Coupang trades at $22.25 per share and has stayed right on track with the overall market, gaining 8% over the last six months. At the same time, the S&P 500 has returned 9.3%.

Is now the time to buy CPNG? Find out in our full research report, it’s free.

Why Does CPNG Stock Spark Debate?

Founded in 2010 by Harvard Business School student Bom Kim, Coupang (NYSE: CPNG) is an e-commerce giant often referred to as the "Amazon of South Korea".

Two Positive Attributes:

1. Active Customers Drive Additional Growth Opportunities

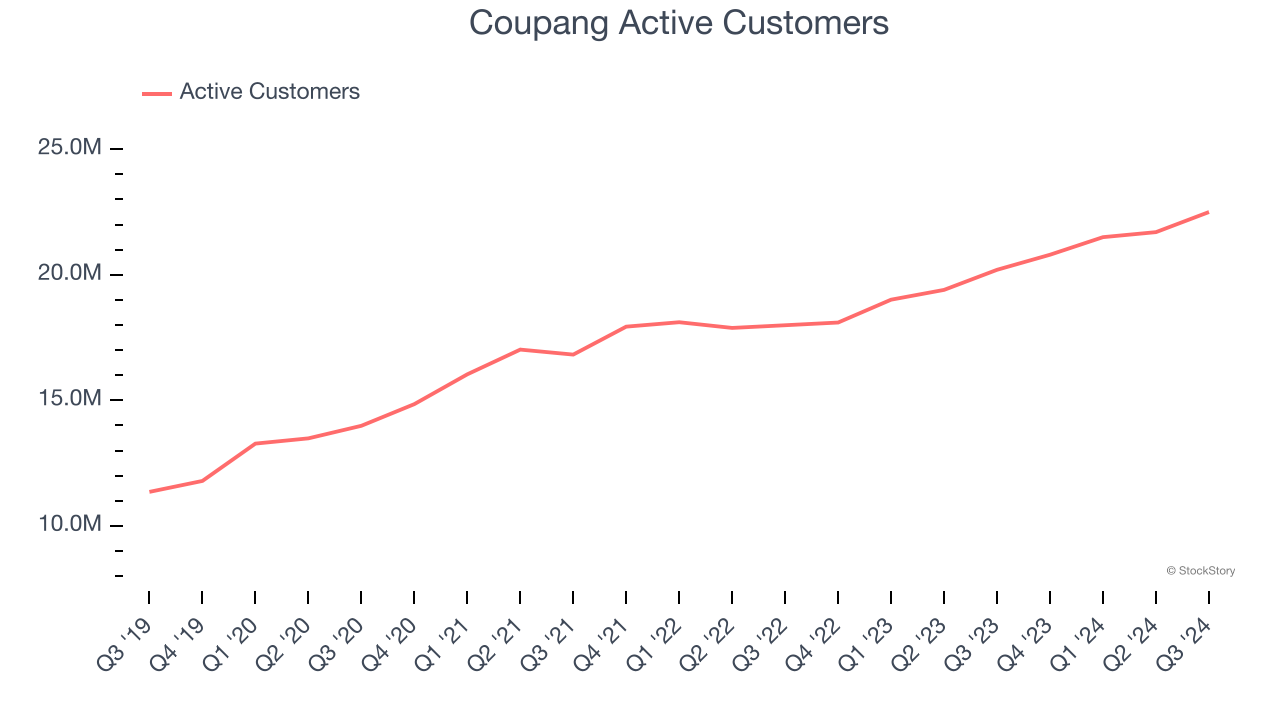

As an online retailer, Coupang generates revenue growth by expanding its number of users and the average order size in dollars.

Over the last two years, Coupang’s active customers, a key performance metric for the company, increased by 9.7% annually to 22.5 million in the latest quarter. This growth rate is solid for a consumer internet business and indicates people are excited about its offerings.

2. Outstanding Long-Term EPS Growth

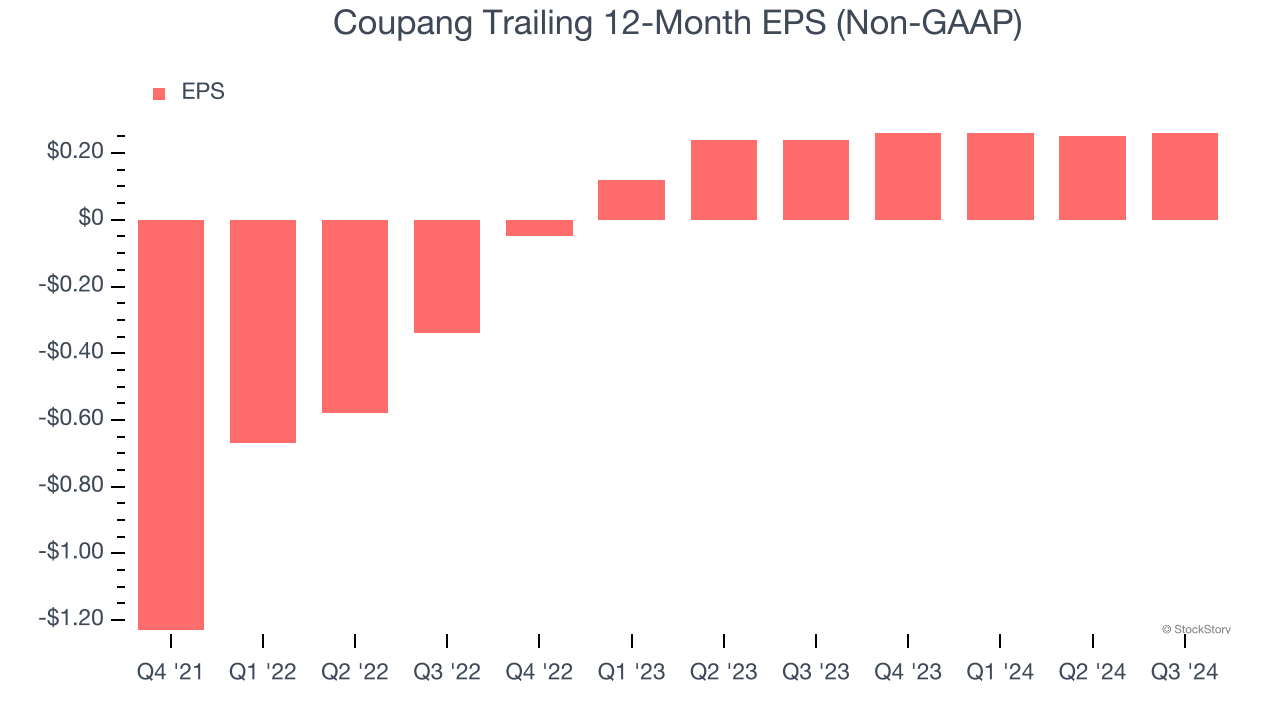

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Coupang’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

One Reason to be Careful:

Low Gross Margin Reveals Weak Structural Profitability

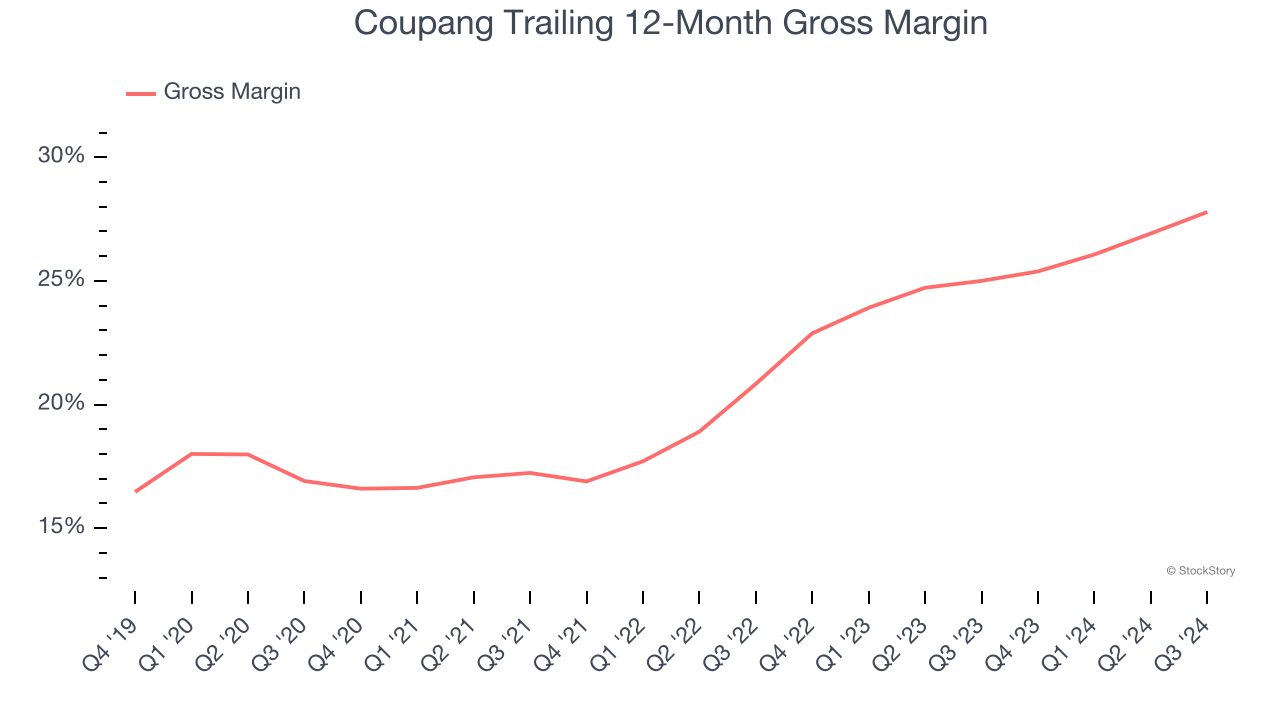

For online retail (separate from online marketplaces) businesses like Coupang, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include the cost of acquiring the products sold, shipping and fulfillment, customer service, and digital infrastructure.

Coupang’s unit economics are far below other consumer internet companies because it must carry inventories as an online retailer. This means it has relatively higher capital intensity than a pure software business like Meta or Airbnb and signals it operates in a competitive market. As you can see below, it averaged a 26.5% gross margin over the last two years. Said differently, Coupang had to pay a chunky $73.45 to its service providers for every $100 in revenue.

Final Judgment

Coupang’s merits more than compensate for its flaws, but at $22.25 per share (or 23.6× forward EV-to-EBITDA), is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Coupang

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.