What a fantastic six months it’s been for CECO Environmental. Shares of the company have skyrocketed 122%, hitting $51.20. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy CECO? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Is CECO Environmental a Good Business?

With roots dating back to 1869 and a focus on creating cleaner industrial operations, CECO Environmental (NASDAQ: CECO) provides technology and expertise that helps industrial companies reduce emissions, treat water, and improve energy efficiency across various sectors.

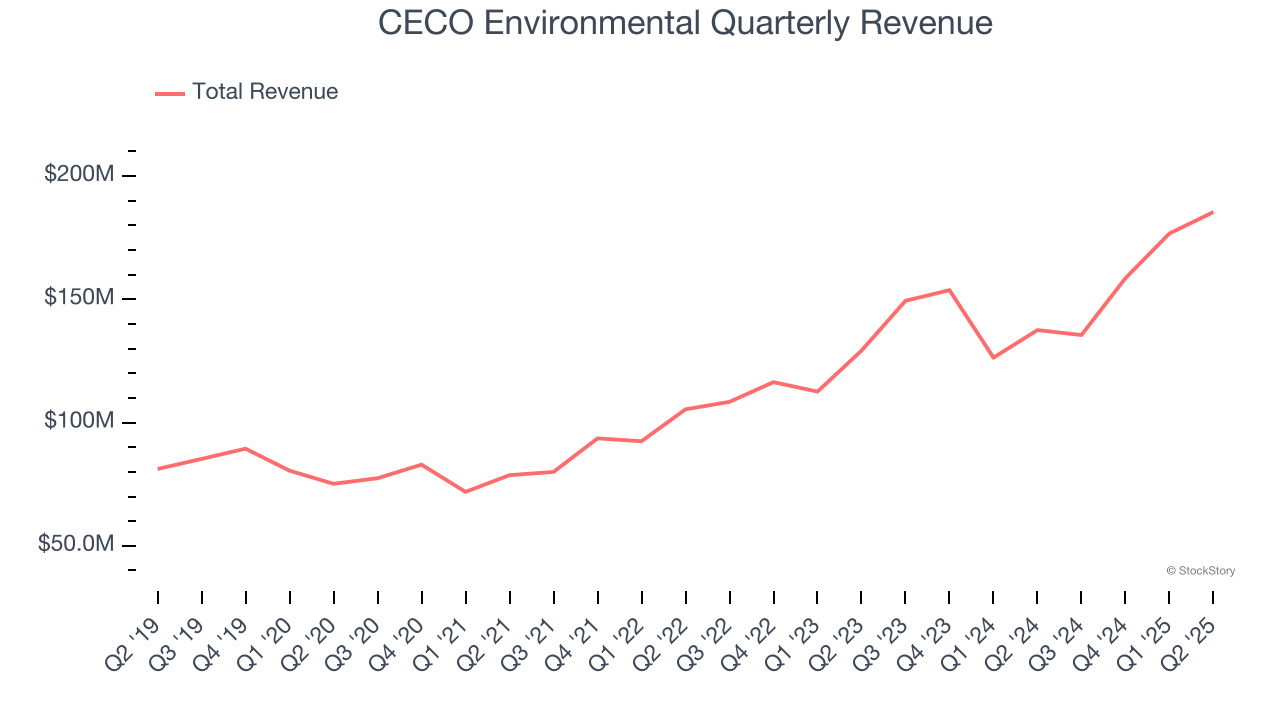

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, CECO Environmental’s 14.7% annualized revenue growth over the last five years was exceptional. Its growth beat the average business services company and shows its offerings resonate with customers.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect CECO Environmental’s revenue to rise by 23%, an improvement versus its 14.7% annualized growth for the past five years. This projection is eye-popping and indicates its newer products and services will catalyze better top-line performance.

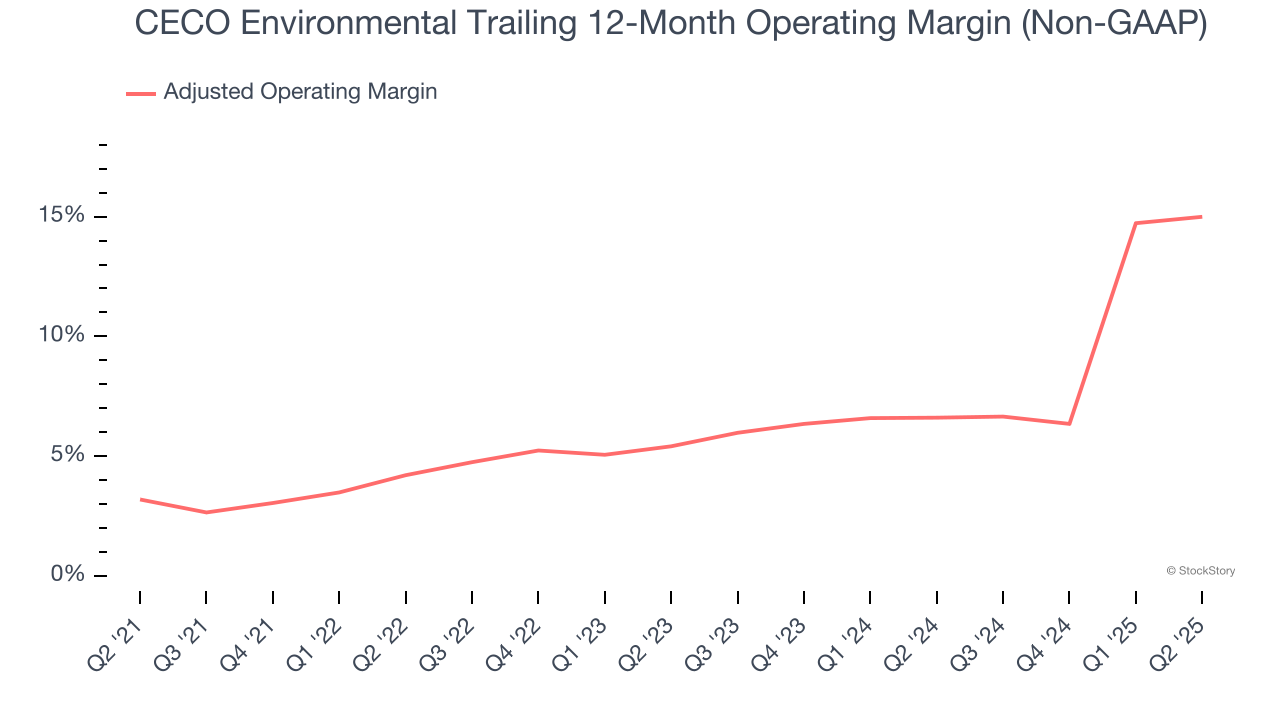

3. Adjusted Operating Margin Rising, Profits Up

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

CECO Environmental’s adjusted operating margin rose by 11.8 percentage points over the last five years, as its sales growth gave it immense operating leverage. Its adjusted operating margin for the trailing 12 months was 15%.

Final Judgment

These are just a few reasons why we're bullish on CECO Environmental, and after the recent surge, the stock trades at 40.4× forward P/E (or $51.20 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.