Animal health company Zoetis (NYSE: ZTS) met Wall Streets revenue expectations in Q3 CY2025, but sales were flat year on year at $2.4 billion. On the other hand, the company’s full-year revenue guidance of $9.44 billion at the midpoint came in 0.8% below analysts’ estimates. Its non-GAAP profit of $1.70 per share was 4.8% above analysts’ consensus estimates.

Is now the time to buy Zoetis? Find out by accessing our full research report, it’s free for active Edge members.

Zoetis (ZTS) Q3 CY2025 Highlights:

- Revenue: $2.4 billion vs analyst estimates of $2.41 billion (flat year on year, in line)

- Adjusted EPS: $1.70 vs analyst estimates of $1.62 (4.8% beat)

- The company dropped its revenue guidance for the full year to $9.44 billion at the midpoint from $9.53 billion, a 0.9% decrease

- Management slightly raised its full-year Adjusted EPS guidance to $6.35 at the midpoint

- Operating Margin: 37%, down from 38.3% in the same quarter last year

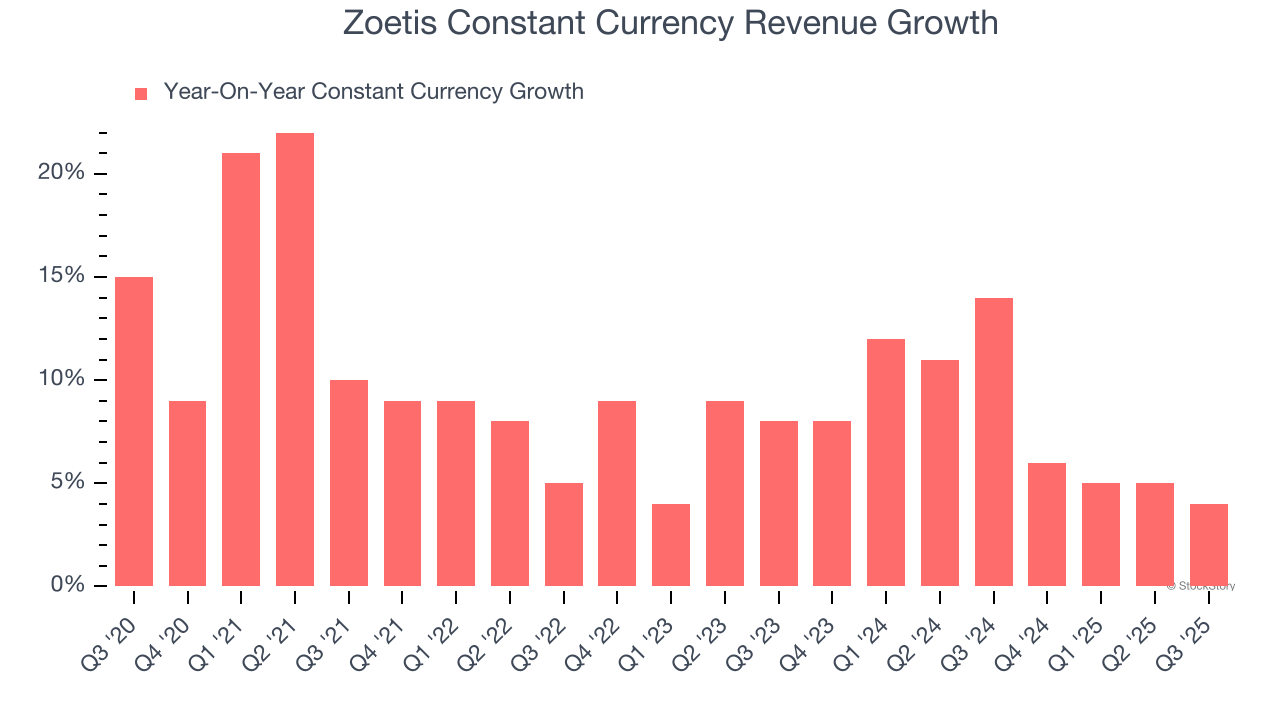

- Constant Currency Revenue rose 4% year on year (14% in the same quarter last year)

- Market Capitalization: $63.97 billion

Company Overview

Originally spun off from Pfizer in 2013 as the world's largest pure-play animal health company, Zoetis (NYSE: ZTS) discovers, develops, and sells medicines, vaccines, diagnostic products, and services for pets and livestock animals worldwide.

Revenue Growth

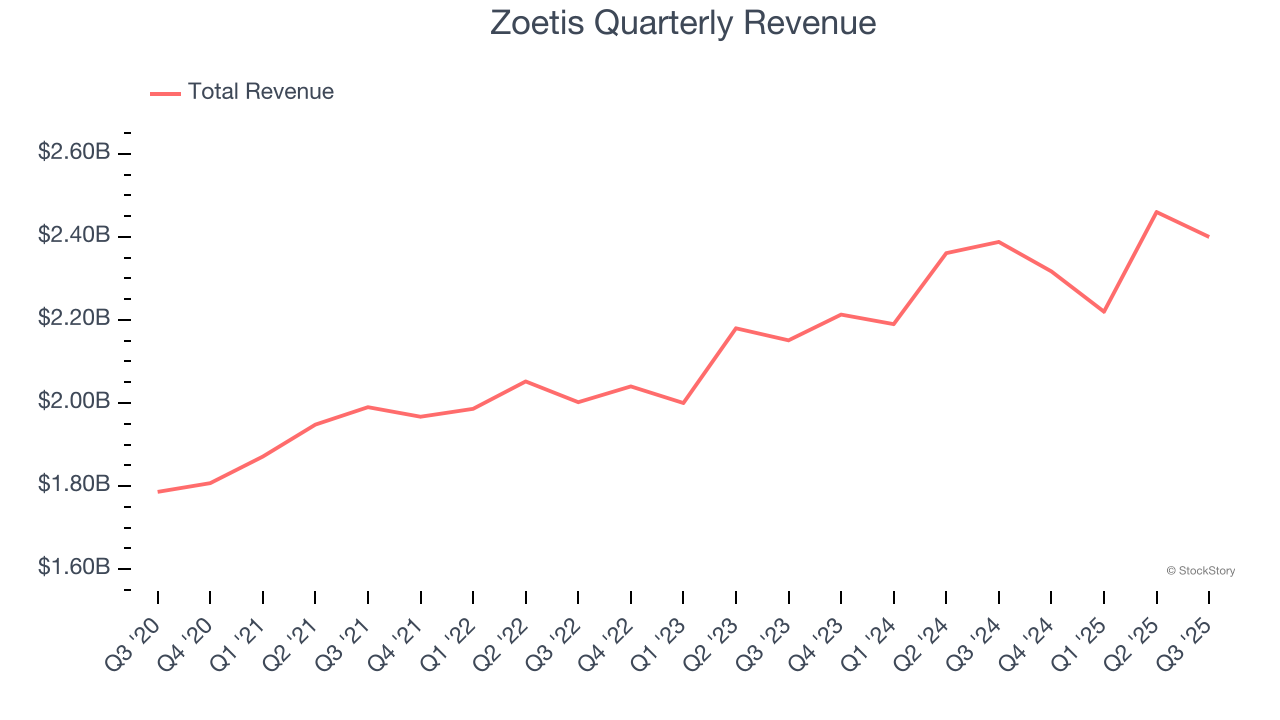

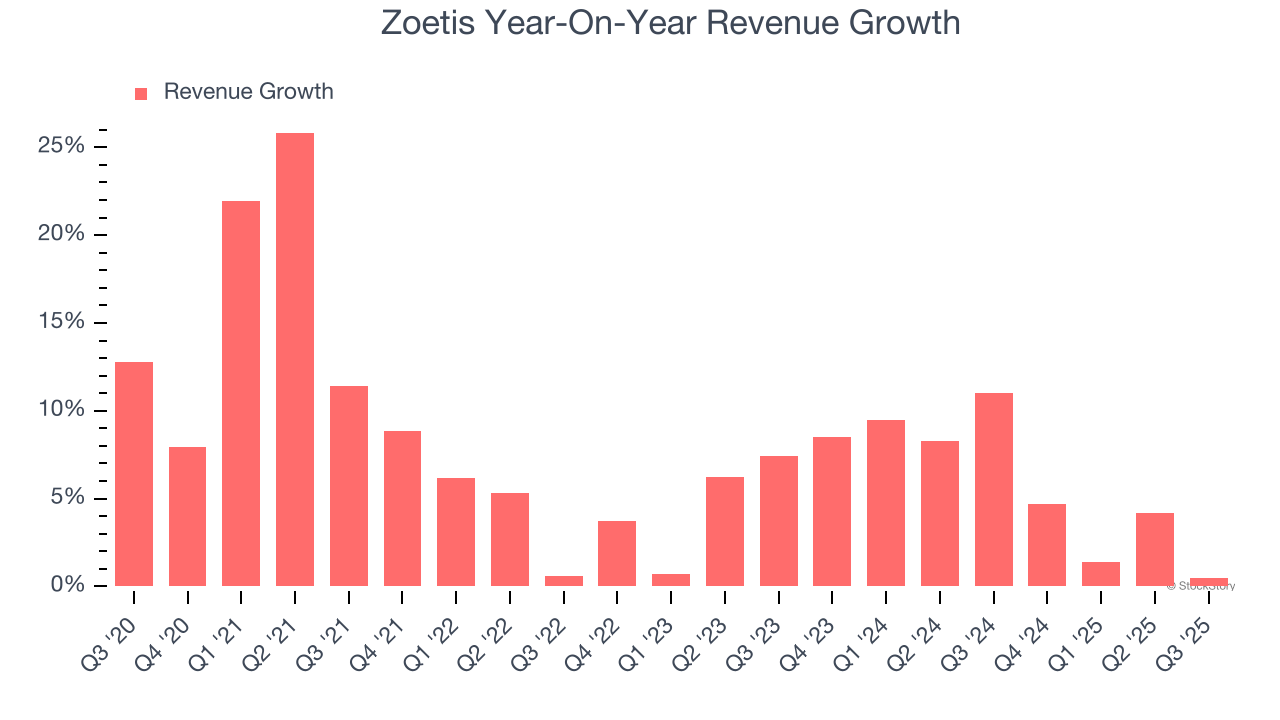

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Zoetis’s 7.5% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Zoetis’s recent performance shows its demand has slowed as its annualized revenue growth of 6% over the last two years was below its five-year trend.

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 8.1% year-on-year growth. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Zoetis.

This quarter, Zoetis’s $2.4 billion of revenue was flat year on year and in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.8% over the next 12 months, similar to its two-year rate. This projection is above the sector average and implies its newer products and services will help support its recent top-line performance.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

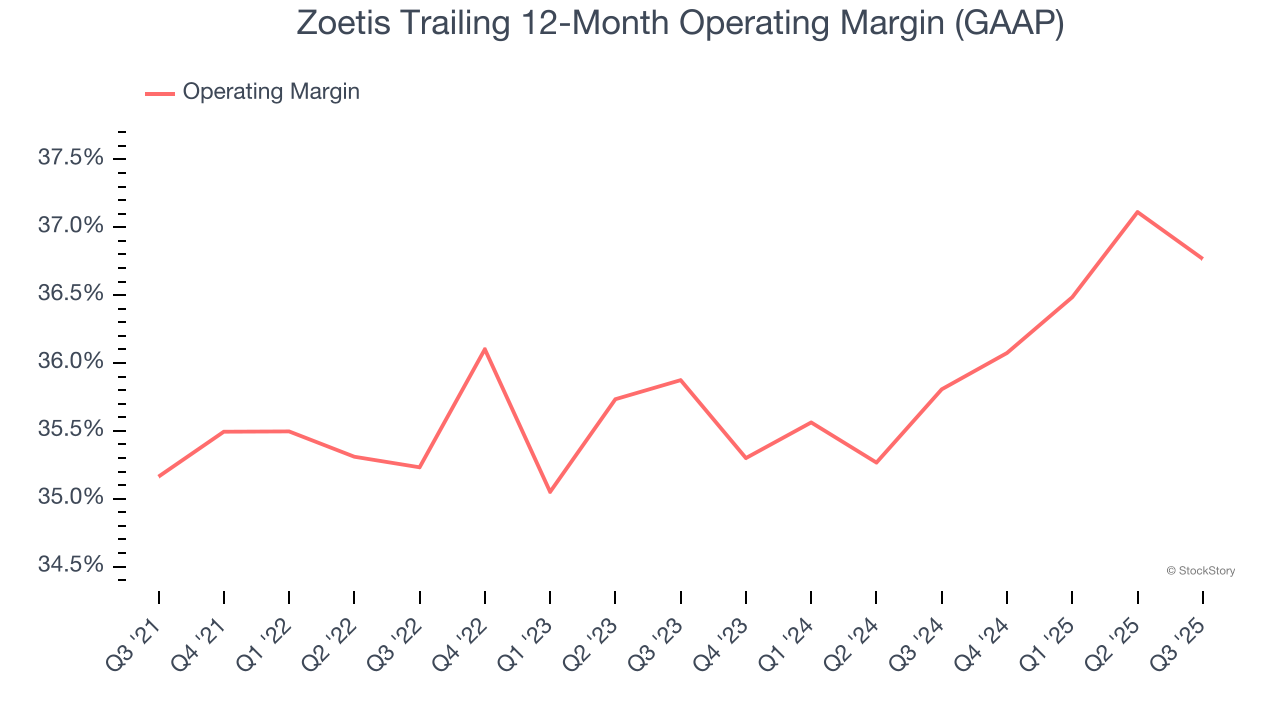

Zoetis has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average operating margin of 35.8%.

Analyzing the trend in its profitability, Zoetis’s operating margin rose by 1.6 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, Zoetis generated an operating margin profit margin of 37%, down 1.4 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

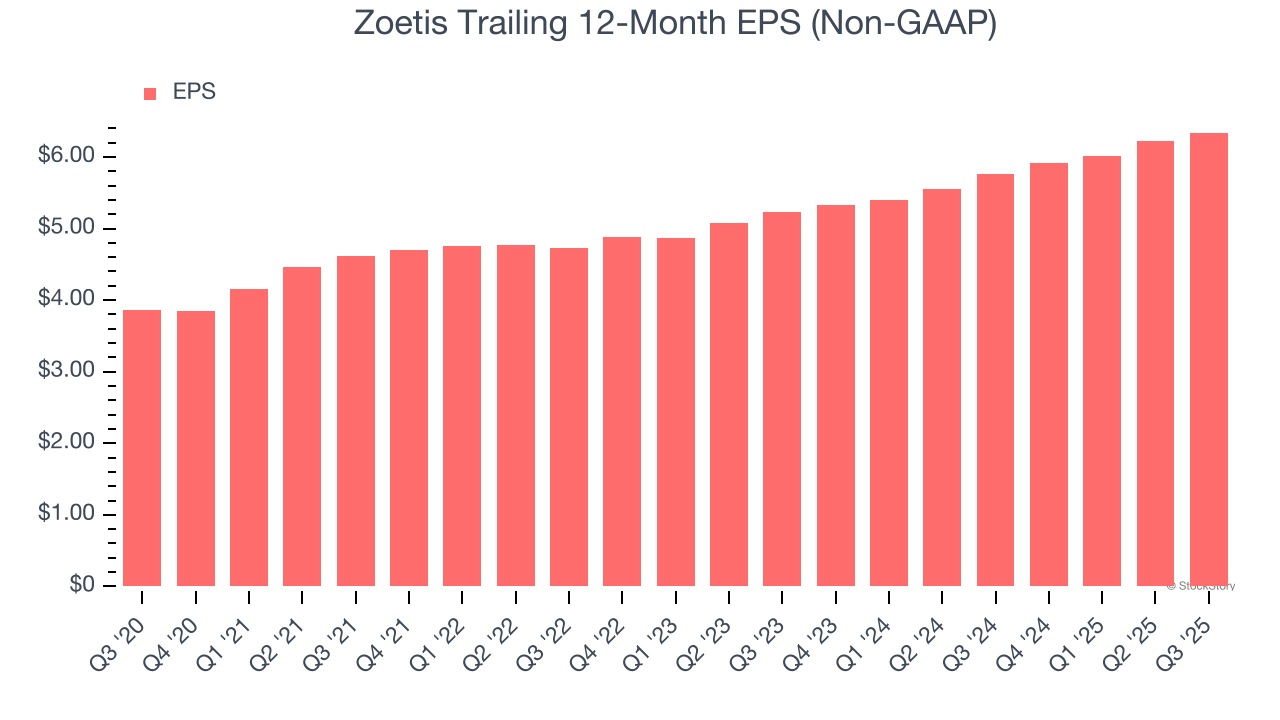

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

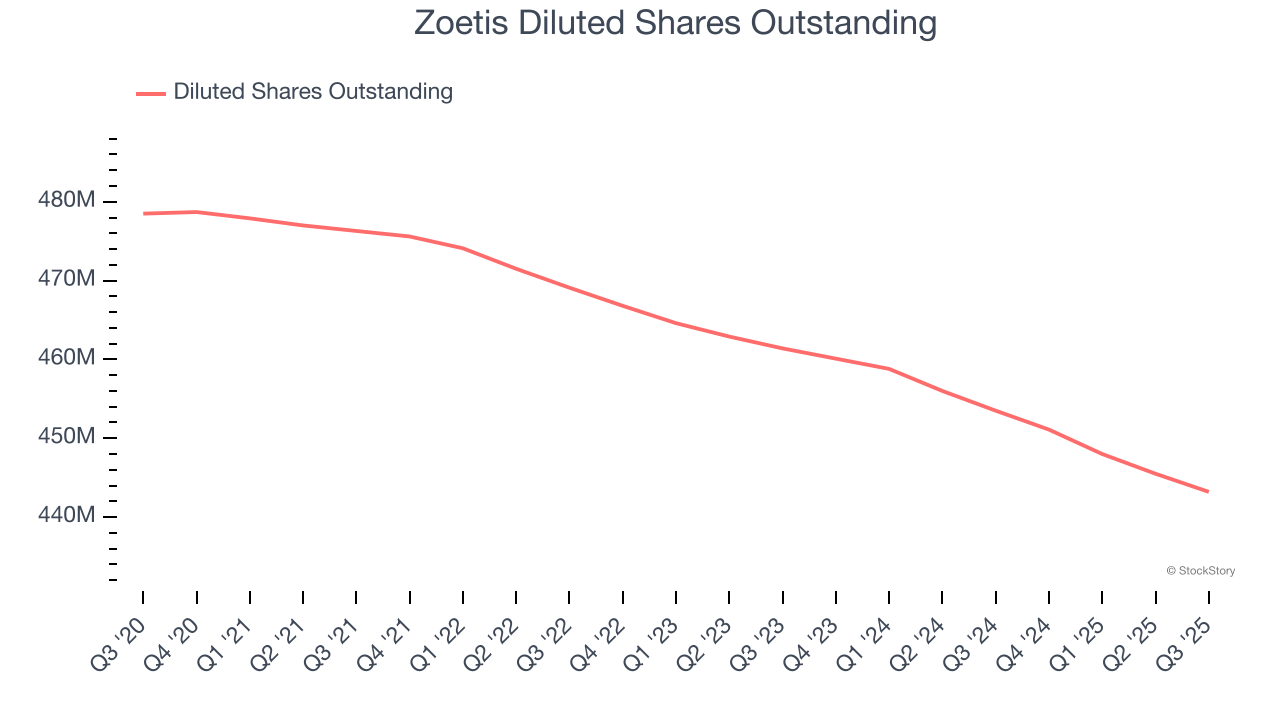

Zoetis’s EPS grew at a remarkable 10.5% compounded annual growth rate over the last five years, higher than its 7.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Zoetis’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Zoetis’s operating margin declined this quarter but expanded by 1.6 percentage points over the last five years. Its share count also shrank by 7.4%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q3, Zoetis reported adjusted EPS of $1.70, up from $1.58 in the same quarter last year. This print beat analysts’ estimates by 4.8%. Over the next 12 months, Wall Street expects Zoetis’s full-year EPS of $6.34 to grow 5.7%.

Key Takeaways from Zoetis’s Q3 Results

We liked how Zoetis beat analysts’ constant currency revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed Wall Street’s estimates after being lowered. Zooming out, we think this was a mixed quarter. Investors were likely hoping for more, and shares traded down 9.3% to $131 immediately after reporting.

Is Zoetis an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.