The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how healthcare technology stocks fared in Q3, starting with Tandem Diabetes (NASDAQ: TNDM).

The 7 healthcare technology stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 5% while next quarter’s revenue guidance was 0.7% below.

In light of this news, share prices of the companies have held steady as they are up 1.8% on average since the latest earnings results.

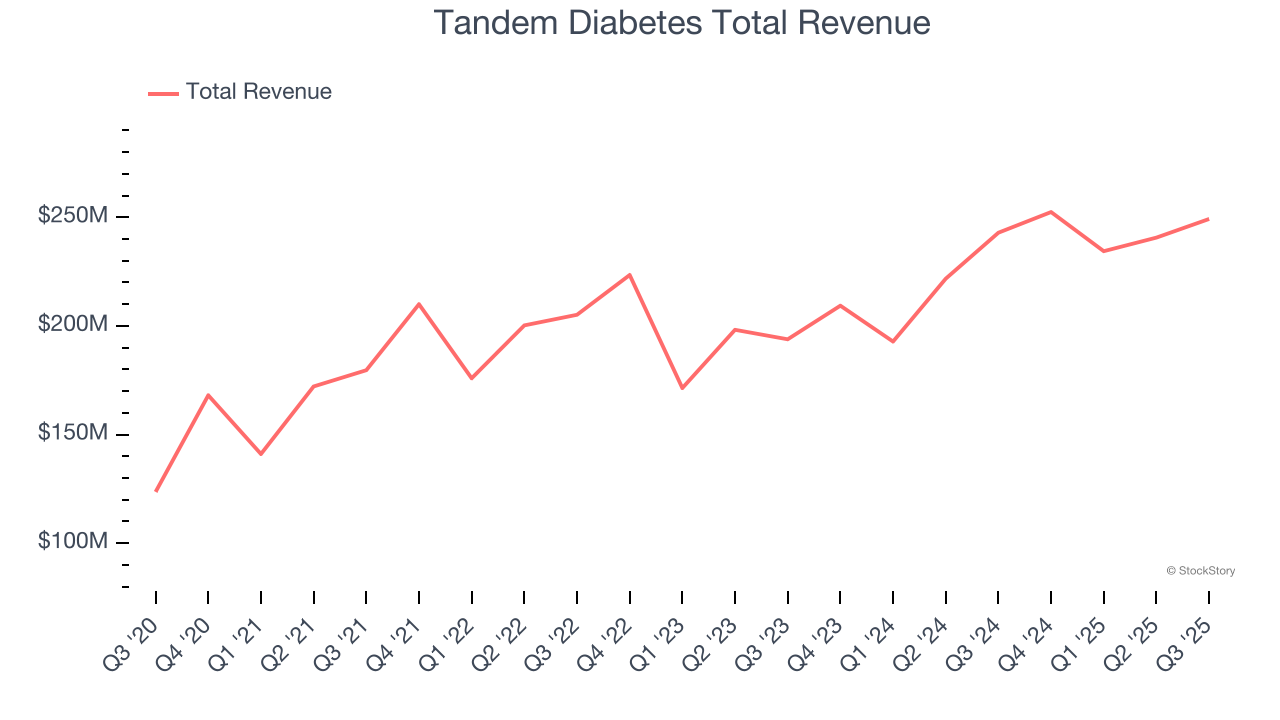

Tandem Diabetes (NASDAQ: TNDM)

With technology that automatically adjusts insulin delivery based on continuous glucose monitoring data, Tandem Diabetes Care (NASDAQ: TNDM) develops and manufactures automated insulin delivery systems that help people with diabetes manage their blood glucose levels.

Tandem Diabetes reported revenues of $249.3 million, up 2.6% year on year. This print exceeded analysts’ expectations by 5.4%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ revenue estimates and a beat of analysts’ EPS estimates.

Interestingly, the stock is up 61.7% since reporting and currently trades at $21.56.

Is now the time to buy Tandem Diabetes? Access our full analysis of the earnings results here, it’s free for active Edge members.

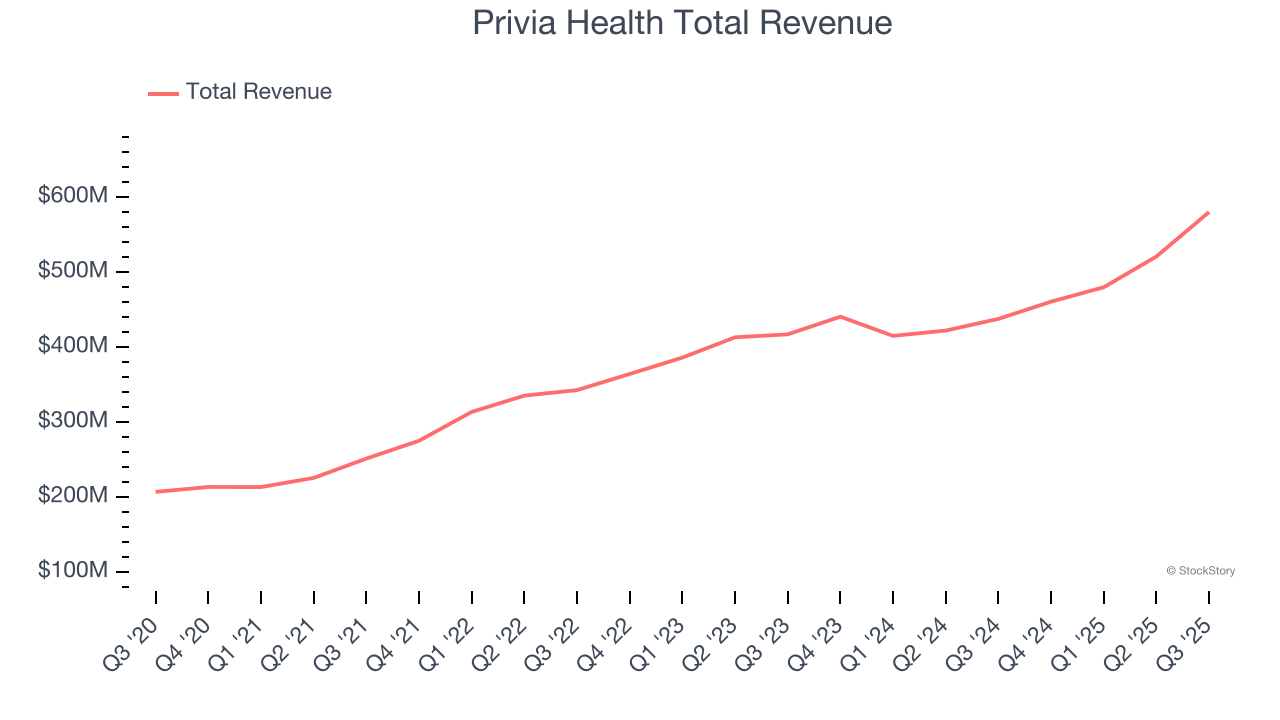

Best Q3: Privia Health (NASDAQ: PRVA)

Operating in 13 states and the District of Columbia with over 4,300 providers serving more than 4.8 million patients, Privia Health (NASDAQ: PRVA) is a technology-driven company that helps physicians optimize their practices, improve patient experiences, and transition to value-based care models.

Privia Health reported revenues of $580.4 million, up 32.5% year on year, outperforming analysts’ expectations by 16.6%. The business had a stunning quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ revenue estimates.

Privia Health achieved the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 4.2% since reporting. It currently trades at $23.98.

Is now the time to buy Privia Health? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Astrana Health (NASDAQ: ASTH)

Formerly known as Apollo Medical Holdings until early 2024, Astrana Health (NASDAQ: ASTH) operates a technology-powered healthcare platform that enables physicians to deliver coordinated care while successfully participating in value-based payment models.

Astrana Health reported revenues of $956 million, up 99.7% year on year, exceeding analysts’ expectations by 0.6%. Still, it was a softer quarter as it posted a significant miss of analysts’ EPS estimates and full-year revenue guidance missing analysts’ expectations.

Astrana Health delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. As expected, the stock is down 29.8% since the results and currently trades at $23.42.

Read our full analysis of Astrana Health’s results here.

Hims & Hers Health (NYSE: HIMS)

Originally launched with a focus on stigmatized conditions like hair loss and sexual health, Hims & Hers Health (NYSE: HIMS) operates a consumer-focused telehealth platform that connects patients with healthcare providers for prescriptions and wellness products.

Hims & Hers Health reported revenues of $599 million, up 49.2% year on year. This number beat analysts’ expectations by 3.3%. Zooming out, it was a mixed quarter as it also recorded a beat of analysts’ EPS estimates but revenue guidance for next quarter missing analysts’ expectations significantly.

Hims & Hers Health pulled off the highest full-year guidance raise among its peers. The company added 32,000 customers to reach a total of 2.47 million. The stock is down 21.8% since reporting and currently trades at $34.64.

Read our full, actionable report on Hims & Hers Health here, it’s free for active Edge members.

GoodRx (NASDAQ: GDRX)

Started in 2011 to tackle the problem of high prescription drug costs in America, GoodRx (NASDAQ: GDRX) operates a digital platform that helps consumers find lower prices on prescription medications through price comparison tools and discount codes.

GoodRx reported revenues of $196 million, flat year on year. This print topped analysts’ expectations by 1.1%. Taking a step back, it was a slower quarter as it logged a significant miss of analysts’ EPS estimates and a slight miss of analysts’ customer base estimates.

The company lost 300,000 customers and ended up with a total of 5.4 million. The stock is down 16.2% since reporting and currently trades at $2.74.

Read our full, actionable report on GoodRx here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.