Let’s dig into the relative performance of TPI Composites (NASDAQ: TPIC) and its peers as we unravel the now-completed Q3 renewable energy earnings season.

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 18 renewable energy stocks we track reported a slower Q3. As a group, revenues missed analysts’ consensus estimates by 7.5% while next quarter’s revenue guidance was 7.2% below.

In light of this news, share prices of the companies have held steady as they are up 2.5% on average since the latest earnings results.

TPI Composites (NASDAQ: TPIC)

Founded in 1968, TPI Composites (NASDAQ: TPIC) manufactures composite wind turbine blades and provides related precision molding and assembly systems.

TPI Composites reported revenues of $380.8 million, up 2.1% year on year. This print exceeded analysts’ expectations by 5.9%. Despite the top-line beat, it was still a mixed quarter for the company with a solid beat of analysts’ billings estimates but a significant miss of analysts’ adjusted operating income estimates.

“The third quarter marked a significant improvement for the company, showcasing improved profitability with positive adjusted EBITDA. This improvement was largely driven by 89% utilization in our plants as we made progress on transitioning/starting up ten lines with next-generation workhorse blades. Our results also benefited from eliminating losses that had been burdening our financial performance by divesting the Automotive business and shutting down the Nordex Matamoros plant at the end of the second quarter of this year. Sales reached $380.8 million, reflecting 23% sequential, quarterly growth, and positioning us well to achieve the mid-point of our full-year sales guidance,” said Bill Siwek, President and CEO of TPI Composites.”

Unsurprisingly, the stock is down 41.6% since reporting and currently trades at $1.63.

Read our full report on TPI Composites here, it’s free.

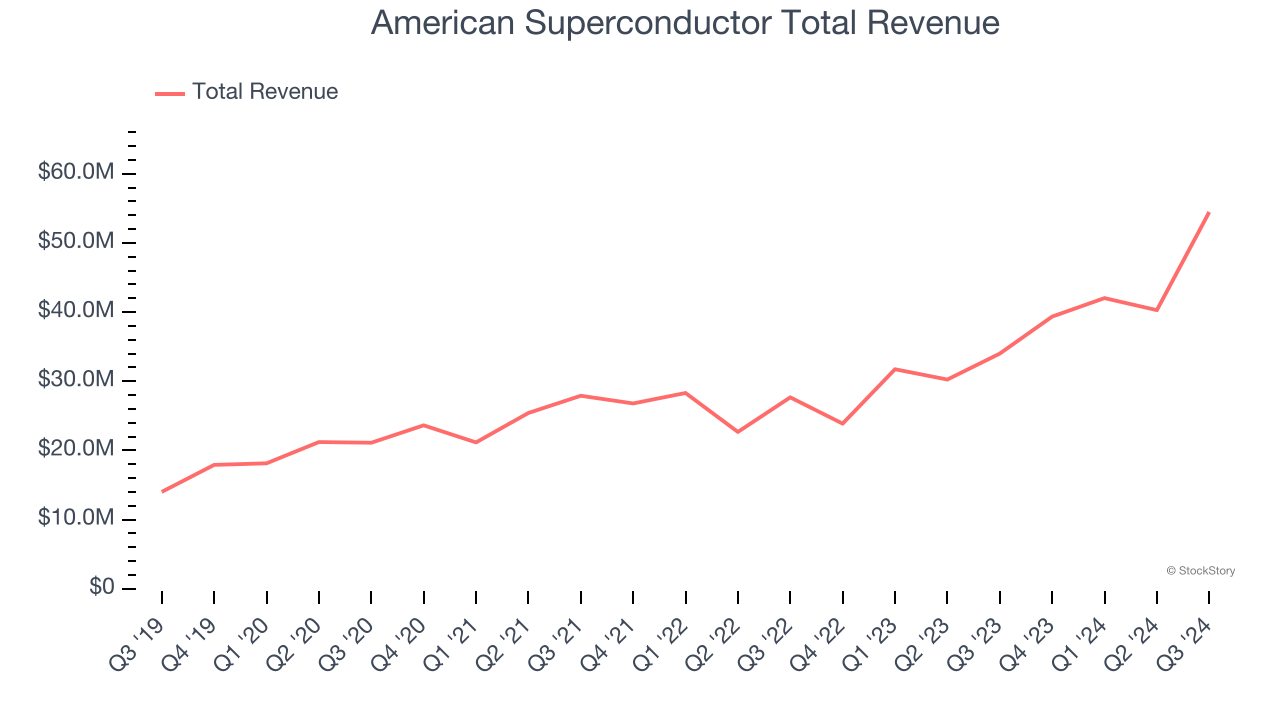

Best Q3: American Superconductor (NASDAQ: AMSC)

Founded in 1987, American Superconductor (NASDAQ: AMSC) has shifted from superconductor research to developing power systems, adapting to changing energy grid needs and naval technology requirements.

American Superconductor reported revenues of $54.47 million, up 60.2% year on year, outperforming analysts’ expectations by 6.1%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 18.7% since reporting. It currently trades at $27.91.

Is now the time to buy American Superconductor? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Blink Charging (NASDAQ: BLNK)

One of the first EV charging companies to go public, Blink Charging (NASDAQ: BLNK) is a manufacturer, owner, operator, and provider of electric vehicle charging equipment and networked EV charging services.

Blink Charging reported revenues of $25.19 million, down 41.9% year on year, falling short of analysts’ expectations by 28.1%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Blink Charging delivered the weakest full-year guidance update in the group. As expected, the stock is down 19.4% since the results and currently trades at $1.62.

Read our full analysis of Blink Charging’s results here.

NuScale (NYSE: SMR)

Founded by a team of nuclear scientists, NuScale (NYSE: SMR) specializes in small modular reactor technology, providing scalable nuclear power solutions.

NuScale reported revenues of $475,000, down 93.2% year on year. This number lagged analysts' expectations by 95.6%. Overall, it was a disappointing quarter as it also produced a significant miss of analysts’ EPS estimates.

NuScale had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is down 8.7% since reporting and currently trades at $19.77.

Read our full, actionable report on NuScale here, it’s free.

SolarEdge (NASDAQ: SEDG)

Established in 2006, SolarEdge (NASDAQ: SEDG) creates advanced systems to improve the efficiency of solar panels.

SolarEdge reported revenues of $260.9 million, down 64% year on year. This result came in 3.7% below analysts' expectations. Overall, it was a disappointing quarter as it also recorded revenue guidance for next quarter missing analysts’ expectations.

The stock is up 3.3% since reporting and currently trades at $15.15.

Read our full, actionable report on SolarEdge here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.