LPL Financial has been treading water for the past six months, recording a small return of 3.4% while holding steady at $373.35. The stock also fell short of the S&P 500’s 13.3% gain during that period.

Given the weaker price action, is now a good time to buy LPLA? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free for active Edge members.

Why Is LPLA a Good Business?

As the nation's largest independent broker-dealer with no proprietary products of its own, LPL Financial (NASDAQ: LPLA) provides technology, compliance, and business support services to independent financial advisors and institutions who manage investments for retail clients.

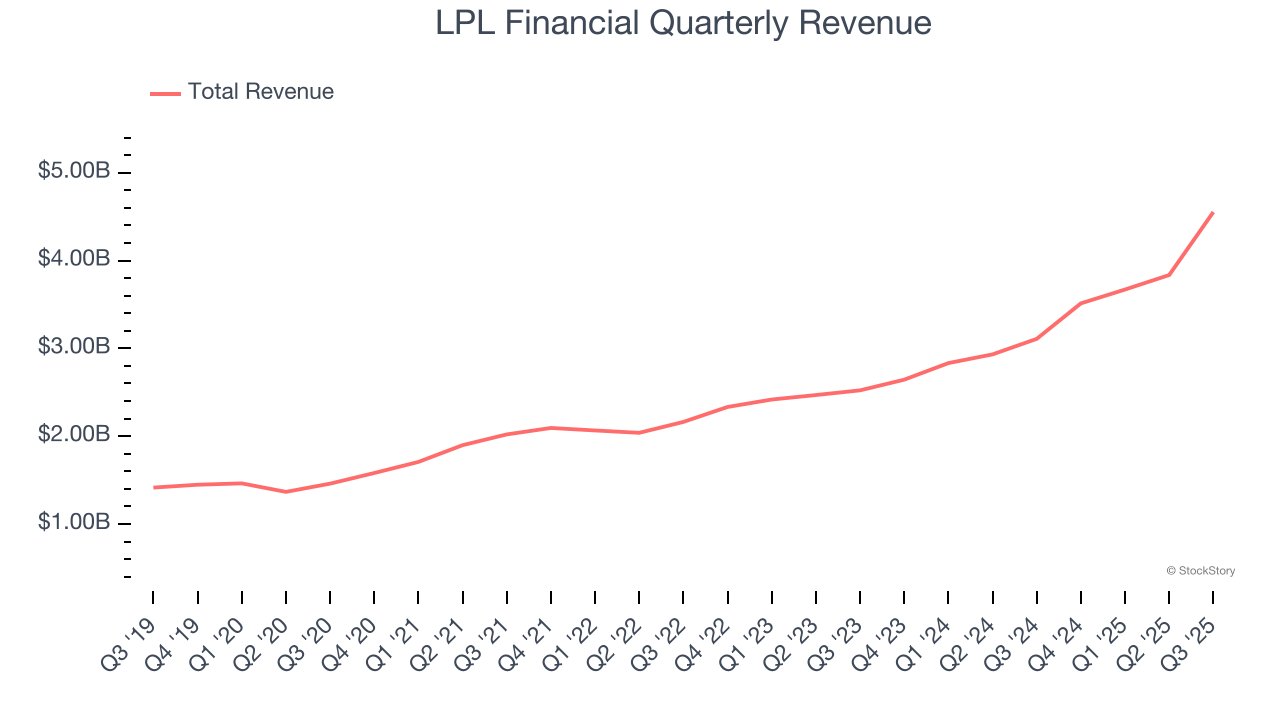

1. Skyrocketing Revenue Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Luckily, LPL Financial’s revenue grew at an exceptional 22.1% compounded annual growth rate over the last five years. Its growth surpassed the average financials company and shows its offerings resonate with customers.

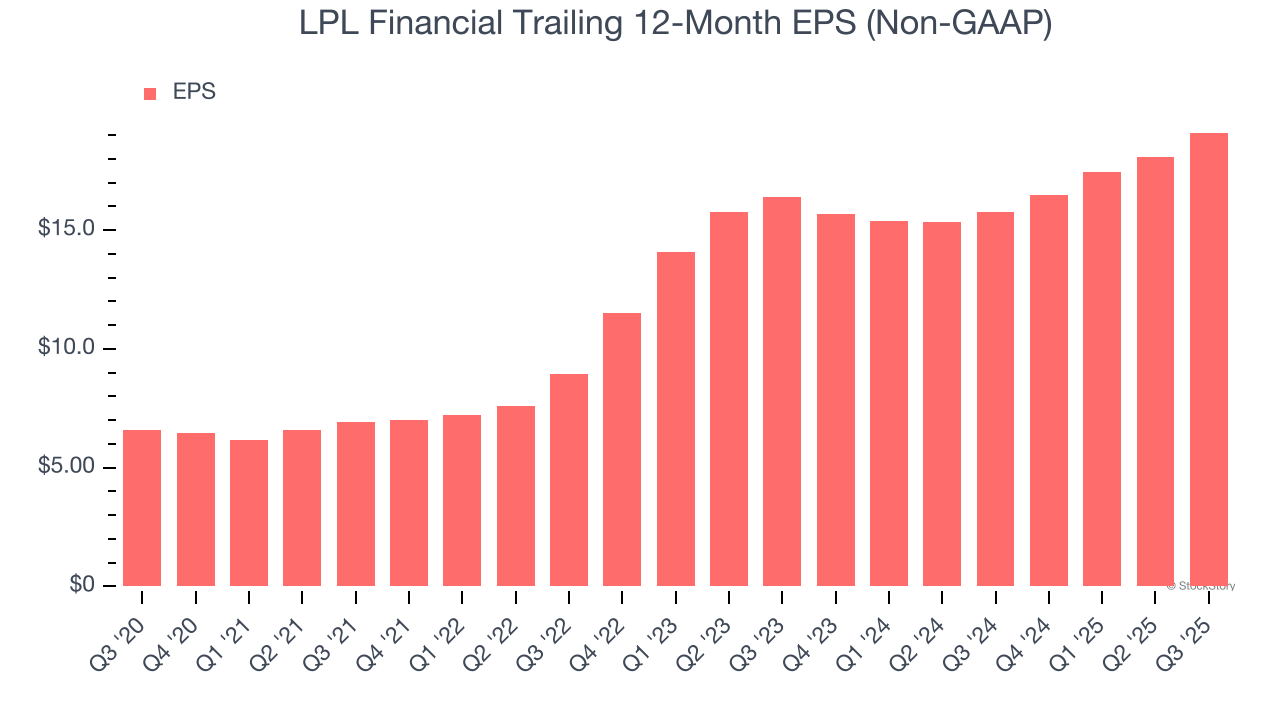

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

LPL Financial’s spectacular 23.7% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

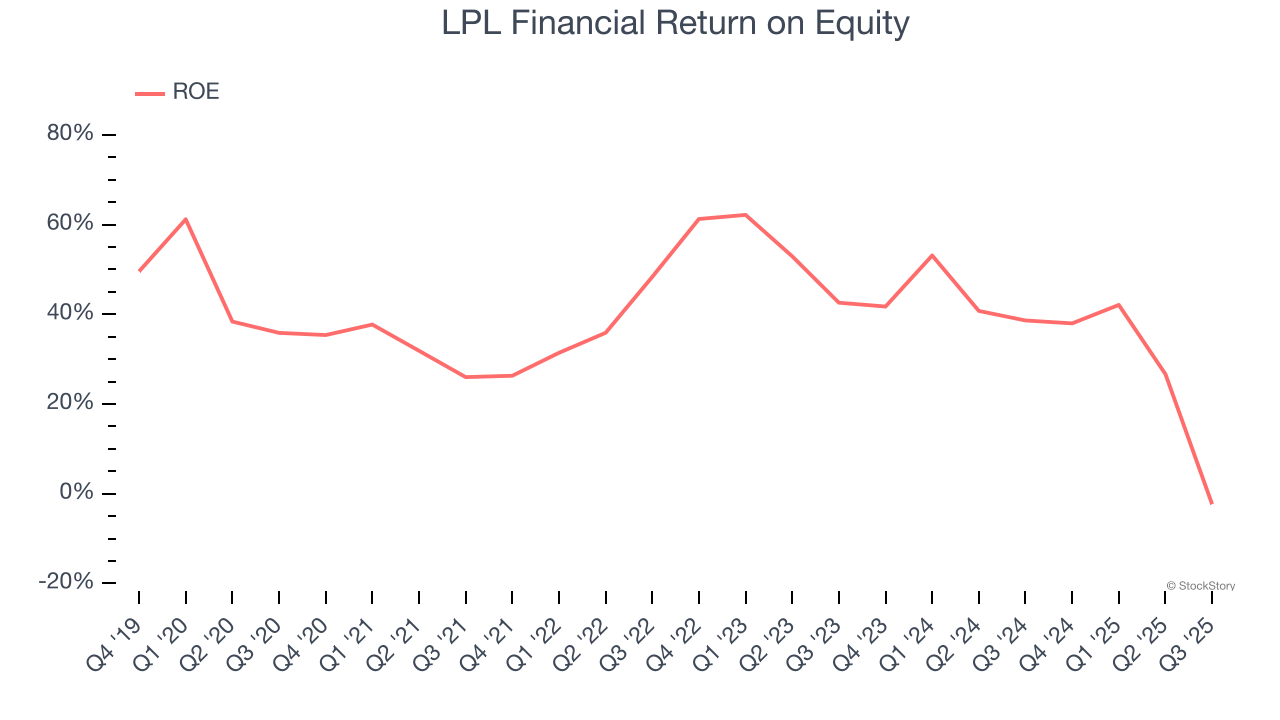

3. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, LPL Financial has averaged an ROE of 38.5%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows LPL Financial has a strong competitive moat.

Final Judgment

These are just a few reasons why LPL Financial ranks near the top of our list. With its shares lagging the market recently, the stock trades at 16.7× forward P/E (or $373.35 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free for active Edge members.

Stocks We Like Even More Than LPL Financial

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.