Let’s dig into the relative performance of Moog (NYSE: MOG.A) and its peers as we unravel the now-completed Q4 aerospace earnings season.

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

The 15 aerospace stocks we track reported a strong Q4. As a group, revenues missed analysts’ consensus estimates by 0.5% while next quarter’s revenue guidance was in line.

Luckily, aerospace stocks have performed well with share prices up 30.7% on average since the latest earnings results.

Moog (NYSE: MOG.A)

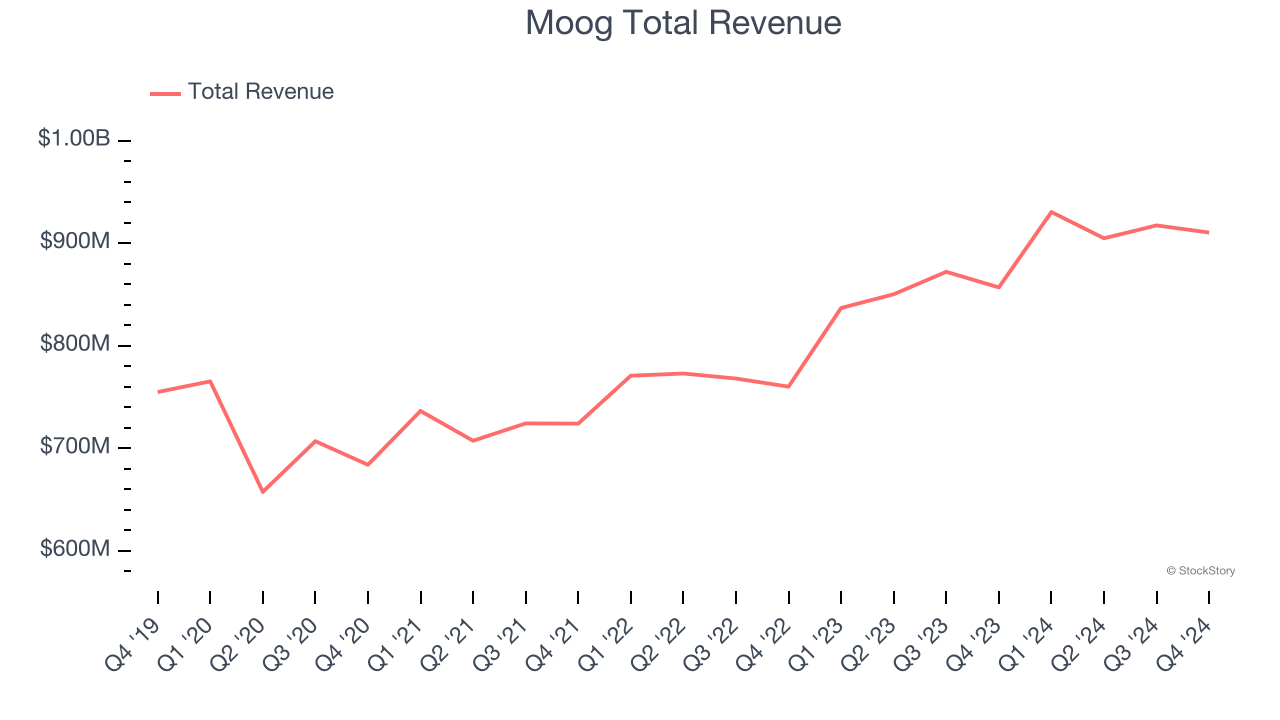

Responsible for the flight control actuation system integrated in the B-2 stealth bomber, Moog (NYSE: MOG.A) provides precision motion control solutions used in aerospace and defense applications

Moog reported revenues of $910.3 million, up 6.2% year on year. This print exceeded analysts’ expectations by 5.3%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ adjusted operating income estimates.

"We have delivered a great quarter with strong sales growth, impressive bookings and solid margin enhancement," said Pat Roche, CEO.

Unsurprisingly, the stock is down 9.1% since reporting and currently trades at $190.70.

Is now the time to buy Moog? Access our full analysis of the earnings results here, it’s free.

Best Q4: AAR (NYSE: AIR)

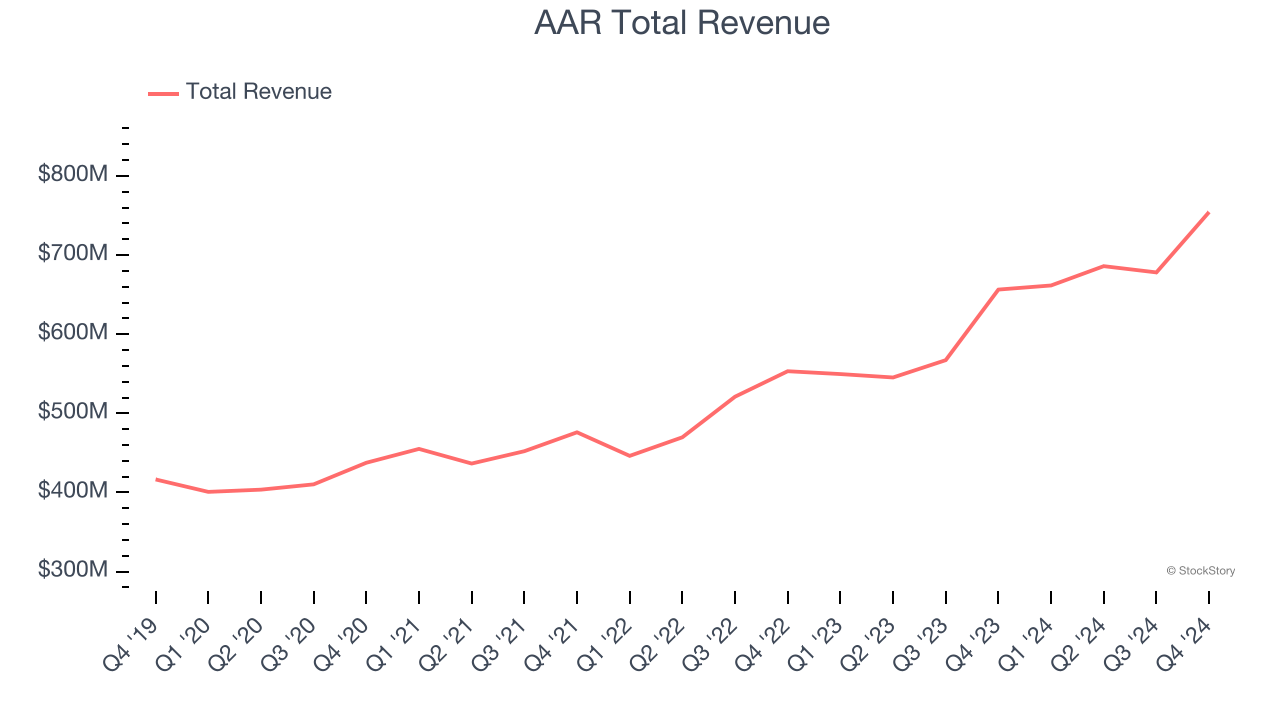

The first third-party MRO approved by the FAA for Safety Management System Requirements, AAR (NYSE: AIR) is a provider of aircraft maintenance services

AAR reported revenues of $754.5 million, up 14.9% year on year, outperforming analysts’ expectations by 8.6%. The business had a stunning quarter with a solid beat of analysts’ EBITDA estimates.

AAR pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 9.1% since reporting. It currently trades at $81.90.

Is now the time to buy AAR? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: AerSale (NASDAQ: ASLE)

Providing a one-stop shop that integrates multiple services and product offerings, AerSale (NASDAQ: ASLE) delivers full-service support to mid-life commercial aircraft.

AerSale reported revenues of $65.78 million, down 27.4% year on year, falling short of analysts’ expectations by 26.3%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

AerSale delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 21.5% since the results and currently trades at $5.52.

Read our full analysis of AerSale’s results here.

Howmet (NYSE: HWM)

Inventing the first forged aluminum truck wheel, Howmet (NYSE: HWM) specializes in lightweight metals engineering and manufacturing multi-material components used in vehicles.

Howmet reported revenues of $1.94 billion, up 6.5% year on year. This print met analysts’ expectations. Overall, it was a very strong quarter as it also logged an impressive beat of analysts’ adjusted operating income estimates and full-year EBITDA guidance exceeding analysts’ expectations.

The stock is up 35.7% since reporting and currently trades at $187.85.

Read our full, actionable report on Howmet here, it’s free.

TransDigm (NYSE: TDG)

Supplying parts for nearly all aircraft currently in service, TransDigm (NYSE: TDG) develops and manufactures components and systems for military and commercial aviation.

TransDigm reported revenues of $2.15 billion, up 12% year on year. This number missed analysts’ expectations by 0.7%. More broadly, it was a mixed quarter as it also logged a solid beat of analysts’ adjusted operating income estimates but a slight miss of analysts’ organic revenue estimates.

The stock is up 7.8% since reporting and currently trades at $1,590.

Read our full, actionable report on TransDigm here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.