Over the past six months, Assurant’s stock price fell to $184.85. Shareholders have lost 14.8% of their capital, which is disappointing considering the S&P 500 has climbed by 5.8%. This might have investors contemplating their next move.

Is now the time to buy Assurant, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Assurant Not Exciting?

Despite the more favorable entry price, we're cautious about Assurant. Here are three reasons why we avoid AIZ and a stock we'd rather own.

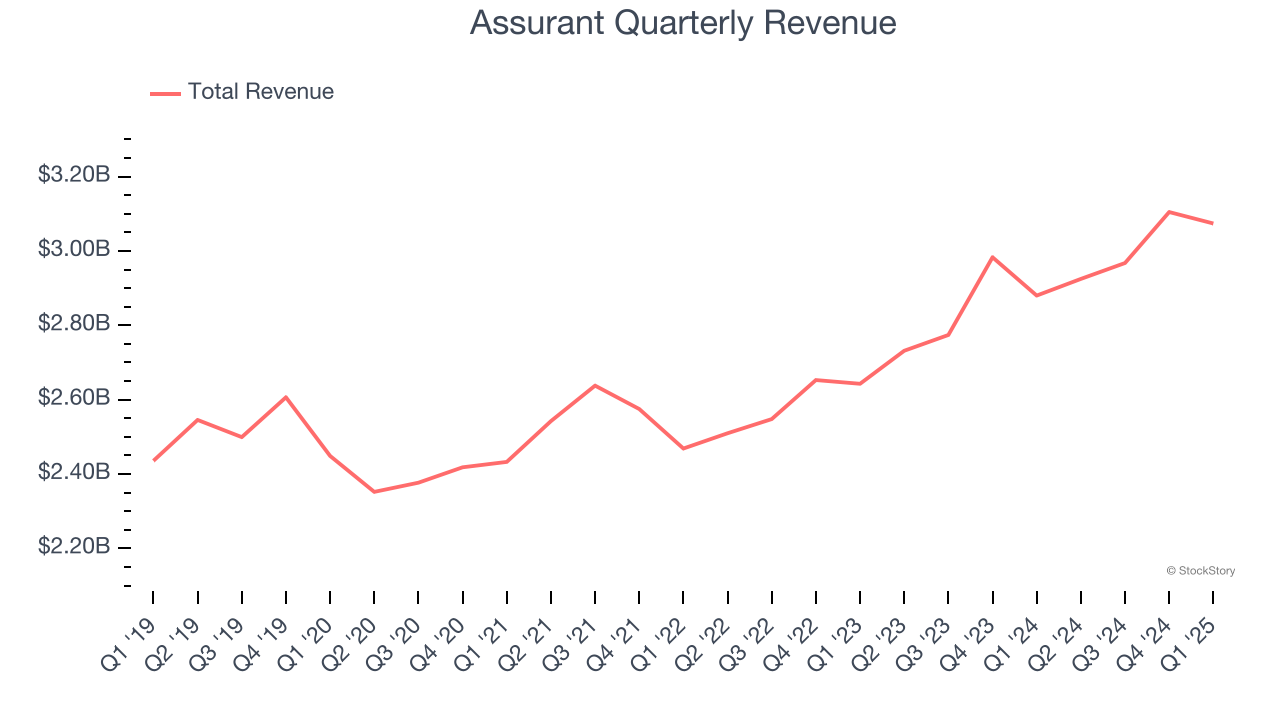

1. Long-Term Revenue Growth Disappoints

Insurance companies earn revenue from three primary sources:

- The core insurance business itself, often called underwriting and represented in the income statement as premiums

- Income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities

- Fees from various sources such as policy administration, annuities, or other value-added services

Unfortunately, Assurant’s 3.6% annualized revenue growth over the last five years was sluggish. This was below our standard for the insurance sector.

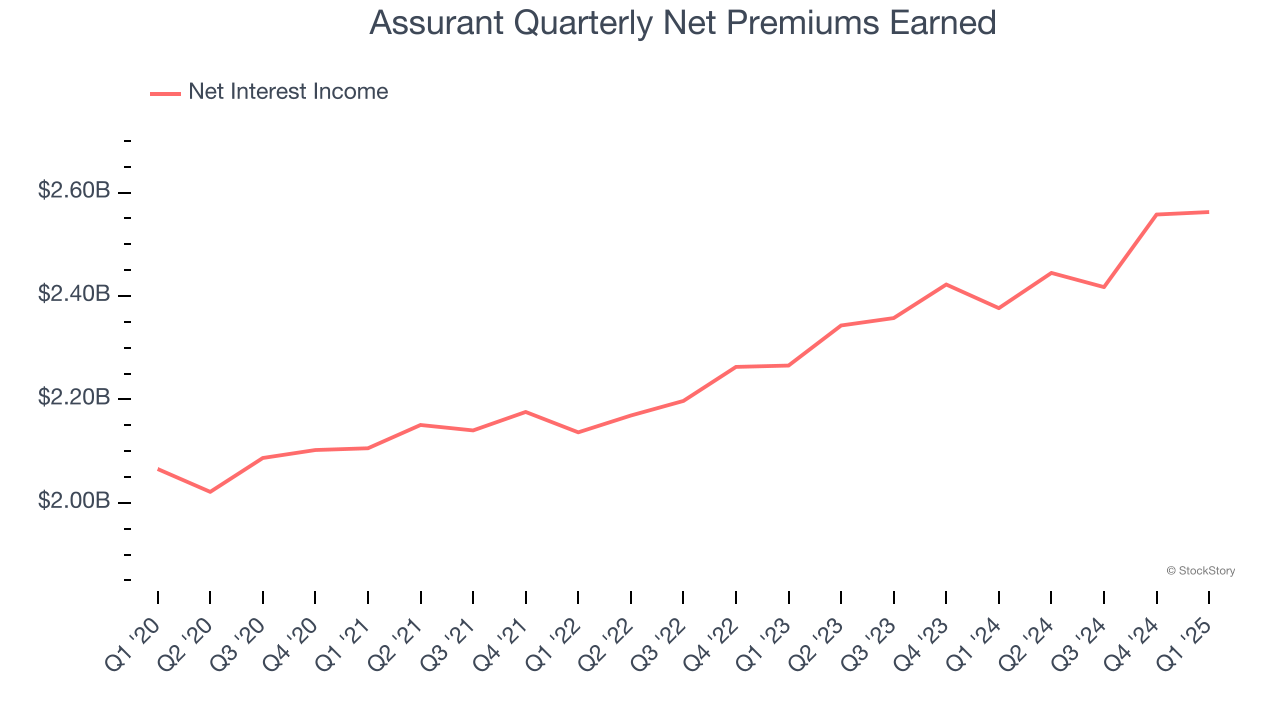

2. Net Premiums Earned Points to Soft Demand

Net premiums earned commands greater market attention due to its reliability and consistency, whereas investment and fee income are often seen as more volatile revenue streams that fluctuate with market conditions.

Assurant’s net premiums earned has grown at a 4.7% annualized rate over the last four years, worse than the broader insurance industry.

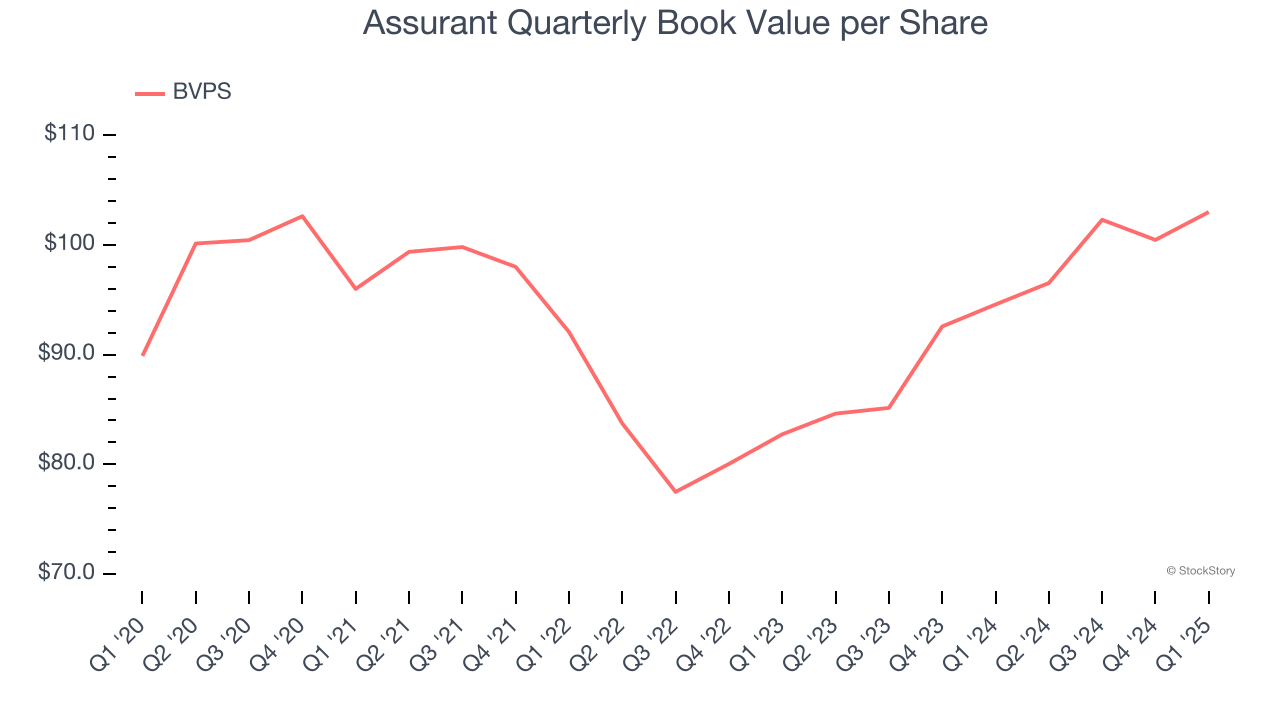

3. Substandard BVPS Growth Indicates Limited Asset Expansion

For insurers, book value per share (BVPS) is a vital measure of financial health, representing the total assets available to shareholders after accounting for all liabilities, including policyholder reserves and claims obligations.

To the detriment of investors, Assurant’s BVPS grew at a mediocre 11.6% annual clip over the last two years.

Final Judgment

Assurant isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 1.7× forward P/B (or $184.85 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of Assurant

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.