The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how travel and vacation providers stocks fared in Q1, starting with Delta (NYSE: DAL).

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 19 travel and vacation providers stocks we track reported a mixed Q1. As a group, revenues beat analysts’ consensus estimates by 0.7% while next quarter’s revenue guidance was 4.1% above.

Luckily, travel and vacation providers stocks have performed well with share prices up 22.6% on average since the latest earnings results.

Delta (NYSE: DAL)

One of the ‘Big Four’ airlines in the US, Delta Air Lines (NYSE: DAL) is a major global air carrier that serves both business and leisure travelers through its domestic and international flights.

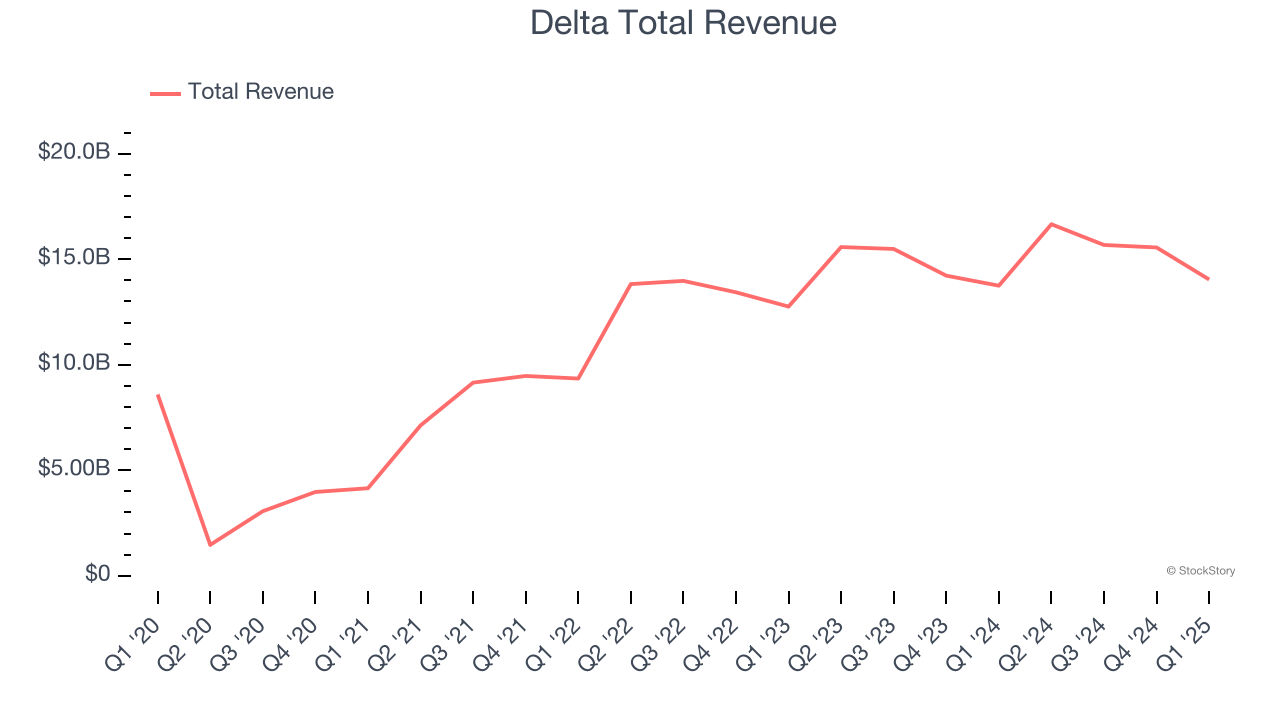

Delta reported revenues of $14.04 billion, up 2.1% year on year. This print exceeded analysts’ expectations by 1.1%. Despite the top-line beat, it was still a mixed quarter for the company with revenue guidance for next quarter topping analysts’ expectations but a miss of analysts’ EPS estimates.

Interestingly, the stock is up 39.2% since reporting and currently trades at $50.

Read our full report on Delta here, it’s free.

Best Q1: Lindblad Expeditions (NASDAQ: LIND)

Founded by explorer Sven-Olof Lindblad in 1979, Lindblad Expeditions (NASDAQ: LIND) offers cruising experiences to remote destinations in partnership with National Geographic.

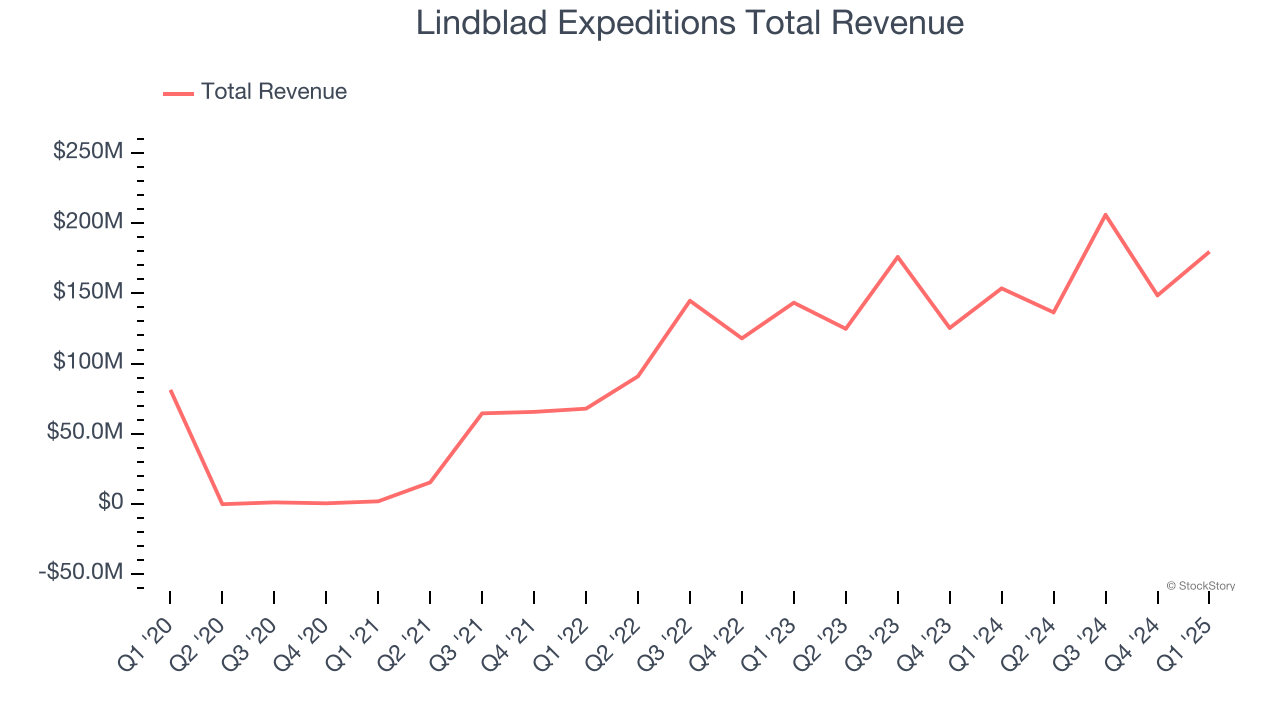

Lindblad Expeditions reported revenues of $179.7 million, up 17% year on year, outperforming analysts’ expectations by 18.8%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Lindblad Expeditions pulled off the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 39.1% since reporting. It currently trades at $12.67.

Is now the time to buy Lindblad Expeditions? Access our full analysis of the earnings results here, it’s free.

Slowest Q1: Hilton Grand Vacations (NYSE: HGV)

Spun off from Hilton Worldwide in 2017, Hilton Grand Vacations (NYSE: HGV) is a global timeshare company that provides travel experiences for its customers through its timeshare resorts and club membership programs.

Hilton Grand Vacations reported revenues of $1.15 billion, flat year on year, falling short of analysts’ expectations by 7.6%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

Hilton Grand Vacations delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 33.9% since the results and currently trades at $45.03.

Read our full analysis of Hilton Grand Vacations’s results here.

Marriott Vacations (NYSE: VAC)

Spun off from Marriott International in 1984, Marriott Vacations (NYSE: VAC) is a vacation company providing leisure experiences for travelers around the world.

Marriott Vacations reported revenues of $1.2 billion, flat year on year. This result lagged analysts' expectations by 0.7%. Aside from that, it was a strong quarter as it recorded a solid beat of analysts’ EPS estimates and a decent beat of analysts’ EBITDA estimates.

The stock is up 36.1% since reporting and currently trades at $79.19.

Read our full, actionable report on Marriott Vacations here, it’s free.

Target Hospitality (NASDAQ: TH)

Building mini-communities at places such as oil drilling sites, Target Hospitality (NASDAQ: TH) is a provider of specialty workforce lodging accommodations and services.

Target Hospitality reported revenues of $69.9 million, down 34.5% year on year. This number topped analysts’ expectations by 7%. More broadly, it was a mixed quarter as it also logged a decent beat of analysts’ EBITDA estimates.

Target Hospitality had the weakest full-year guidance update among its peers. The stock is up 7.8% since reporting and currently trades at $7.65.

Read our full, actionable report on Target Hospitality here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.