Civil infrastructure company Construction Partners (NASDAQ: ROAD) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 13.3% year on year to $538.2 million. The company’s full-year revenue guidance of $2.53 billion at the midpoint came in 1.4% above analysts’ estimates. Its GAAP profit of $0.56 per share was 2.2% below analysts’ consensus estimates.

Is now the time to buy Construction Partners? Find out by accessing our full research report, it’s free.

Construction Partners (ROAD) Q3 CY2024 Highlights:

- Revenue: $538.2 million vs analyst estimates of $538.1 million (13.3% year-on-year growth, in line)

- Adjusted EPS: $0.56 vs analyst expectations of $0.57 (2.2% miss)

- Adjusted EBITDA: $77 million vs analyst estimates of $77.33 million (14.3% margin, in line)

- Management’s revenue guidance for the upcoming financial year 2025 is $2.53 billion at the midpoint, beating analyst estimates by 1.4% and implying 38.7% growth (vs 16.6% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $362 million at the midpoint, above analyst estimates of $355.5 million

- Operating Margin: 8.5%, in line with the same quarter last year

- Free Cash Flow Margin: 14.6%, up from 10.1% in the same quarter last year

- Backlog: $1.96 billion at quarter end

- Market Capitalization: $4.82 billion

Fred J. (Jule) Smith, III, the Company's President and Chief Executive Officer, said, "We are pleased to report significant growth in fiscal year 2024, led by the strong operational performance of our family of companies throughout the Sunbelt. We are proud of the contributions from our more than 5,000 employees that helped deliver a record fiscal year and generated revenue growth of 17%, net income growth of 41%, and Adjusted EBITDA(1) growth of 28% compared to fiscal 2023, including Adjusted EBITDA Margin(1) of 12.1% for fiscal 2024. In addition, we completed eight acquisitions in fiscal 2024 that expanded our geographic footprint into new growth markets and enhanced CPI's relative market share across our Sunbelt states."

Company Overview

Founded in 2001, Construction Partners (NASDAQ: ROAD) is a civil infrastructure company that builds and maintains roads, highways, and other infrastructure projects.

Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years–. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

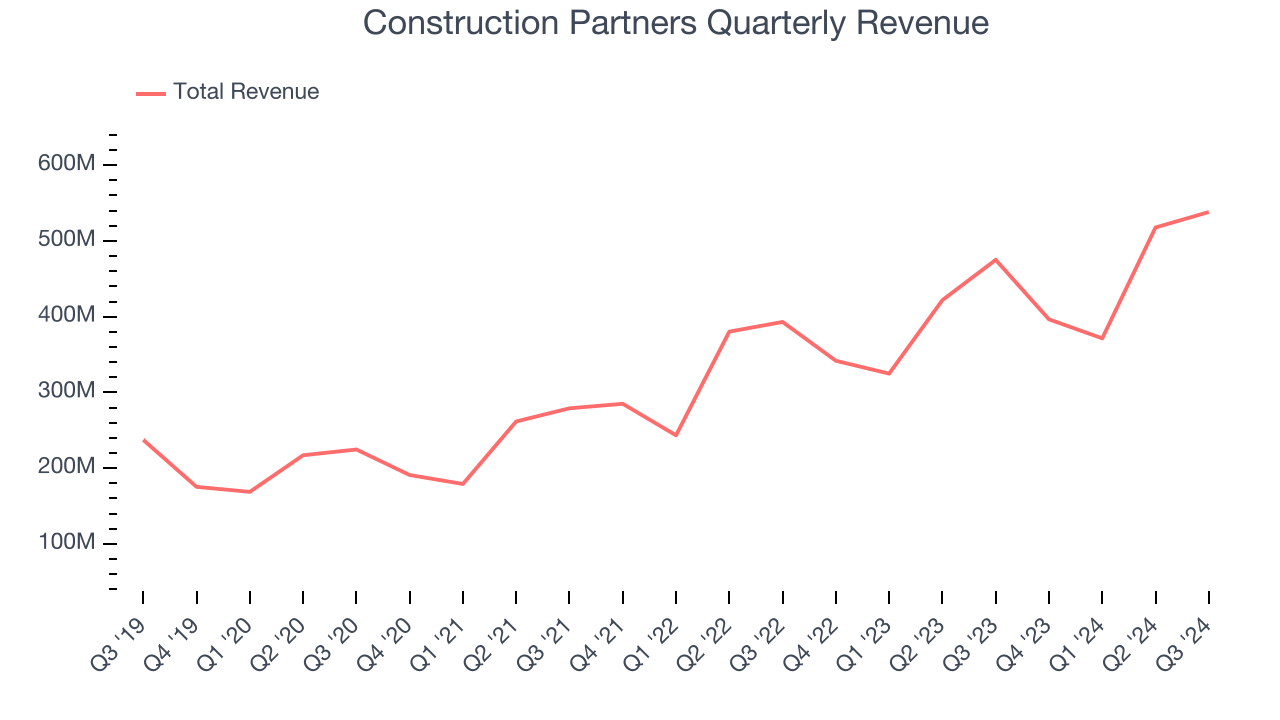

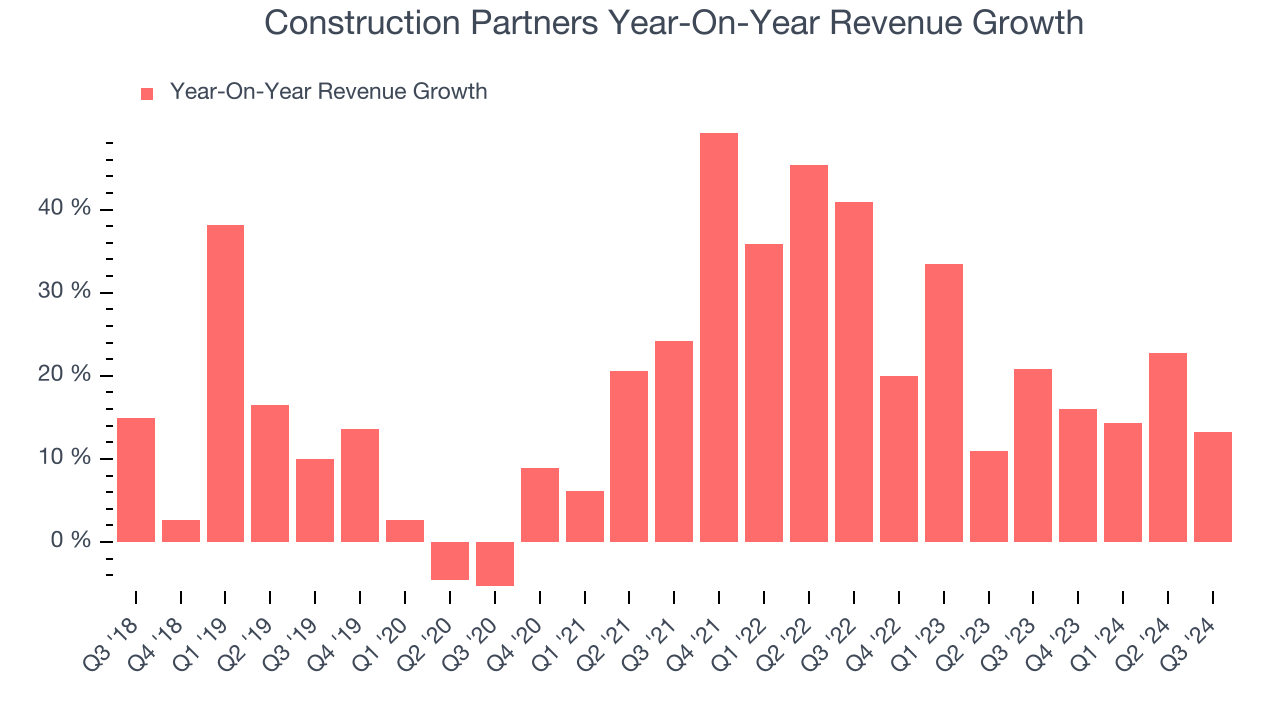

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Construction Partners’s 18.4% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Construction Partners’s annualized revenue growth of 18.4% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, Construction Partners’s year-on-year revenue growth was 13.3%, and its $538.2 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 36.6% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and indicates its newer products and services will fuel higher growth rates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

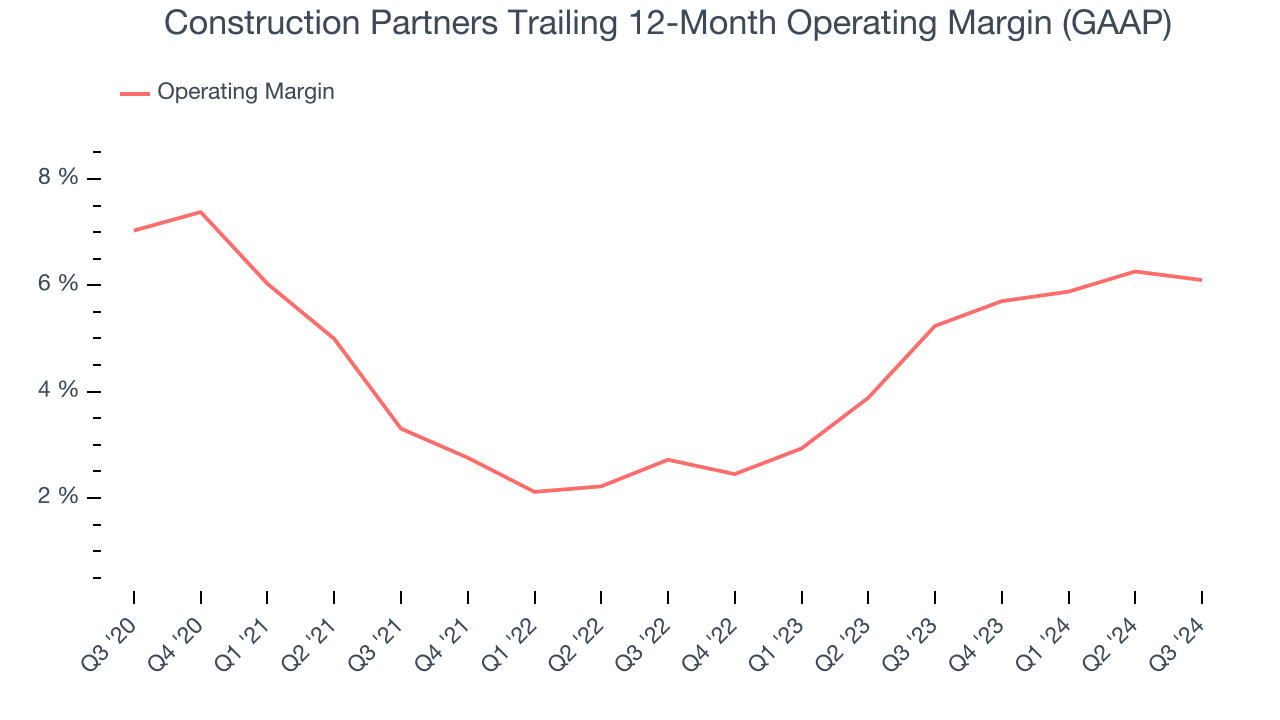

Operating Margin

Construction Partners was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.9% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Construction Partners’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, which doesn’t help its cause.

In Q3, Construction Partners generated an operating profit margin of 8.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

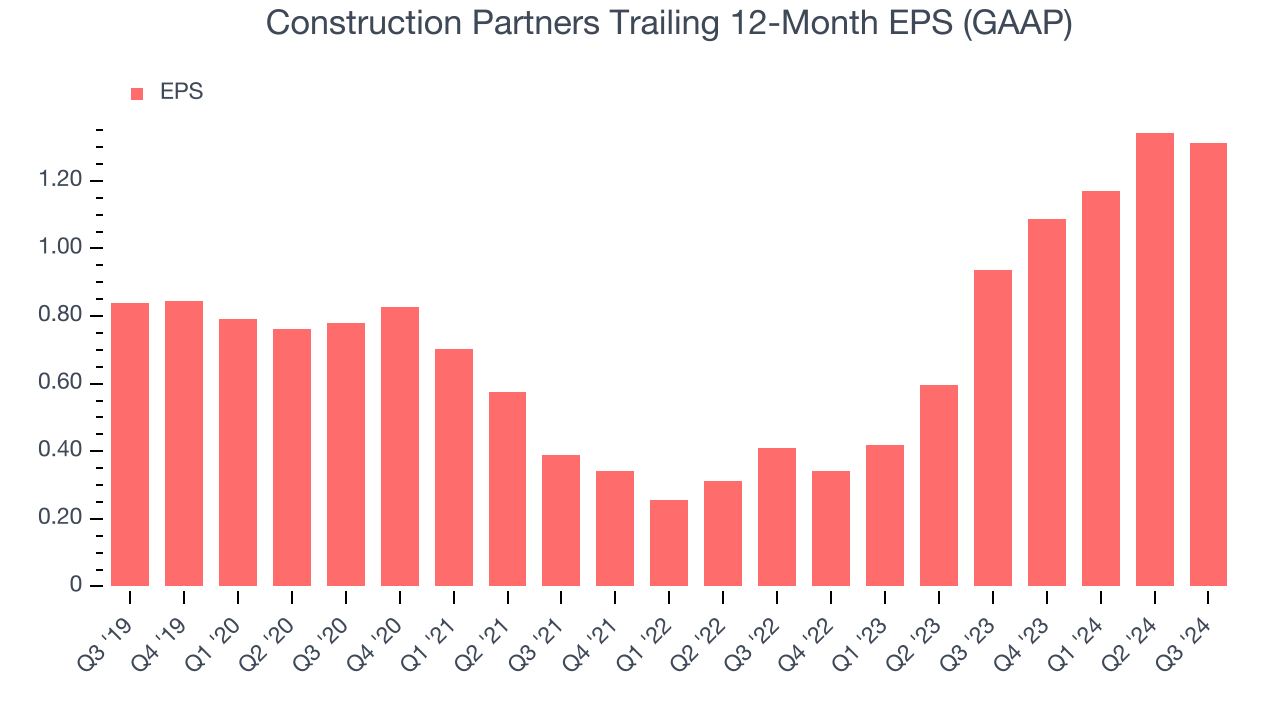

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

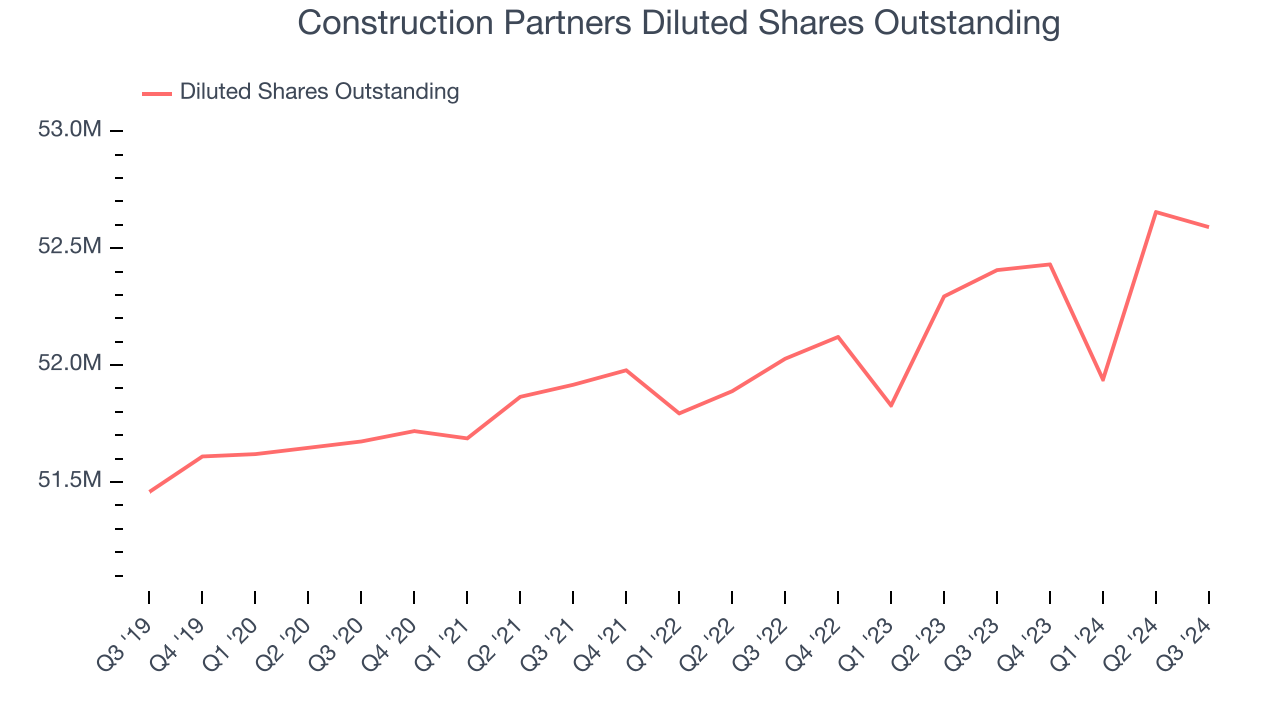

Construction Partners’s EPS grew at a decent 9.4% compounded annual growth rate over the last five years. However, this performance was lower than its 18.4% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Construction Partners’s earnings quality to better understand the drivers of its performance. A five-year view shows Construction Partners has diluted its shareholders, growing its share count by 2.2%. This has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Construction Partners, its two-year annual EPS growth of 78.8% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.In Q3, Construction Partners reported EPS at $0.56, down from $0.59 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Construction Partners’s full-year EPS of $1.31 to grow by 40.4%.

Key Takeaways from Construction Partners’s Q3 Results

It was good to see Construction Partners provide full-year revenue and EBITDA guidance that topped analysts’ expectations. On the other hand, its EPS missed Wall Street's estimates. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock remained flat at $92.50 immediately after reporting.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.