Professional staffing firm Kforce (NYSE: KFRC) announced better-than-expected revenue in Q3 CY2025, but sales fell by 5.9% year on year to $332.6 million. On top of that, next quarter’s revenue guidance ($330 million at the midpoint) was surprisingly good and 3% above what analysts were expecting. Its GAAP profit of $0.63 per share was 12.7% above analysts’ consensus estimates.

Is now the time to buy Kforce? Find out by accessing our full research report, it’s free for active Edge members.

Kforce (KFRC) Q3 CY2025 Highlights:

- Revenue: $332.6 million vs analyst estimates of $327.6 million (5.9% year-on-year decline, 1.5% beat)

- EPS (GAAP): $0.63 vs analyst estimates of $0.56 (12.7% beat)

- Adjusted EBITDA: $19.41 million vs analyst estimates of $18.67 million (5.8% margin, 3.9% beat)

- Revenue Guidance for Q4 CY2025 is $330 million at the midpoint, above analyst estimates of $320.3 million

- Operating Margin: 4.5%, in line with the same quarter last year

- Free Cash Flow Margin: 9.1%, up from 7.8% in the same quarter last year

- Market Capitalization: $447.2 million

Joseph J. Liberatore, President and Chief Executive Officer, said, "We are pleased with our performance in the third quarter where we exceeded both top and bottom line expectations led by better-than-expected results in both our Technology and FA businesses. We are particularly encouraged that, following the early third quarter lows, consultants on assignment in our Technology segment improved throughout the third quarter. Our team has also done a nice job stabilizing and now meaningfully growing our FA business sequentially. The momentum has largely been carried into the fourth quarter, which puts us in a position to expect to deliver sequential billing day growth in both our Technology and FA businesses in the fourth quarter. "

Company Overview

With nearly 60 years of matching skilled professionals with the right opportunities, Kforce (NYSE: KFRC) is a professional staffing company that specializes in placing technology and finance experts with businesses on both temporary and permanent bases.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $1.34 billion in revenue over the past 12 months, Kforce is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels.

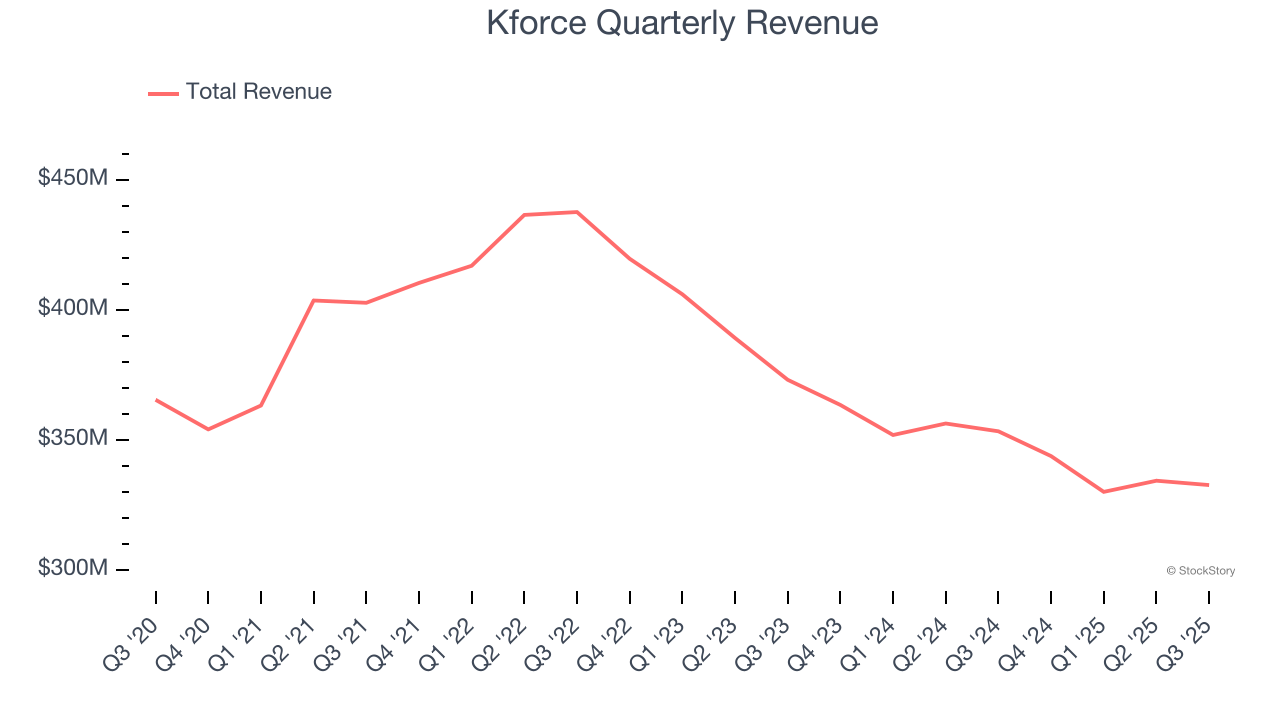

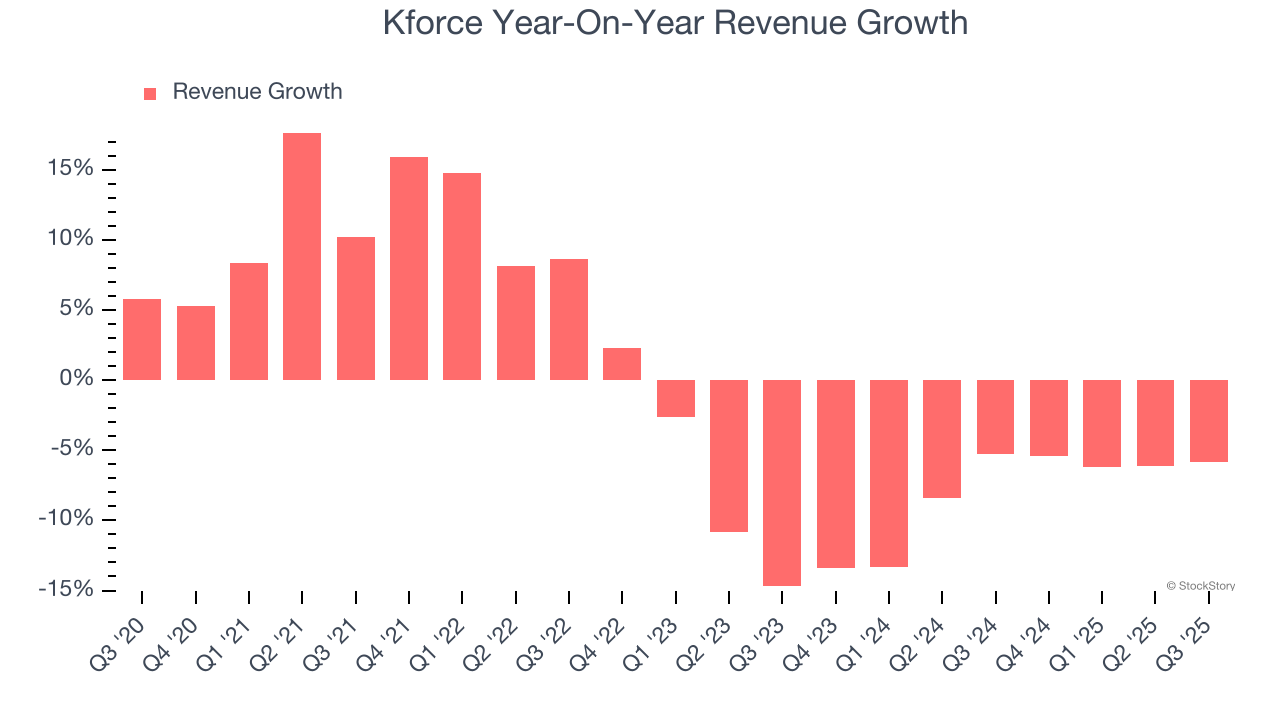

As you can see below, Kforce struggled to increase demand as its $1.34 billion of sales for the trailing 12 months was close to its revenue five years ago. This shows demand was soft, a poor baseline for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Kforce’s recent performance shows its demand remained suppressed as its revenue has declined by 8.1% annually over the last two years.

This quarter, Kforce’s revenue fell by 5.9% year on year to $332.6 million but beat Wall Street’s estimates by 1.5%. Company management is currently guiding for a 4% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 2.8% over the next 12 months. Although this projection is better than its two-year trend, it’s hard to get excited about a company that is struggling with demand.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

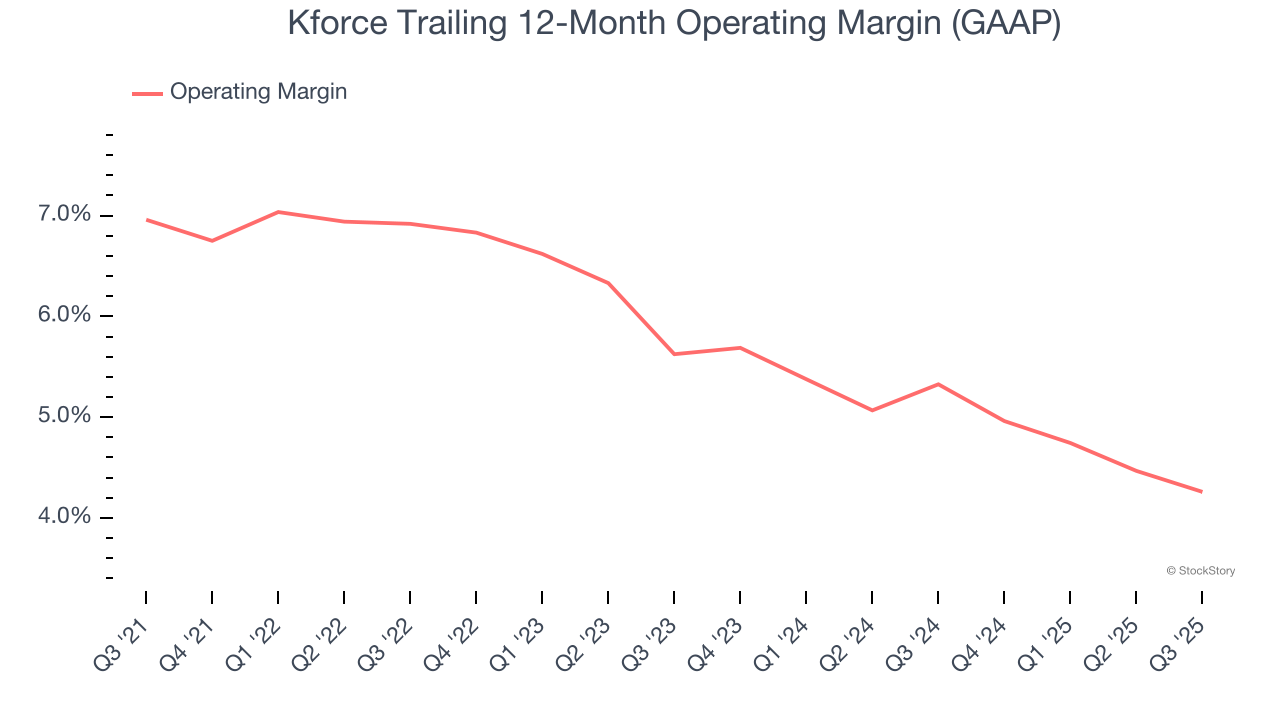

Kforce was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.9% was weak for a business services business.

Analyzing the trend in its profitability, Kforce’s operating margin decreased by 2.7 percentage points over the last five years. Kforce’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Kforce generated an operating margin profit margin of 4.5%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

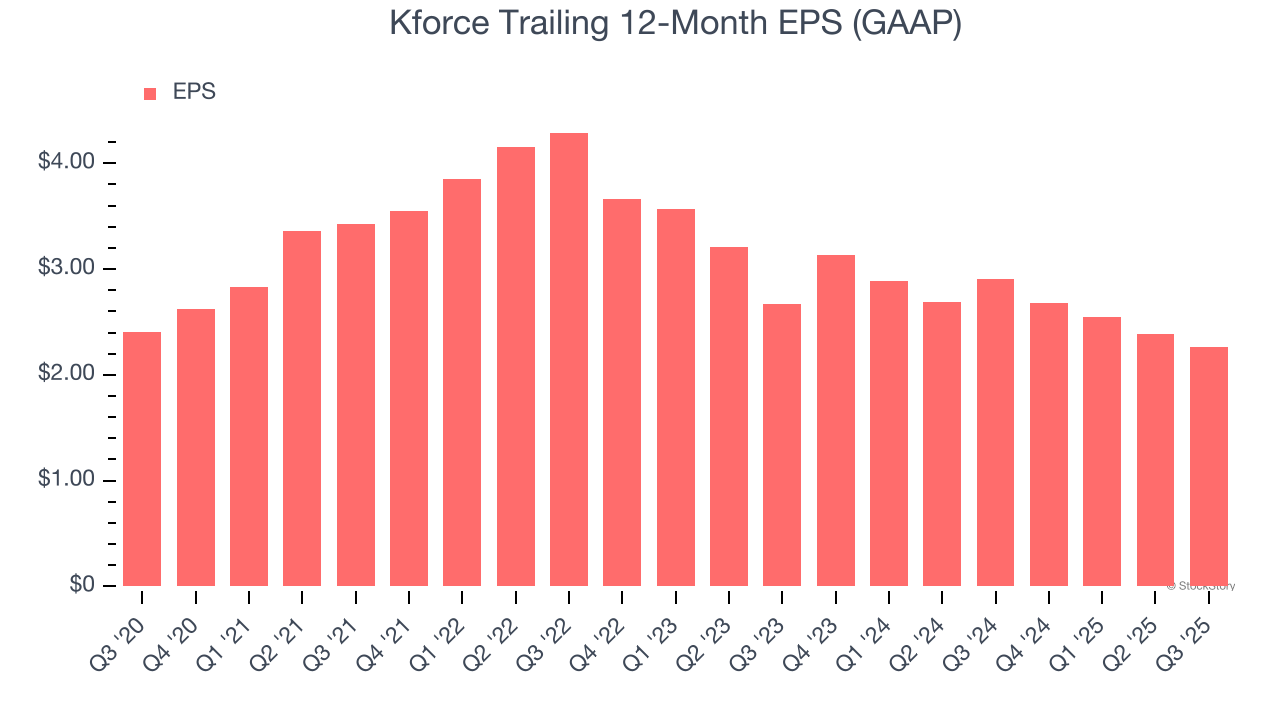

Sadly for Kforce, its EPS declined by 1.3% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences.If the tide turns unexpectedly, Kforce’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Kforce, its two-year annual EPS declines of 7.9% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q3, Kforce reported EPS of $0.63, down from $0.75 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Kforce’s full-year EPS of $2.26 to shrink by 6.6%.

Key Takeaways from Kforce’s Q3 Results

We were impressed by Kforce’s optimistic revenue guidance for next quarter, which blew past analysts’ expectations. We were also glad its EPS outperformed Wall Street’s estimates. Looking ahead, revenue guidance for next quarter also exceeded expectations. Zooming out, we think this was a very good print with some key areas of upside. The stock traded up 14.1% to $28 immediately following the results.

Kforce may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.