Looking back on toys and electronics stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including Bark (NYSE: BARK) and its peers.

The toys and electronics industry presents both opportunities and challenges for investors. Established companies often enjoy strong brand recognition and customer loyalty while smaller players can carve out a niche if they develop a viral, hit new product. The downside, however, is that success can be short-lived because the industry is very competitive: the barriers to entry for developing a new toy are low, which can lead to pricing pressures and reduced profit margins, and the rapid pace of technological advancements necessitates continuous product updates, increasing research and development costs, and shortening product life cycles for electronics companies. Furthermore, these players must navigate various regulatory requirements, especially regarding product safety, which can pose operational challenges and potential legal risks.

The 4 toys and electronics stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 2.9% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 11.9% since the latest earnings results.

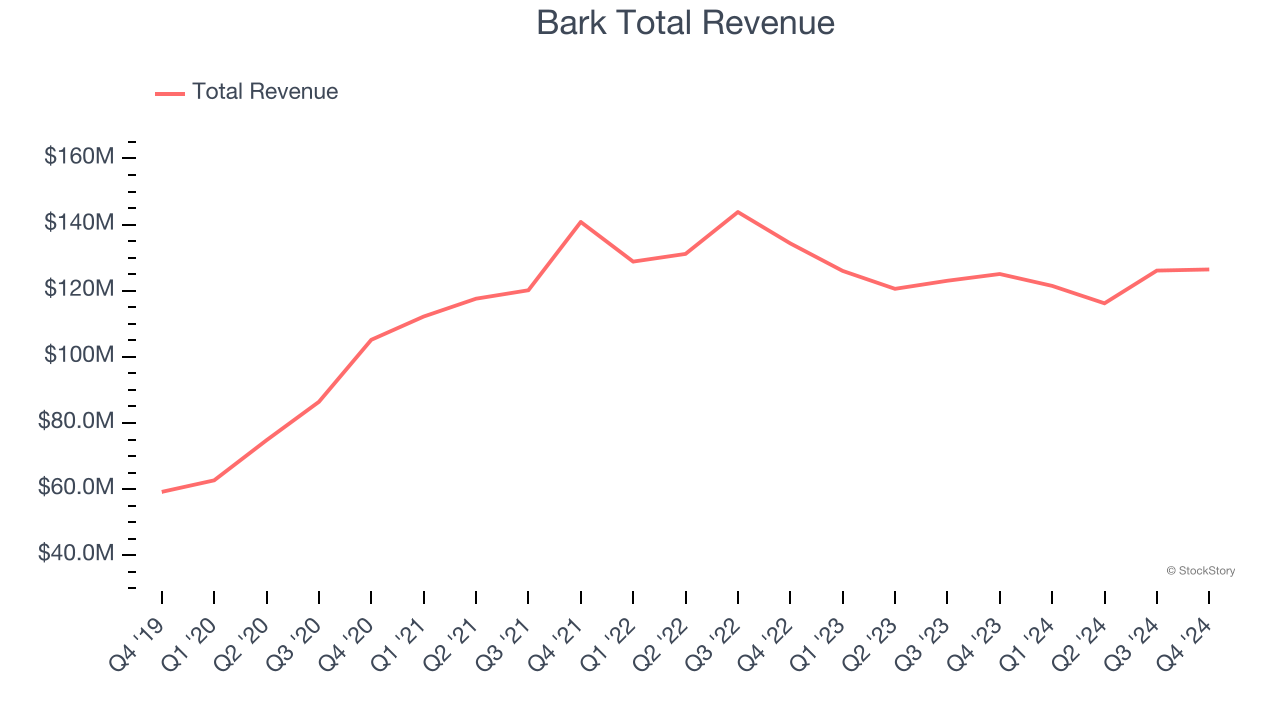

Weakest Q4: Bark (NYSE: BARK)

Making a name for itself with the BarkBox, Bark (NYSE: BARK) specializes in subscription-based, personalized pet products.

Bark reported revenues of $126.4 million, up 1.1% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with full-year EBITDA guidance missing analysts’ expectations.

"We closed 2024 on a high note, exceeding our revenue expectations and delivering our tenth consecutive year-over-year improvement in Adjusted EBITDA," said Matt Meeker, Co-Founder and Chief Executive Officer.

Bark delivered the weakest performance against analyst estimates and weakest full-year guidance update of the whole group. The stock is down 29.4% since reporting and currently trades at $1.38.

Read our full report on Bark here, it’s free.

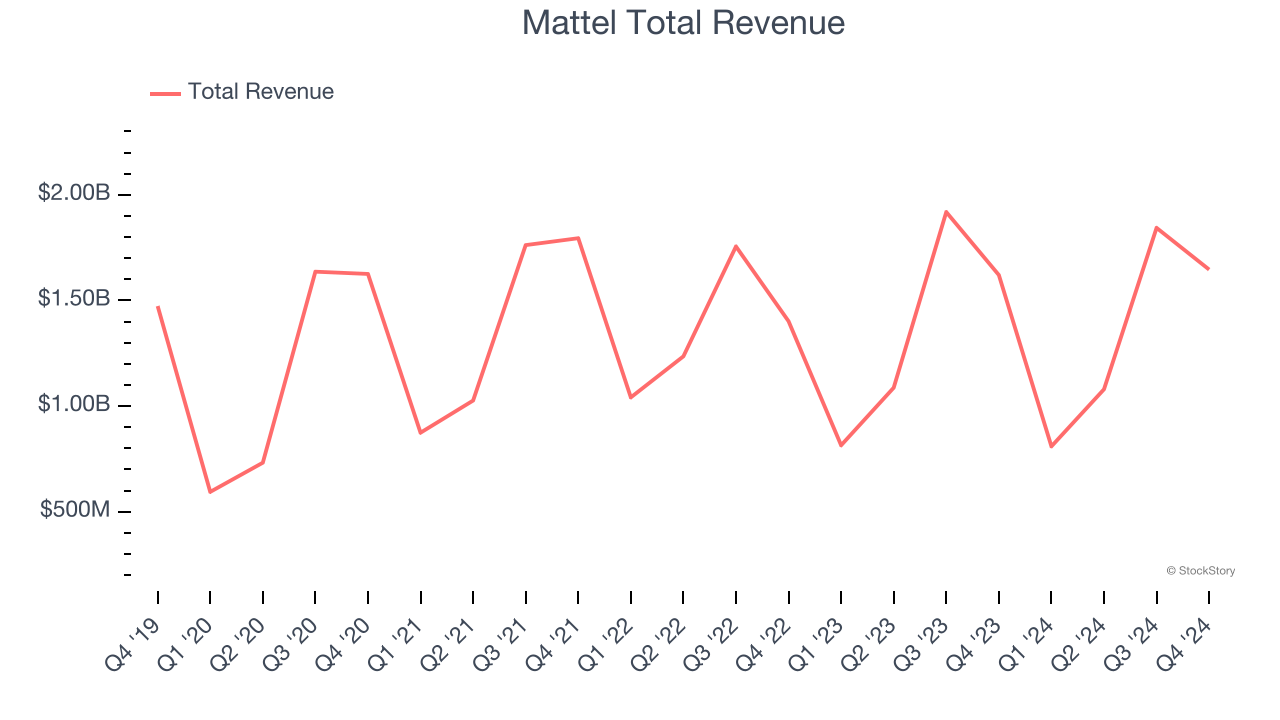

Best Q4: Mattel (NASDAQ: MAT)

Known for the creation of iconic toys such as Barbie and Hotwheels, Mattel (NASDAQ: MAT) is a global children's entertainment company specializing in the design and production of consumer products.

Mattel reported revenues of $1.65 billion, up 1.6% year on year, outperforming analysts’ expectations by 1.2%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Mattel scored the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 10.5% since reporting. It currently trades at $19.97.

Is now the time to buy Mattel? Access our full analysis of the earnings results here, it’s free.

Funko (NASDAQ: FNKO)

Boasting partnerships with media franchises like Marvel and One Piece, Funko (NASDAQ: FNKO) is a company specializing in creating and distributing licensed pop culture collectibles.

Funko reported revenues of $293.7 million, flat year on year, exceeding analysts’ expectations by 2.7%. It was a satisfactory quarter as it also posted a solid beat of analysts’ adjusted operating income estimates.

As expected, the stock is down 27.8% since the results and currently trades at $7.47.

Read our full analysis of Funko’s results here.

Hasbro (NASDAQ: HAS)

Credited with the creation of toys such as Mr. Potato Head and the Rubik’s Cube, Hasbro (NASDAQ: HAS) is a global entertainment company offering a diverse range of toys, games, and multimedia experiences for children and families.

Hasbro reported revenues of $1.10 billion, down 14.5% year on year. This number surpassed analysts’ expectations by 7.6%. It was a very strong quarter as it also logged a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

Hasbro scored the biggest analyst estimates beat but had the slowest revenue growth among its peers. The stock is flat since reporting and currently trades at $60.57.

Read our full, actionable report on Hasbro here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.