What a brutal six months it’s been for AMD. The stock has dropped 22% and now trades at $121.52, rattling many shareholders. This might have investors contemplating their next move.

Following the drawdown, is now a good time to buy AMD? Find out in our full research report, it’s free.

Why Does AMD Spark Debate?

Founded in 1969 by a group of former Fairchild semiconductor executives led by Jerry Sanders, Advanced Micro Devices (NASDAQ: AMD) is one of the leading designers of computer processors and graphics chips used in PCs and data centers.

Two Positive Attributes:

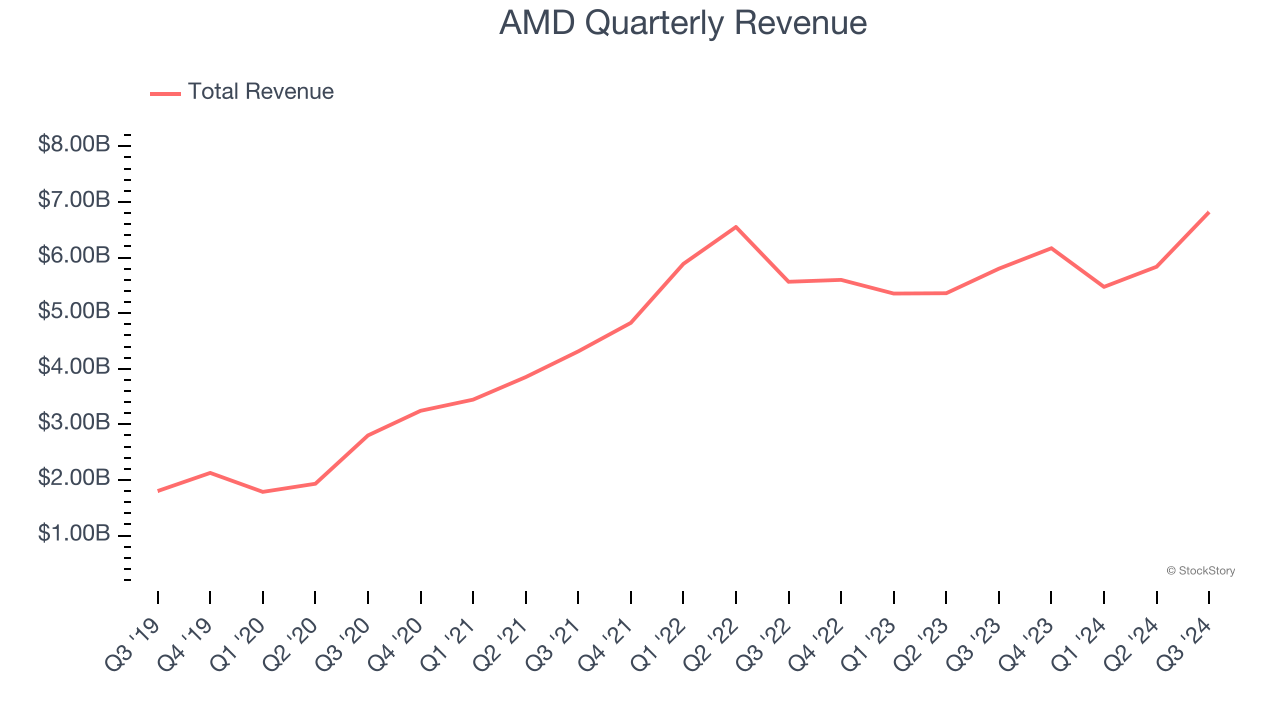

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, AMD’s 32.2% annualized revenue growth over the last five years was incredible. Its growth beat the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

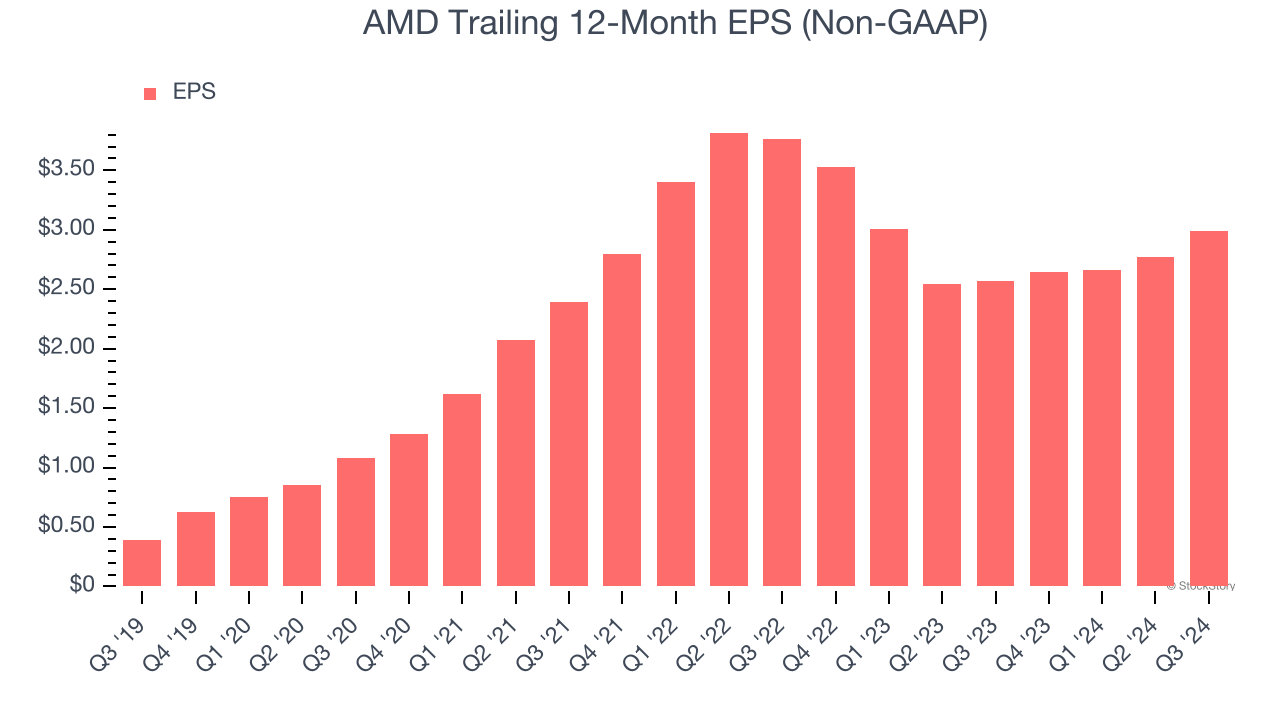

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

AMD’s EPS grew at an astounding 50.4% compounded annual growth rate over the last five years, higher than its 32.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

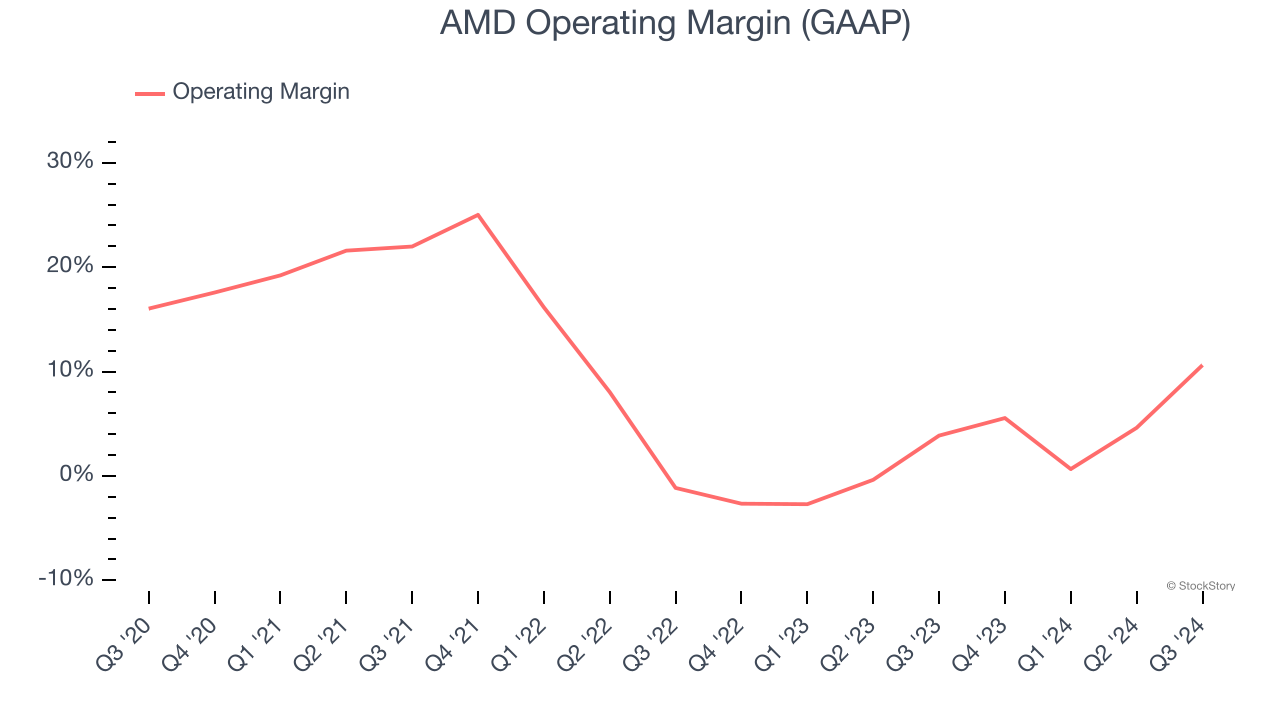

One Reason to be Careful:

Weak Operating Margin Could Cause Trouble

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

AMD was profitable over the last two years but held back by its large cost base. Its average operating margin of 2.8% was among the worst in the semiconductor sector. This result is surprising given its high gross margin as a starting point.

Final Judgment

AMD’s merits more than compensate for its flaws. After the recent drawdown, the stock trades at 24.9× forward price-to-earnings (or $121.52 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than AMD

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.