Let’s dig into the relative performance of F&G Annuities & Life (NYSE: FG) and its peers as we unravel the now-completed Q1 life insurance earnings season.

Life insurance companies collect premiums from policyholders in exchange for providing a future death benefit or retirement income stream. Interest rates matter for the sector (and make it cyclical), with higher rates allowing insurers to reinvest their fixed-income portfolios at more attractive yields and vice versa. Additionally, favorable demographic shifts, such as an aging population, are driving strong demand for retirement products while AI and data analytics offer significant opportunities to improve underwriting accuracy and operational efficiency. Conversely, the industry faces headwinds from persistent competition from agile insurtechs that threaten traditional distribution models.

The 15 life insurance stocks we track reported a softer Q1. As a group, revenues missed analysts’ consensus estimates by 3.1%.

While some life insurance stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.2% since the latest earnings results.

F&G Annuities & Life (NYSE: FG)

Founded in 1959 and serving approximately 677,000 policyholders who rely on its financial protection products, F&G Annuities & Life (NYSE: FG) provides fixed annuities, life insurance, and pension risk transfer solutions to retail and institutional clients.

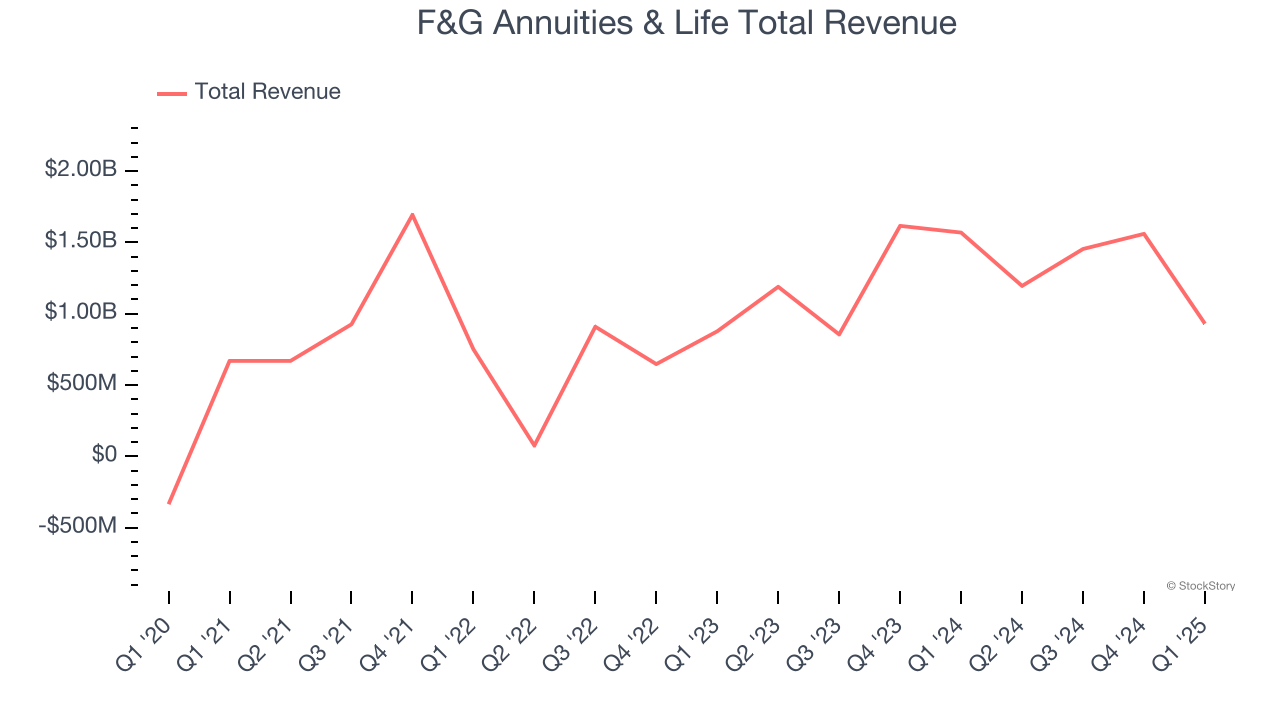

F&G Annuities & Life reported revenues of $930 million, down 40.7% year on year. This print fell short of analysts’ expectations by 36.9%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ net premiums earned and EPS estimates.

Chris Blunt, Chief Executive Officer, commented, "Despite some near-term headwinds, F&G's solid foundation is underpinned by a conservatively positioned investment portfolio and the ability to optimize our capital allocation to secure the highest returning business, which positions us to succeed in an uncertain economy. We achieved record AUM before flow reinsurance of $67.4 billion, an increase of 16% from the year ago first quarter, driven by strong indexed annuity sales. Additionally, our equity offering in March provides us with the flexibility to take advantage of both opportunities to further grow the business given the strong secular tailwinds that exist as well as providing additional capital should the environment turn increasingly challenging. Overall, the credit quality of our portfolio remains high with 96% of our fixed maturities being investment grade combined with credit related impairments remaining well below our pricing assumptions over the past five years and current quarter. We remain confident that we will deliver on our medium-term Investor Day targets, to grow AUM and expand returns, in the coming years."

F&G Annuities & Life delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Unsurprisingly, the stock is down 14.3% since reporting and currently trades at $30.76.

Is now the time to buy F&G Annuities & Life? Access our full analysis of the earnings results here, it’s free.

Best Q1: Corebridge Financial (NYSE: CRBG)

Spun off from insurance giant AIG in 2022 to focus on the growing retirement market, Corebridge Financial (NYSE: CRBG) provides retirement solutions, annuities, life insurance, and institutional risk management products in the United States.

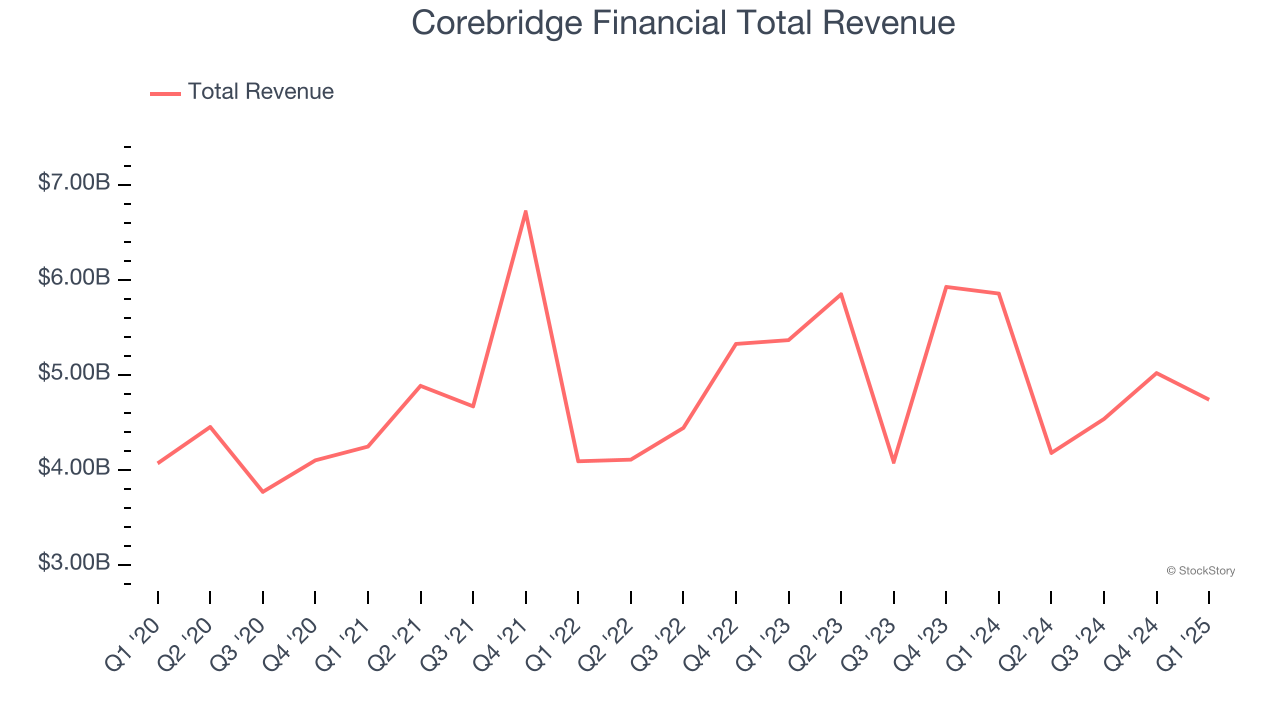

Corebridge Financial reported revenues of $4.74 billion, down 19.1% year on year, outperforming analysts’ expectations by 7.9%. The business had a satisfactory quarter.

Corebridge Financial delivered the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 4.7% since reporting. It currently trades at $34.50.

Is now the time to buy Corebridge Financial? Access our full analysis of the earnings results here, it’s free.

Equitable Holdings (NYSE: EQH)

Tracing its roots back to 1859 as one of America's oldest financial institutions, Equitable Holdings (NYSE: EQH) provides retirement planning, asset management, and life insurance products through its two main franchises, Equitable and AllianceBernstein.

Equitable Holdings reported revenues of $3.78 billion, up 4% year on year, falling short of analysts’ expectations by 5.7%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 1.5% since the results and currently trades at $52.80.

Read our full analysis of Equitable Holdings’s results here.

CNO Financial Group (NYSE: CNO)

Rebranded from Conseco in 2010 to signal a fresh start after navigating financial challenges, CNO Financial Group (NYSE: CNO) develops and markets health insurance, annuities, and life insurance products primarily targeting middle-income pre-retirees and retirees.

CNO Financial Group reported revenues of $948.6 million, up 5.7% year on year. This result came in 1.9% below analysts' expectations. It was a softer quarter as it also produced a significant miss of analysts’ book value per share estimates and EPS in line with analysts’ estimates.

The stock is down 8.9% since reporting and currently trades at $36.33.

Read our full, actionable report on CNO Financial Group here, it’s free.

Primerica (NYSE: PRI)

With a sales force of over 140,000 licensed representatives operating on an independent contractor model, Primerica (NYSE: PRI) provides term life insurance, investment products, and other financial services to middle-income households in the United States and Canada.

Primerica reported revenues of $803.6 million, up 9.4% year on year. This number topped analysts’ expectations by 2.1%. Taking a step back, it was a mixed quarter as it also logged net premiums earned in line with analysts’ estimates but a slight miss of analysts’ book value per share estimates.

The stock is down 1.3% since reporting and currently trades at $263.21.

Read our full, actionable report on Primerica here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.