Commercial real estate lender Franklin BSP Realty Trust (NYSE: FBRT) fell short of the market’s revenue expectations in Q2 CY2025, but sales rose 188% year on year to $53.81 million. Its GAAP profit of $0.19 per share was 30.3% below analysts’ consensus estimates.

Is now the time to buy Franklin BSP Realty Trust? Find out by accessing our full research report, it’s free.

Franklin BSP Realty Trust (FBRT) Q2 CY2025 Highlights:

- Net Interest Income: $40.96 million vs analyst estimates of $46.2 million (8,649% year-on-year growth, 11.3% miss)

- Revenue: $53.81 million vs analyst estimates of $55.77 million (188% year-on-year growth, 3.5% miss)

- EPS (GAAP): $0.19 vs analyst expectations of $0.27 (30.3% miss)

- Market Capitalization: $840.2 million

NEW YORK--(BUSINESS WIRE)--Franklin BSP Realty Trust, Inc. (NYSE: FBRT) (“FBRT” or the “Company”) today announced the closing of its previously announced acquisition of NewPoint Holdings JV L.L.C. (“NewPoint”) for a total consideration of $425 million.

Company Overview

Operating as a specialized real estate investment trust (REIT) with roots dating back to 2012, Franklin BSP Realty Trust (NYSE: FBRT) originates and manages a diversified portfolio of commercial real estate debt investments secured by properties in the United States and abroad.

Sales Growth

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities.

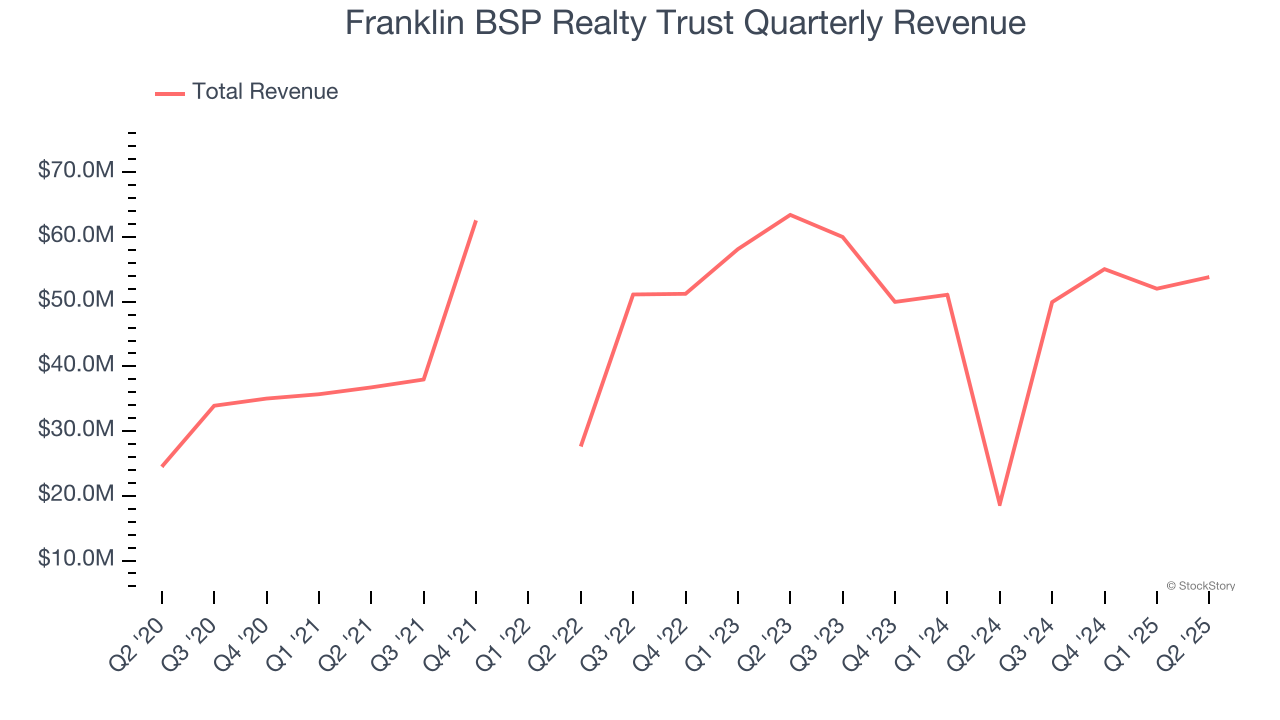

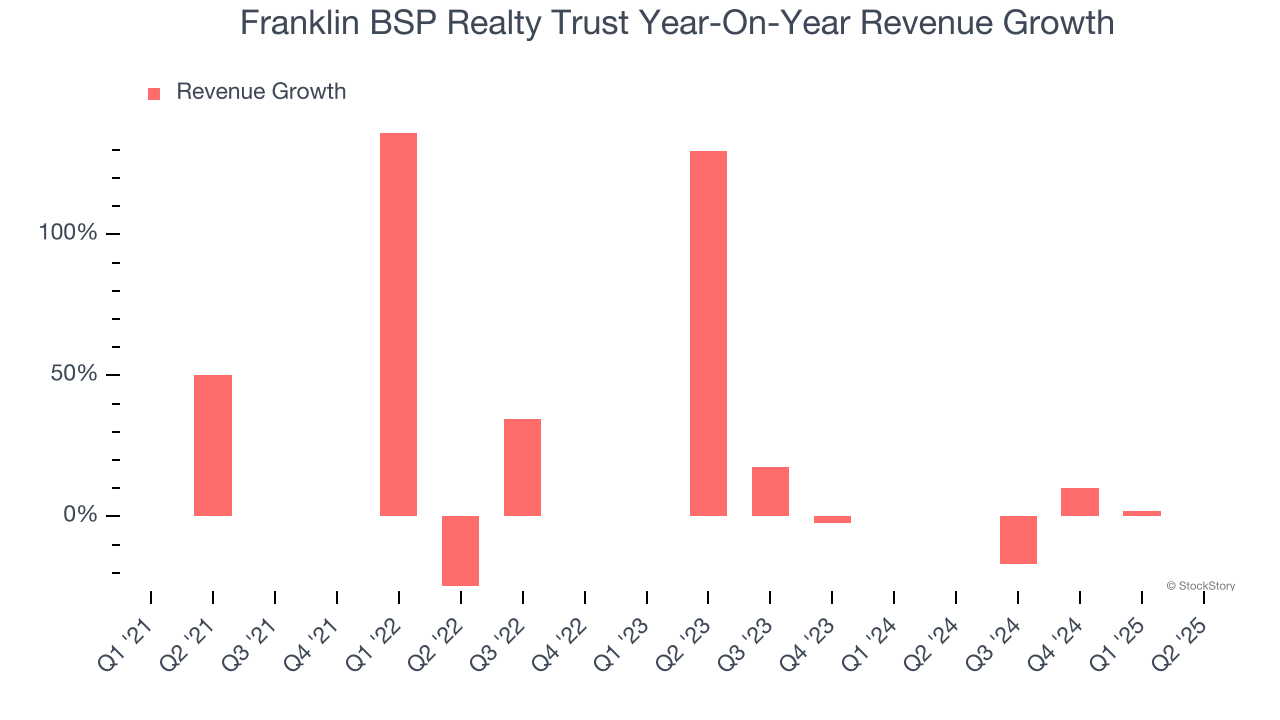

Luckily, Franklin BSP Realty Trust’s revenue grew at an impressive 10.5% compounded annual growth rate over the last five years. Its growth beat the average bank company and shows its offerings resonate with customers.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Franklin BSP Realty Trust’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 3% over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Franklin BSP Realty Trust achieved a magnificent 188% year-on-year revenue growth rate, but its $53.81 million of revenue fell short of Wall Street’s lofty estimates.

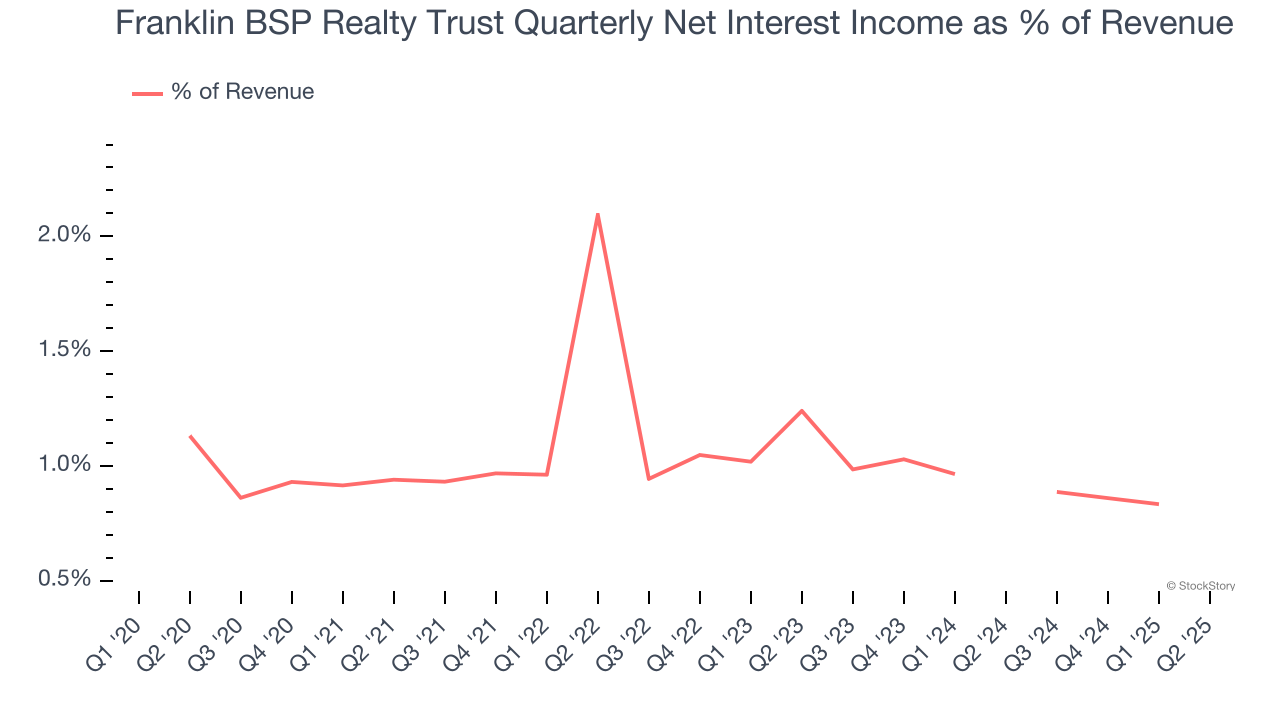

Net interest income made up 4.9% of the company’s total revenue during the last five years, meaning Franklin BSP Realty Trust is well diversified and has a variety of income streams driving its overall growth. Nevertheless, net interest income is critical to analyze for banks because they’re considered a higher-quality, more recurring revenue source by investors.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Key Takeaways from Franklin BSP Realty Trust’s Q2 Results

We struggled to find many positives in these results. Its revenue missed and its net interest income fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 1.1% to $9.98 immediately after reporting.

The latest quarter from Franklin BSP Realty Trust’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.