Yext trades at $6.11 per share and has moved almost in lockstep with the market over the last six months. The stock has lost 13.9% while the S&P 500 is down 8.9%. This might have investors contemplating their next move.

Is there a buying opportunity in Yext, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Even with the cheaper entry price, we're swiping left on Yext for now. Here are three reasons why you should be careful with YEXT and a stock we'd rather own.

Why Do We Think Yext Will Underperform?

Founded in 2006 by Howard Lerman, Yext (NYSE: YEXT) offers software as a service that helps their clients manage and monitor their online listings and customer reviews across all relevant databases, from Google Maps to Alexa or Siri.

1. Weak ARR Points to Soft Demand

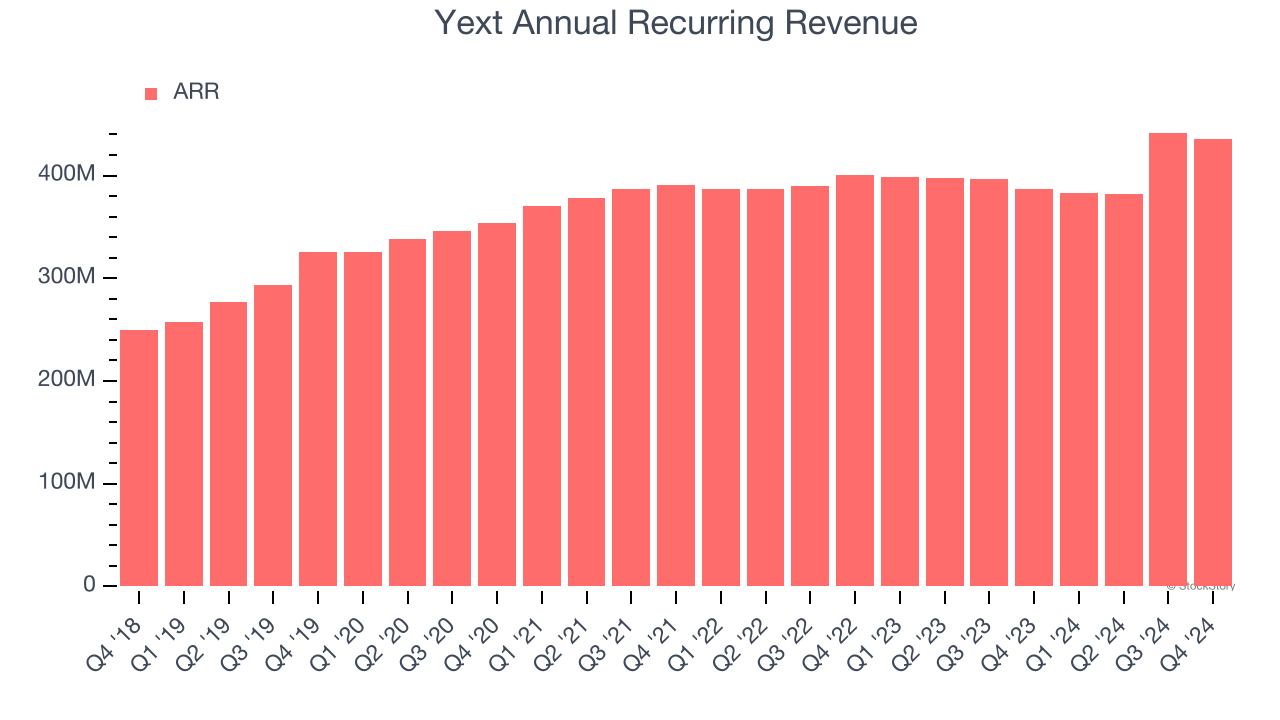

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Yext’s ARR came in at $435.7 million in Q4, and over the last four quarters, its year-on-year growth averaged 4%. This performance was underwhelming and suggests that increasing competition is causing challenges in securing longer-term commitments.

2. Long Payback Periods Delay Returns

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Yext’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Yext’s products and its peers.

3. Shrinking Operating Margin

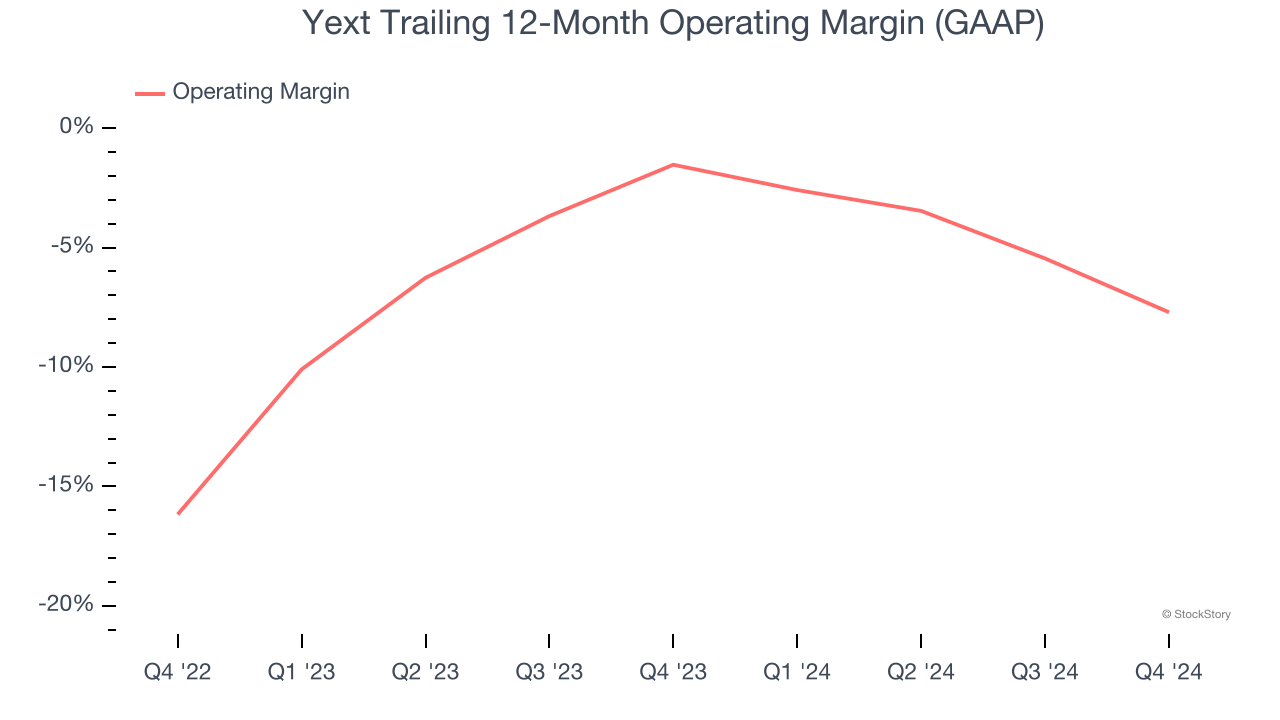

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Looking at the trend in its profitability, Yext’s operating margin decreased by 6.2 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Yext’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was negative 7.7%.

Final Judgment

We see the value of companies addressing major business pain points, but in the case of Yext, we’re out. After the recent drawdown, the stock trades at 1.7× forward price-to-sales (or $6.11 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are more exciting stocks to buy at the moment. We’d recommend looking at one of our all-time favorite software stocks.

Stocks We Like More Than Yext

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.