The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how defense contractors stocks fared in Q3, starting with CACI (NYSE: CACI).

Defense contractors typically require technical expertise and government clearance. Companies in this sector can also enjoy long-term contracts with government bodies, leading to more predictable revenues. Combined, these factors create high barriers to entry and can lead to limited competition. Lately, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression towards Taiwan–highlight the need for defense spending. On the other hand, demand for these products can ebb and flow with defense budgets and even who is president, as different administrations can have vastly different ideas of how to allocate federal funds.

The 15 defense contractors stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was 2.7% below.

While some defense contractors stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.6% since the latest earnings results.

CACI (NYSE: CACI)

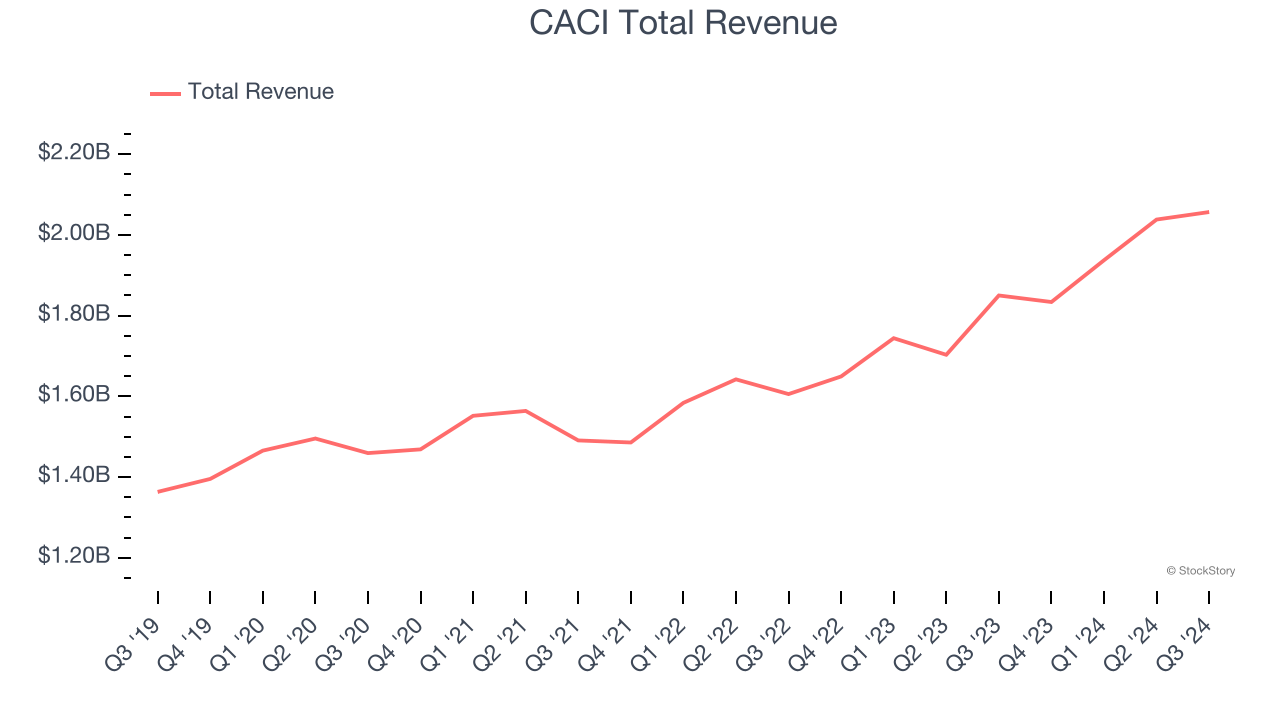

Founded to commercialize SIMSCRIPT, CACI International (NYSE: CACI) offers defense, intelligence, and IT solutions to support national security and government transformation efforts.

CACI reported revenues of $2.06 billion, up 11.2% year on year. This print exceeded analysts’ expectations by 7%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ backlog and EBITDA estimates.

“In the first quarter, CACI delivered exceptional financial results across the board with revenue growth of 11%, healthy profitability and cash flow, and strong awards and backlog. In addition, we demonstrated our flexible and opportunistic approach to capital deployment by announcing two strategic acquisitions, Azure Summit Technology and Applied Insight,” said John Mengucci, CACI President and Chief Executive Officer.

Unsurprisingly, the stock is down 13.7% since reporting and currently trades at $452.39.

Is now the time to buy CACI? Access our full analysis of the earnings results here, it’s free.

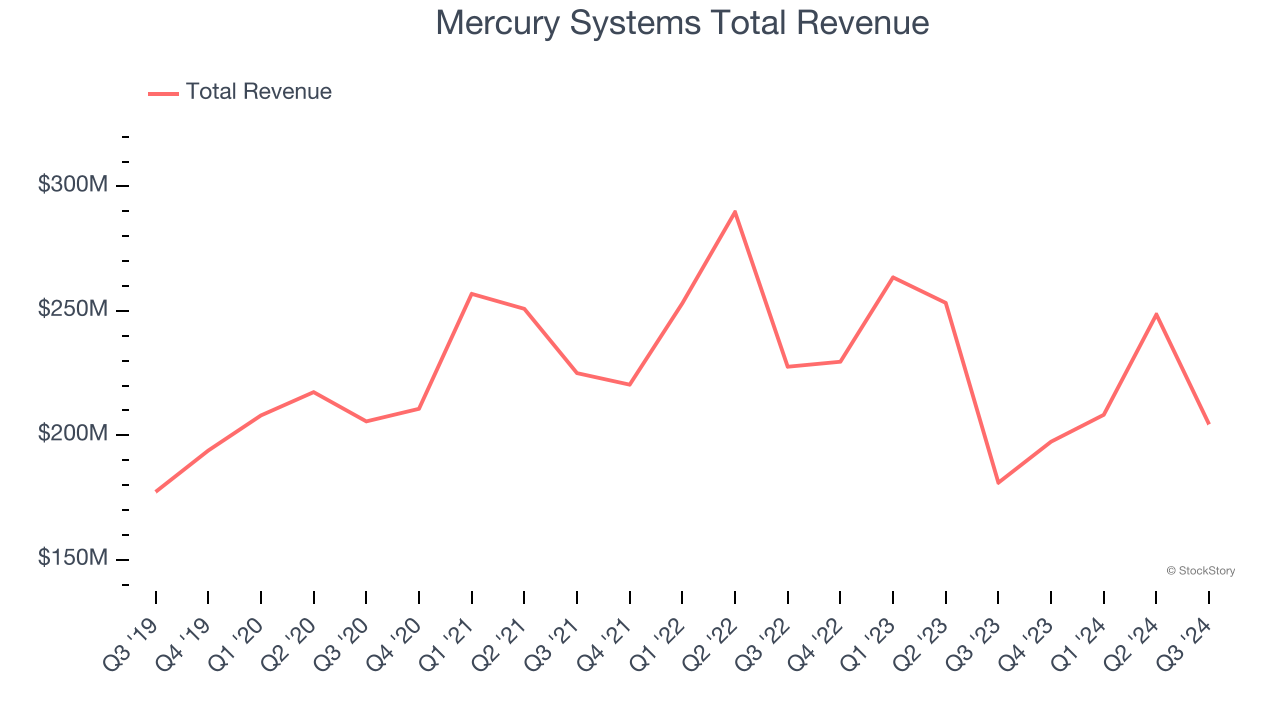

Best Q3: Mercury Systems (NASDAQ: MRCY)

Founded in 1981, Mercury Systems (NASDAQ: MRCY) specializes in providing processing subsystems and components for primarily defense applications.

Mercury Systems reported revenues of $204.4 million, up 13% year on year, outperforming analysts’ expectations by 12.5%. The business had an incredible quarter with a solid beat of analysts’ organic revenue estimates and an impressive beat of analysts’ EPS estimates.

Mercury Systems scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 25.4% since reporting. It currently trades at $42.95.

Is now the time to buy Mercury Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Huntington Ingalls (NYSE: HII)

Building Nimitz-class aircraft carriers used in active service, Huntington Ingalls (NYSE: HII) develops marine vessels and their mission systems and maintenance services.

Huntington Ingalls reported revenues of $2.75 billion, down 2.4% year on year, falling short of analysts’ expectations by 4%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Huntington Ingalls delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 19.3% since the results and currently trades at $202.56.

Read our full analysis of Huntington Ingalls’s results here.

BWX (NYSE: BWXT)

Contributing components and materials to the famous Manhattan Project in the 1940s, BWX (NYSE: BWXT) is a manufacturer and service provider of nuclear components and fuel for government and commercial industries.

BWX reported revenues of $672 million, up 13.9% year on year. This print beat analysts’ expectations by 2%. It was a strong quarter as it also recorded full-year revenue guidance beating analysts’ expectations and a decent beat of analysts’ EBITDA estimates.

The stock is up 2.7% since reporting and currently trades at $123.

Read our full, actionable report on BWX here, it’s free.

ICF (NASDAQ: ICFI)

Originally founded as Inner City Fund, ICF International (NASDAQ: ICFI) delivers consulting and technology services in health, environment, and infrastructure.

ICF reported revenues of $517 million, up 3.1% year on year. This number lagged analysts' expectations by 2.1%. More broadly, it was a mixed quarter as it also produced full-year EPS guidance exceeding analysts’ expectations.

The stock is down 23% since reporting and currently trades at $129.44.

Read our full, actionable report on ICF here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.