The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how PubMatic (NASDAQ: PUBM) and the rest of the advertising software stocks fared in Q4.

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

The 7 advertising software stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 40.6% since the latest earnings results.

PubMatic (NASDAQ: PUBM)

Founded in 2006 as an online ad platform helping ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

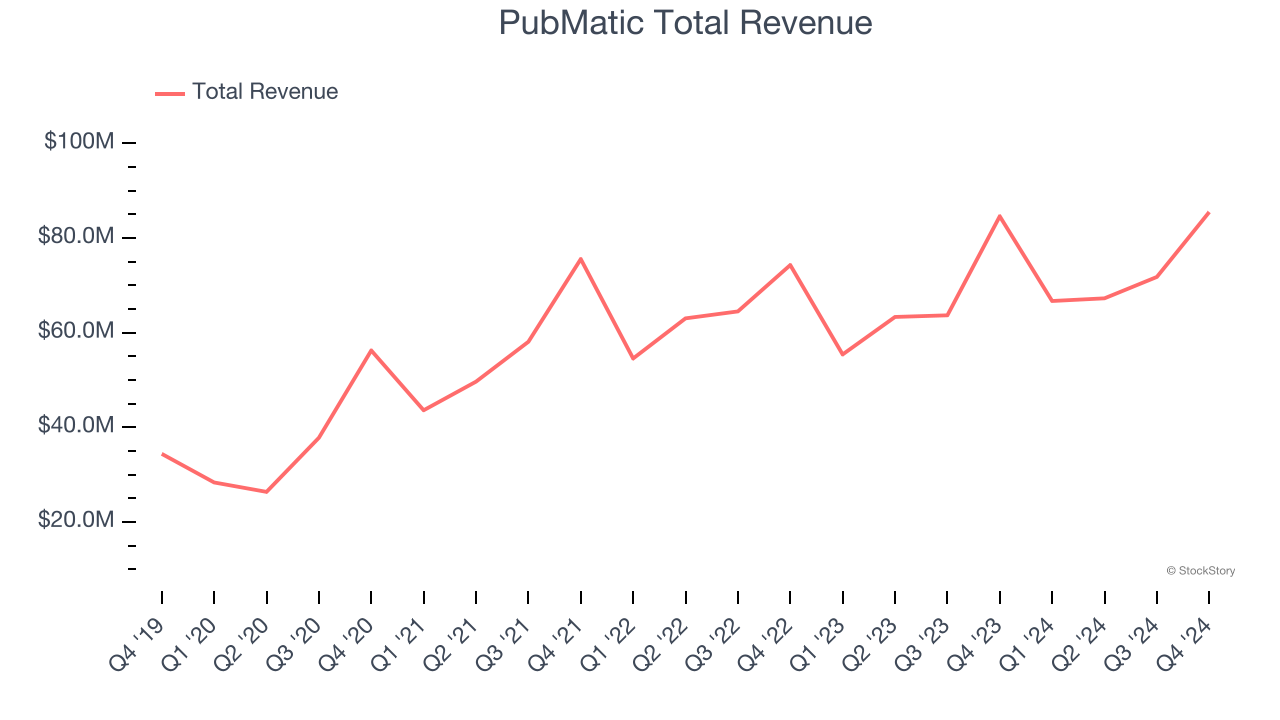

PubMatic reported revenues of $85.5 million, up 1.1% year on year. This print fell short of analysts’ expectations by 3.1%. Overall, it was a slower quarter for the company with EBITDA guidance for next quarter missing analysts’ expectations significantly and a poor net revenue retention rate.

“Revenue growth in the year more than doubled over 2023, driven by strength in CTV, emerging revenue streams, and marquee customers choosing PubMatic to build and scale their ad businesses. Our revenue mix is evolving; in the fourth quarter, CTV more than doubled to 20% of total revenue. These achievements mark an inflection point in our underlying business that highlights critical scale on our platform and a significant shift in ad buying toward channels with the highest consumer engagement such as CTV, mobile app and commerce media,” said Rajeev Goel, co-founder and CEO at PubMatic.

PubMatic delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Unsurprisingly, the stock is down 41.3% since reporting and currently trades at $8.21.

Read our full report on PubMatic here, it’s free.

Best Q4: Zeta (NYSE: ZETA)

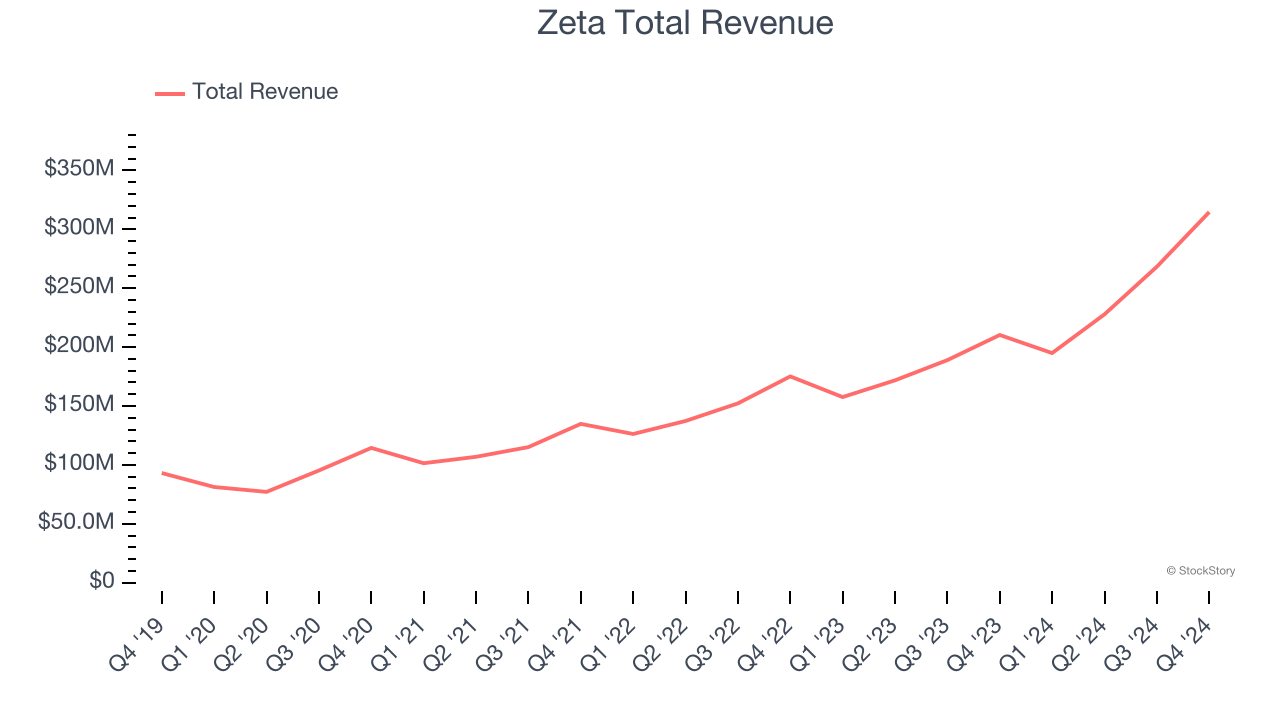

Co-founded by former Apple CEO John Sculley, Zeta Global (NYSE: ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

Zeta reported revenues of $314.7 million, up 49.6% year on year, outperforming analysts’ expectations by 6.7%. The business had an exceptional quarter with a solid beat of analysts’ billings estimates and EBITDA guidance for next quarter exceeding analysts’ expectations.

Zeta achieved the fastest revenue growth and highest full-year guidance raise among its peers. The stock is down 42.1% since reporting. It currently trades at $11.93.

Is now the time to buy Zeta? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: The Trade Desk (NASDAQ: TTD)

Founded by former Microsoft engineers Jeff Green and Dave Pickles, The Trade Desk (NASDAQ: TTD) offers cloud-based software that uses data to help advertisers better plan, place, and target their online ads.

The Trade Desk reported revenues of $741 million, up 22.3% year on year, falling short of analysts’ expectations by 2.3%. It was a disappointing quarter as it posted EBITDA guidance for next quarter missing analysts’ expectations and a significant miss of analysts’ billings estimates.

The stock is down 59.9% since the results and currently trades at $49.10.

Read our full analysis of The Trade Desk’s results here.

AppLovin (NASDAQ: APP)

Co-founded by Adam Foroughi, who was frustrated with not being able to find a good solution to market his own dating app, AppLovin (NASDAQ: APP) is both a mobile game studio and provider of marketing and monetization tools for mobile app developers.

AppLovin reported revenues of $1.37 billion, up 44% year on year. This number surpassed analysts’ expectations by 8.6%. It was a very strong quarter as it also put up EBITDA guidance for next quarter exceeding analysts’ expectations.

AppLovin achieved the biggest analyst estimates beat among its peers. The stock is down 37.2% since reporting and currently trades at $238.73.

Read our full, actionable report on AppLovin here, it’s free.

Integral Ad Science (NASDAQ: IAS)

Founded in 2009, Integral Ad Science (NASDAQ: IAS) provides digital advertising verification and optimization solutions, ensuring that ads are viewable by real people in brand-safe environments across various platforms and devices.

Integral Ad Science reported revenues of $153 million, up 14% year on year. This print topped analysts’ expectations by 2.7%. Overall, it was a strong quarter as it also logged an impressive beat of analysts’ EBITDA estimates.

Integral Ad Science had the weakest full-year guidance update among its peers. The stock is down 34.3% since reporting and currently trades at $6.34.

Read our full, actionable report on Integral Ad Science here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.