Online used car dealer Carvana (NYSE: CVNA) reported Q2 CY2025 results exceeding the market’s revenue expectations, with sales up 41.9% year on year to $4.84 billion.

Is now the time to buy Carvana? Find out by accessing our full research report, it’s free.

Carvana (CVNA) Q2 CY2025 Highlights:

- Revenue: $4.84 billion vs analyst estimates of $4.58 billion (41.9% year-on-year growth, 5.7% beat)

- Adjusted EBITDA: $601 million vs analyst estimates of $554.8 million (12.4% margin, 8.3% beat)

- Operating Margin: 10.6%, up from 7.6% in the same quarter last year

- Retail Units Sold: 143,280, up 41,840 year on year

- Market Capitalization: $45.44 billion

Company Overview

Known for its glass tower car vending machines, Carvana (NYSE: CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

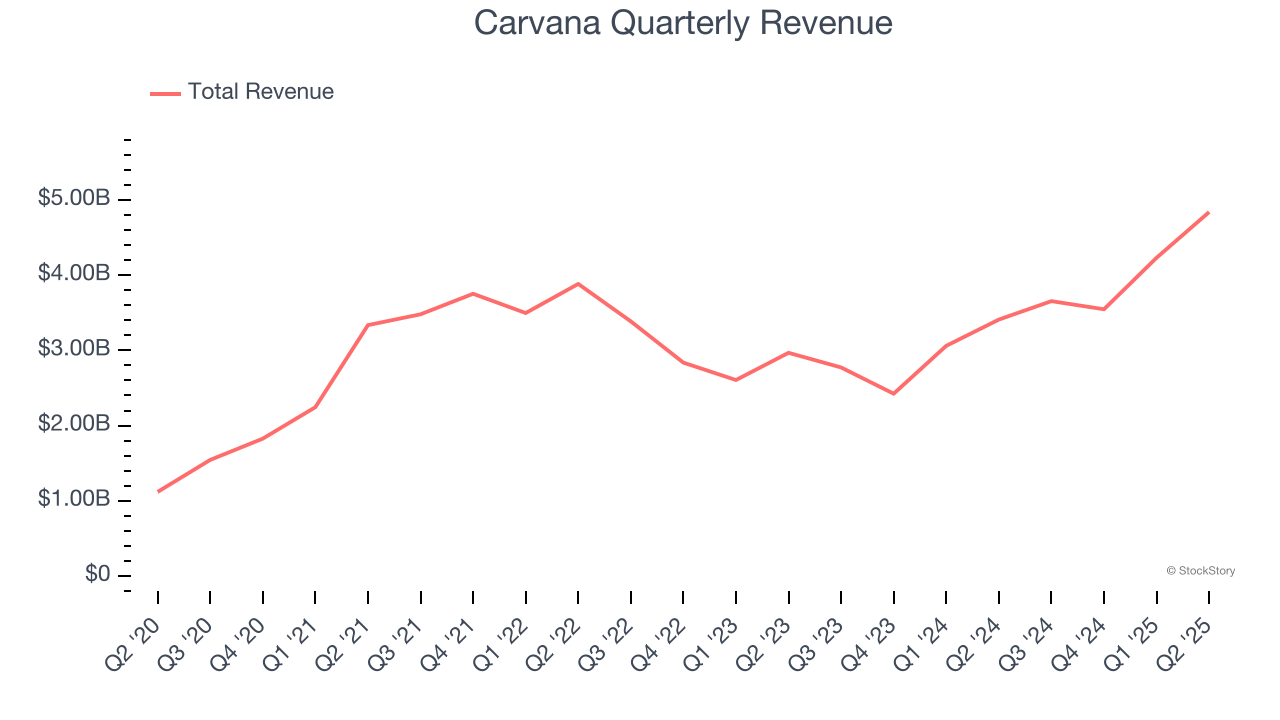

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, Carvana grew its sales at a sluggish 3.7% compounded annual growth rate. This wasn’t a great result compared to the rest of the consumer internet sector, but there are still things to like about Carvana.

This quarter, Carvana reported magnificent year-on-year revenue growth of 41.9%, and its $4.84 billion of revenue beat Wall Street’s estimates by 5.7%.

Looking ahead, sell-side analysts expect revenue to grow 20.9% over the next 12 months, an acceleration versus the last three years. This projection is particularly healthy for a company of its scale and suggests its newer products and services will catalyze better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Retail Units Sold

Unit Growth

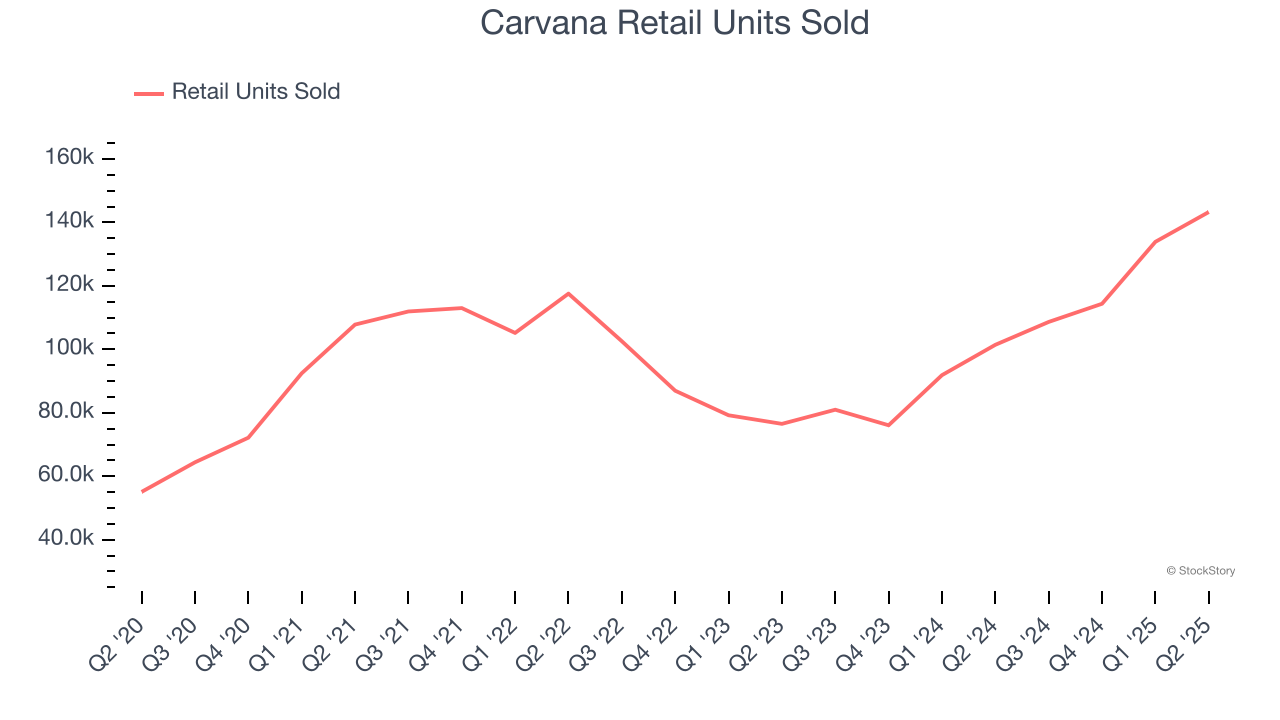

As an online retailer, Carvana generates revenue growth by expanding its number of users and the average order size in dollars.

Over the last two years, Carvana’s retail units sold, a key performance metric for the company, increased by 23.3% annually to 143,280 in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q2, Carvana added 41,840 retail units sold, leading to 41.2% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating unit growth.

Revenue Per Unit

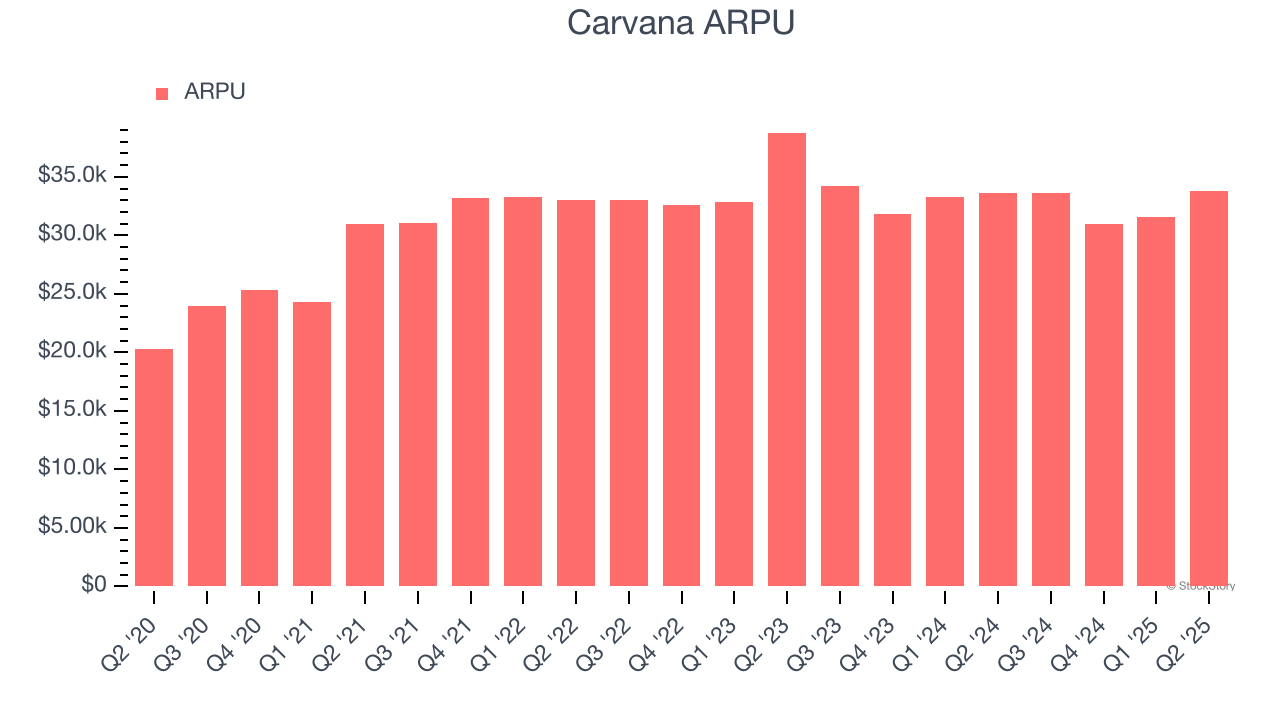

Average revenue per unit (ARPU) is a critical metric to track because it measures how much customers spend per order.

Carvana’s ARPU fell over the last two years, averaging 2.5% annual declines. This isn’t great, but the increase in retail units sold is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Carvana tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether units can continue growing at the current pace.

This quarter, Carvana’s ARPU clocked in at $33,780. It was flat year on year, worse than the change in its retail units sold.

Key Takeaways from Carvana’s Q2 Results

We were impressed by how significantly Carvana blew past analysts’ EBITDA expectations this quarter. We were also glad it expanded its number of units. Zooming out, we think this quarter featured some important positives. The stock traded up 16.6% to $389 immediately following the results.

Indeed, Carvana had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.