Banking and retail technology provider Diebold Nixdorf (NYSE: DBD) will be reporting earnings this Wednesday morning. Here’s what investors should know.

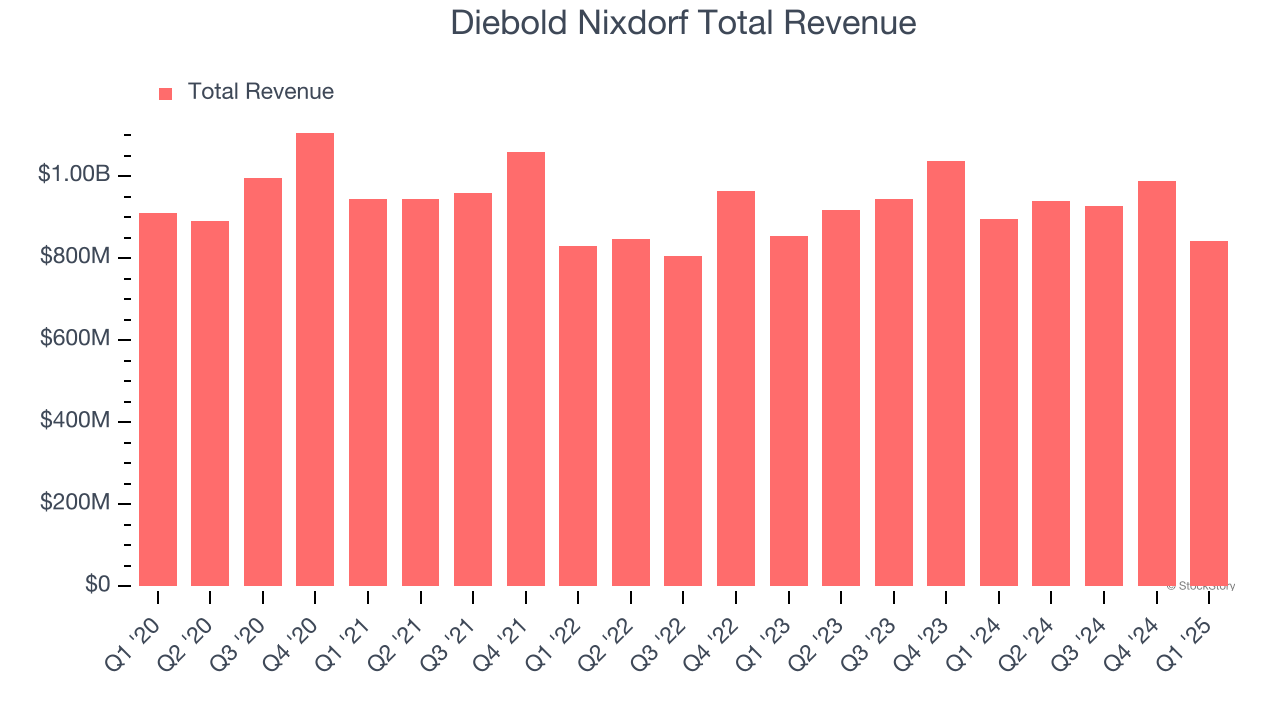

Diebold Nixdorf missed analysts’ revenue expectations by 0.6% last quarter, reporting revenues of $841.1 million, down 6.1% year on year. It was a softer quarter for the company, with a significant miss of analysts’ EPS estimates.

Is Diebold Nixdorf a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting Diebold Nixdorf’s revenue to decline 5.7% year on year to $886.1 million, a reversal from the 2.4% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.58 per share.

The majority of analysts covering the company have reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Diebold Nixdorf has missed Wall Street’s revenue estimates three times over the last two years.

Looking at Diebold Nixdorf’s peers in the it services & other tech segment, some have already reported their Q2 results, giving us a hint as to what we can expect. Xerox posted flat year-on-year revenue, beating analysts’ expectations by 1.6%, and Applied Digital reported a revenue decline of 13%, in line with consensus estimates. Xerox traded down 24.7% following the results while Applied Digital was up 31.3%.

Read our full analysis of Xerox’s results here and Applied Digital’s results here.

The euphoria surrounding Trump’s November win lit a fire under major indices, but potential tariffs have caused the market to do a 180 in 2025. While some of the it services & other tech stocks have shown solid performance in this choppy environment, the group has generally underperformed, with share prices down 2.1% on average over the last month. Diebold Nixdorf is down 6.9% during the same time and is heading into earnings with an average analyst price target of $72.33 (compared to the current share price of $55.25).

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.