As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the business services & supplies industry, including RB Global (NYSE: RBA) and its peers.

This is a sector that encompasses many types of business, and so it follows that a number of trends will impact the space. For industrial and environmental services companies, for example, trends around environmental compliance and increasing corporate ESG commitments matter while for safety and security services companies, the intersection of physical security, cybersecurity, and workplace safety regulations are the topics du jour. Broadly, AI and automation could be tailwinds for companies in the space that invest wisely. On the other hand, shifting regulatory frameworks could force continual changes in go-to-market and costly investments.

The 19 business services & supplies stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 1.8% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 2.7% on average since the latest earnings results.

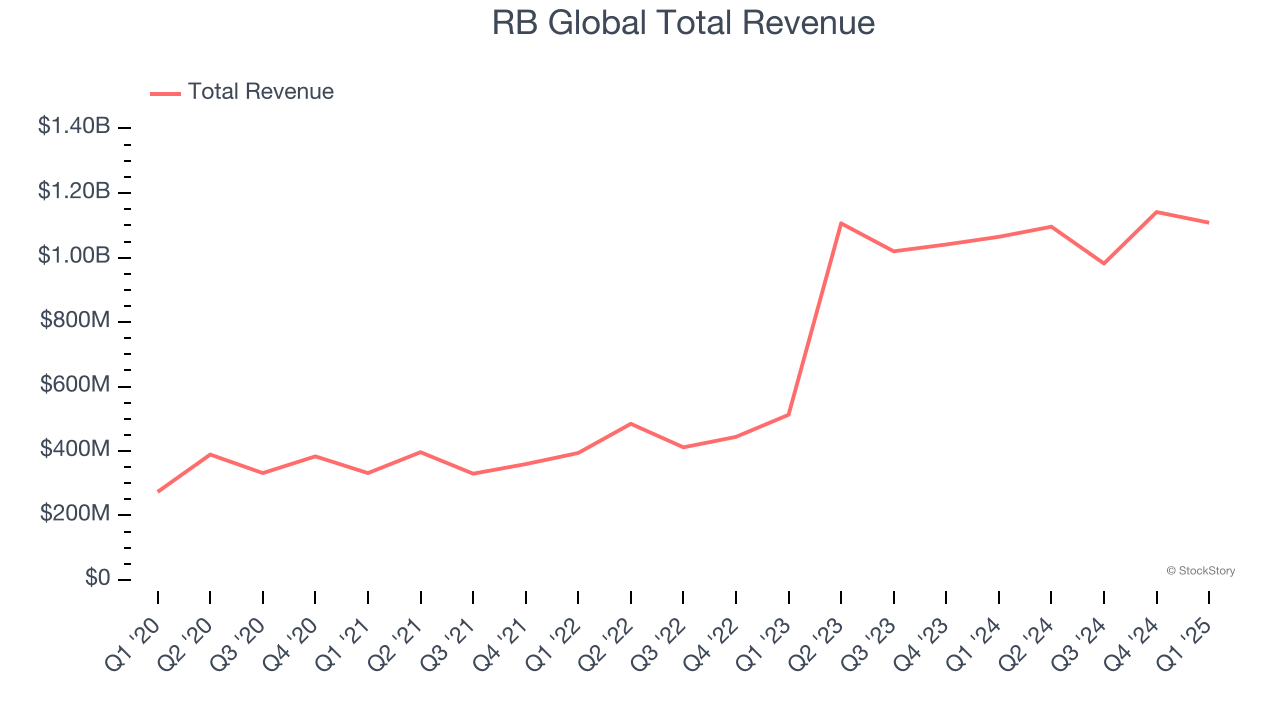

RB Global (NYSE: RBA)

Born from the 1958 founding of Ritchie Bros. Auctioneers and rebranded in 2023, RB Global (NYSE: RBA) operates global marketplaces that connect buyers and sellers of commercial assets, vehicles, and equipment across multiple industries.

RB Global reported revenues of $1.11 billion, up 4.1% year on year. This print exceeded analysts’ expectations by 6.9%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EPS estimates.

The stock is up 3% since reporting and currently trades at $105.30.

We think RB Global is a good business, but is it a buy today? Read our full report here, it’s free.

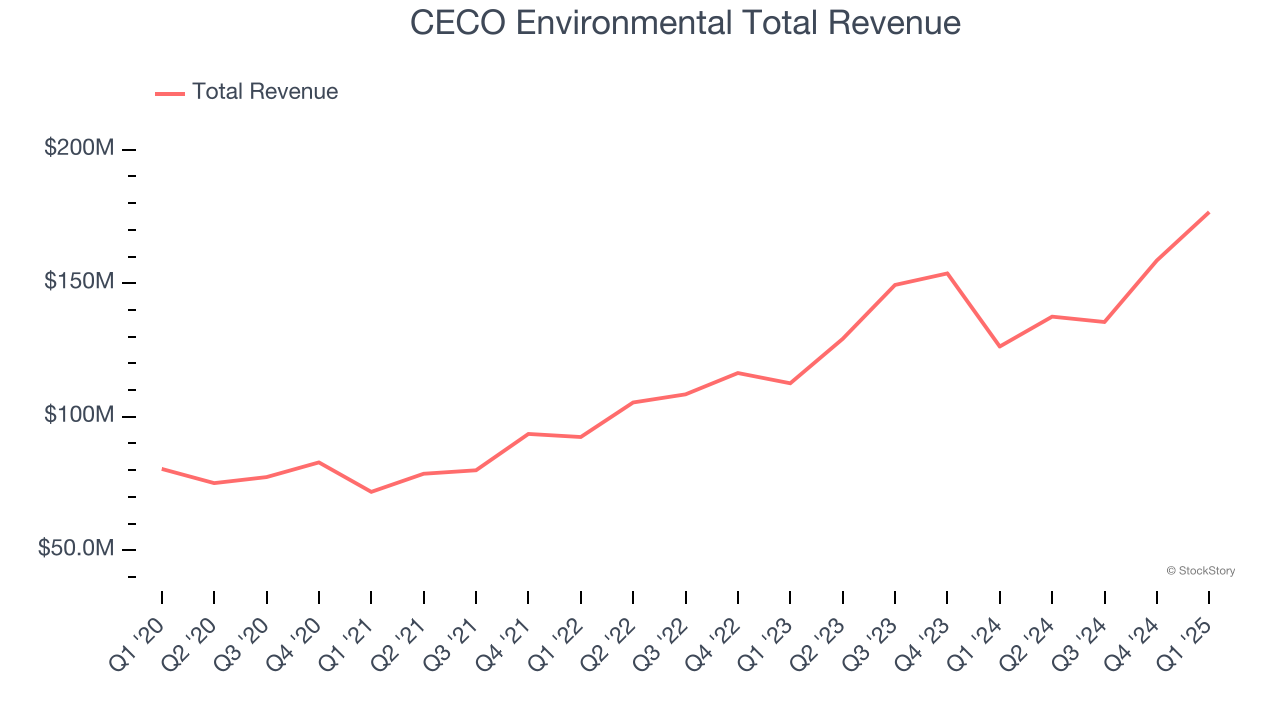

Best Q1: CECO Environmental (NASDAQ: CECO)

With roots dating back to 1869 and a focus on creating cleaner industrial operations, CECO Environmental (NASDAQ: CECO) provides technology and expertise that helps industrial companies reduce emissions, treat water, and improve energy efficiency across various sectors.

CECO Environmental reported revenues of $176.7 million, up 39.9% year on year, outperforming analysts’ expectations by 17%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and full-year revenue guidance beating analysts’ expectations.

CECO Environmental delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 40.1% since reporting. It currently trades at $26.89.

Is now the time to buy CECO Environmental? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: GEO Group (NYSE: GEO)

With a global footprint spanning three continents and approximately 81,000 beds across 100 facilities, GEO Group (NYSE: GEO) operates secure facilities, processing centers, and reentry services for government agencies in the United States, Australia, and South Africa.

GEO Group reported revenues of $604.6 million, flat year on year, falling short of analysts’ expectations by 2%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

GEO Group delivered the weakest full-year guidance update in the group. As expected, the stock is down 10.1% since the results and currently trades at $27.23.

Read our full analysis of GEO Group’s results here.

OPENLANE (NYSE: KAR)

Facilitating the sale of approximately 1.3 million used vehicles in 2023, OPENLANE (NYSE: KAR) operates digital marketplaces that connect sellers and buyers of used vehicles across North America and Europe, facilitating wholesale transactions.

OPENLANE reported revenues of $460.1 million, up 7% year on year. This result surpassed analysts’ expectations by 1.4%. It was a strong quarter as it also recorded a solid beat of analysts’ EPS estimates.

The stock is up 19.6% since reporting and currently trades at $22.93.

Read our full, actionable report on OPENLANE here, it’s free.

CoreCivic (NYSE: CXW)

Originally founded in 1983 as the first private prison company in the United States, CoreCivic (NYSE: CXW) operates correctional facilities, detention centers, and residential reentry programs for government agencies across the United States.

CoreCivic reported revenues of $488.6 million, down 2.4% year on year. This number beat analysts’ expectations by 2.5%. Overall, it was an exceptional quarter as it also produced a solid beat of analysts’ EPS estimates.

The stock is down 2.9% since reporting and currently trades at $21.96.

Read our full, actionable report on CoreCivic here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.