Over the last six months, Hope Bancorp’s shares have sunk to $9.95, producing a disappointing 16% loss - a stark contrast to the S&P 500’s 4.5% gain. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Hope Bancorp, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Hope Bancorp Will Underperform?

Despite the more favorable entry price, we're cautious about Hope Bancorp. Here are three reasons why there are better opportunities than HOPE and a stock we'd rather own.

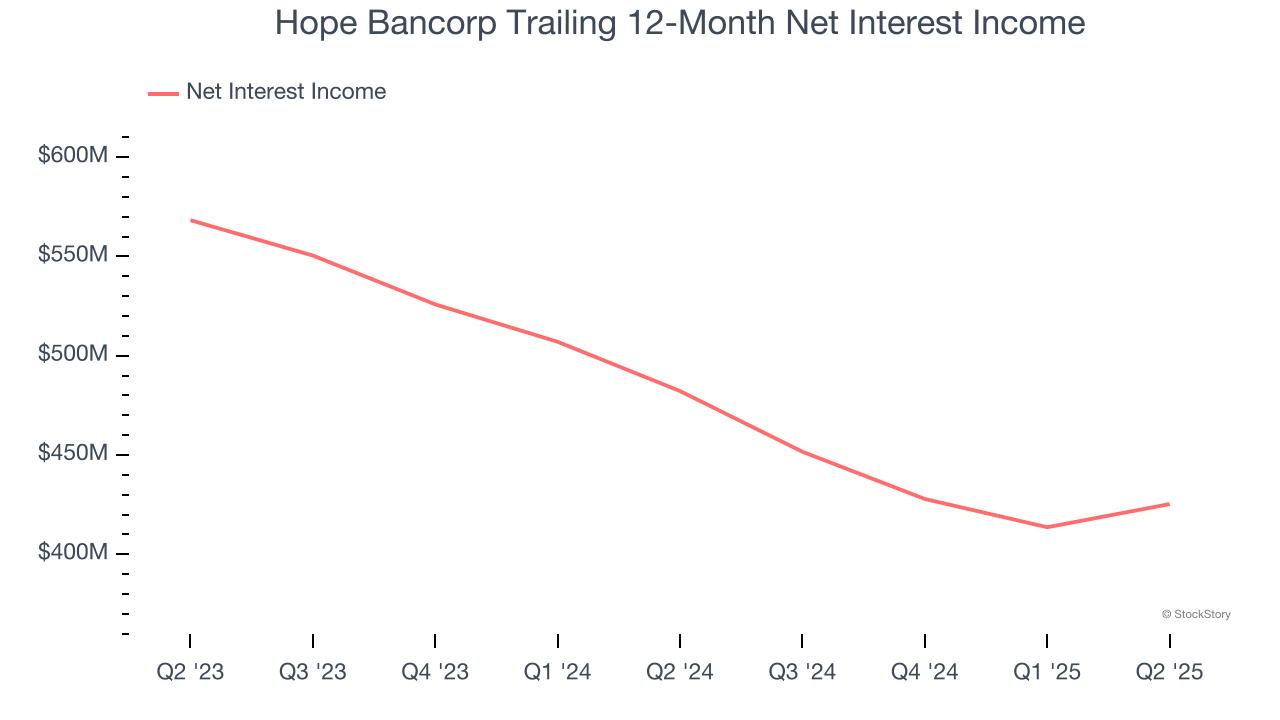

1. Net Interest Income Hits a Plateau

While bank generate revenue from multiple sources, investors view net interest income as a cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of one-time fees.

Hope Bancorp’s net interest income was flat over the last five years, much worse than the broader bank industry. A silver lining is that lending outperformed its other business lines.

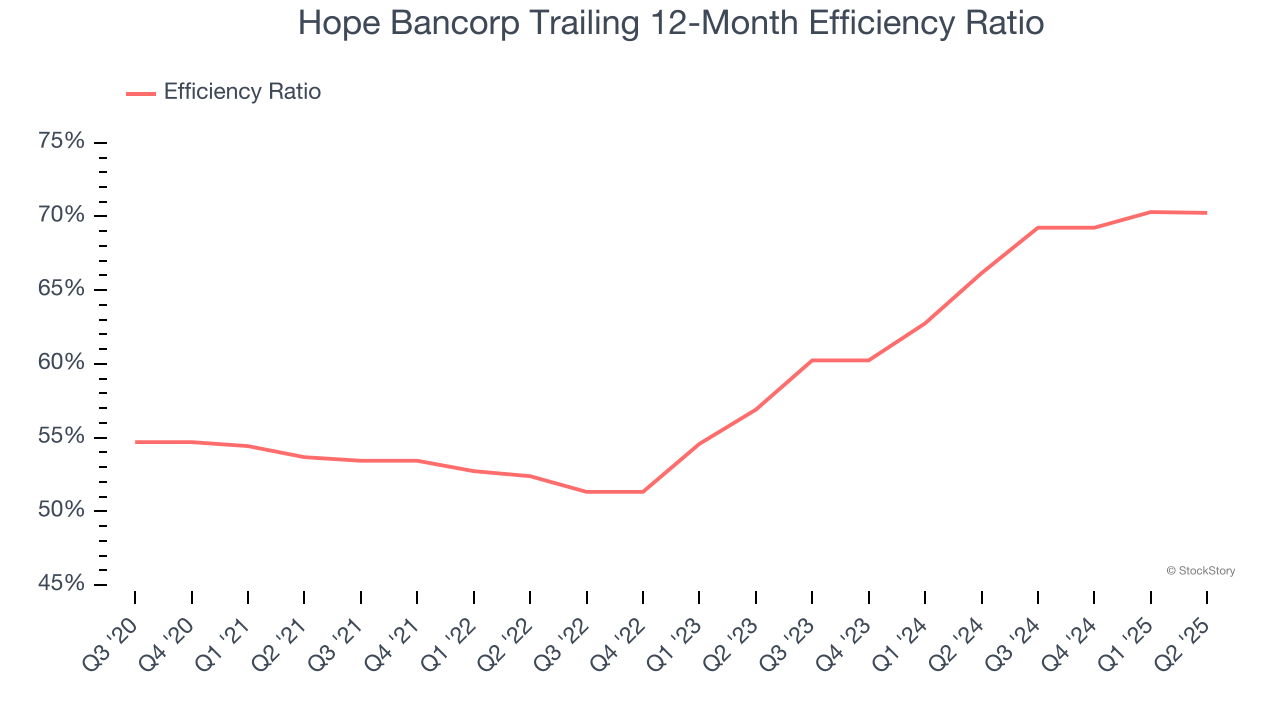

2. Deteriorating Efficiency Ratio

Topline growth alone doesn't tell the complete story - the profitability of that growth shapes actual earnings impact. Banks track this dynamic through efficiency ratios, which compare non-interest expenses such as personnel, rent, IT, and marketing costs to total revenue streams.

Markets emphasize efficiency ratio trends over static measurements, recognizing that revenue compositions drive different expense bases. Lower efficiency ratios signal superior performance by indicating that banks are controlling costs effectively relative to their income.

Over the last four years, Hope Bancorp’s efficiency ratio has swelled by 16.6 percentage points, hitting 70.2% for the past 12 months. Said differently, the company’s expenses have increased at a faster rate than revenue, which is usually raises questions in mature industries (the exception is a high-growth company that reinvests its profits in attractive ventures).

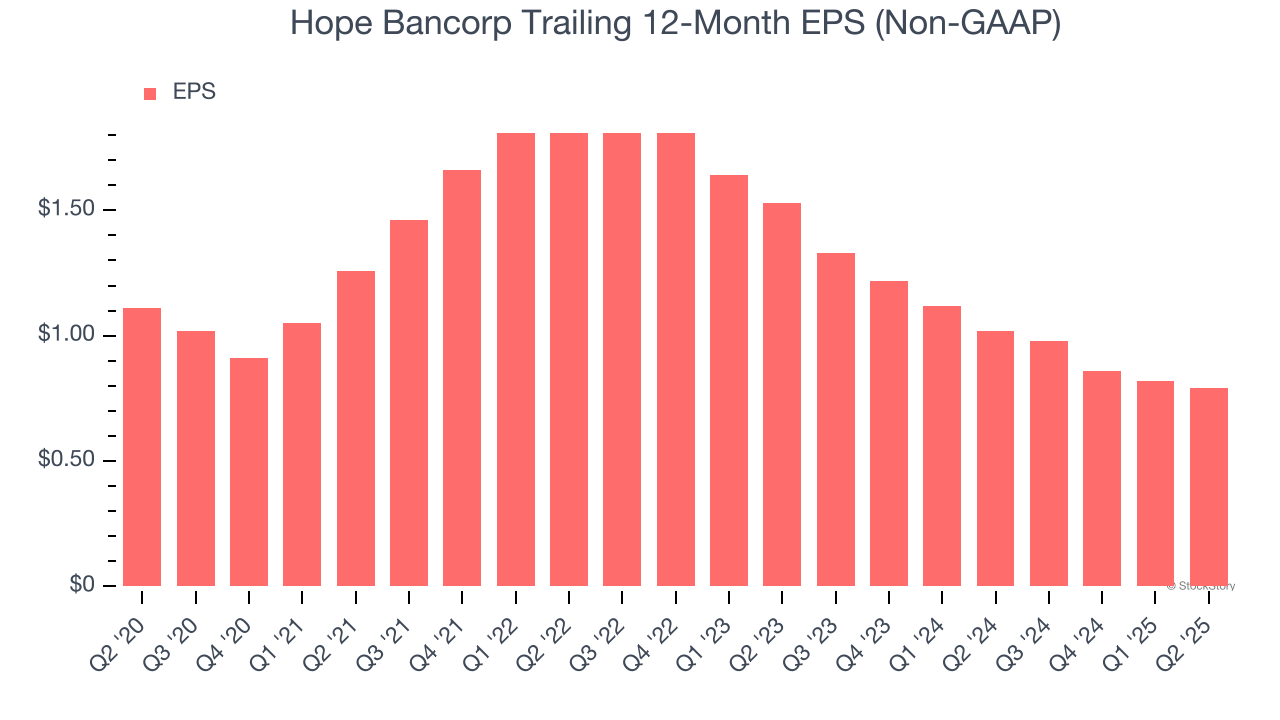

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Hope Bancorp, its EPS declined by 6.6% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

Hope Bancorp falls short of our quality standards. After the recent drawdown, the stock trades at 0.6× forward P/B (or $9.95 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Hope Bancorp

When Trump unveiled his aggressive tariff plan in April 2024, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.