Digital infrastructure provider Applied Digital (NASDAQ: APLD) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 5.8% year on year to $64.22 million. Its non-GAAP loss of $0.03 per share was 80.6% above analysts’ consensus estimates.

Is now the time to buy Applied Digital? Find out by accessing our full research report, it’s free for active Edge members.

Applied Digital (APLD) Q3 CY2025 Highlights:

- Revenue: $64.22 million vs analyst estimates of $54.59 million (5.8% year-on-year growth, 17.6% beat)

- Adjusted EPS: -$0.03 vs analyst estimates of -$0.16 (80.6% beat)

- Adjusted EBITDA: $537,000 vs analyst estimates of $2.01 million (0.8% margin, 73.3% miss)

- Operating Margin: -34.7%, down from -24.2% in the same quarter last year

- Free Cash Flow was -$331.4 million compared to -$130.7 million in the same quarter last year

- Market Capitalization: $7.65 billion

“We feel this third lease validates our platform and execution, positioning Applied Digital as a trusted strategic partner to the world’s largest technology companies,” said Wes Cummins, Chairman and CEO of Applied Digital.

Company Overview

Pivoting from its origins in cryptocurrency mining to become a key player in the AI infrastructure boom, Applied Digital (NASDAQ: APLD) designs and operates specialized data centers that provide high-performance computing infrastructure for artificial intelligence and blockchain applications.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $219 million in revenue over the past 12 months, Applied Digital is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

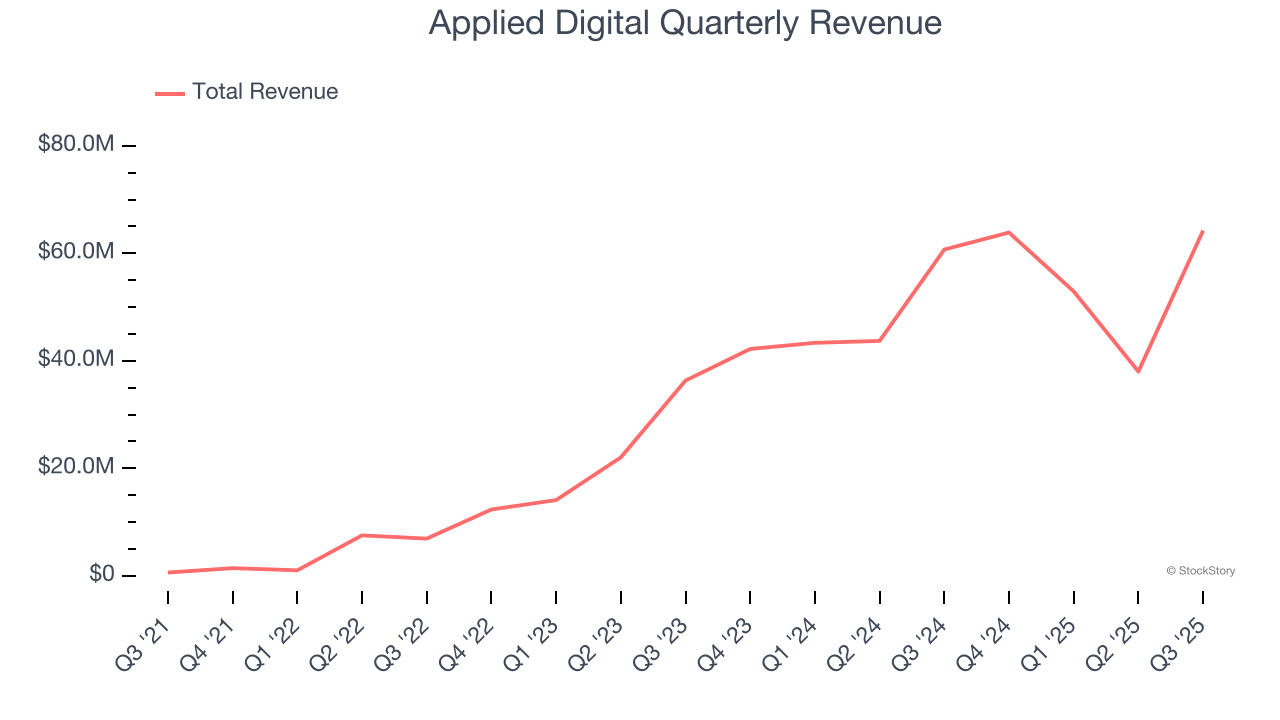

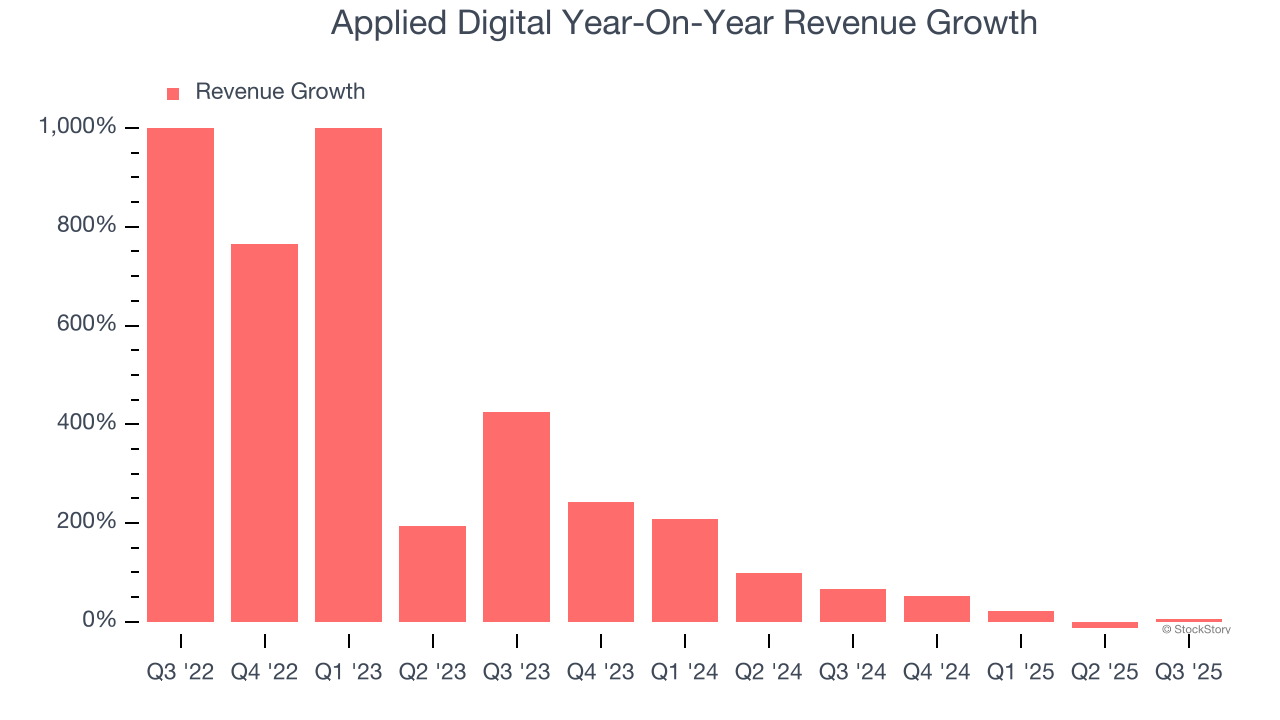

As you can see below, Applied Digital’s sales grew at an incredible 262% compounded annual growth rate over the last three years. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a stretched historical view may miss new innovations or demand cycles. Applied Digital’s annualized revenue growth of 60.7% over the last two years is below its three-year trend, but we still think the results suggest healthy demand.

This quarter, Applied Digital reported year-on-year revenue growth of 5.8%, and its $64.22 million of revenue exceeded Wall Street’s estimates by 17.6%.

Looking ahead, sell-side analysts expect revenue to grow 53.9% over the next 12 months, a deceleration versus the last two years. Still, this projection is noteworthy and suggests the market sees success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

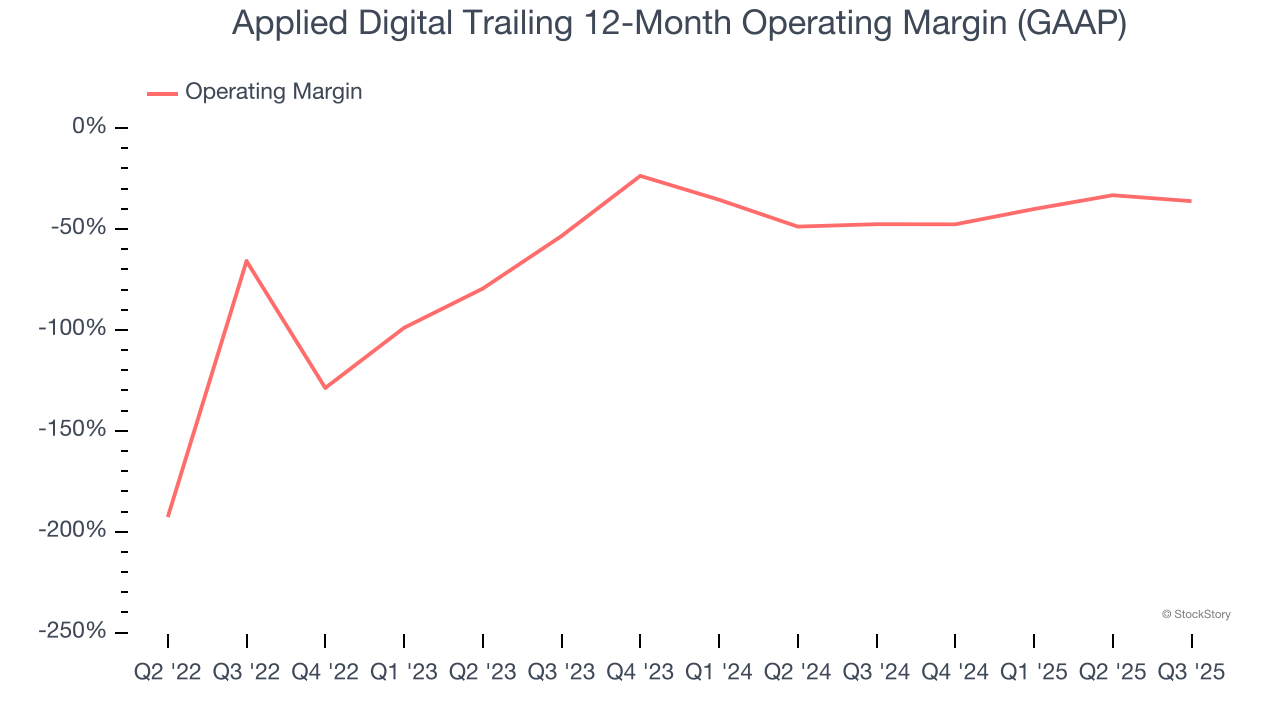

Applied Digital’s high expenses have contributed to an average operating margin of negative 46.8% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Applied Digital’s operating margin rose by 29.7 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

In Q3, Applied Digital generated a negative 34.7% operating margin.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

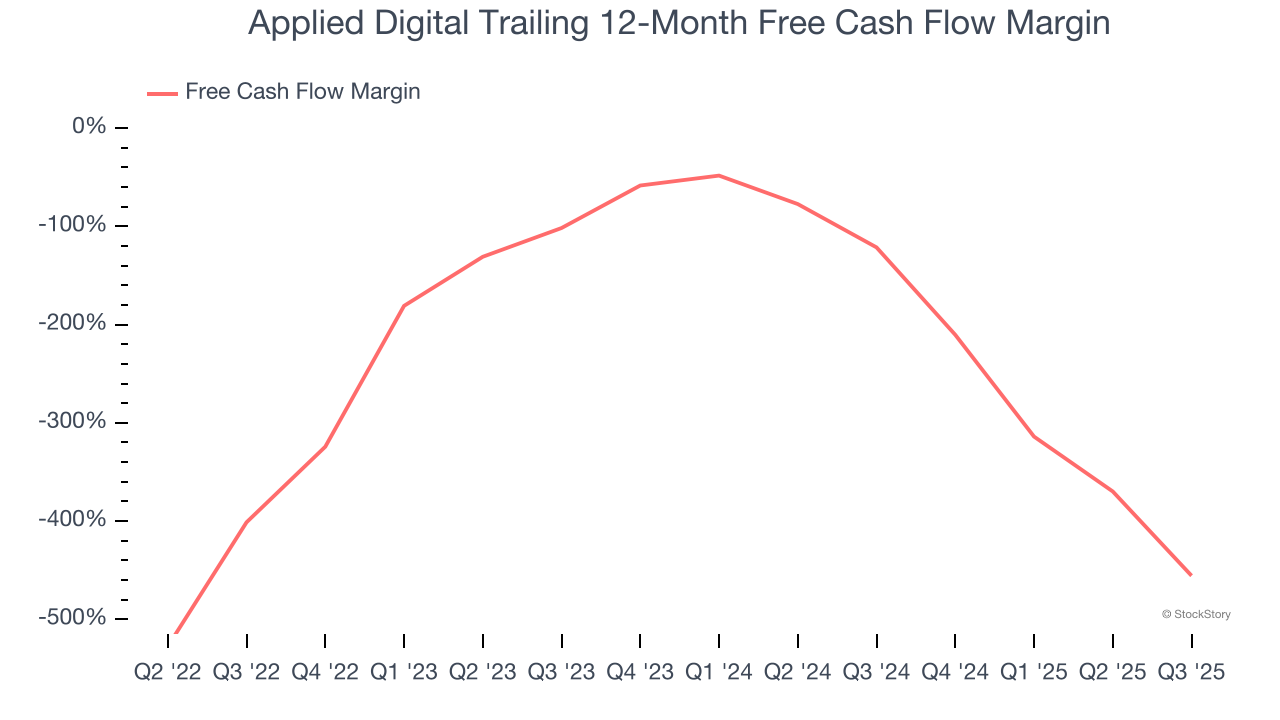

Applied Digital’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 271%, meaning it lit $270.86 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Applied Digital’s margin dropped by 54.3 percentage points during that time. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business.

Applied Digital burned through $331.4 million of cash in Q3, equivalent to a negative 516% margin. The company’s cash burn increased from $130.7 million of lost cash in the same quarter last year.

Key Takeaways from Applied Digital’s Q3 Results

It was good to see Applied Digital beat analysts’ revenue and EPS expectations this quarter. On the other hand, adjusted EBITDA missed and operating margin worsened from the same period last year. Zooming out, we think this was a mixed print. The stock remained flat at $29.00 immediately after reporting.

So do we think Applied Digital is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.