Shareholders of UiPath would probably like to forget the past six months even happened. The stock dropped 23.5% and now trades at $11.39. This may have investors wondering how to approach the situation.

Is now the time to buy UiPath, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is UiPath Not Exciting?

Even though the stock has become cheaper, we're swiping left on UiPath for now. Here are three reasons why PATH doesn't excite us and a stock we'd rather own.

1. Weak Billings Point to Soft Demand

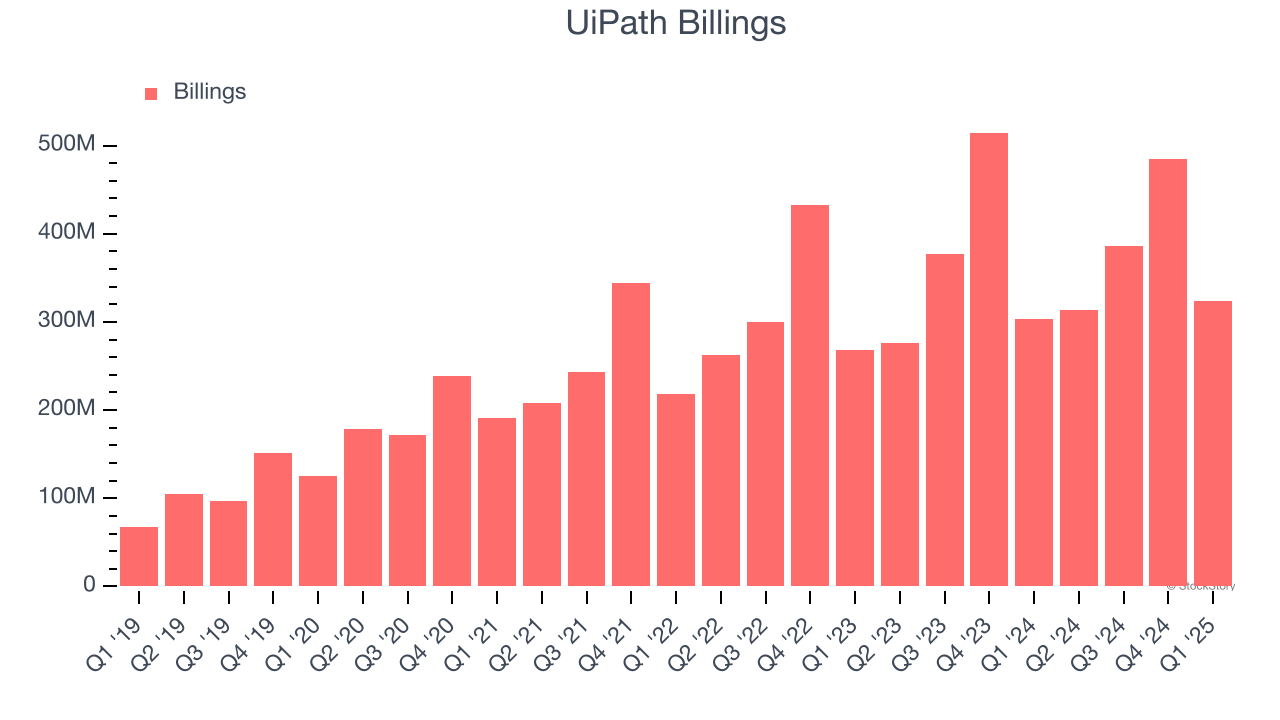

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

UiPath’s billings came in at $323.3 million in Q1, and over the last four quarters, its year-on-year growth averaged 4.2%. This performance was underwhelming and suggests that increasing competition is causing challenges in acquiring/retaining customers.

2. Long Payback Periods Delay Returns

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

UiPath’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

3. Operating Losses Sound the Alarms

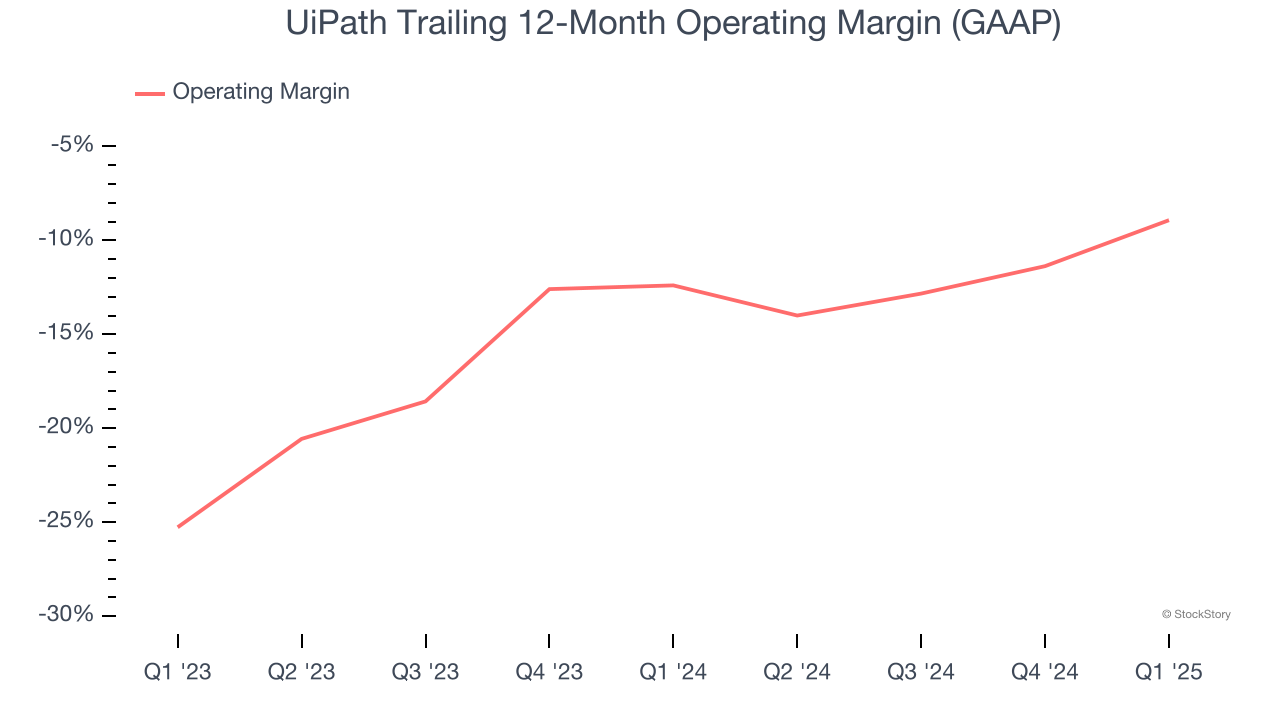

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

UiPath’s expensive cost structure has contributed to an average operating margin of negative 8.9% over the last year. Unprofitable software companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if UiPath reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

Final Judgment

UiPath’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 3.9× forward price-to-sales (or $11.39 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at our favorite semiconductor picks and shovels play.

Stocks We Would Buy Instead of UiPath

When Trump unveiled his aggressive tariff plan in April 2024, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.