WeightWatchers’s stock price has taken a beating over the past six months, shedding 40.1% of its value and falling to $1.03 per share. This might have investors contemplating their next move.

Is now the time to buy WeightWatchers, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.Even though the stock has become cheaper, we don't have much confidence in WeightWatchers. Here are three reasons why we avoid WW and a stock we'd rather own.

Why Do We Think WeightWatchers Will Underperform?

Known by many for its old cable television commercials, WeightWatchers (NASDAQ: WW) is a wellness company offering a range of products and services promoting weight loss and healthy habits.

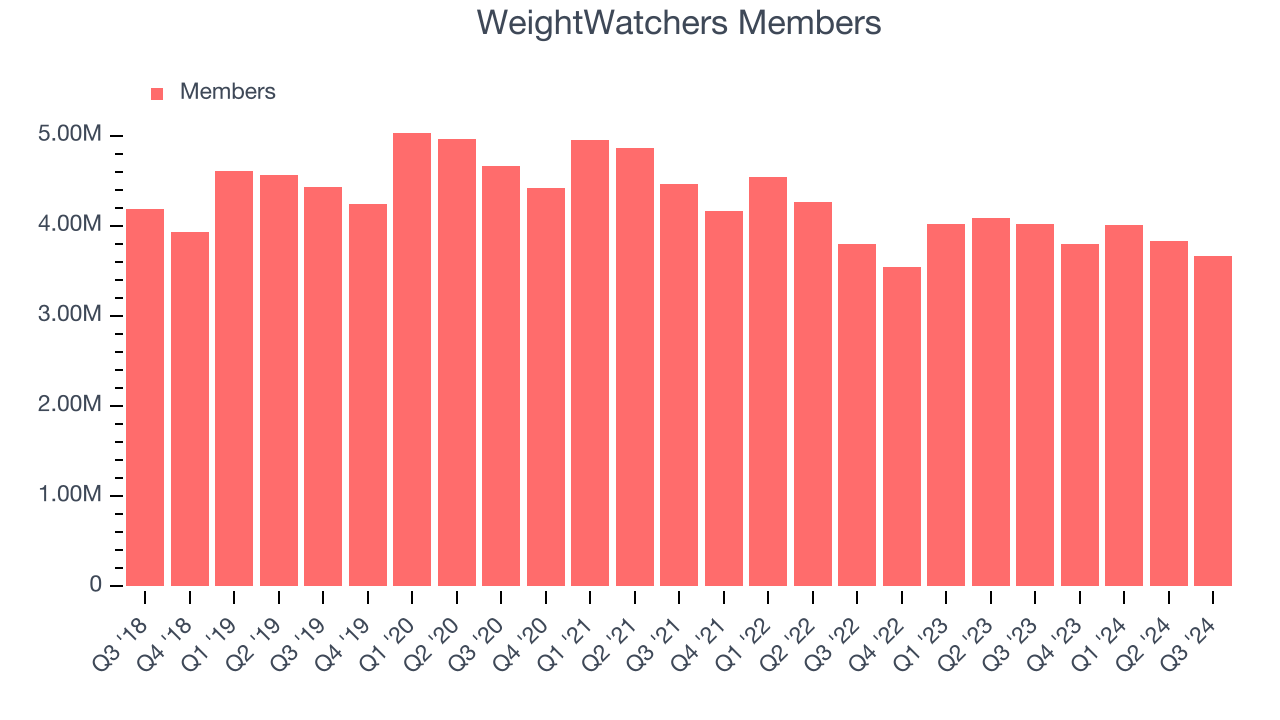

1. Decline in Members Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like WeightWatchers, our preferred volume metric is members). While both are important, the latter is the most critical to analyze because prices have a ceiling.

WeightWatchers’s members came in at 3.67 million in the latest quarter, and over the last two years, averaged 4.1% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests WeightWatchers might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

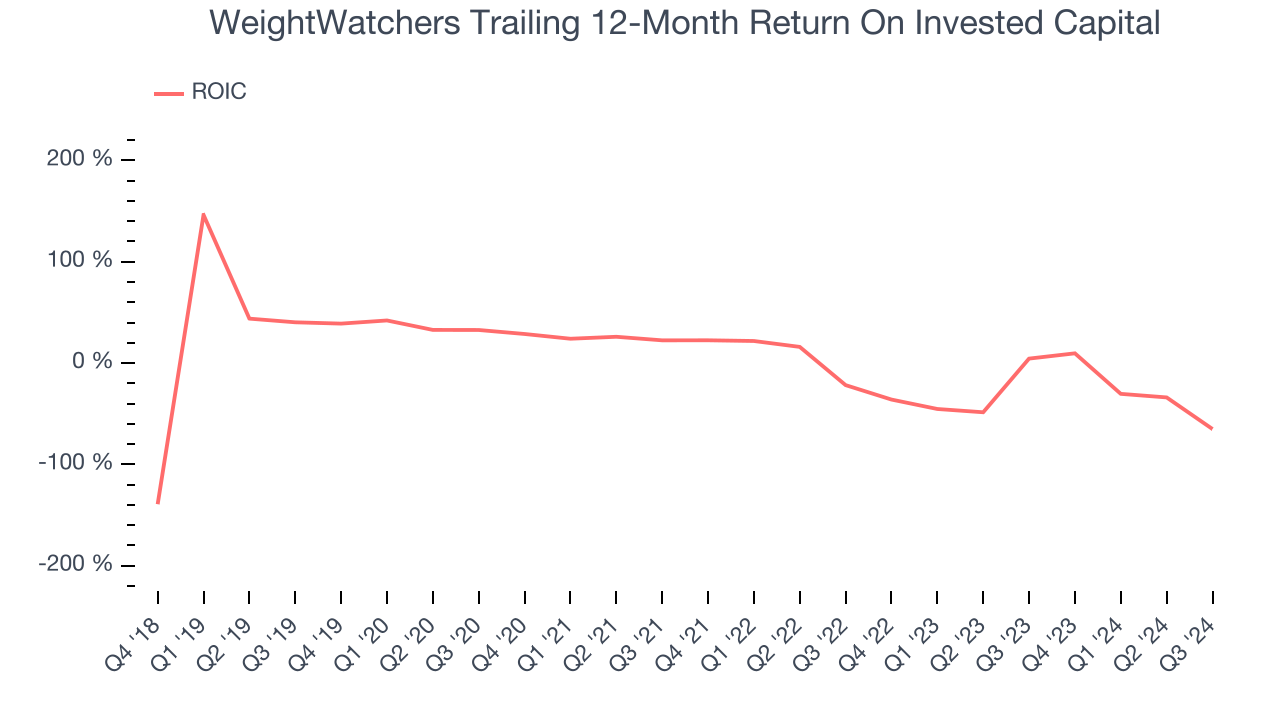

2. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Over the last few years, WeightWatchers’s ROIC has decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

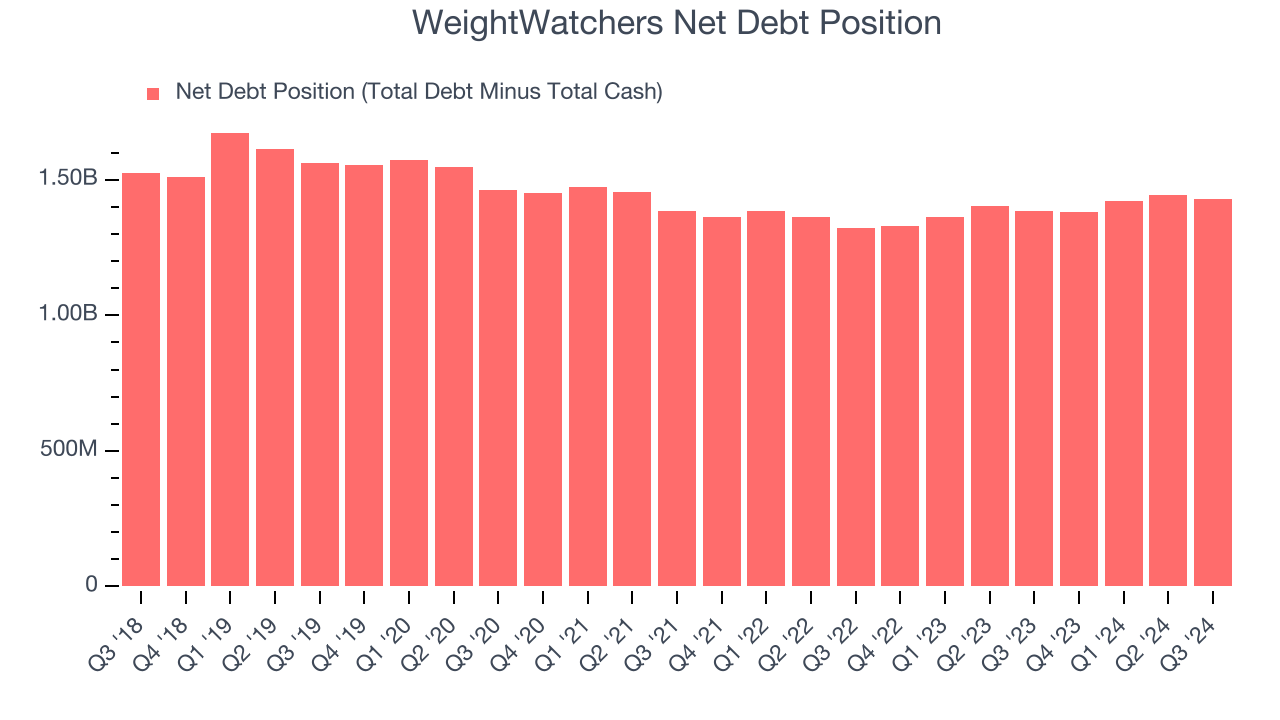

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

WeightWatchers’s $1.49 billion of debt exceeds the $57.18 million of cash on its balance sheet. Furthermore, its 12x net-debt-to-EBITDA ratio (based on its EBITDA of $124.1 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. WeightWatchers could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope WeightWatchers can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

WeightWatchers doesn’t pass our quality test. Following the recent decline, the stock trades at 0.6x forward EV-to-EBITDA (or $1.03 per share). Regardless of price, we think there are better investment opportunities out there. We’d recommend taking a look at FTAI Aviation, an aerospace company benefiting from Boeing and Airbus’s struggles.

Stocks We Would Buy Instead of WeightWatchers

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.