Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Brookdale (NYSE: BKD) and its peers.

The senior health, home care, and hospice care industries provide essential services to aging populations and patients with chronic or terminal conditions. These companies benefit from stable, recurring revenue driven by relationships with patients and families that can extend many months or even years. However, the labor-intensive nature of the business makes it vulnerable to rising labor costs and staffing shortages, while profitability is constrained by reimbursement rates from Medicare, Medicaid, and private insurers. Looking ahead, the industry is positioned for tailwinds from an aging population, increasing chronic disease prevalence, and a growing preference for personalized in-home care. Advancements in remote monitoring and telehealth are expected to enhance efficiency and care delivery. However, headwinds such as labor shortages, wage inflation, and regulatory uncertainty around reimbursement could pose challenges. Investments in digitization and technology-driven care will be critical for long-term success.

The 7 senior health, home health & hospice stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.8%.

While some senior health, home health & hospice stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.7% since the latest earnings results.

Brookdale (NYSE: BKD)

Founded in 1978, Brookdale Senior Living (NYSE: BKD) offers independent living, assisted living, Alzheimer's and dementia care, rehabilitation, and skilled nursing care.

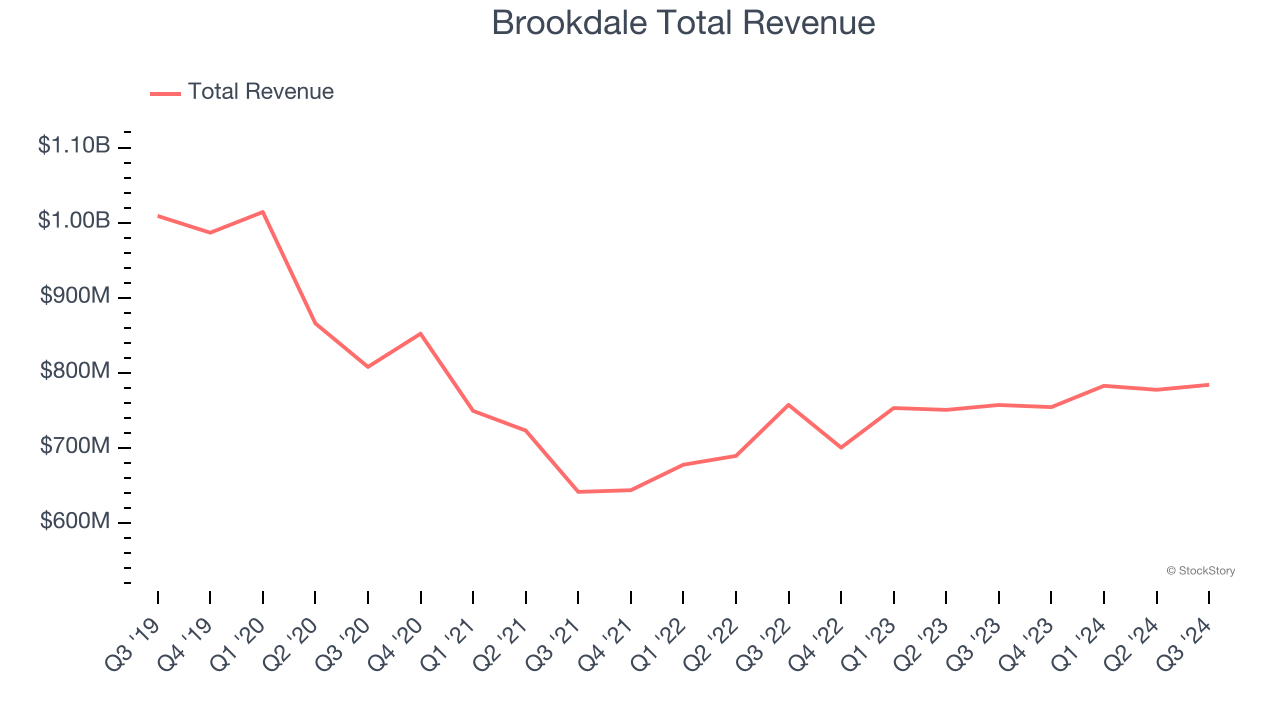

Brookdale reported revenues of $784.2 million, up 3.5% year on year. This print was in line with analysts’ expectations, but overall, it was a softer quarter for the company with a significant miss of analysts’ EPS estimates and EBITDA guidance for next quarter missing analysts’ expectations.

"At Brookdale, we are deeply committed to creating value for our shareholders by providing high-quality care and services to our residents, ensuring that we are an attractive place for employees to work, and improving both our capital structure and capital allocation," said Lucinda ("Cindy") Baier, Brookdale's President and CEO.

The stock is down 17.4% since reporting and currently trades at $5.34.

Read our full report on Brookdale here, it’s free.

Best Q3: Option Care Health (NASDAQ: OPCH)

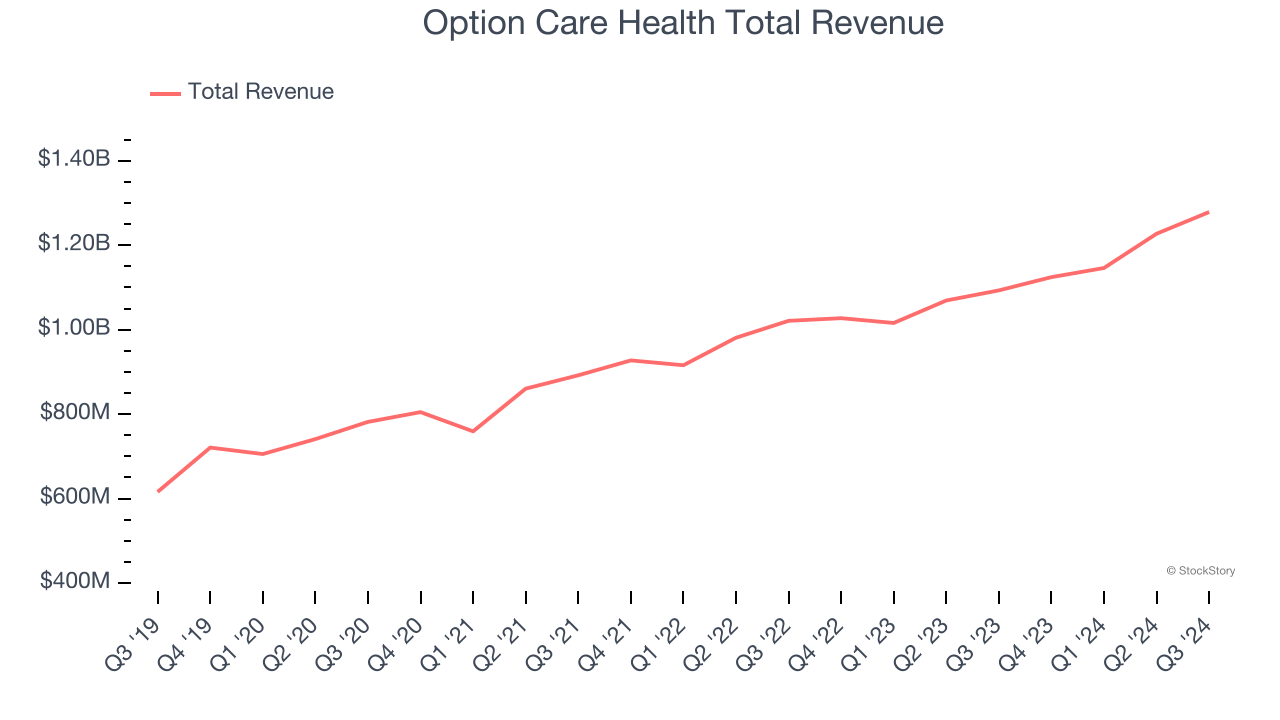

Founded in 1979, Option Care Health (NASDAQ: OPCH) delivers home and alternate site infusion therapy services, specializing in the administration of medications and care for patients with chronic and acute conditions.

Option Care Health reported revenues of $1.28 billion, up 17% year on year, outperforming analysts’ expectations by 5%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and full-year revenue guidance beating analysts’ expectations.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $30.61.

Is now the time to buy Option Care Health? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Chemed (NYSE: CHE)

Founded in 1970, Chemed (NYSE: CHE) provides hospice care and plumbing services through its subsidiaries VITAS Healthcare and Roto-Rooter, respectively, focusing on end-of-life care and residential and commercial plumbing solutions.

Chemed reported revenues of $606.2 million, up 7.4% year on year, falling short of analysts’ expectations by 1%. It was a disappointing quarter as it posted a miss of analysts’ full-year EPS guidance estimates.

Chemed delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 9% since the results and currently trades at $555.61.

Read our full analysis of Chemed’s results here.

AdaptHealth (NASDAQ: AHCO)

Founded in 2012, AdaptHealth Corp. (NASDAQ: AHCO) provides home medical equipment and related services, specializing in respiratory therapy, diabetes management supplies, mobility products.

AdaptHealth reported revenues of $805.9 million, flat year on year. This print met analysts’ expectations. Aside from that, it was a mixed quarter as it also produced a solid beat of analysts’ EPS estimates but full-year revenue guidance slightly missing analysts’ expectations.

AdaptHealth had the slowest revenue growth and weakest full-year guidance update among its peers. The stock is down 10% since reporting and currently trades at $9.13.

Read our full, actionable report on AdaptHealth here, it’s free.

Addus HomeCare (NASDAQ: ADUS)

Founded in 1979, Addus HomeCare (NASDAQ: ADUS) provides personal care services, hospice care, and home health services aimed at supporting individuals with daily living activities, chronic condition management, and end-of-life care.

Addus HomeCare reported revenues of $289.8 million, up 7% year on year. This result was in line with analysts’ expectations. Zooming out, it was a slower quarter as it recorded EPS in line with analysts’ estimates and a slight miss of analysts’ sales volume estimates.

The stock is down 10.4% since reporting and currently trades at $115.49.

Read our full, actionable report on Addus HomeCare here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.