Footwear conglomerate Wolverine Worldwide (NYSE: WWW) reported Q1 CY2025 results exceeding the market’s revenue expectations, with sales up 4.4% year on year to $412.3 million. The company expects next quarter’s revenue to be around $445 million, close to analysts’ estimates. Its non-GAAP profit of $0.18 per share was 64.2% above analysts’ consensus estimates.

Is now the time to buy Wolverine Worldwide? Find out by accessing our full research report, it’s free.

Wolverine Worldwide (WWW) Q1 CY2025 Highlights:

- Revenue: $412.3 million vs analyst estimates of $396 million (4.4% year-on-year growth, 4.1% beat)

- Adjusted EPS: $0.18 vs analyst estimates of $0.11 (64.2% beat)

- Adjusted EBITDA: $31.5 million vs analyst estimates of $25.05 million (7.6% margin, 25.7% beat)

- Revenue Guidance for Q2 CY2025 is $445 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for Q2 CY2025 is $0.22 at the midpoint, below analyst estimates of $0.24

- Operating Margin: 4.8%, up from -0.8% in the same quarter last year

- Free Cash Flow was -$91.4 million compared to -$42.3 million in the same quarter last year

- Market Capitalization: $1.20 billion

Company Overview

Founded in 1883, Wolverine Worldwide (NYSE: WWW) is a global footwear company with a diverse portfolio of brands including Merrell, Hush Puppies, and Saucony.

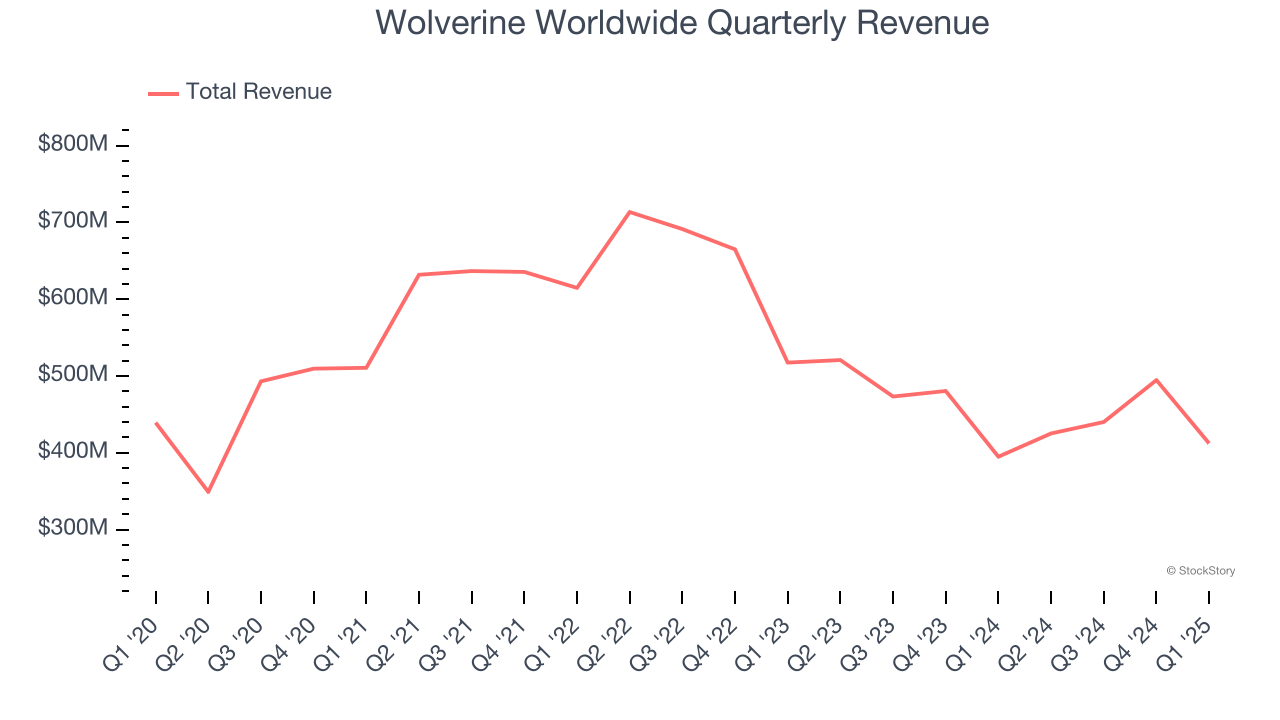

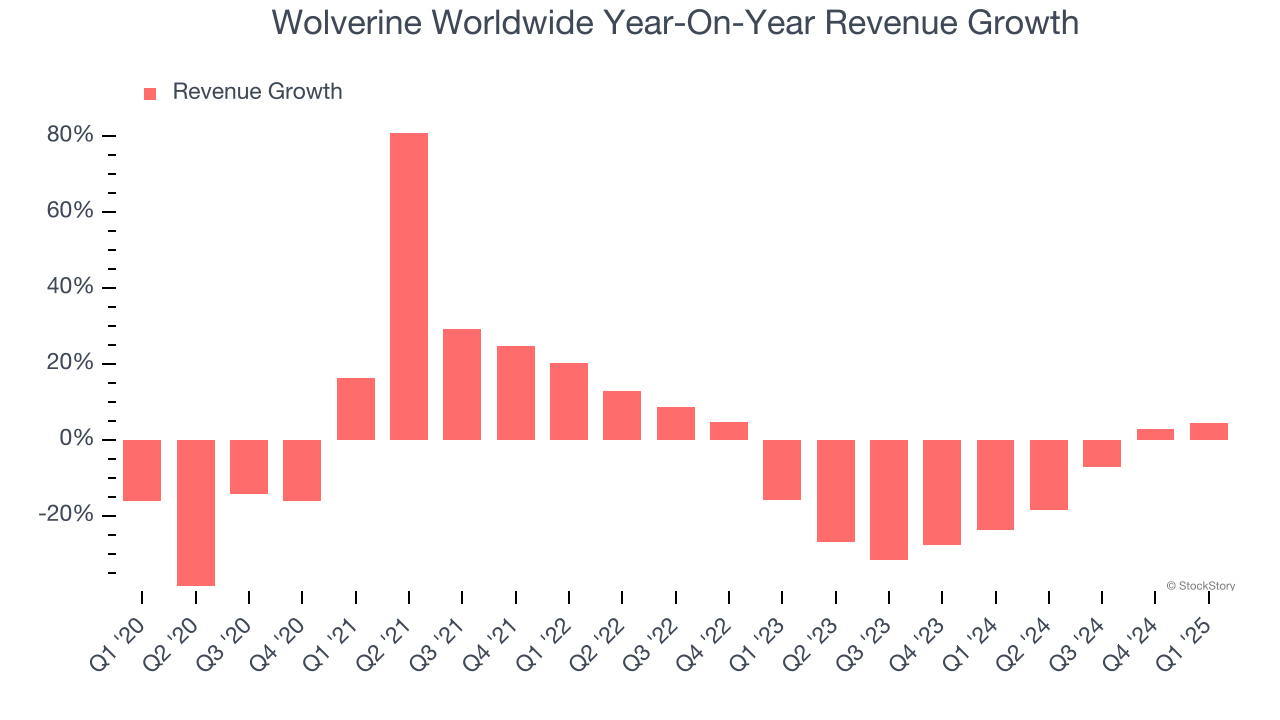

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Wolverine Worldwide’s demand was weak and its revenue declined by 4.1% per year. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Wolverine Worldwide’s recent performance shows its demand remained suppressed as its revenue has declined by 17.2% annually over the last two years.

This quarter, Wolverine Worldwide reported modest year-on-year revenue growth of 4.4% but beat Wall Street’s estimates by 4.1%. Company management is currently guiding for a 4.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.1% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

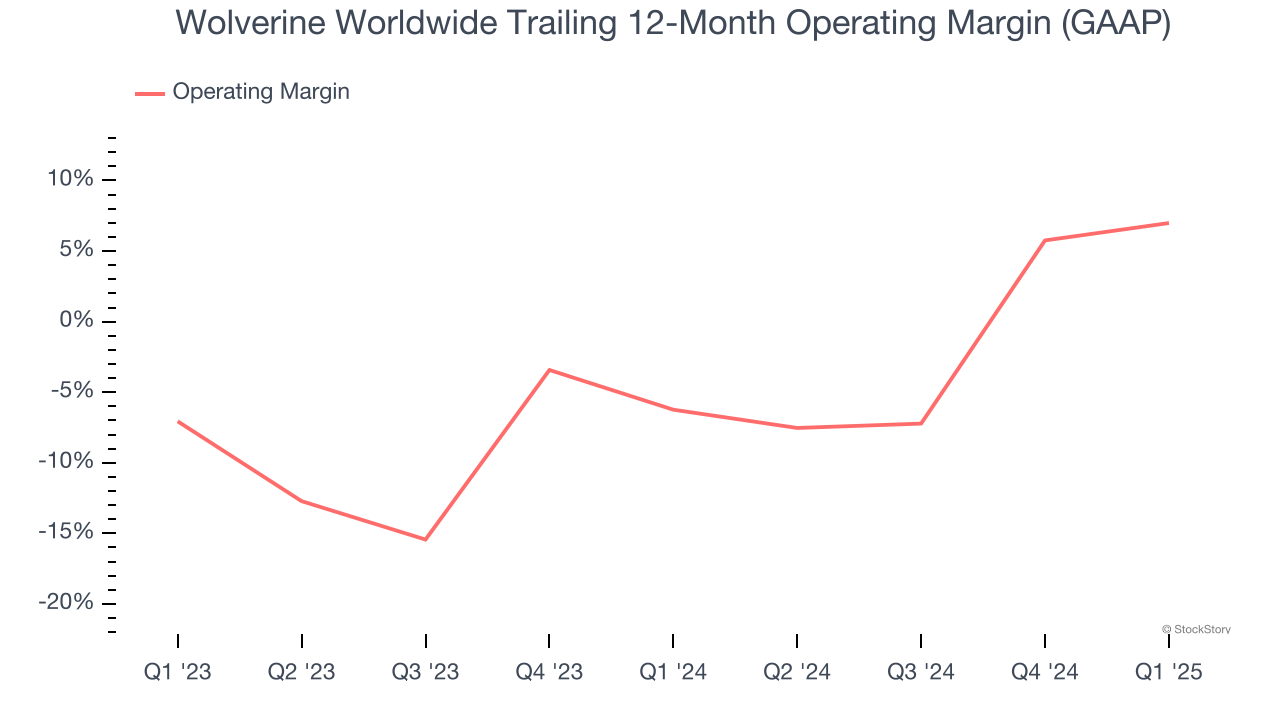

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Wolverine Worldwide’s operating margin has been trending up over the last 12 months, leading to break even profits over the last two years. However, its large expense base and inefficient cost structure mean it still sports inadequate profitability for a consumer discretionary business.

In Q1, Wolverine Worldwide generated an operating profit margin of 4.8%, up 5.6 percentage points year on year. This increase was a welcome development and shows it was more efficient.

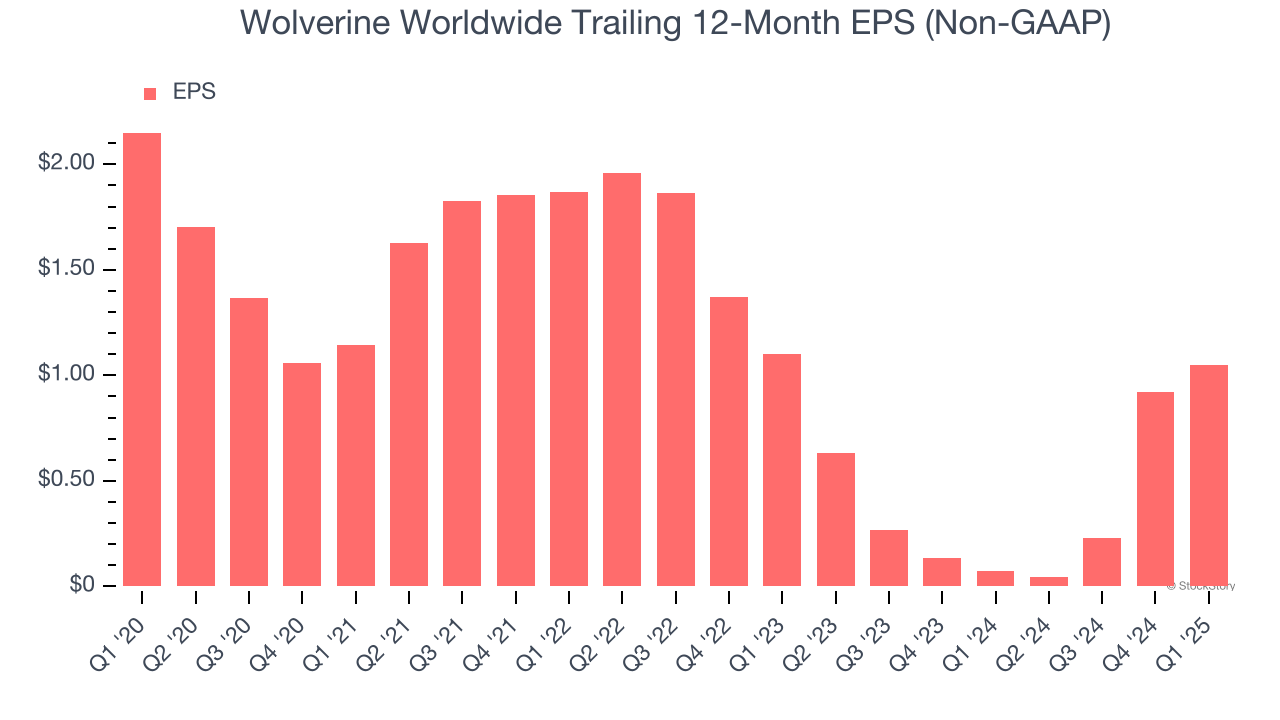

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Wolverine Worldwide, its EPS declined by 13.4% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q1, Wolverine Worldwide reported EPS at $0.18, up from $0.05 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Wolverine Worldwide’s full-year EPS of $1.05 to grow 6.7%.

Key Takeaways from Wolverine Worldwide’s Q1 Results

We were impressed by how significantly Wolverine Worldwide blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its EPS guidance for next quarter missed. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 4.7% to $15.51 immediately following the results.

Indeed, Wolverine Worldwide had a rock-solid quarterly earnings result, but is this stock a good investment here? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.