Main Street Capital has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 8.8% to $62.80 per share while the index has gained 13.6%.

Is now the time to buy Main Street Capital, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is Main Street Capital Not Exciting?

We don't have much confidence in Main Street Capital. Here are two reasons there are better opportunities than MAIN and a stock we'd rather own.

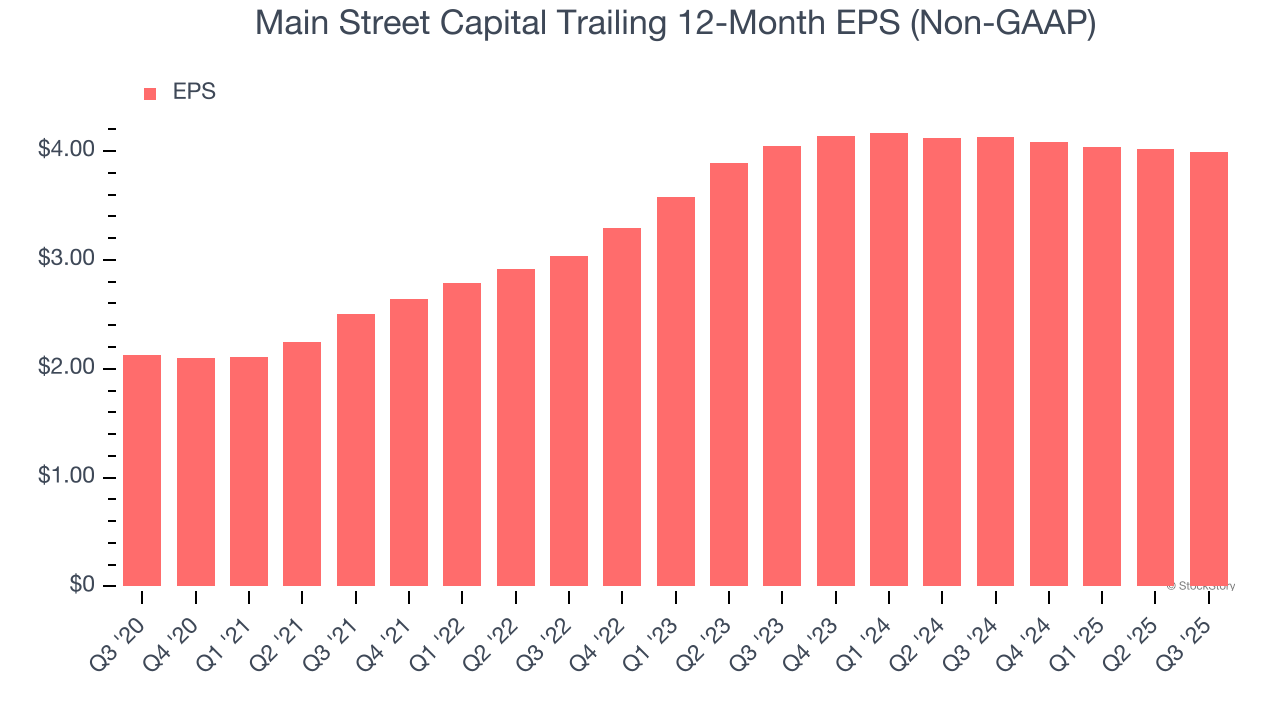

1. EPS Growth Has Stalled Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Main Street Capital’s flat EPS over the last two years was worse than its 7.6% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

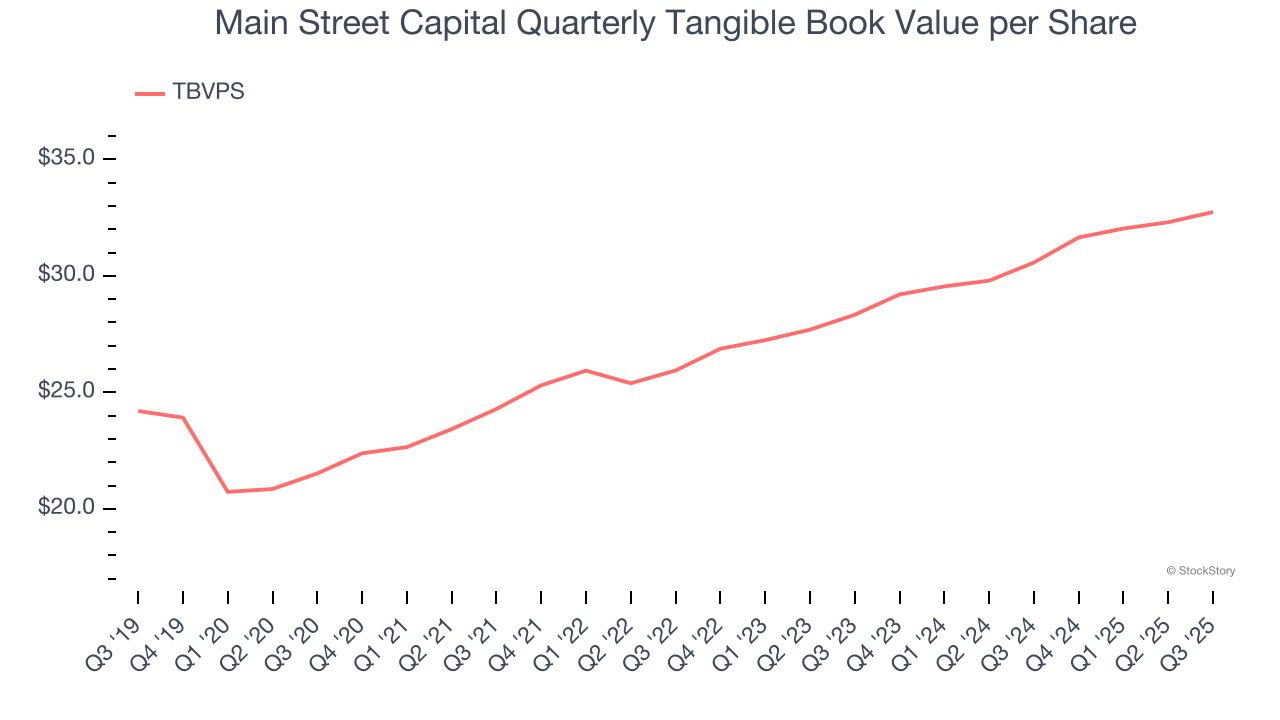

2. Substandard TBVPS Growth Indicates Limited Asset Expansion

We consider tangible book value per share (TBVPS) an important metric for financial firms. TBVPS represents the real, liquid net worth per share of a company, excluding intangible assets that have debatable value upon liquidation.

Although Main Street Capital’s TBVPS increased by 8.8% annually over the last five years, growth has recently decelerated a bit to a mediocre 7.5% over the past two years (from $28.33 to $32.74 per share).

Final Judgment

Main Street Capital isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 15.9× forward P/E (or $62.80 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at our favorite semiconductor picks and shovels play.

Stocks We Like More Than Main Street Capital

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.