Conveyorized car wash service company Mister Car Wash (NYSE: MCW) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 9.1% year on year to $251.2 million. On the other hand, the company’s full-year revenue guidance of $1.05 billion at the midpoint came in 2.3% below analysts’ estimates. Its non-GAAP profit of $0.09 per share was 25.1% above analysts’ consensus estimates.

Is now the time to buy Mister Car Wash? Find out by accessing our full research report, it’s free.

Mister Car Wash (MCW) Q4 CY2024 Highlights:

- Revenue: $251.2 million vs analyst estimates of $248.3 million (9.1% year-on-year growth, 1.2% beat)

- Adjusted EPS: $0.09 vs analyst estimates of $0.07 (25.1% beat)

- Adjusted EBITDA: $78.28 million vs analyst estimates of $74.05 million (31.2% margin, 5.7% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.05 billion at the midpoint, missing analyst estimates by 2.3% and implying 5.7% growth (vs 7.3% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $0.44 at the midpoint, beating analyst estimates by 12.2%

- EBITDA guidance for the upcoming financial year 2025 is $340 million at the midpoint, below analyst estimates of $343.9 million

- Operating Margin: 12.7%, down from 16% in the same quarter last year

- Free Cash Flow was -$20.4 million compared to -$70.27 million in the same quarter last year

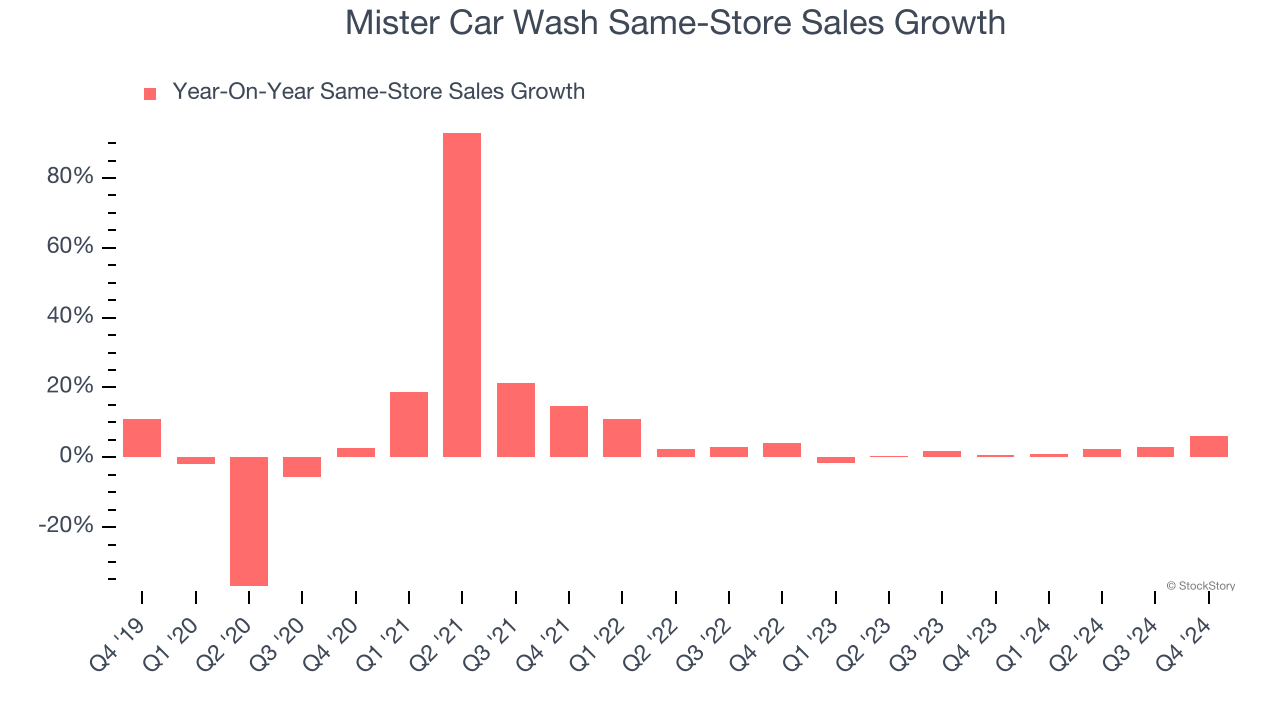

- Same-Store Sales rose 6% year on year (0.7% in the same quarter last year)

- Market Capitalization: $2.46 billion

Company Overview

Formerly known as Hotshine Holdings, Mister Car Wash (NYSE: MCW) offers car washes across the United States through its conveyorized service.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

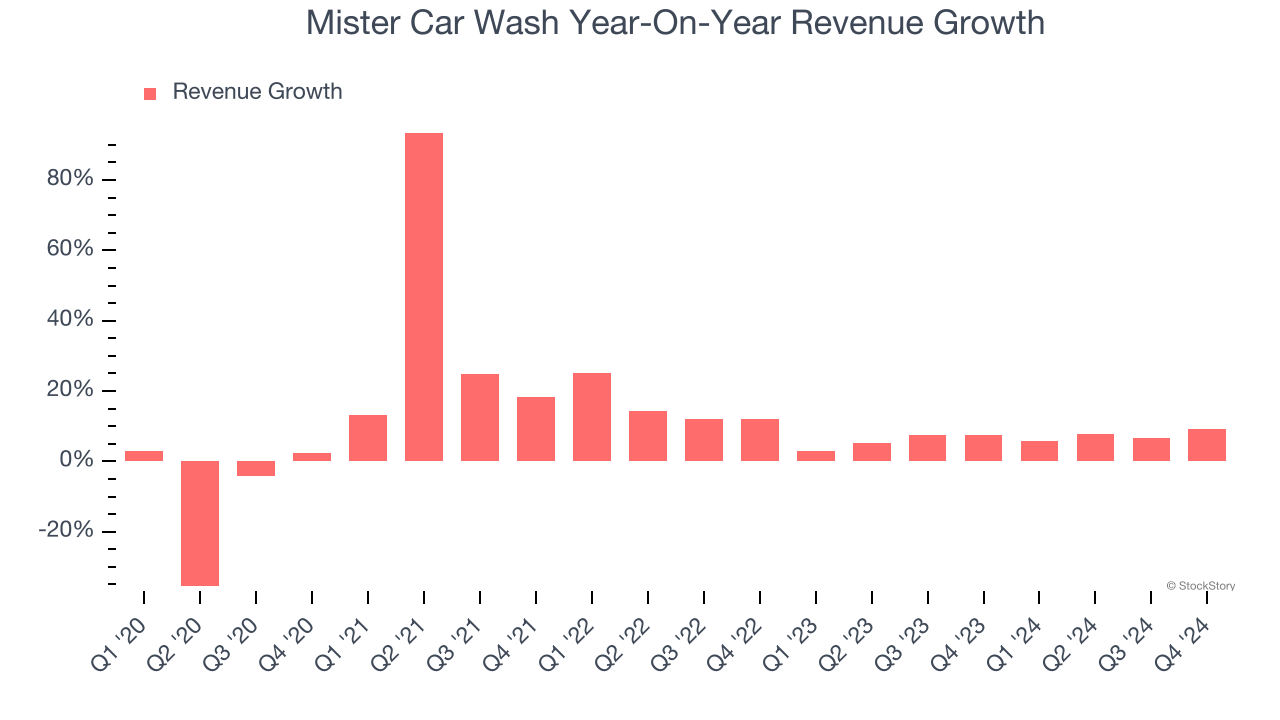

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last five years, Mister Car Wash grew its sales at a tepid 9.6% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Mister Car Wash’s recent history shows its demand slowed as its annualized revenue growth of 6.5% over the last two years is below its five-year trend.

We can dig further into the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Mister Car Wash’s same-store sales averaged 1.7% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company’s top-line performance.

This quarter, Mister Car Wash reported year-on-year revenue growth of 9.1%, and its $251.2 million of revenue exceeded Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to grow 7.9% over the next 12 months, similar to its two-year rate. While this projection suggests its newer products and services will spur better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

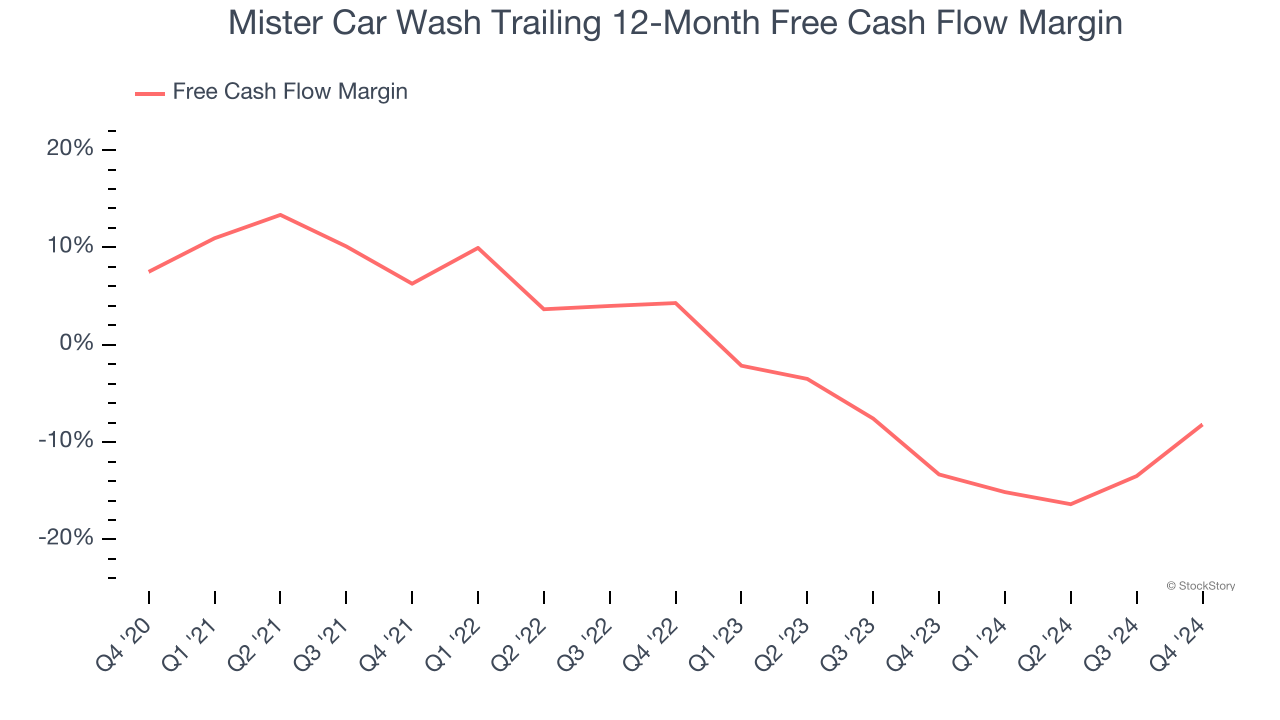

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Over the last two years, Mister Car Wash’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 10.7%, meaning it lit $10.66 of cash on fire for every $100 in revenue. This is a stark contrast from its operating margin, and its investments in working capital/capital expenditures are the primary culprit.

Mister Car Wash burned through $20.4 million of cash in Q4, equivalent to a negative 8.1% margin. The company’s cash burn slowed from $70.27 million of lost cash in the same quarter last year.

Over the next year, analysts predict Mister Car Wash’s cash burn will increase. Their consensus estimates imply its free cash flow margin of negative 8.2% for the last 12 months will fall to negative 10%.

Key Takeaways from Mister Car Wash’s Q4 Results

We enjoyed seeing Mister Car Wash exceed analysts’ same-store sales expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed and its full-year EBITDA guidance also fell slightly short of Wall Street’s estimates. It looks like the market is more focused on quarter than the guidance. The stock traded up 4.1% to $7.91 immediately after reporting.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.