Since January 2020, the S&P 500 has delivered a total return of 82.4%. But one standout stock has more than doubled the market - over the past five years, O'Reilly has surged 186% to $1,248 per share. Its momentum hasn’t stopped as it’s also gained 19% in the last six months, beating the S&P by 9.7%.

Is now still a good time to buy ORLY? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Are We Positive On O'Reilly?

Serving both the DIY customer and professional mechanic, O’Reilly Automotive (NASDAQ: ORLY) is an auto parts and accessories retailer that sells everything from fuel pumps to car air fresheners to mufflers.

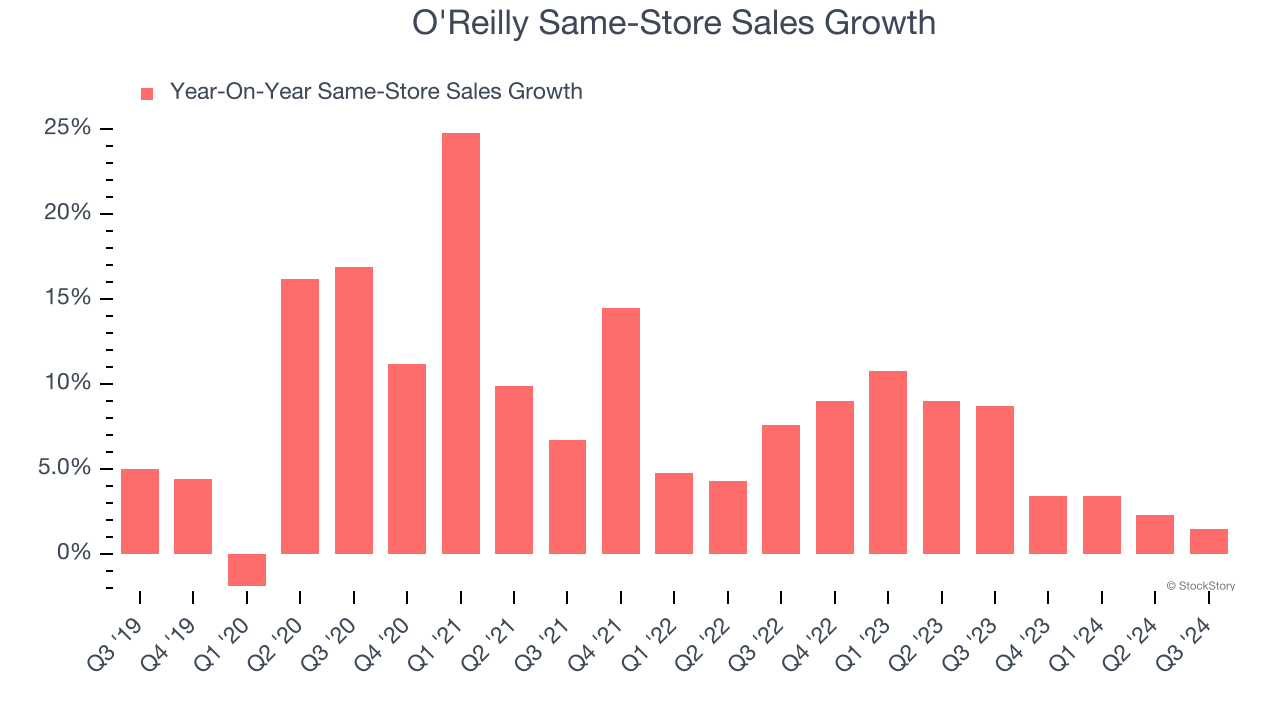

1. Surging Same-Store Sales Show Increasing Demand

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

O'Reilly has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 6%.

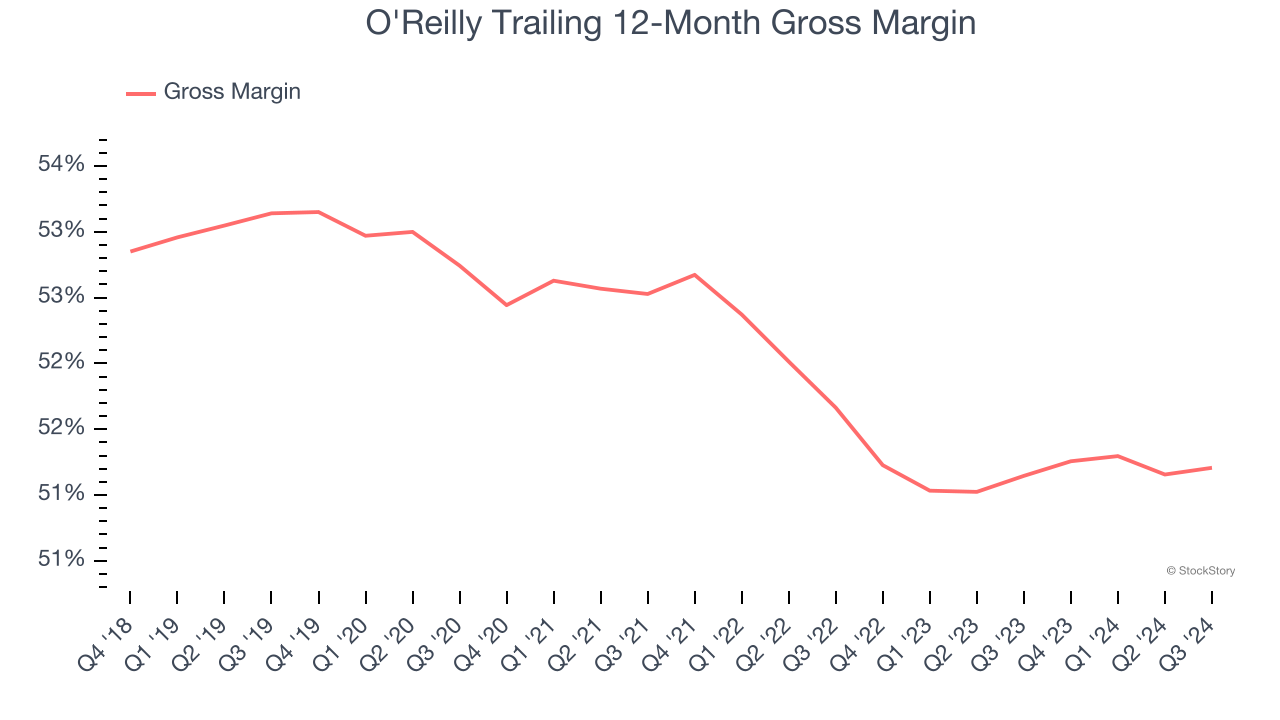

2. Elite Gross Margin Powers Best-In-Class Business Model

Gross profit margins are an important measure of a retailer’s pricing power, product differentiation, and negotiating leverage.

O'Reilly has best-in-class unit economics for a retailer, enabling it to invest in areas such as marketing and talent. As you can see below, it averaged an elite 51.2% gross margin over the last two years. That means for every $100 in revenue, only $48.82 went towards paying for inventory, transportation, and distribution.

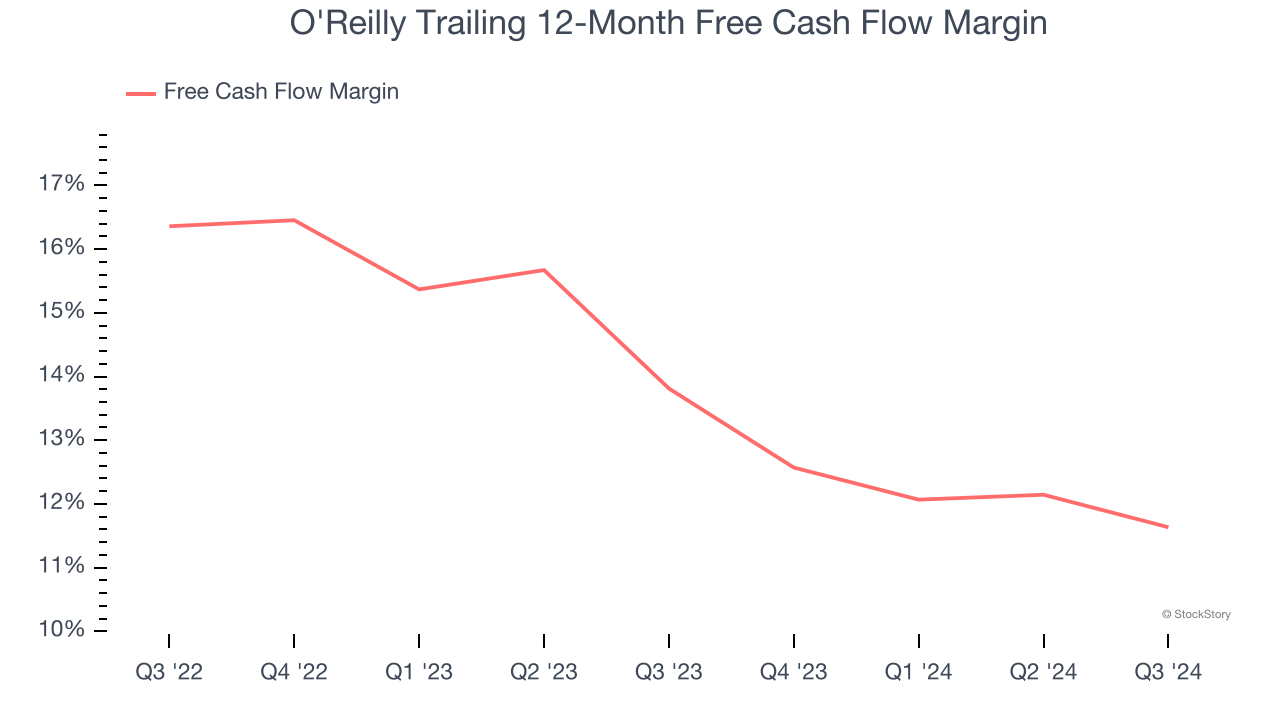

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

O'Reilly has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer retail sector, averaging 12.7% over the last two years.

Final Judgment

These are just a few reasons why we think O'Reilly is an elite consumer retail company, and with its shares beating the market recently, the stock trades at 27.7× forward price-to-earnings (or $1,248 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than O'Reilly

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.