Over the past six months, Udemy’s shares (currently trading at $7.44) have posted a disappointing 14.2% loss, well below the S&P 500’s 9.2% gain. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Udemy, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even though the stock has become cheaper, we're swiping left on Udemy for now. Here are three reasons why UDMY doesn't excite us and a stock we'd rather own.

Why Is Udemy Not Exciting?

With courses ranging from investing to cooking to computer programming, Udemy (NASDAQ: UDMY) is an online learning platform that connects learners with expert instructors who specialize in a wide range of topics.

1. Customer Spending Decreases, Engagement Falling?

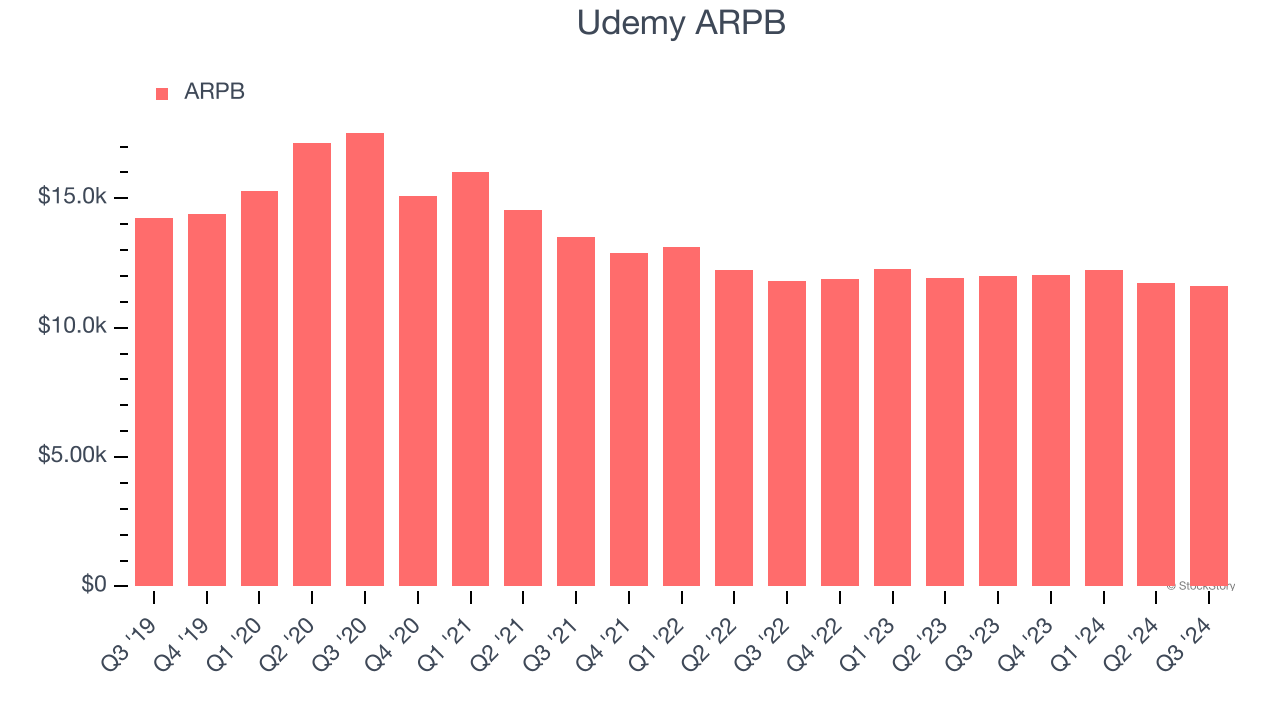

Average revenue per buyer (ARPB) is a critical metric to track for consumer subscription businesses like Udemy because it measures how much the average buyer spends. ARPB is also a key indicator of how valuable its buyers are (and can be over time).

Udemy’s ARPB fell over the last two years, averaging 2.4% annual declines. This isn’t great, but the increase in monthly active buyers is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Udemy tries boosting ARPB by taking a more aggressive approach to monetization, it’s unclear whether buyers can continue growing at the current pace.

2. Poor Marketing Efficiency Drains Profits

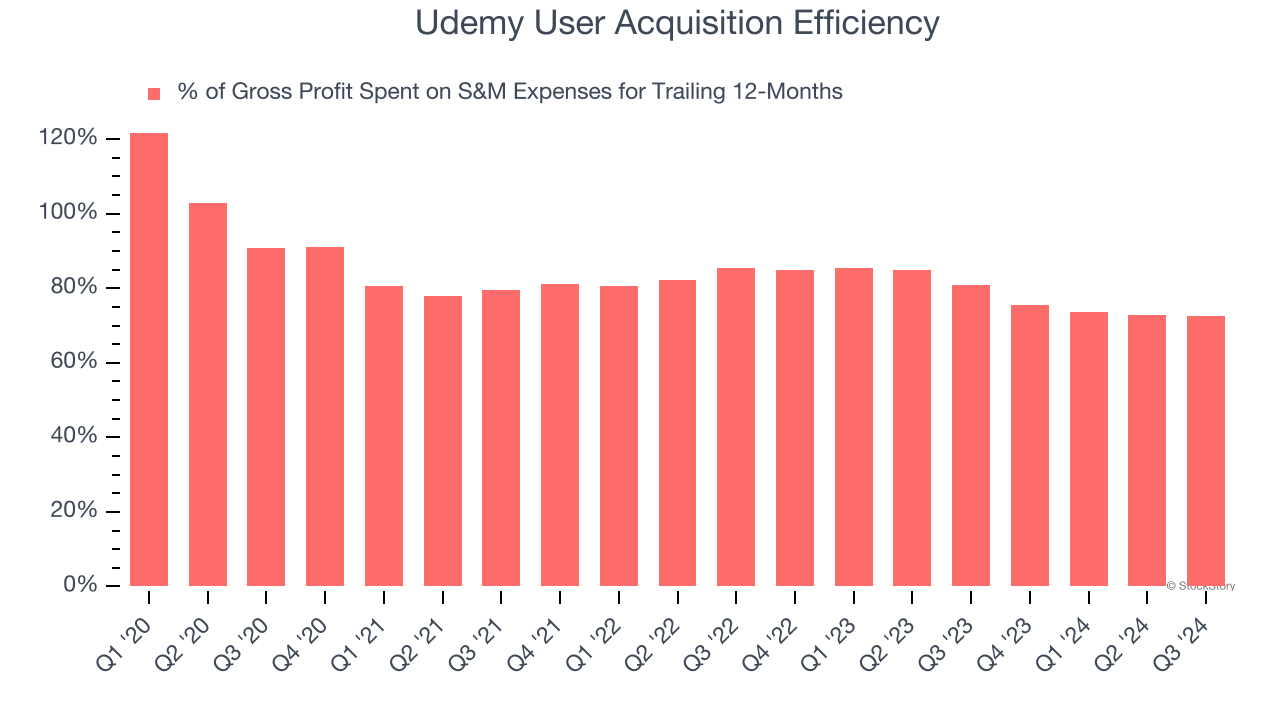

Unlike enterprise software that’s typically sold by dedicated sales teams, consumer internet businesses like Udemy grow from a combination of product virality, paid advertisement, and incentives.

It’s very expensive for Udemy to acquire new users as the company has spent 72.5% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates a highly competitive environment with little differentiation between Udemy and its peers.

3. Cash Burn Ignites Concerns

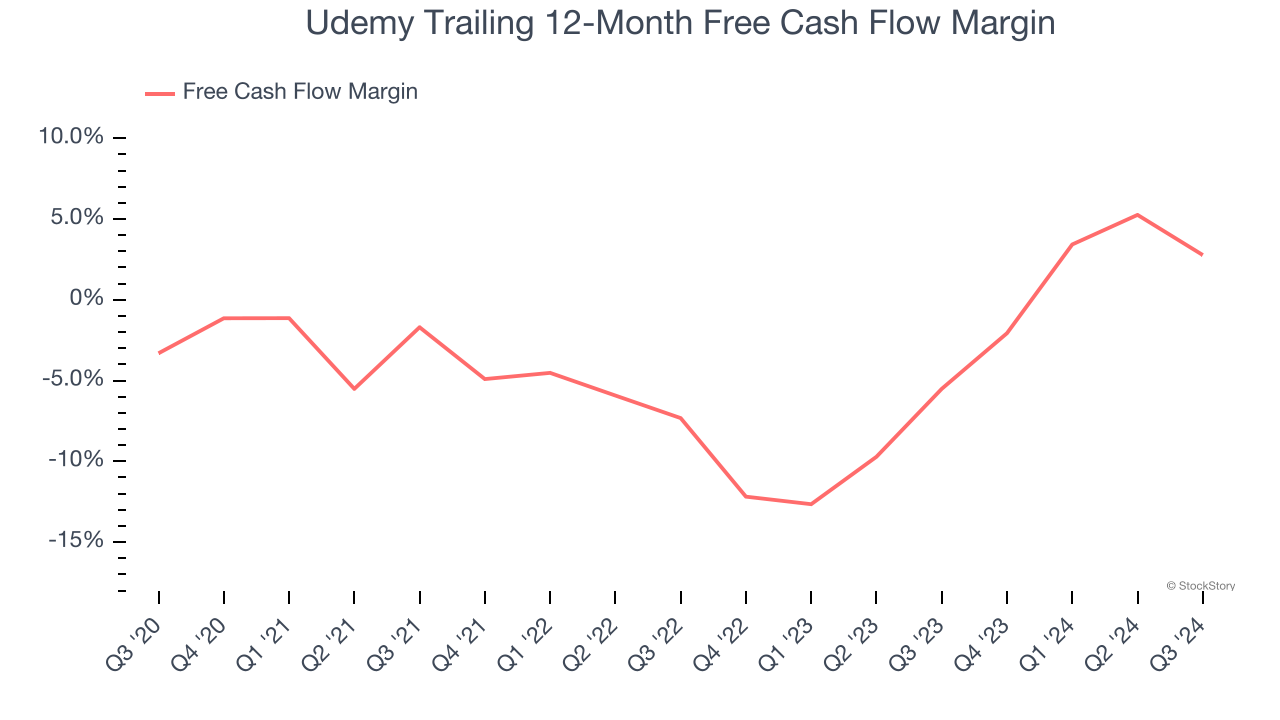

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Udemy’s demanding reinvestments have consumed many resources over the last two years, contributing to an average free cash flow margin of negative 1.2%. This means it lit $1.17 of cash on fire for every $100 in revenue.

Final Judgment

Udemy isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 20.9× forward EV-to-EBITDA (or $7.44 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. We’d suggest looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of Udemy

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.