IT solutions provider ePlus (NASDAQ: PLUS) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 18.2% year on year to $608.8 million. Its non-GAAP profit of $1.53 per share was 61.9% above analysts’ consensus estimates.

Is now the time to buy ePlus? Find out by accessing our full research report, it’s free for active Edge members.

ePlus (PLUS) Q3 CY2025 Highlights:

- Revenue: $608.8 million vs analyst estimates of $518.3 million (18.2% year-on-year growth, 17.5% beat)

- Adjusted EPS: $1.53 vs analyst estimates of $0.95 (61.9% beat)

- Adjusted EBITDA: $58.7 billion vs analyst estimates of $38.3 million (9,642% margin, significant beat)

- Operating Margin: 8%, in line with the same quarter last year

- Market Capitalization: $1.95 billion

"Fiscal 2026 is off to a very strong start as the strength from the first quarter carried into the second quarter, with net sales growing 23.4% and diluted EPS increasing almost 63%. This quarter marks an important milestone for ePlus, as we posted quarterly gross billings exceeding $1 billion for the first time in our history. Our second-quarter performance reflects steady progress in executing our strategic priorities as we reported double-digit growth in key financial metrics: revenue, gross profit, net earnings from continuing operations, Adjusted EBITDA and EPS," commented Mark Marron, president and CEO of ePlus.

Company Overview

Starting as a financing company in 1990 before evolving into a full-service technology provider, ePlus (NASDAQ: PLUS) provides comprehensive IT solutions, professional services, and financing options to help organizations optimize their technology infrastructure and supply chain processes.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $2.26 billion in revenue over the past 12 months, ePlus is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

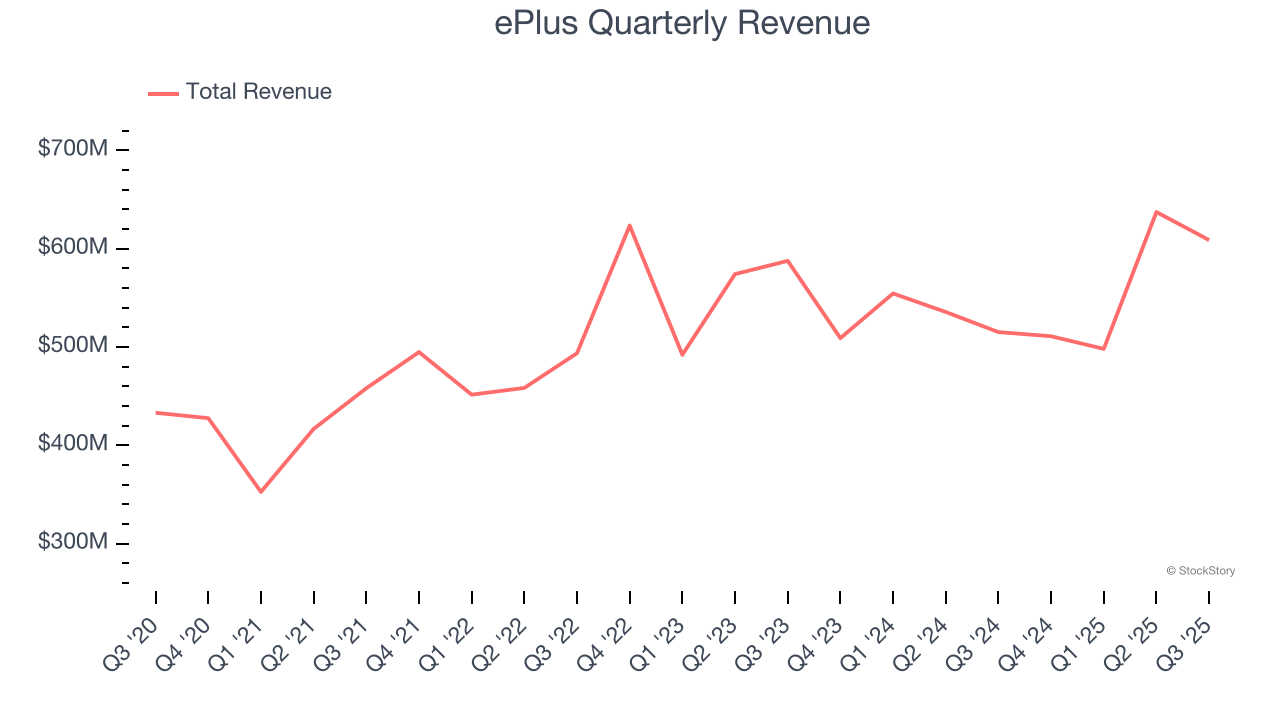

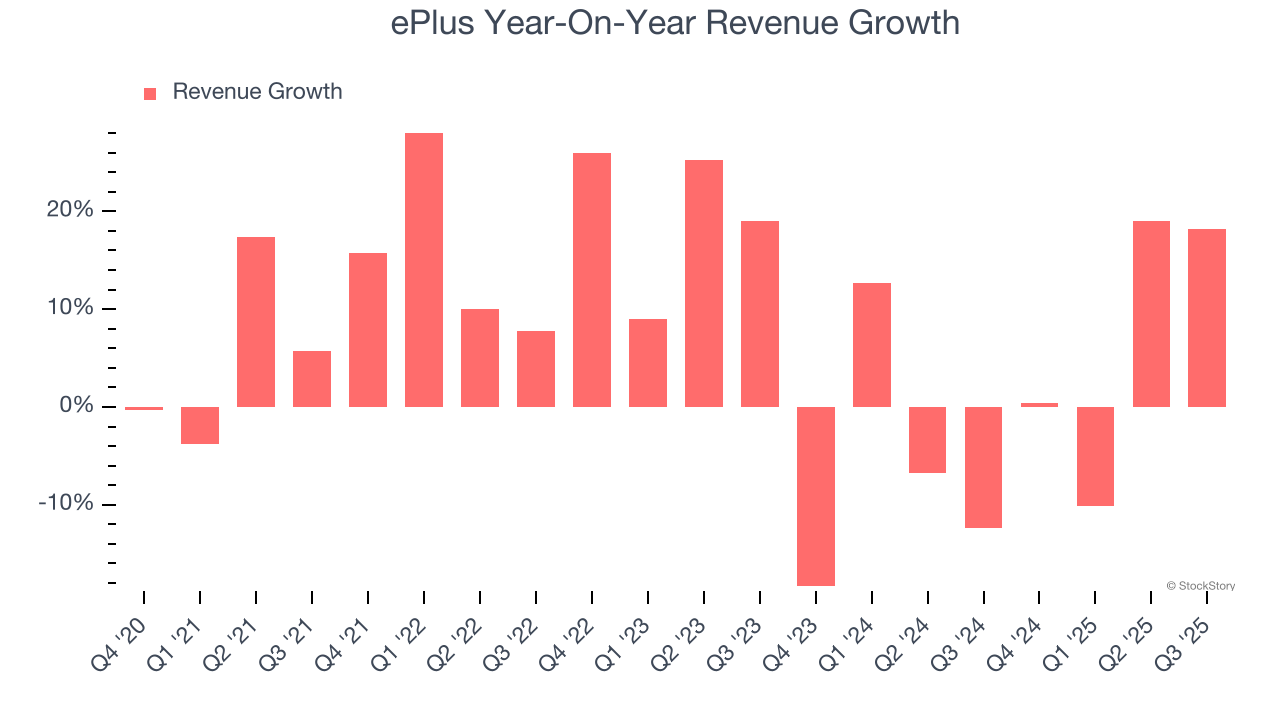

As you can see below, ePlus’s sales grew at a solid 7.3% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. ePlus’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, ePlus reported year-on-year revenue growth of 18.2%, and its $608.8 million of revenue exceeded Wall Street’s estimates by 17.5%.

Looking ahead, sell-side analysts expect revenue to decline by 6.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

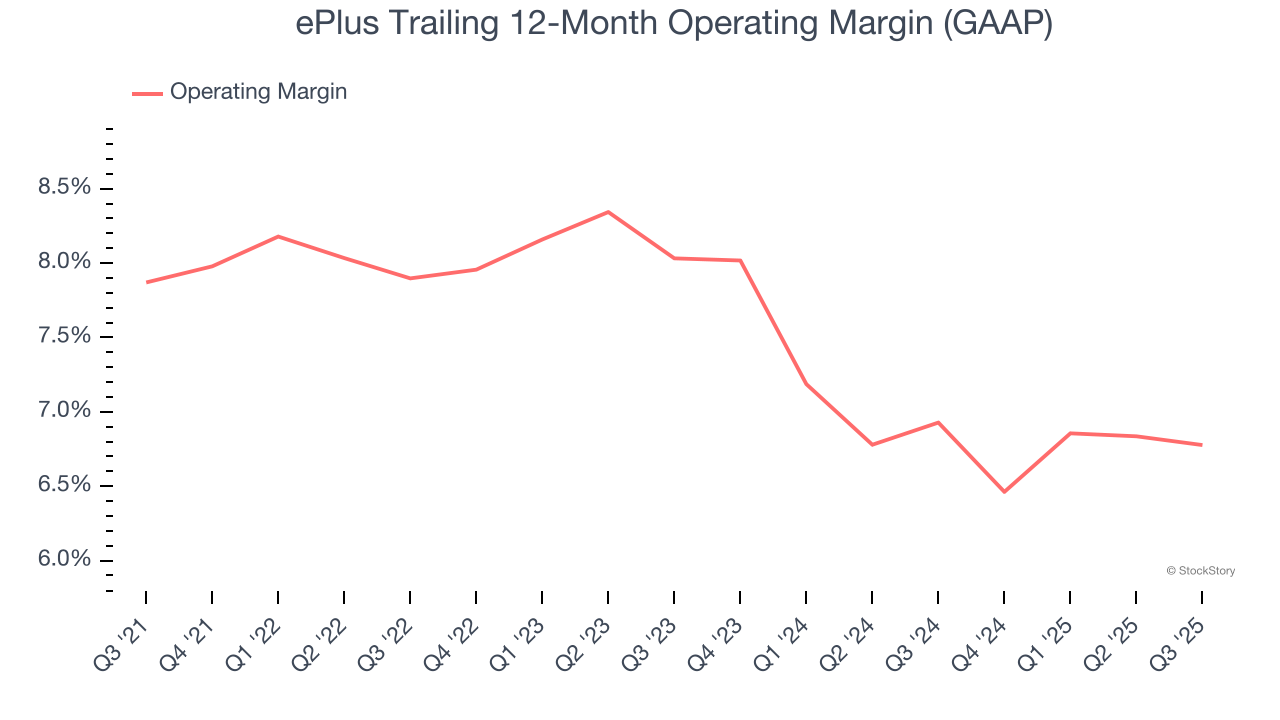

ePlus was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.5% was weak for a business services business.

Looking at the trend in its profitability, ePlus’s operating margin decreased by 1.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. ePlus’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, ePlus generated an operating margin profit margin of 8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

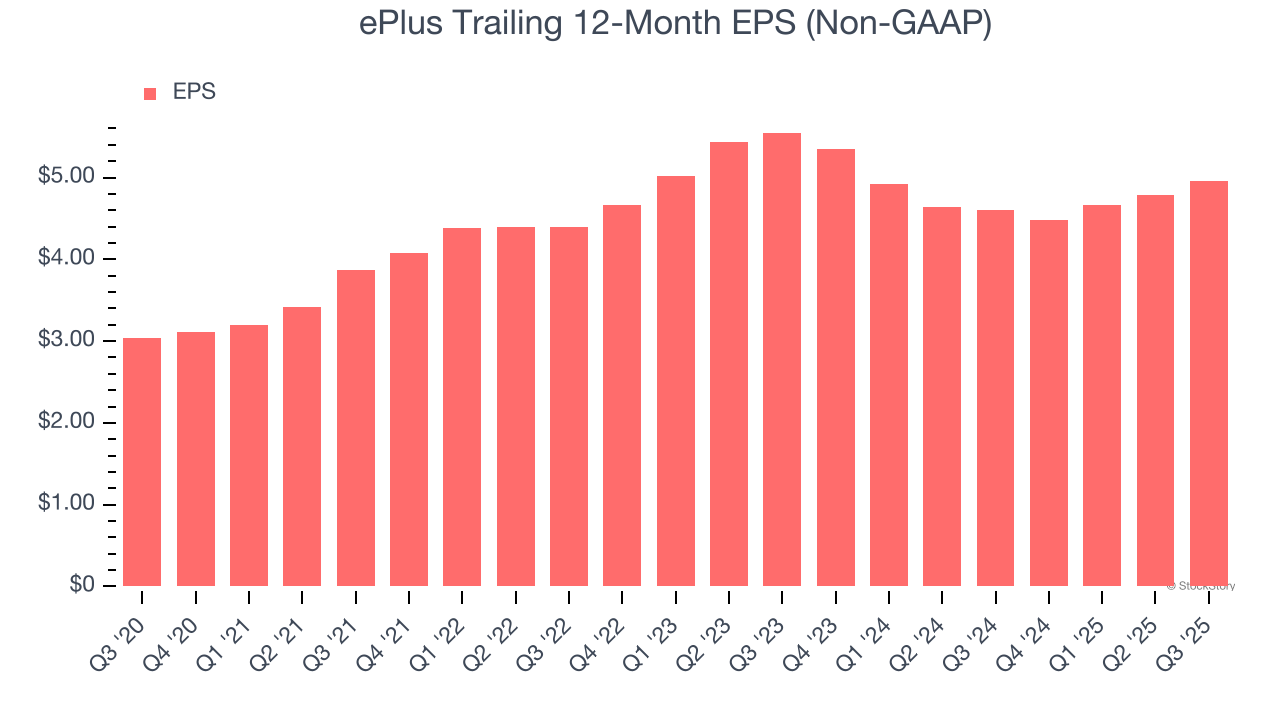

ePlus’s EPS grew at a solid 10.3% compounded annual growth rate over the last five years, higher than its 7.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

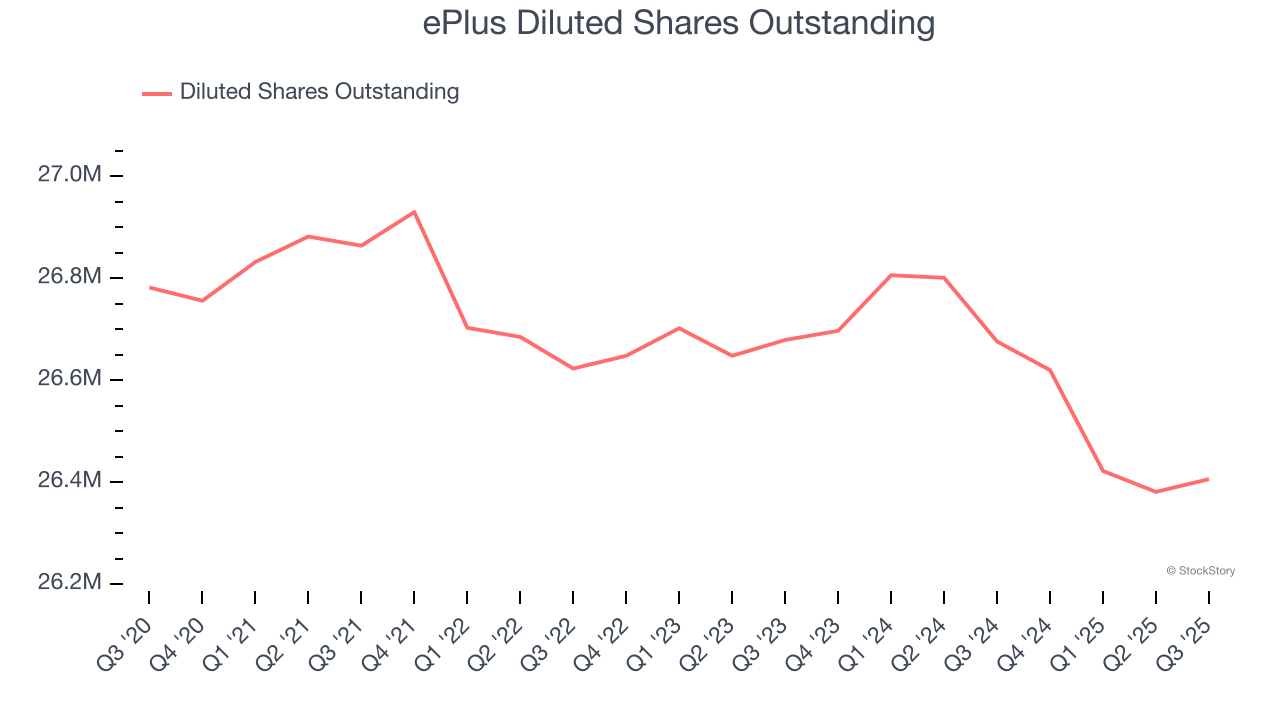

We can take a deeper look into ePlus’s earnings to better understand the drivers of its performance. A five-year view shows that ePlus has repurchased its stock, shrinking its share count by 1.4%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For ePlus, its two-year annual EPS declines of 5.5% mark a reversal from its (seemingly) healthy five-year trend. We hope ePlus can return to earnings growth in the future.

In Q3, ePlus reported adjusted EPS of $1.53, up from $1.36 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects ePlus’s full-year EPS of $4.96 to shrink by 16.4%.

Key Takeaways from ePlus’s Q3 Results

It was good to see ePlus beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 7.6% to $79 immediately following the results.

ePlus had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.