Identity management software maker Okta (OKTA) reported Q1 CY2025 results exceeding the market’s revenue expectations, with sales up 11.5% year on year to $688 million. The company expects next quarter’s revenue to be around $711 million, close to analysts’ estimates. Its non-GAAP profit of $0.86 per share was 11.5% above analysts’ consensus estimates.

Is now the time to buy Okta? Find out by accessing our full research report, it’s free.

Okta (OKTA) Q1 CY2025 Highlights:

- Revenue: $688 million vs analyst estimates of $680.1 million (11.5% year-on-year growth, 1.2% beat)

- Adjusted EPS: $0.86 vs analyst estimates of $0.77 (11.5% beat)

- Adjusted Operating Income: $184 million vs analyst estimates of $169.4 million (26.7% margin, 8.6% beat)

- The company reconfirmed its revenue guidance for the full year of $2.86 billion at the midpoint

- Adjusted EPS guidance for the full year is $3.26 at the midpoint, beating analyst estimates by 1.6%

- "Additionally, we’re now factoring in potential risks related to the uncertain economic environment for the remainder of" the fiscal year

- Operating Margin: 5.7%, up from -7.6% in the same quarter last year

- Free Cash Flow Margin: 34.6%, down from 41.6% in the previous quarter

- Market Capitalization: $21.66 billion

“Okta had a solid start to FY26 highlighted by record operating profit and another quarter of robust free cash flow,” said Todd McKinnon, Chief Executive Officer and co-founder of Okta.

Company Overview

Founded during the aftermath of the financial crisis in 2009, Okta (NASDAQ: OKTA) is a cloud-based software-as-a-service platform that helps companies manage identity for their employees and customers.

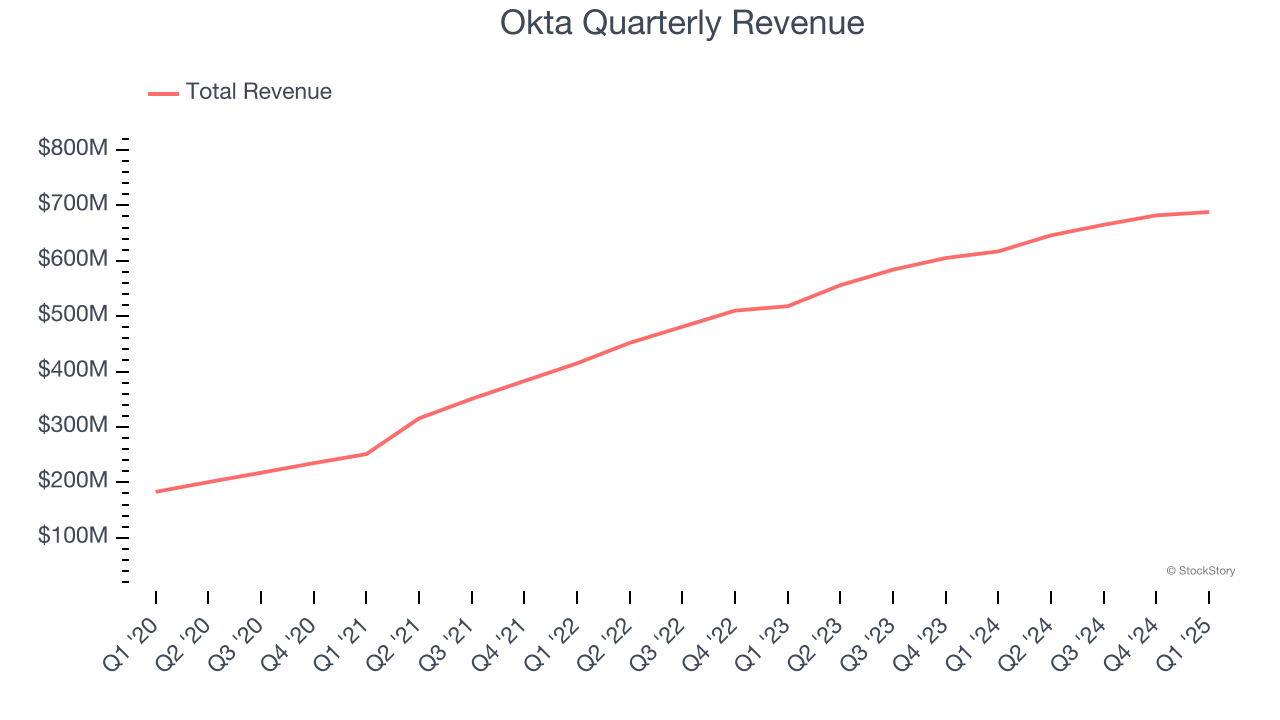

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Okta grew its sales at a decent 22.3% compounded annual growth rate. Its growth was slightly above the average software company and shows its offerings resonate with customers.

This quarter, Okta reported year-on-year revenue growth of 11.5%, and its $688 million of revenue exceeded Wall Street’s estimates by 1.2%. Company management is currently guiding for a 10.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.3% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

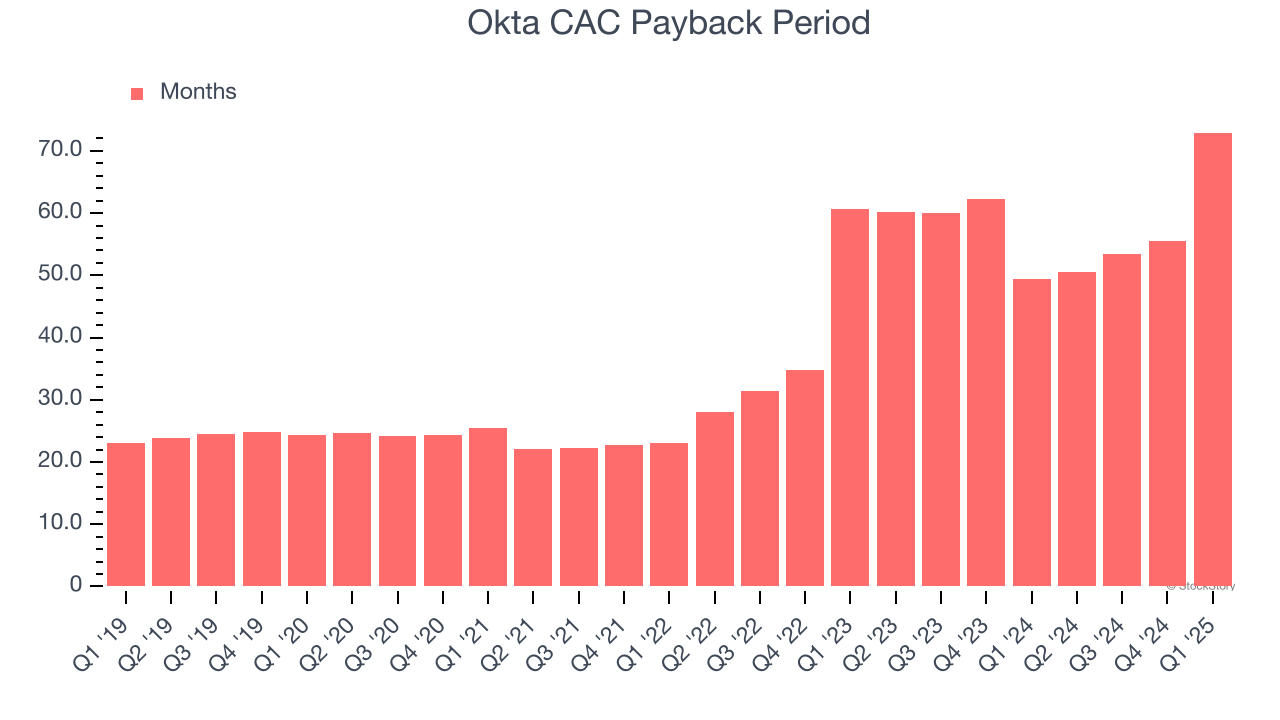

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s relatively expensive for Okta to acquire new customers as its CAC payback period checked in at 72.9 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

Key Takeaways from Okta’s Q1 Results

Revenue and adjusted EPS both beat, which is a good start. Despite the beat, Okta only reconfirmed full-year revenue guidance, which was in line with Wall Street's estimates. Typically, beats are flowed through to an increase in the full-year guidance. The company also stated that they are "now factoring in potential risks related to the uncertain economic environment for the remainder of" the year. Cybersecurity has been a strong performer as of late as the market sees the market as recession resistant and largely unaffected by tariffs. This print puts a dent in that. Shares traded down 11% to $111.77 immediately following the results.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.