@auranovaresources.com

Cautionary Statement Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (together, "forward-looking statements") within the meaning of applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as "plans", "expects", "estimates", "intends", "anticipates", "believes" or variations of such words, or statements that certain actions, events or results "may", "could", "would", "might", "will be taken", "occur" or "be achieved". Forward-looking statements involve risks, uncertainties and other factors disclosed under the heading "Risk Factors" and elsewhere in the Company's filings with Canadian securities regulators, that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements. Mineralisation on adjacent or nearby properties is not necessarily indicative of mineralisation on the Company's property. Although the Company believes that the assumptions and factors used in preparing these forward-looking statements are reasonable based upon the information currently available to management as of the date hereof, actual results and developments may differ materially from those contemplated by these statements. Readers are therefore cautioned not to place undue reliance on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/281901