9/30/2025

1. Introduction

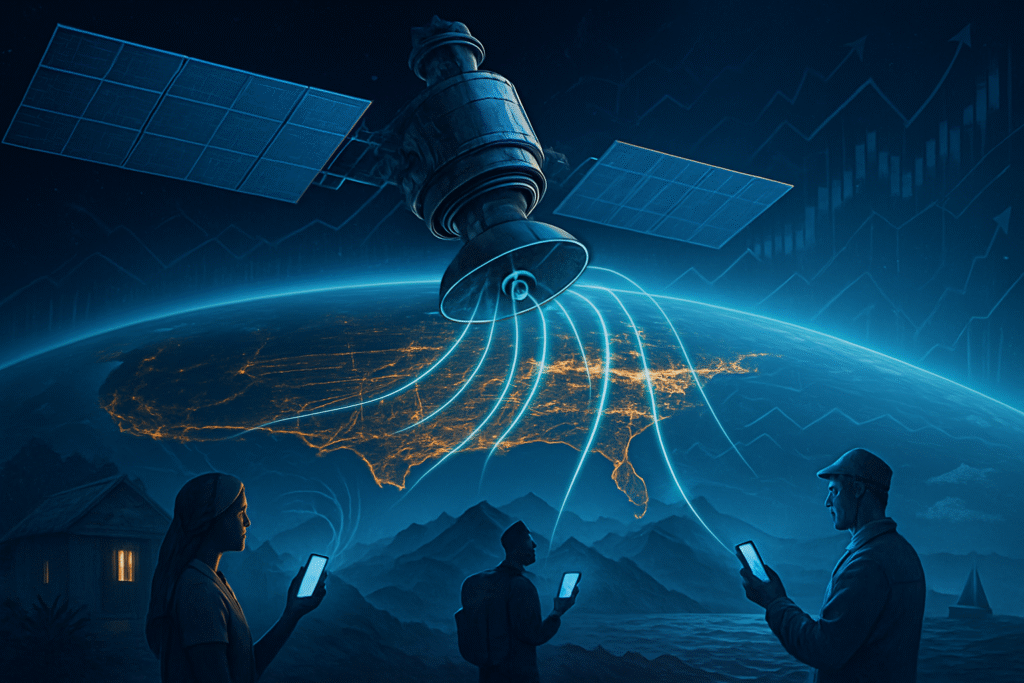

AST SpaceMobile (NASDAQ: ASTS) stands at the forefront of a telecommunications revolution, aiming to deliver space-based cellular broadband directly to unmodified smartphones worldwide. Founded in 2017 by Abel Avellan, the Midland, Texas-based company is developing the SpaceMobile satellite constellation, a network designed to eliminate connectivity gaps for billions of mobile subscribers in areas traditionally underserved by terrestrial cellular infrastructure. The company’s innovative approach, leveraging large low Earth orbit (LEO) satellites with phased-array antennas, has garnered significant attention from investors, industry giants, and governments alike. As of September 30, 2025, AST SpaceMobile is transitioning from groundbreaking technology demonstrations, such as the BlueWalker 3 prototype’s successful 4G and 5G connections to unmodified handsets, to the initial deployment of its commercial BlueBird satellites. This pivotal phase, marked by strategic partnerships with major mobile network operators (MNOs) like AT&T, Vodafone, and Verizon, and the securing of U.S. government contracts, positions AST SpaceMobile as a potentially transformative force in global connectivity, albeit one navigating complex operational, financial, and competitive landscapes. Its ability to execute its ambitious satellite deployment schedule and successfully commercialize its unique service will be critical determinants of its future relevance and market impact.

2. Historical Background

AST SpaceMobile’s journey began in May 2017, when Abel Avellan founded AST & Science LLC with the ambitious vision of creating a global cellular broadband network in space that could connect directly with standard mobile phones. Avellan, drawing on his extensive experience in satellite communications and his prior success with Emerging Markets Communications (EMC), sought to bypass traditional terrestrial infrastructure limitations and bring connectivity to the billions of people worldwide who remain underserved.

Early milestones quickly underscored the company’s technical ambition and strategic acumen. In March 2018, AST & Science acquired a controlling interest in NanoAvionics, a Lithuanian satellite manufacturer, bolstering its in-house production capabilities. This was followed by the launch of BlueWalker 1, its initial test satellite, in April 2019, which validated core concepts of satellite-to-smartphone communication.

A significant turning point came in March 2020 with a $110 million Series B funding round, led by telecommunications heavyweights Vodafone and Rakuten, alongside Samsung Next, American Tower, and Cisneros. This capital infusion was crucial for advancing its technology. The company’s public market debut occurred in April 2021, when AST SpaceMobile went public on NASDAQ (ASTS) through a business combination with New Providence Acquisition Corp., a special purpose acquisition company (SPAC). This transaction injected approximately $462 million in gross proceeds, providing essential funding for its ambitious satellite constellation development.

The development and launch of BlueWalker 3, an experimental satellite featuring a massive, unfurling antenna array (693 square feet), marked a critical technical achievement. Launched in 2022, BlueWalker 3 successfully demonstrated the world’s first space-based two-way telephone call and subsequent 4G and 5G video calls with unmodified smartphones in April 2023, achieving download speeds up to 21 Mbit/s. This validated the core premise of AST SpaceMobile’s technology.

Since these early successes, AST SpaceMobile has undergone several key transformations. It has transitioned from pure R&D to active commercial deployment, investing heavily in scaling its manufacturing capabilities at its Midland, Texas facility, with plans to expand its footprint to 400,000 square feet by the end of 2025. The company aims to produce six satellites per month by late 2025. Crucially, it has forged strategic global partnerships with over 50 mobile network operators, collectively representing over 2.8 billion subscribers, integrating its space-based solution into existing terrestrial ecosystems. In September 2024, the first five commercial “BlueBird” satellites were successfully launched, marking a significant step towards commercial service. Furthermore, AST SpaceMobile has expanded its focus to include government applications, securing contracts with the U.S. government and being selected for the Space Development Agency’s HALO program, diversifying its revenue potential. These transformations highlight a rapid evolution from a visionary concept to a company on the cusp of delivering a globally disruptive connectivity solution.

3. Business Model

AST SpaceMobile's business model is fundamentally a "super wholesale" approach, designed to leverage existing mobile network operator (MNO) infrastructure and customer bases rather than competing directly for end-users. This strategy positions the company as a crucial enabler for MNOs to extend their coverage to previously unserved or underserved areas globally.

Revenue Sources:

The primary revenue stream for AST SpaceMobile is projected to come from selling wholesale broadband satellite capacity to MNOs. These MNOs, in turn, integrate this space-based connectivity into their existing service plans, offering it to their subscribers as an add-on or a "day pass" for use outside traditional terrestrial coverage. Revenue sharing agreements with MNOs are typically structured on a 50/50 basis. While the company is still largely in its pre-revenue development phase from its core SpaceMobile service, it reported negligible revenue for fiscal year 2024, primarily from non-core services. However, AST SpaceMobile projects a significant ramp-up in revenue, targeting $50 million to $75 million in the second half of 2025 as satellite launches accelerate and initial commercial services commence. Beyond MNO partnerships, the company has also started generating revenue from U.S. government contracts, which represent a growing ancillary revenue source.

Product Lines:

AST SpaceMobile's core product is its proprietary satellite constellation, known as "SpaceMobile," comprised of its "BlueBird" satellites.

- BlueWalker 3: This experimental satellite, launched in September 2022, served as a crucial technology demonstrator, successfully proving direct voice and data links to unmodified smartphones using its massive 693-square-foot phased-array antenna.

- BlueBird Satellites (Block 1 and Block 2): These are the commercial operational satellites. The first five Block 1 BlueBird satellites were launched in September 2024, initiating the path toward commercial service. AST SpaceMobile aims to launch between 45 and 60 satellites by 2026 to achieve continuous global coverage in key markets. The Block 2 BlueBird satellites, currently in development and expected to be ready for launch in 2024, are designed to be significantly larger and offer enhanced capacity, with the company aiming to ramp up production to six satellites per month by the end of 2025.

Services:

The primary service offered by AST SpaceMobile is direct-to-device cellular broadband connectivity (supporting 4G/5G speeds) from space to standard, unmodified mobile phones. This service is designed to:

- Eliminate Coverage Gaps: Provide internet access and cellular service (voice, data, video) in remote, rural, and underserved regions where terrestrial networks are absent or unreliable.

- Enable Emergency Connectivity: Offer crucial communication capabilities during natural disasters or in crisis situations when ground-based infrastructure is compromised.

- Ensure Seamless Integration: Devices are intended to automatically switch between terrestrial and space-based networks, providing a continuous user experience.

Beyond consumer applications, the technology also holds significant potential for enterprise users (e.g., IoT connectivity for agriculture) and government applications, including secure 5G communications and intelligence, surveillance, and reconnaissance (ISR).

Segments:

AST SpaceMobile targets several distinct market segments:

- Mobile Network Operators (MNOs): This is the foundational segment, as MNOs are the direct customers and distribution channels. The partnerships allow MNOs to expand their geographic reach without costly terrestrial infrastructure build-outs.

- Underserved and Unconnected Populations: A core humanitarian and commercial goal is to connect the estimated 2.5 billion people globally who lack mobile internet access and to provide coverage to the 90% of Earth's land surface currently without mobile service.

- Geographic Regions: Initial commercial focus includes the continental United States (via AT&T and Verizon partnerships), Europe, Japan, Canada, and emerging markets, particularly Africa and India, where connectivity gaps are most pronounced.

- Enterprise and Government: Dedicated communication solutions for businesses requiring remote IoT connectivity and for military/government users needing resilient and secure communication channels.

Customer Base:

AST SpaceMobile's direct customers are MNOs. The company has established agreements and understandings with over 50 MNOs worldwide, collectively representing more than 3 billion potential subscribers. Key strategic partners and investors include AT&T, Vodafone, Verizon, Rakuten, Google, American Tower, Bell Canada, and América Móvil. These alliances are critical for market access, spectrum utilization, and the integration of AST SpaceMobile’s service into existing mobile ecosystems. The ultimate beneficiaries are the billions of mobile phone users who will gain access to broadband connectivity in previously unserved areas using their existing devices.

4. Stock Performance Overview

AST SpaceMobile (ASTS) has experienced a highly volatile and dynamic stock performance since its public debut on Nasdaq in April 2021. Given this relatively recent IPO, a 5-year and 10-year analysis is not fully applicable. The company's trajectory on the public market reflects the high-risk, high-reward nature of its innovative, capital-intensive space-based technology.

Overall Performance (April 2021 – September 2025):

After its IPO, ASTS generally trended downwards, falling from an initial price point around $10 to an all-time low of approximately $1.97 on April 1, 2024. This prolonged decline was largely attributed to the significant capital requirements of its development phase, the inherent risks of a pre-revenue technology company, and initial delays.

However, from mid-2024 onwards, ASTS witnessed a remarkable turnaround and substantial appreciation. The stock reached an all-time high closing price of $60.06 on July 24, 2025 (or $60.95 on July 20, 2025), indicating a surge in investor confidence in its technological progress and commercialization prospects. As of September 29, 2025, the stock closed at $48.84.

1-Year Stock Performance (September 30, 2024 – September 30, 2025):

The past year has been particularly eventful and largely bullish for AST SpaceMobile, showcasing significant upward momentum and increased volatility.

- Start of the Period (September 2024): Around September 25, 2024, the stock was trading at approximately $13.60.

- Early 2025 Capital Raise: In January 2025, AST SpaceMobile priced a public offering at $3.10 per share, raising approximately $100 million. While dilutive, this provided crucial capital near the stock's historical lows.

- May 2025 Surge: The stock surged over 69% in May 2025 following Verizon's commitment of $100 million to a partnership, a strong validation of AST SpaceMobile's technology and market potential.

- August 2025 Jump: Shares climbed 38% in August 2025 after the company confirmed it was on track for commercial satellite launches in the coming weeks, coupled with initial U.S. regulatory approvals and partner progress.

- First Half 2025 Rally: ASTS experienced a substantial rally, surging 121.5% in the first half of 2025 and continuing its ascent into the second half.

- June 2025 Developments: The company secured new licensing for L-Band wireless spectrum, extending for over 80 years, and expanded its partnership with Vodafone to bring satellite-based cellular broadband to India.

- Q2 2025 Earnings and Commercial Plans (August 2025): Despite reporting a Q2 revenue miss ($1.16 million vs. $6.37 million expected) and a larger-than-expected loss per share ($0.41 vs. $0.19 expected), the company's reiterated plans for U.S. satellite internet connectivity by late 2025 and projections of $50 million to $75 million in revenue for the second half of 2025 fueled investor optimism. Plans to deploy 45 to 60 satellites by 2026, with launches every one to two months, reinforced the positive outlook.

- Recent Highs and Pullback (July – September 2025): The stock reached its 52-week high of $60.95 in July 2025 but subsequently pulled back approximately 30% by mid-September. On September 23, 2025, shares rose 12.2% to $54.80 before closing at $48.84 on September 29, 2025.

Comparing the closing price of $48.84 on September 29, 2025, to approximately $13.60 on September 25, 2024, ASTS has demonstrated an increase of over 250% in the past year. The 52-week low for ASTS was $17.50, and the 52-week high was $60.95. This exceptional performance over the last year is largely attributed to significant progress in satellite deployment, critical partnerships, and the anticipation of initial commercial service revenue. While recent volatility and a pullback from its peak have occurred, the overall trajectory since mid-2024 reflects growing investor confidence in its groundbreaking direct-to-device satellite technology.

5. Financial Performance

As of September 30, 2025, AST SpaceMobile (ASTS) is a company heavily investing in its future, characterized by significant capital expenditure and a nascent revenue stream. Its financial performance reflects a company in the critical build-out phase of a revolutionary satellite network.

Latest Earnings (Q2 2025):

AST SpaceMobile reported its Q2 2025 financial results on August 11, 2025. The company posted an earnings per share (EPS) of -$0.41, significantly missing the consensus estimate of -$0.19. Quarterly revenue for Q2 2025 was $1.16 million, falling substantially short of analysts' expectations of $6.37 million. While this was an increase from $0.9 million in the year-ago quarter, the miss highlighted challenges in immediate monetization.

Revenue Growth:

Despite the modest absolute figures, AST SpaceMobile is experiencing high percentage-wise revenue growth from a low base. For the trailing 12 months ending June 30, 2025, the company's revenue was $4.89 million, representing a year-over-year growth of 249.43%. Quarterly revenue for Q2 2025 showed a 61% increase from the previous quarter. For fiscal year 2024, annual revenue was $4.4 million. Looking ahead, analysts forecast substantial future revenue growth, with projections of 56% per annum and an average of 411.1% over the next five fiscal years. The company itself projects 2025 revenue to range from $50 million to $75 million, primarily in the second half, driven by government contracts and initial commercialization efforts.

Margins:

Given its developmental stage and significant R&D and deployment costs, AST SpaceMobile currently reports negative margins. As of June 30, 2025, the net profit margin was a substantial -7213.9%. The operating margin for the last 12 months was -5315.4%. The gross profit margin for the latest twelve months is 100.0%, peaking at 100.0% in December 2024. This indicates that while the direct cost of the limited services currently offered might be low, the overwhelming operating expenses and investments lead to significant overall losses.

Debt:

As of June 2025, AST SpaceMobile reported total debt of approximately $0.50 billion USD. However, the company has actively managed its debt and maintained a strong cash position. In September 2024, it had $200.9 million of debt offset by $516.4 million in cash, resulting in a net cash position of $315.5 million. More recently, as of June 30, 2025, it held $923.6 million in cash and cash equivalents against $482.5 million in long-term debt. The company recently repurchased $225 million worth of its 4.25% convertible notes due 2032 through a stock sale, which is expected to eliminate approximately $63.8 million in future interest payments and leave $235 million in principal notes on its books. The debt-to-equity ratio stands at 42.3%, an increase from 6.8% over the past five years, reflecting the substantial financing required for its constellation build-out.

Cash Flow:

AST SpaceMobile is currently cash flow negative due to its intensive capital expenditures for satellite manufacturing and deployment. For Q1 2025, free cash flow was -$149 million USD. In fiscal year 2024, free cash flow was -$300.27 million USD, and operating cash flow was -$126.14 million USD. For the first six months of 2025, the company utilized $72 million of cash for operating activities, compared to $64.3 million in the year-ago period. The company's pro-forma cash position, including a recent convertible note offering, reportedly increased to over $1.5 billion, providing a crucial runway for its ambitious deployment plans.

Valuation Metrics:

As of September 30, 2025, AST SpaceMobile has a market capitalization of approximately $12 billion against $4.9 million in trailing 12-month revenue. Its enterprise value is roughly $15.7 billion USD. Given its lack of profitability, traditional P/E ratios are negative (e.g., -33.7 P/E and -20.6 P/EBIT). The Price-to-Sales (P/S) ratio is exceptionally high at 5436.84, reflecting market anticipation of future revenue rather than current performance. The Price-to-Book (P/B) ratio is 15.2x, which is significantly higher than the peer average (4.1x) and the U.S. Telecom industry average (1.6x), indicating that the stock is priced at a substantial premium based on its growth potential. Intrinsic value analyses often suggest that ASTS is currently overvalued, with some discounted cash flow models yielding negative intrinsic values, underscoring the speculative nature of the investment at this stage.

6. Leadership and Management

AST SpaceMobile's leadership is anchored by its visionary founder, Abel Avellan, and supported by an evolving executive team and a diverse board of directors. The company's strategic direction is laser-focused on the ambitious goal of establishing a global space-based cellular broadband network.

CEO: Abel Avellan

Abel Avellan is the Founder, Chairman, and Chief Executive Officer of AST SpaceMobile, a role he has held since April 2021, having founded the company in 2017. Avellan is a recognized entrepreneur and innovator in the space industry, holding 24 U.S. patents. His prior experience includes founding and leading Emerging Markets Communications (EMC) until its sale in 2016 for $550 million. Avellan's vision for AST SpaceMobile is to bridge the digital divide by enabling direct cellular broadband connectivity to unmodified mobile phones from space.

Leadership Team

The executive leadership team has seen strategic realignments, particularly in June 2024, to support the company's accelerated growth and commercialization phase.

- Scott Wisniewski: President & Chief Strategy Officer. Oversees commercialization, product development, regulatory affairs, corporate development, capital markets, and investor relations.

- Dr. Huiwen Yao: Chief Technology Officer.

- Shanti Gupta: Chief Operating Officer. Promoted in June 2024, he drives operations, supply chain, vendor relationships, cost optimization, risk management, and IT.

- Andrew Johnson: Chief Financial Officer & Chief Legal Officer. Appointed to the additional CFO role in June 2024, he manages accounting, treasury, compliance, risk, and legal matters.

- Chris Ivory: Chief Commercial Officer.

- Roy Sofer: SVP, Engineering.

- Sriram Jayasimha: Chief Scientist, Commercial Applications.

- Dr. Raymond Sedwick: Chief Scientist, Space Systems.

This team combines deep technical expertise with strategic business development and financial management experience, crucial for navigating the complexities of the space telecommunications industry.

Board of Directors

The AST SpaceMobile Board of Directors includes a mix of company executives and independent directors, often with strong ties to its strategic partners, ensuring diverse perspectives and industry insights. The board is considered experienced, with an average tenure of 4.4 years.

Notable members include:

- Abel Avellan: Founder, Chairman, and CEO.

- Andrew Johnson: CFO & Chief Legal Officer, appointed January 2025.

- Luke Ibbetson: Head of Group R&D at Vodafone.

- Hiroshi Mikitani: Founder, Chairman, and CEO of Rakuten Group.

- Adriana Cisneros: CEO of Cisneros.

- Ed Knapp: CTO for American Tower Corporation.

- Richard Sarnoff: Partner at KKR.

- Ronald Rubin: Co-Founder and Managing Director of Tower Alliance, LLC.

Julio A. Torres: Managing Partner at Multiple Equilibria Capital. - Johan Wibergh: Former Chief Technology and Information Officer, Vodafone.

- Keith Larson: Board Member, Northwest Pipe, and Senior Managing Director, Intel Capital (nominated by AT&T, appointed January 2025).

The presence of representatives from key partners like Vodafone, Rakuten, American Tower, and AT&T on the board underscores the collaborative nature of AST SpaceMobile's strategy and ensures alignment with its critical alliances.

Strategic Direction

AST SpaceMobile's strategic direction is firmly centered on its core mission:

- Technological Innovation: Continuously developing and refining its patented technology, particularly its large phased-array satellites (BlueBird), to ensure robust, high-speed cellular broadband directly to unmodified smartphones.

- Global Coverage and Partnerships: Leveraging its extensive network of MNO partnerships (over 50 globally) to achieve widespread market access and provide seamless connectivity in underserved regions.

- Accelerated Satellite Deployment: Executing an aggressive launch schedule to deploy 45-60 satellites by 2026, enabling continuous service in initial target markets like the U.S., Europe, Japan, and Canada.

- Market Expansion: Targeting not only consumer mobile connectivity but also enterprise IoT applications and government/defense sectors, diversifying its revenue streams.

- Spectrum Dominance: Strategically acquiring and utilizing premium spectrum (L-Band, S-Band, and 3GPP cellular) to ensure high-capacity and high-speed service delivery.

Governance Reputation

AST SpaceMobile maintains corporate governance guidelines established by its Board of Directors, emphasizing high standards for all personnel. In June 2025, stockholders approved an amendment allowing for director removal by written consent, and all nominated directors were elected. KPMG LLP was ratified as the independent auditor for fiscal year 2025, and executive compensation measures were approved.

The company's mission to bridge the digital divide aligns with strong social governance objectives, potentially contributing to positive ESG (Environmental, Social, and Governance) ratings. However, the company's significant financial losses, high operating costs, and reliance on capital raises pose governance challenges, requiring transparent reporting and effective risk management. Regulatory scrutiny, such as past FCC delays and ongoing disputes with competitors like SpaceX regarding orbital safety and interference, also highlight areas where strong governance and transparent communication are paramount. Insider stock sales have also been noted, which investors typically monitor closely.

7. Products, Services, and Innovations

AST SpaceMobile is rapidly advancing its vision of a global space-based cellular broadband network, distinguishing itself through its direct-to-standard-smartphone technology, robust innovation pipeline, extensive patent portfolio, and a strategic competitive edge built on partnerships with mobile network operators. As of September 30, 2025, the company is transitioning from testing to commercial deployment, with significant milestones achieved and aggressive plans for expansion.

Current Offerings

AST SpaceMobile’s current offerings are centered around its groundbreaking capability to provide cellular broadband connectivity directly to unmodified, everyday smartphones. The prototype satellite, BlueWalker 3, successfully demonstrated 4G and 5G connectivity, including the first-ever space-based 5G voice and video calls between unmodified handsets.

In September 2024, AST SpaceMobile launched its first five commercial satellites, known as BlueBirds. These satellites are designed to provide initial "non-continuous" cellular broadband service across the United States and in select global markets. This service supports beta test users for strategic partners like AT&T and Verizon. The BlueBird satellites utilize large commercial communications arrays in low Earth orbit, aiming to provide voice, data, and video services directly to standard smartphones.

Innovation Pipeline

AST SpaceMobile’s innovation pipeline is focused on scaling its constellation and enhancing service capabilities. A key element is the deployment of Block 2 BlueBird satellites. These next-generation satellites are significantly larger, approximately 3.5 times the size of their predecessors, and boast 10 times the capacity. This increased capacity allows for higher peak data rates, targeting up to 120 Mbps per cell, and enables greater spectrum reuse.

The company has a "fully-funded plan" to deploy 45 to 60 satellites into orbit during 2025 and 2026. This aggressive launch schedule, with orbital launches planned every one to two months on average, is intended to achieve continuous service in crucial markets, including the United States, Europe, Japan, Canada, and for the U.S. Government. Assembly of microns for phased arrays of eight Block 2 BlueBird satellites has been completed, with a target to complete the equivalent of 40 satellites by early 2026 to support full voice, data, and video services. The first Block 2 BlueBird satellite (FM1) was expected to be ready for shipment in August 2025.

Furthermore, AST SpaceMobile has expanded its spectrum strategy by acquiring 60 MHz of global S-Band spectrum priority rights, complementing its existing 3GPP cellular and L-Band strategies. This expanded spectrum access, combined with their technology, is crucial for delivering true broadband speeds globally.

Research & Development (R&D)

AST SpaceMobile demonstrates a strong commitment to R&D, operating state-of-the-art, vertically integrated manufacturing and testing facilities. Their primary facility in Midland, Texas, spans 185,000 square feet, with plans for global expansion to over 400,000 square feet by the end of 2025. This vertical integration enables them to maintain a high production cadence, targeting six satellites per month by Q4 2025.

R&D expenses are significant, with the company reporting increased adjusted operating expenses and a surge in capital expenditures in Q2 2025, reflecting intensive investment in satellite production and infrastructure. This investment supports their goal of deploying a large constellation of powerful satellites.

Patents

AST SpaceMobile possesses an extensive intellectual property portfolio, with over 3,700 patents and patent-pending claims globally. These patents cover fundamental aspects of their technology, including satellite architecture, energy efficiencies, deployment mechanisms, and communication protocols designed for high throughput and reliable direct-to-cellular connectivity.

Key patented technologies include:

- US9973266B1: Described as their most popular patent, it covers core technology for satellite-to-cell phone communication, enabling standard mobile phones to connect directly to satellites without specialized hardware.

- SATCOM GSM solution directly communicate with GSM phones (US12095544B1): Granted in September 2024, this patent focuses on GSM satellite communication systems and direct communication with active User Equipment (UEs).

- Dynamic Time Division Duplex (DTDD) access for satellite RAN (US12155608B1): Granted in November 2024, this patent pertains to efficient communication between ground stations and satellites with user equipment.

- Satellite radio access network (SAT RAN) beam and gateway seamless handover (US12401395B1): Granted in August 2025, this covers seamless transitions between satellite beams for continuous connectivity.

- Method and system for inactive and active beam transition in a satellite radio access network (US12250062B1): Granted in March 2025, this patent describes managing satellite beams to provide network access efficiently.

This comprehensive patent portfolio underscores the company's innovative approach and serves as a significant barrier to entry for competitors.

Competitive Edge

AST SpaceMobile’s competitive edge is primarily derived from its unique technological approach and strategic business model:

- Direct-to-Standard-Smartphone Technology: Unlike competitors like Starlink and Project Kuiper, which primarily require proprietary user terminals (dishes or modems), AST SpaceMobile's technology allows standard, unmodified mobile phones to connect directly to its satellites. This eliminates the need for expensive additional hardware for end-users, significantly reducing barriers to adoption.

- Wholesale Partnership Model: AST SpaceMobile operates as a wholesaler, partnering with over 50 mobile network operators (MNOs) globally, representing nearly 3.0 billion subscribers, including major players like AT&T, Verizon, Vodafone, and Rakuten. This strategy allows them to leverage existing MNO infrastructure and customer bases, offering satellite connectivity as an add-on service and avoiding the complexities and costs of direct-to-consumer sales and support. This contrasts with Starlink's direct-to-consumer approach, which can create competition with MNOs.

- Broadband Capability from Day One: While some competitors initially focus on emergency text messaging for direct-to-cell services, AST SpaceMobile aims to provide full cellular broadband (voice, data, and video) from the outset of commercial service.

- Large and Powerful Satellites: The design of AST SpaceMobile's BlueBird satellites, particularly the Block 2 generation, with their large communication arrays and high capacity, is a key differentiator. These larger, more powerful satellites are designed for greater spectrum reuse and enhanced signal strength, potentially requiring fewer satellites to achieve continuous coverage compared to smaller aperture designs.

- Strategic Spectrum Access: By augmenting its 3GPP cellular spectrum strategy with L-Band and a recently acquired 60 MHz of global S-Band priority rights, AST SpaceMobile secures premium spectrum necessary for robust broadband services.

While Starlink benefits from lower launch costs due to its vertical integration with SpaceX, AST SpaceMobile's unique technology, MNO partnership model, and focus on delivering comprehensive broadband directly to unmodified phones position it as a strong contender in the low Earth orbit satellite communication market, particularly for bridging connectivity gaps globally. The company also has secured contract awards from the U.S. Government.

8. Competitive Landscape

AST SpaceMobile operates in the rapidly evolving satellite-to-cellular market, facing a dynamic competitive landscape as of September 30, 2025. The company's unique approach to providing direct connectivity to unmodified smartphones positions it with distinct strengths and weaknesses against several key rivals.

Industry Rivals:

The primary competitors in the satellite-to-cellular market include:

- Starlink (SpaceX): A formidable rival, particularly with its "Direct to Cell" service. While Starlink initially focused on terminal-based satellite internet, it is aggressively moving into direct-to-device connectivity. It has established partnerships with T-Mobile for satellite messaging and has significantly expanded its spectrum assets through recent acquisitions, including a substantial deal with EchoStar. SpaceX's advantage lies in its extensive existing constellation of over 8,000 Starlink satellites, with approximately 600 already D2D-capable, and its vertical integration through owning launch capabilities. However, its direct-to-cell communication is currently limited to SMS, with voice and data services still in testing, and its pricing for some services can be significantly higher than traditional fiber options.

- Lynk Global: An early innovator in the direct-to-device (D2D) sector, Lynk Global offers emergency alerts and two-way SMS messaging. The company has secured over 40 commercial service contracts with mobile network operators (MNOs) across approximately 50 nations and supports 2G, 3G, 4G, 5G, and NB-IoT services directly to standard handsets. Despite its early entry and proven technology, Lynk has not scaled its satellite constellation as rapidly as some competitors and has faced challenges with its SPAC listing.

- Omnispace: This company operates as a hybrid satellite wireless broadband provider, utilizing a non-geosynchronous orbit (NGSO) constellation and leveraging the 2 GHz frequency band for converged satellite and mobile communication. Omnispace targets remote and rural areas, as well as IoT sectors, but has a smaller funding base compared to AST SpaceMobile and Starlink.

- Apple (in partnership with Globalstar): Apple offers emergency SOS via satellite, primarily integrated into newer iPhone models (iPhone 14 and later). This service targets modified devices and specific dedicated spectrum, focusing on emergency communication rather than broad cellular broadband.

- Iridium Communications: Iridium provides dedicated global voice and data communication services through a mesh architecture of 66 operational Low Earth Orbit (LEO) satellites. While a long-standing player, its direct competition in the unmodified smartphone segment is more limited.

- Viasat: Also a player in the broader satellite connectivity market, Viasat is mentioned in the competitive landscape, engaging in partnerships with telecom providers.

- Amazon's Project Kuiper: Although primarily focused on broader satellite internet, Project Kuiper is a significant player in the satellite industry, with the potential to impact the market similarly to Starlink.

Market Share:

The direct satellite-to-phone cellular market is still in its nascent stages, making definitive market share percentages for 2025 difficult to ascertain. However, projections indicate significant growth: the global direct satellite-to-phone cellular market was valued at $2.5 billion in 2024 and is projected to reach $43.3 billion by 2034, with a compound annual growth rate (CAGR) of 32.7% from 2025 to 2034. The year 2025 is considered "ground zero for commercialization" in this sector.

AST SpaceMobile expects to generate between $50 million and $75 million in revenue during the second half of 2025 from gateway equipment sales and early commercial services. However, its Q2 2025 revenue of $1.15 million significantly missed forecasts, highlighting challenges in monetization during its pre-commercial phase. The market for direct-to-unmodified-device satellite connectivity is projected to be substantially larger than that for modified devices, with an estimated 8.8 billion units by 2028 compared to 1.5 billion.

AST SpaceMobile's Competitive Strengths and Weaknesses:

Competitive Strengths:

- Direct-to-Device (D2D) Broadband to Unmodified Phones: AST SpaceMobile's core competitive advantage lies in its patented technology that enables true cellular broadband connectivity (2G, 4G, and 5G) directly to standard, unmodified mobile phones. This eliminates the need for specialized equipment, offering a seamless user experience.

- Strategic Partnerships with MNOs: The company has established critical alliances with over 50 major global Mobile Network Operators (MNOs), including AT&T, Vodafone, Verizon, and Vodafone Idea in India. These partnerships provide a robust go-to-market strategy, access to MNOs' existing customer bases (representing nearly 3 billion subscribers), and valuable spectrum.

- Advanced Satellite Technology: AST SpaceMobile's "BlueBird" satellites feature massive phased-array antennas, making them among the largest commercial communication arrays deployed in LEO. These larger satellites are designed to provide high capacity and may require fewer units in orbit to achieve comparable service levels.

- Spectrum Holdings: AST SpaceMobile has broadened its spectrum strategy, securing 45 MHz of mid-band spectrum in North America and an agreement to acquire 60 MHz of global S-Band spectrum priority rights, which complements its existing 3GPP cellular and L-Band strategies. This enables high peak data rates of up to 120 Mbps per cell.

- Extensive Intellectual Property: The company boasts a substantial patent portfolio with over 3,650 patent and patent-pending claims globally, safeguarding its proprietary technology.

- Vertical Integration: With 95% vertical integration, AST SpaceMobile maintains significant control over its manufacturing and development processes, contributing to quality control, cost efficiency, and accelerated timelines.

- Strong Liquidity: As of June 30, 2025, the company reported over $1.5 billion in cash and cash equivalents, along with securing $550 million in non-recourse financing and $100 million in equipment financing, providing a substantial financial runway for its ambitious deployment plans.

Competitive Weaknesses:

- High Capital Expenditure and Operating Costs: The development and deployment of a global satellite constellation require significant capital investment, leading to substantial net losses and high research and development (R&D) expenses.

- Pre-Commercial Status and Monetization Challenges: Despite numerous partnerships, AST SpaceMobile remains largely in its pre-commercial phase. The significant miss in Q2 2025 revenue forecasts raises concerns about the speed and effectiveness of monetizing its technology at scale.

- Satellite Deployment Timelines and Execution Risk: The company faces an aggressive timeline to deploy 45-60 satellites by 2026 to achieve continuous service, requiring a launch cadence of one to two satellites per month. Delays due to launch bottlenecks or technical issues could significantly impact its commercialization goals.

- Regulatory Hurdles: Operating a space-based network is subject to complex and stringent regulatory requirements. Long-term U.S. and Canadian spectrum approvals remain pending, introducing an element of risk.

- Reliance on SpaceX for Launches: AST SpaceMobile relies on SpaceX for its satellite launches, which could expose it to potential delays or bottlenecks in SpaceX's launch schedule.

- High Valuation: Market analysts note that the company's valuation (market capitalization ranging from $12.5 billion to $19.8 billion in mid-2025) is considerably high for a pre-revenue company, suggesting it is priced based on future potential rather than current financial performance.

- Potential for Interference: While low-band cellular spectrum is advantageous for penetration, it can be susceptible to interference from ground-based communication systems, which could affect performance and signal reliability.

9. Industry and Market Trends

The satellite-to-cellular communication industry is experiencing significant transformation and growth, driven by the increasing demand for ubiquitous connectivity and technological advancements. AST SpaceMobile, a key player in this emerging sector, is navigating these trends with a unique approach and considerable investment.

Sector-Level Trends:

The satellite-to-cellular industry is characterized by rapid growth and a shift towards direct-to-device (D2D) connectivity for unmodified smartphones. This sector is projected to grow significantly, with revenue from direct-to-cellphone satellite connectivity expected to reach approximately $16.8 billion by 2028, potentially surpassing satellite broadband revenue by 2027.

Key trends include:

- Direct-to-Device (D2D) Momentum: D2D, also known as direct-to-cell, is considered a "holy grail" for the industry, aiming to connect billions of mobile terrestrial devices directly to satellites for the first time.

- Unmodified Smartphone Focus: A major distinguishing trend is the capability to provide services to unmodified, everyday smartphones, rather than requiring specialized hardware. This market is expected to be substantially larger, with forecasts suggesting 8.8 billion units by 2028 compared to 1.5 billion for modified devices. AST SpaceMobile is specifically building a network for unmodified smartphones.

- Proliferation of LEO Constellations: The industry is witnessing a surge in the deployment of Low Earth Orbit (LEO) satellite constellations, with predictions of up to 50,000 active satellites by the end of the decade. This LEO architecture is crucial for reducing latency and enabling direct communication with handheld devices.

- Convergence with Terrestrial Networks: Deep integration and collaboration with existing terrestrial cellular networks are pivotal, often rooted in 3GPP 5G standardization. This allows satellite solutions to extend the reach of mobile network operators.

- Emergency and Underserved Area Connectivity: Initial applications prominently feature emergency text messaging and extending mobile broadband coverage to remote, rural, and underserved areas, thereby bridging the digital divide.

Macro Drivers:

Several overarching factors are propelling the growth of the satellite-to-cellular industry:

- Demand for Ubiquitous Connectivity: A fundamental driver is the escalating global demand for high-speed, reliable, and uninterrupted communication services, particularly in areas lacking traditional terrestrial infrastructure such as oceans, mountains, and deserts.

- Digital Transformation and 5G/6G Evolution: The ongoing digital transformation in telecommunications emphasizes cloud-native networks, AI, and customer-ready innovations like fixed wireless access (FWA) and satellite-to-phone. The expansion of 5G technology and the planning for 6G further underscore the need for ubiquitous connectivity that satellite-to-cellular can provide.

- Government and Military Applications: There is increasing demand for secure and resilient communication systems for defense, intelligence, disaster preparedness, and emergency response. Satellite communication plays a critical role when terrestrial infrastructure is compromised. AST SpaceMobile has identified opportunities with the U.S. Government.

- Increased Smartphone Penetration: The global proliferation of smartphones presents a vast addressable market for satellite-to-cellular services, as it enables connectivity without requiring users to purchase specialized devices.

Supply Chain Considerations:

The nascent and rapidly expanding satellite-to-cellular industry faces unique supply chain challenges, particularly for companies like AST SpaceMobile involved in large-scale constellation deployment.

- Limited and Specialized Supply Chains: The industry contends with severely limited supply chains, a challenge frequently discussed at industry conferences. Demand has shifted from single satellite units to large-scale constellation orders, requiring robust and high-volume component procurement. Many suppliers are highly specialized, creating critical interdependencies within the ecosystem.

- Long Development Cycles: Advanced satellite designs, especially those incorporating software-defined payloads with phased arrays and digital signal processing, entail long development cycles. These complex systems, while offering greater functionality, can lead to program delays.

- Capital Expenditure and Component Procurement: Building and deploying satellite constellations is a capital-intensive undertaking. AST SpaceMobile has significantly invested in infrastructure growth, with aggressive capital expenditures exceeding $310 million and plans to ramp up manufacturing capacity. The company is actively procuring components and materials for its Block 2 BlueBird satellites.

- Reliance on Launch Providers: While AST SpaceMobile has announced a multi-provider orbital launch plan with five contracted launches over the next six to nine months, reliance on external launch services can expose operational risks. Delays or issues with launch providers can impact deployment timelines.

- Regulatory Approvals: Navigating complex regulatory approvals and spectrum-related topics with partners and industry groups is essential for launch and operation, and can introduce delays.

Cyclical Effects:

The satellite-to-cellular industry, while promising, is subject to economic and market cycles, impacting investment and operational realities.

- Investment Volatility: The broader satellite industry has experienced fluctuating investment, with private equity and venture capital significantly declining in 2022-2023, reflecting a degree of "cold feet" and skepticism. However, within this context, AST SpaceMobile's stock has shown significant gains, indicating strong investor interest in its disruptive potential despite market volatility.

- High Upfront Costs and Path to Profitability: Companies like AST SpaceMobile, in the early stages of deploying capital-intensive infrastructure, typically incur substantial operating losses and negative free cash flow. AST SpaceMobile reported a significant net loss in Q2 2025 and negative pretax profit margins, yet revenue over five years shows long-term potential. The company anticipates generating meaningful revenue in the second half of 2025.

- Market Valuation and Dilution: Investor optimism often drives high valuations for companies in emerging, high-potential sectors. AST SpaceMobile, despite weak earnings, has a high price-to-sales ratio, suggesting that future growth is largely priced into its current market capitalization. To fund its substantial investments, the company has raised capital through convertible bonds and stock offerings, leading to an increase in shares outstanding, which could dilute existing shareholder value over the long term.

- Competition and Strategic Alliances: The industry is highly competitive, with players like SpaceX (Starlink), Lynk Global, and Amazon (Project Kuiper) vying for market share. AST SpaceMobile faces potential short-term competitive pressure, for example, from the EchoStar-Starlink alliance. However, strategic alliances with major mobile network operators like AT&T and Verizon are crucial for AST SpaceMobile's long-term growth and market penetration.

- Regulatory Cycles: The satellite communication sector is heavily influenced by regulatory cycles related to spectrum allocation, licensing, and international agreements. Positive regulatory developments can enhance prospects, while delays or evolving frameworks can hinder progress.

In summary, the satellite-to-cellular industry is on the cusp of significant expansion, fueled by technological innovation and global connectivity demands. AST SpaceMobile is strategically positioned to capitalize on these trends through its focus on unmodified smartphones and partnerships with major carriers. However, the company faces considerable challenges related to supply chain limitations, high capital requirements, intense competition, and the need to achieve commercial viability amidst complex regulatory environments.

10. Risks and Challenges

AST SpaceMobile, a company aiming to provide space-based cellular broadband directly to unmodified mobile phones, faces a range of significant operational, regulatory, controversial, and market risks as of late 2025. These challenges are inherent in pioneering a revolutionary technology in a highly capital-intensive and competitive industry.

Operational Risks:

AST SpaceMobile's operational success is heavily reliant on its ability to develop, launch, and maintain a complex satellite constellation. A primary risk is the delays in satellite production and launch. The company has experienced multiple postponements in the launch of its Block 1 BlueBird satellites due to issues with key subsystem suppliers, pushing back expected launch dates. As of September 2025, only 5 of a planned 168 satellites for 2026 coverage have been launched, significantly lagging competitors. The company aims to launch 45-60 satellites by 2026 to achieve continuous coverage in key markets, a schedule that demands significant acceleration.

The design, manufacture, and launch of satellite systems are highly complex, often leading to delays and cost overruns. AST SpaceMobile's large BlueBird satellites, featuring massive deployable antennas, introduce technical challenges related to unfolding mechanisms, which could impact performance and mission objectives.

Furthermore, the company faces high initial capital expenditures and substantial ongoing operating costs for satellite deployment, ground infrastructure, and research and development (R&D). Its business model is currently pre-revenue from its core SpaceMobile service, leading to significant net losses and a high cash burn rate (approximately $700 million per year as of June 2025). While the company recently secured over $1.5 billion in pro forma cash and equivalents, this runway is estimated to last roughly two years, aligning tightly with its aggressive deployment goals.

Reliance on third-party suppliers and launch service providers, such as SpaceX, also exposes AST SpaceMobile to coordination and execution risks. The inherent risks of space operations, including the susceptibility of Low Earth Orbit (LEO) satellites to solar storms and the potential for launch failures, also pose threats, although launch risks are generally considered insurable.

Regulatory Risks:

Operating in the satellite communications sector involves navigating a complex and evolving regulatory landscape. AST SpaceMobile faces potential delays in obtaining necessary regulatory approvals and licenses from authorities like the U.S. Federal Communications Commission (FCC) for its operations. For instance, SpaceX has publicly criticized AST SpaceMobile's satellite applications, citing "careless errors" and "inconsistencies" in its FCC applications, which has drawn regulatory scrutiny and could further delay FCC approvals for commercial service in key markets like the U.S. and Europe.

There is also scrutiny regarding orbital safety, collision risks, and potential interference from AST SpaceMobile's large satellites. SpaceX, a direct competitor, has repeatedly urged the FCC to scrutinize AST's plans, alleging critical gaps in collision risk assessment and underestimation of objects needing avoidance in orbit. Concerns have also been raised by astronomers about light pollution and radio interference from the company's large satellites, such as the BlueWalker 3 prototype.

Beyond the U.S., AST SpaceMobile will require approvals from governing bodies in other jurisdictions like the European Union, the UK, China, and Japan before it can operate in those regions. The company also faces potential spectrum interference from competing satellite networks.

Controversies:

AST SpaceMobile has been embroiled in several controversies, particularly concerning its communication with investors and its relationship with competitors.

Multiple class action lawsuits have been filed against AST SpaceMobile by investors. These lawsuits, including those by The Gross Law Firm and Rosen Law Firm, allege that the company and its executives issued "materially false and/or misleading statements" and failed to disclose critical information regarding delays in the production and launch of its Block 1 BlueBird satellites. These alleged omissions led to significant drops in the company's share price (e.g., a near 24% drop in April 2024).

There is an ongoing public dispute with SpaceX, a major competitor. SpaceX has accused AST SpaceMobile of "littering space with satellites" and of "careless errors" and "inconsistencies" in its FCC applications, suggesting the company is trying to "hide the risks of its operations". In response, AST SpaceMobile has accused SpaceX of using "anticompetitive tactics" and attempting to "manufacture a controversy" to deflect from its own technical shortcomings and to undermine a competitor. This rivalry extends to regulatory battles over radio emission limits and potential interference.

Astronomers and scientific communities have also raised concerns about the environmental impact of AST SpaceMobile's large satellites, specifically citing light pollution and interference with astronomical observations.

Market Risks:

The market for space-based cellular broadband is rapidly developing but presents substantial risks for AST SpaceMobile.

One of the most significant market risks is intense competition. Established players like Starlink (SpaceX) are rapidly expanding their constellations and offering direct-to-cell services, with a much larger number of satellites already in orbit (over 9,000 operational Starlink satellites). Other competitors include Globalstar, OneWeb, and Viasat. Starlink, backed by Elon Musk, has substantial funding and has been positioned to potentially capture a significant share of the rural broadband market in the U.S.. The increasing activity of competitors means AST SpaceMobile's late entry and value proposition may become less compelling.

AST SpaceMobile is operating with high market expectations due to its revolutionary technology, which can lead to significant stock price volatility if milestones are not met or if there are perceived execution risks. The company's stock has experienced dramatic price movements and sharp swings. Its valuation is currently considered high, with a price-to-sales ratio of 5436.84 and a price-to-book multiple of 15.2x (compared to industry averages of 1.6x-3.9x), suggesting the market has priced in substantial future growth. Any stumble in growth or execution could significantly challenge this valuation.

The company's potential profitability is dependent on the successful commercial introduction and acceptance of its SpaceMobile Service, which may not occur as expected. While AST SpaceMobile has strategic partnerships with major mobile network operators (MNOs) like AT&T, Vodafone, and Rakuten Mobile, there's a risk that these partnerships may not translate into sufficient revenue or widespread customer adoption. The company reported a significant revenue shortfall in Q2 2025, missing forecasts by 79%.

Financial risks also include the need for continuous funding and the potential for shareholder dilution if future equity offerings are required to cover capital and operating expenditures. Macroeconomic conditions, such as inflation, higher interest rates, and capital market volatility, can further impact the company's operating efficiency and production costs. While the addressable market for global mobile connectivity is vast, there is still a risk that the market size may not justify the company's valuation in the short to medium term.

11. Opportunities and Catalysts

AST SpaceMobile is positioning itself as a transformative force in satellite connectivity, aiming to provide space-based cellular broadband directly to standard mobile phones globally. The company's growth trajectory is dependent on several key levers, strategic market expansions, potential merger and acquisition activities, and near-term events that could act as catalysts.

Growth Levers:

AST SpaceMobile's primary growth levers revolve around its unique technology and strategic partnerships:

- Direct-to-Smartphone Technology: The company is building the first and only space-based cellular broadband network designed to operate directly with standard unmodified mobile devices, eliminating the need for specialized hardware. This technology aims to bridge the global connectivity gap for billions of mobile users.

- Satellite Constellation Deployment: AST SpaceMobile plans a significant rollout of its BlueBird satellites. The company intends to deploy between 45 and 60 satellites into orbit by 2026 to support global service launches. Manufacturing capacity is being accelerated, targeting a production rate of six satellites per month by the fourth quarter of 2025.

- Strategic Partnerships: AST SpaceMobile has established crucial alliances with major mobile network operators (MNOs) globally, including AT&T and Verizon in the United States, Vodafone in Europe, Rakuten in Japan, Google, and VI in India. These partnerships represent access to nearly 3 billion subscribers worldwide.

- Government Contracts: The company has secured significant contracts, including a $43 million agreement with the U.S. Space Development Agency and up to $20 million with the Defense Innovation Unit through a prime contractor. They are also supporting first responders through FirstNet in the U.S. and Mission Critical in Europe, and have a partnership with Singapore's Defense Science and Technology Agency.

- Spectrum Acquisition: AST SpaceMobile has strategically acquired critical spectrum rights. This includes the 100% acquisition of EllioSat, which holds S-Band ITU priority rights for Mobile Satellite Services frequencies. Additionally, the confirmation of Ligado's bankruptcy plan allows for the transfer of 45 MHz of L-Band spectrum to AST for use across North America. This provides a path for premium spectrum on a global basis.

- Expanded Manufacturing and R&D: The company has increased its manufacturing footprint in Midland, Texas, Homestead, Florida, and Barcelona, Spain, and opened a European research center with Vodafone and the University of Malaga.

New Markets:

AST SpaceMobile is targeting several key markets for its services:

- United States: Initial cellular broadband capabilities and beta services with AT&T and Verizon are planned for activation in the U.S. by the end of 2025.

- Europe and Japan: Expansion into these regions is slated for the first quarter of 2026, with continuous service expected in the U.S., Europe, and Japan in the second half of 2026.

- Canada: Services are also expected to launch in Canada in Q1 2026.

- India: A partnership with Indian telecom provider VI (Vodafone Idea) aims to deliver direct-to-device satellite connectivity to unconnected regions across India.

- Global Underserved Areas: The overarching mission is to eliminate connectivity gaps for the estimated 5 billion mobile users who currently lack reliable broadband access, including government and commercial applications worldwide.

M&A Potential:

While AST SpaceMobile has recently engaged in strategic acquisitions to bolster its spectrum holdings, there has also been speculation regarding its potential as a takeover target:

- Acquisition of EllioSat: AST SpaceMobile completed the acquisition of EllioSat for its S-Band spectrum priority rights, reinforcing its satellite connectivity expansion strategy.

- Ligado Spectrum Transfer: The confirmed Ligado bankruptcy plan will transfer L-Band spectrum for use over North America to AST SpaceMobile.

- Takeover Speculation: There has been speculation about a potential takeover interest from a large U.S.-based tech company, with some discussions mentioning Apple or Google as potential interested parties, particularly given Apple's emergency satellite calling capabilities. However, these remain rumors.

Near-Term Events (Catalysts):

Several near-term events are anticipated to act as significant catalysts for AST SpaceMobile:

- Earnings Announcements: AST SpaceMobile is expected to report its Q3 2025 earnings around November 13, 2025. The Q2 2025 earnings, reported on August 11, 2025, missed consensus estimates.

- Satellite Launches:

- The company initiated a series of five satellite launches between July 2025 and early 2026. The first Block 2 BlueBird (BB2) satellite was scheduled for an orbital launch during July 2025.

- AST SpaceMobile anticipates orbital launches every one to two months on average throughout 2025 and 2026.

- The FM1 prototype satellite, after some delays, was ready to ship in September 2025, but a specific launch date has not been confirmed.

- Commercial Service Activation: The commencement of beta services for AT&T and Verizon in the U.S. by the end of 2025 is a critical milestone. This is part of the path towards a successful U.S. commercial launch in the coming quarters. Full-scale commercial service is expected to launch across multiple regions in early 2026.

- Regulatory Approvals: The FCC approval for full U.S. commercial service is a key upcoming catalyst. The company has already secured a Coordination Agreement with the U.S. National Science Foundation to minimize interference with astronomy research, removing a regulatory hurdle.

- Revenue Generation: AST SpaceMobile expects to generate between $50 million and $75 million in revenue during the second half of 2025, driven by government contracts, gateway sales, and initial commercialization efforts.

- Funding Milestones: Recent securing of $575 million in convertible notes has bolstered the company's liquidity to over $1.5 billion, providing capital for network buildout. Unlocking portions of existing revenue prepayments from partners like AT&T, Vodafone, and Verizon upon reaching specific milestones will also act as catalysts.

- Technological Milestones: The completion of assembly of microns for phased arrays of eight Block 2 BlueBird satellites, and targeting 40 satellites equivalent of microns by early 2026, are crucial steps towards enabling full voice, data, and video space-based cellular broadband services. The successful launch of BB2 satellites is seen as a significant technological leap for the direct-to-cell network.

12. Investor Sentiment and Analyst Coverage

AST SpaceMobile (ASTS) presents a complex and dynamic investor sentiment landscape as of September 30, 2025, characterized by mixed Wall Street ratings, significant institutional involvement with varied activity, and a retail investor base that is both hopeful about long-term potential and concerned about short-term operational challenges.

Wall Street Ratings and Price Targets:

Wall Street analysts hold a mixed, but generally positive to neutral, outlook on AST SpaceMobile. A consensus rating of "Buy" is reported by some sources, based on analyses from 5 to 7 analysts. Other reports indicate a "Hold" consensus from a larger group of 9 analysts. This mixed sentiment suggests that while some analysts see strong potential, others are exercising caution.

Average price targets vary across different analytical firms, ranging from $41.84 to $52.65. Given AST SpaceMobile's recent stock price of approximately $49.09 (as of September 26, 2025), some of these average price targets imply a potential downside from the current trading levels.

Recent analyst actions underscore this evolving sentiment:

- In September 2025, UBS Group downgraded AST SpaceMobile from a "buy" to a "neutral" rating and reduced its price target from $62.00 to $43.00.

- Roth Capital reiterated a "buy" rating in August 2025.

- William Blair initiated coverage with a "market perform" rating in August 2025.

- Bank of America started coverage in June 2025 with a "neutral" rating and a $55.00 price target.

- Zacks Research upgraded AST SpaceMobile from a "strong sell" to a "hold" rating in August 2025, maintaining a "Hold" rank for the stock.

Analysts, on average, tend to favor AST SpaceMobile less than other companies in the "computer and technology" sector, with the latter often receiving a "Moderate Buy" consensus compared to ASTS's "Hold".

Hedge Fund Moves and Institutional Investors:

Institutional investors collectively hold a substantial portion of AST SpaceMobile's stock, with ownership figures cited between 45% and 60.95%. As of the second quarter of 2025, 667 institutional owners held a total of 141,499,899 shares, reflecting a 33.13% increase in the number of owners in the most recent quarter.

Key institutional shareholders include Rakuten Investment Management, Inc., Rakuten Group, Inc., The Vanguard Group, Inc., BlackRock, Inc., and Alphabet Inc..

While overall institutional ownership is significant, the activity among these investors is varied. The second quarter of 2025 saw a notable number of new positions opened (33), increased positions (97), and reduced positions (110), alongside some closed positions (33). Overall, total institutional shares long decreased by 2.42% in the last quarter. This indicates a mixed level of confidence, with some institutions increasing their stakes significantly (over 200%) while others reduced holdings (over 50%).

Notably, there have been significant insider sales recently. In September 2025, CTO Huiwen Yao sold 40,000 shares, representing an 89.39% decrease in his position. In August 2025, CFO Andrew Martin Johnson sold 20,000 shares, reducing his ownership by 4.79%. These sales amounted to substantial monetary values.

Retail Investor Sentiment and Chatter:

Retail investors account for approximately 37% of AST SpaceMobile's ownership. Sentiment among retail investors appears broadly positive on some platforms, such as TipRanks, where investor sentiment is "Positive," and 1.0% of retail investors hold ASTS in their portfolios, with an average age between 35-55.

On StockTwits, AST SpaceMobile experiences a "high frequency of mentions," with an estimated 1,010 mentions in a single day, indicating strong market interest and engagement from the trading community. AST SpaceMobile also outperforms a majority of its industry peers in StockTwits mentions, ranking in the 66th percentile. While this high chatter can signal either bullish or bearish trends, it generally reflects significant investor attention.

However, discussions on platforms like Reddit reveal a more nuanced and often cautious sentiment:

- Concerns about Delays and Dilution: Many retail investors express belief in AST SpaceMobile's technology but are frustrated by consistent satellite launch delays, which are seen as critical to generating revenue. There are also concerns about shareholder dilution, as the company has resorted to further offerings to fund operations due to significant cash burn.

- Financial Performance: The company's Q2 2025 earnings report, which significantly missed revenue and EPS targets, baffled some retail investors and led to questions about the company's "trust-capital". AST SpaceMobile reported an EPS of ($0.41), missing the forecast of ($0.19), and revenue of $1.16 million against an anticipated $6.37 million.

- Competition and Execution: The threat of competitors like SpaceX's Starlink, despite perceived technological differences, is a recurring concern, especially given AST SpaceMobile's launch delays.

- Long-Term Potential vs. Short-Term Risks: Despite these challenges, a segment of retail investors maintains a highly bullish long-term outlook, with some speculating on a potential $1,000 stock price by 2030, acknowledging the high-risk, speculative nature of the investment. This long-term optimism is often tied to the company's unique technology and strategic partnerships with major players like Google, AT&T, and Vodafone.

- Perception of Institutional Influence: Some retail investors perceive that institutional investors are "piling into ASTS and robbing retail investors from a 27X" return by manipulating the share price, suggesting a distrust of institutional maneuvers.

In summary, investor sentiment for AST SpaceMobile is a blend of cautious optimism from Wall Street, dynamic and substantial but sometimes decreasing institutional involvement, and a retail investor base grappling with the company's significant long-term potential against persistent short-term operational and financial hurdles.

13. Regulatory, Policy, and Geopolitical Factors

AST SpaceMobile and the broader satellite communication industry operate within a complex and dynamic environment shaped by significant regulatory and geopolitical factors. As of September 30, 2025, these factors encompass evolving laws, compliance requirements, government incentives, and a mix of geopolitical risks and opportunities.

AST SpaceMobile: Laws, Compliance, and Government Incentives:

Regulatory Compliance and Licenses:

AST SpaceMobile has made substantial progress in securing crucial regulatory approvals for its space-based cellular broadband network. The company has obtained initial authorization from the U.S. Federal Communications Commission (FCC) to launch and operate its first five commercial BlueBird satellites, with subsequent approval for 20 satellites. These approvals permit the use of V, S, and UHF frequencies for gateway, feeder link, telemetry, tracking, and control operations.

A significant regulatory development includes AST SpaceMobile's acquisition of 60 MHz of global S-Band spectrum priority rights and long-term access (80+ years) to up to 45 MHz of L-Band spectrum in the U.S. and Canada through a definitive agreement with Ligado Networks, subject to regulatory approvals. This L-Band spectrum, combined with cellular spectrum from partners like AT&T and Verizon, is expected to support broadband speeds up to 120 megabits/second for unmodified smartphones. The company also updated its constellation filings with the International Telecommunication Union (ITU) and related FCC filings in March 2024, placing its planned commercial satellites under U.S. jurisdiction. The FCC's ongoing "Supplemental Coverage from Space" rulemaking process further demonstrates the U.S.'s leadership in direct-to-device (D2D) regulation, which is favorable for AST SpaceMobile's service offering.

Government Incentives and Partnerships:

AST SpaceMobile has actively pursued and secured various government contracts and strategic partnerships. In October 2024, the company was awarded an initial U.S. government contract under the Department of Defense (DoD) through the Space Development Agency (SDA)'s Hybrid Acquisition for proliferated Low-earth Orbit (HALO) program. This agreement allows AST SpaceMobile to compete directly as a prime contractor for prototype demonstration projects aimed at national security space needs, demonstrating the feasibility and scalability of its satellite technology for government use. This contract followed successful in-orbit testing of its BlueWalker-3 satellite under a previous agreement in February 2024.

Beyond direct government contracts, AST SpaceMobile has also attracted strategic investments from major telecommunication companies, including AT&T, Verizon, Google, and Vodafone. These partnerships extend to commercial agreements with over 45 mobile network operators globally, serving more than 2.8 billion subscribers, indicating broad industry support and a pathway for global deployment. A partnership with Vodafone Idea, India's second-largest telecom operator, announced in June 2025, aims to provide 4G/5G cellular coverage to unconnected rural users in India, aligning with the Indian government's "Digital India" initiative.

Satellite Communication Industry: Laws, Compliance, Government Incentives, and Geopolitical Factors:

Regulatory Landscape and Compliance:

The satellite communication industry is governed by a dual layer of international and national regulations. The International Telecommunication Union (ITU) plays a crucial role in harmonizing global spectrum use and orbital resources through its Radio Regulations. The 2024 edition of the ITU Radio Regulations, which entered into force on January 1, 2025, sets the framework for all radio services, including satellite systems, aiming to minimize interference and ensure equitable access to spectrum. National regulatory bodies, such as the FCC in the U.S., develop specific frequency allocation tables that align with ITU guidelines while addressing national priorities.

A key focus for regulators in 2025 is addressing the proliferation of direct-to-device (D2D) services and managing space debris. The FCC is actively exploring expanding satellite use in various frequency bands, including the 12.7-13.25 GHz, 42.0-42.5 GHz, 51.4-52.4 GHz, and parts of the W-band, seeking public comment on technical, operational, and regulatory considerations, including international harmonization. The European Conference of Postal and Telecommunications Administrations (CEPT) and the Body of European Regulators for Electronic Communications (BEREC) are also establishing working groups on D2D regulation. Additionally, there is a growing emphasis on stricter controls on space debris, active debris removal technologies, and satellite end-of-life disposal to ensure sustainable space operations.

Government Incentives:

Governments worldwide recognize the strategic and economic importance of the space sector, integrating it into broader economic and defense strategies. In the U.S., programs like the Universal Service Fund (USF) aim to expand broadband access to rural, insular, and high-cost areas. However, satellite broadband has historically faced political challenges in being fully integrated into these subsidy programs, despite the technological advancements of Low-Earth Orbit (LEO) satellites. Nonetheless, the U.S. government is increasingly collaborating with the commercial space sector, fostering innovation and streamlining regulatory processes.

Other nations are also providing incentives; for instance, India's "Space Sector Reforms" (2020) and the "Indian Space Policy, 2023" aim to open the space sector to private participation, including satellite-based commercial communication services, to support large-scale adoption of satellite internet.

Geopolitical Risks and Opportunities:

The current global geopolitical landscape, characterized by instability and conflicts in regions such as Ukraine, the South China Sea, and the Middle East, significantly impacts the satellite communication industry.

Opportunities:

- Increased Demand for Resilient Communications: Geopolitical tensions highlight the fragility of terrestrial infrastructure in conflict zones, positioning space-based networks like AST SpaceMobile's as resilient alternatives for defense and commercial use. The U.S. defense budget for fiscal year 2025, with a focus on space-based assets, underscores the surging demand for advanced defense technology and intelligence infrastructure, creating opportunities for satcom providers.

- Government Collaboration: There's a growing trend of commercial and government collaboration in the space industry, driven by national security needs and the desire to accelerate the development and deployment of advanced space technologies. This enables companies like AST SpaceMobile to secure defense contracts and diversify revenue streams.

- Global Connectivity Initiatives: Many governments are pushing for universal connectivity, especially in rural and underserved areas. Initiatives like India's "Digital India" create market opportunities for satellite broadband providers who can align with national development goals.

Risks:

- Supply Chain Vulnerabilities: Geopolitical conflicts and trade tensions, particularly the U.S.-China rivalry, expose weaknesses in global supply chains. This can disrupt the sourcing of critical materials and components for satellite manufacturing and deployment, leading to delays and increased production costs.

- Cybersecurity Threats: The increasing digitization of critical infrastructure makes satellite communication systems vulnerable to cyberattacks, which can disrupt services and pose national security risks.

- Spectrum Competition and Interference: The growing number of satellite constellations and terrestrial wireless services intensifies competition for limited radio frequency spectrum. While ITU and national regulators work on harmonization, the risk of interference remains a concern, necessitating careful coordination and robust regulatory frameworks.

- Export Controls and Technology Transfer: Geopolitical rivalries can lead to stricter export controls on advanced space technologies, potentially hindering international collaborations and market access for satellite communication companies.

- Space Militarization: The increasing militarization of space by various nations introduces risks of space debris from anti-satellite (ASAT) tests and potential weaponization of space assets, threatening the sustainability and safety of orbital operations for all stakeholders.

In conclusion, AST SpaceMobile is navigating a favorable regulatory environment in the U.S. with FCC approvals and strategic spectrum acquisitions. It is also capitalizing on government incentives through defense contracts and leveraging commercial partnerships for global expansion, particularly in emerging markets. The broader satellite communication industry benefits from a global push for connectivity and increased defense spending driven by geopolitical instability, but it must contend with regulatory complexities, supply chain risks, and the growing challenges of space debris and cybersecurity.

14. Outlook and Scenarios

AST SpaceMobile (NASDAQ: ASTS) is positioning itself as a pioneer in delivering space-based cellular broadband directly to unmodified smartphones. As of September 30, 2025, the company's future outlook presents a complex picture, characterized by significant potential alongside substantial risks and evolving strategic approaches.

Bull Case vs. Bear Case:

Bull Case Arguments:

The optimistic outlook for AST SpaceMobile is primarily driven by its unique and proprietary direct-to-device (D2D) technology, which allows standard smartphones to connect to satellites without specialized equipment. This capability targets a massive addressable market, estimated to include billions of people globally who lack reliable broadband access, particularly in remote and underserved areas, covering roughly 85-90% of the Earth's surface.